Amex Blue Business Cash Approval Odds

Imagine a small business owner, Sarah, hunched over her laptop, the aroma of freshly brewed coffee filling the air. She's navigating the complex world of business credit cards, searching for the perfect financial tool to fuel her growing venture. The American Express Blue Business Cash Card keeps popping up – promising lucrative rewards and flexible spending power. But a nagging question persists: what are her chances of actually getting approved?

The Amex Blue Business Cash Card has emerged as a popular choice for small business owners seeking a straightforward rewards program and the backing of a reputable financial institution. Understanding the approval odds, however, requires a nuanced look at factors like credit score, business financials, and the overall economic climate. This article delves into the intricacies of securing this coveted card, providing insights to help you assess your approval prospects.

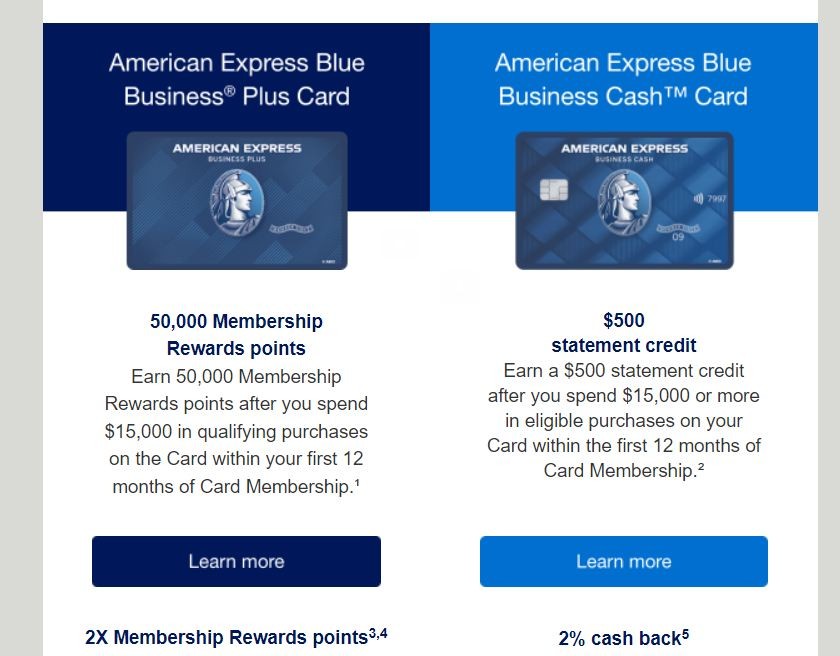

Understanding the Amex Blue Business Cash Card Appeal

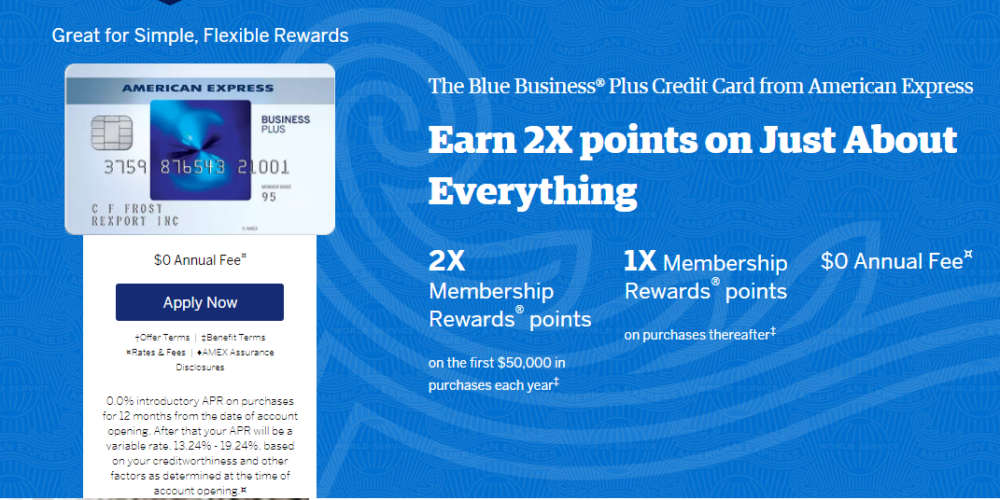

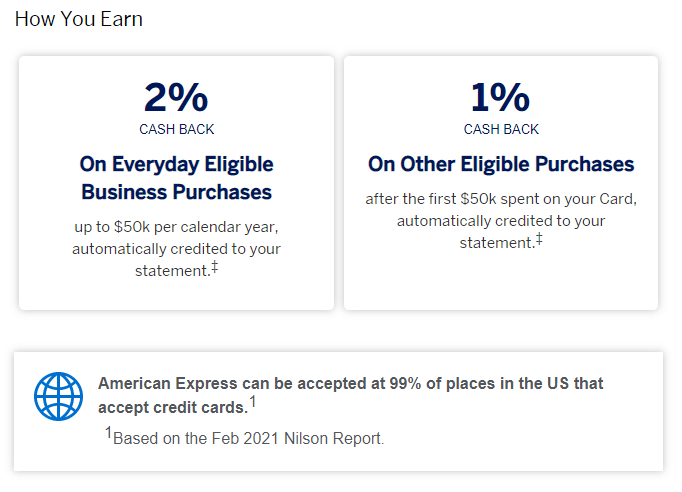

The card's allure lies in its simplicity. Cardholders earn 2% cash back on all eligible purchases up to $50,000 per calendar year, then 1% thereafter. There is no annual fee, which is a significant advantage for businesses looking to minimize expenses.

Beyond the rewards, the Amex Blue Business Cash Card offers the backing of American Express, a brand synonymous with quality customer service and global acceptance. This can be particularly appealing for businesses that travel or conduct international transactions.

Key Factors Influencing Approval Odds

Approval for the Amex Blue Business Cash Card isn't guaranteed, of course. American Express, like any financial institution, carefully evaluates applicants based on several key criteria.

Credit Score: A Cornerstone of Approval

Your personal credit score is a primary factor in the approval process. A good to excellent credit score, generally considered to be 700 or higher, significantly increases your chances.

American Express will review your credit report for any history of late payments, defaults, or bankruptcies. Demonstrating responsible credit management is crucial.

Business Finances: Showcasing Stability

While your personal credit score carries significant weight, American Express also assesses the financial health of your business. This includes factors like annual revenue, time in business, and industry.

A stable and profitable business is seen as a lower risk. Be prepared to provide information about your business's financial performance during the application process.

The Application Itself: Accuracy and Completeness

The application is your first impression. Ensuring all information is accurate and complete is essential.

Inconsistencies or missing details can raise red flags and potentially lead to a denial. Double-check everything before submitting.

Improving Your Approval Prospects

If you're concerned about your approval odds, there are steps you can take to improve your chances. Improving your credit score is key.

Pay your bills on time, reduce your credit utilization, and correct any errors on your credit report. Building a positive credit history takes time, but it's worth the effort.

Strengthening your business financials can also help. Focus on increasing revenue, controlling expenses, and demonstrating consistent profitability.

Navigating the Application Process

The application process for the Amex Blue Business Cash Card is typically straightforward. You can apply online through the American Express website.

Be prepared to provide personal information, business details, and financial data. Review the terms and conditions carefully before submitting your application.

Alternative Options if Denied

If your application is denied, don't despair. There are alternative credit card options available for small businesses.

Consider secured credit cards, which require a security deposit, or cards designed for businesses with fair or limited credit history. Building credit with these cards can pave the way for approval for the Amex Blue Business Cash Card in the future.

Remember that a denial doesn't have to be the end of the road. Use it as an opportunity to strengthen your credit and business financials, paving the way for future success. The Amex Blue Business Cash Card, or other similar cards, could be within reach with a little effort and planning.

/american-express-blue-business-cash-card_blue-4a38bb99746847d3bf66e4bd0dce61e7.jpg)