Amount Of Trade Discount Is Represented By The

The seemingly simple question of how to represent trade discounts has become a surprisingly complex issue, impacting everything from small business accounting to large-scale international trade agreements.

Discrepancies in how these discounts are accounted for can lead to misinterpretations of pricing structures, profitability analyses, and even tax obligations, creating a ripple effect throughout the economic landscape. The stakes are high, demanding a clear understanding of the various methods and their implications.

Understanding the Nuances of Trade Discounts

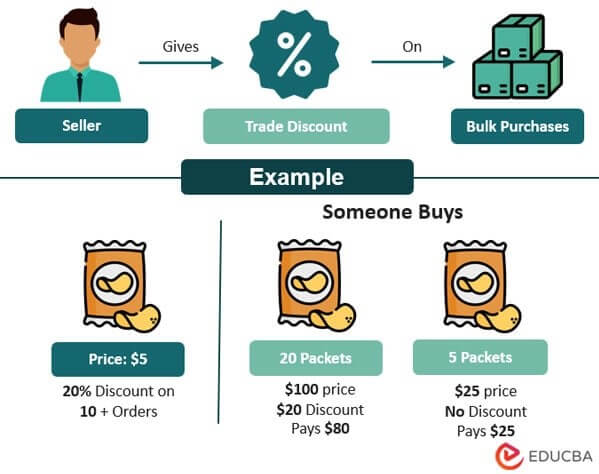

At its core, a trade discount is a reduction in the list price of a product or service offered by a seller to a buyer, typically a reseller or distributor, for the purpose of incentivizing sales and covering the costs of distribution.

Unlike cash discounts, which encourage prompt payment, trade discounts are tied to the buyer's role in the distribution chain.

The challenge arises in how to accurately and transparently represent the amount of this discount in financial records and transactions.

Different Methods of Representation

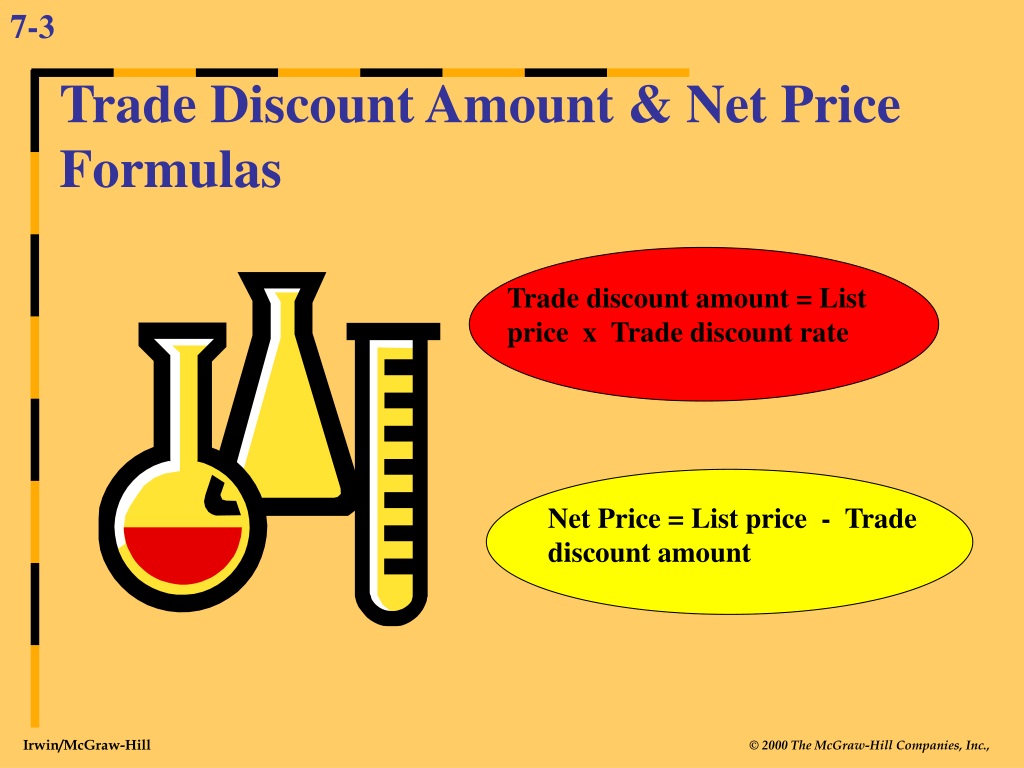

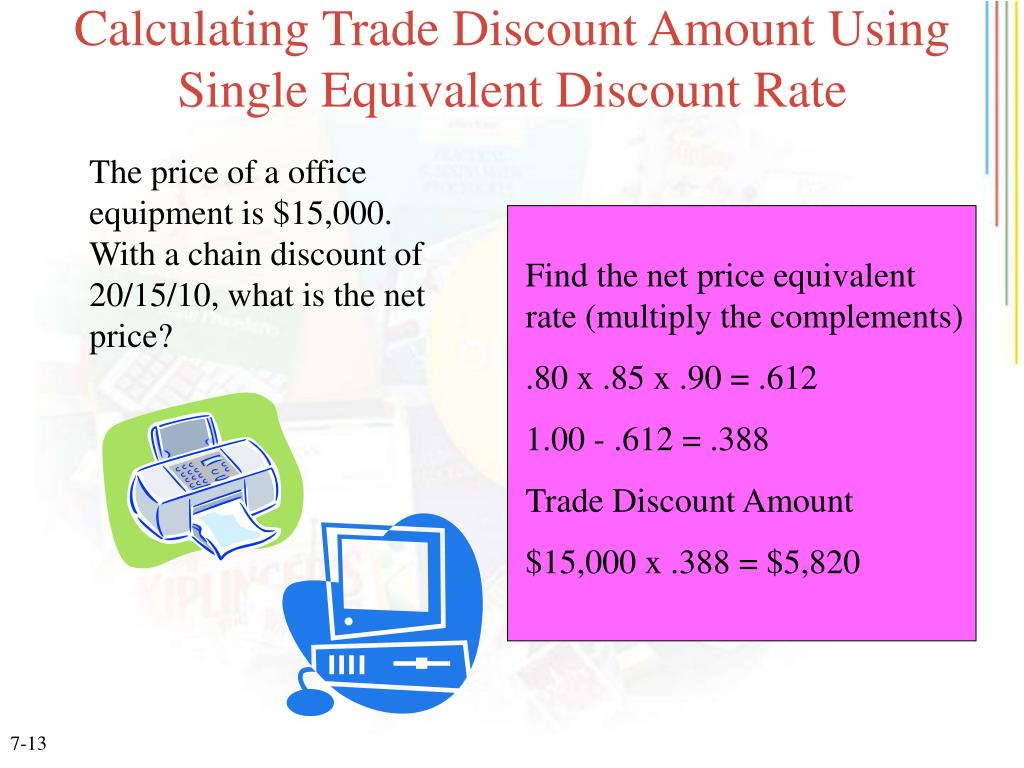

Several methods are used to represent the amount of a trade discount, each with its own advantages and disadvantages.

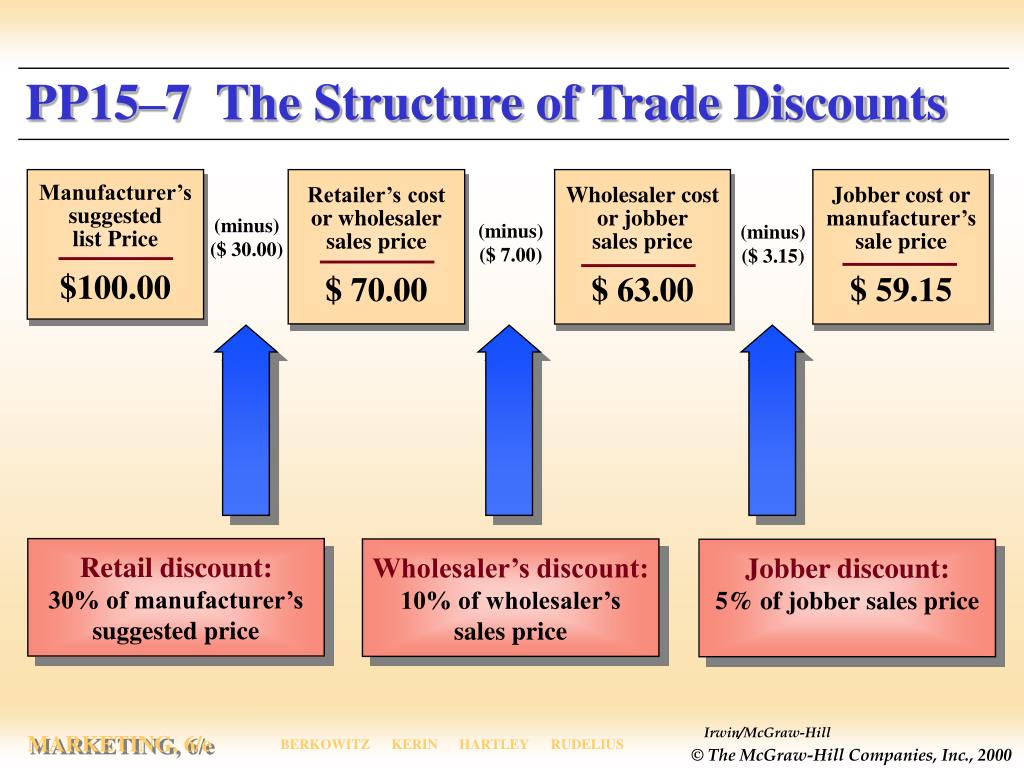

The most common include direct reduction from the list price, separate line-item accounting, and percentage-based calculations.

The chosen method can significantly influence how financial data is interpreted and used.

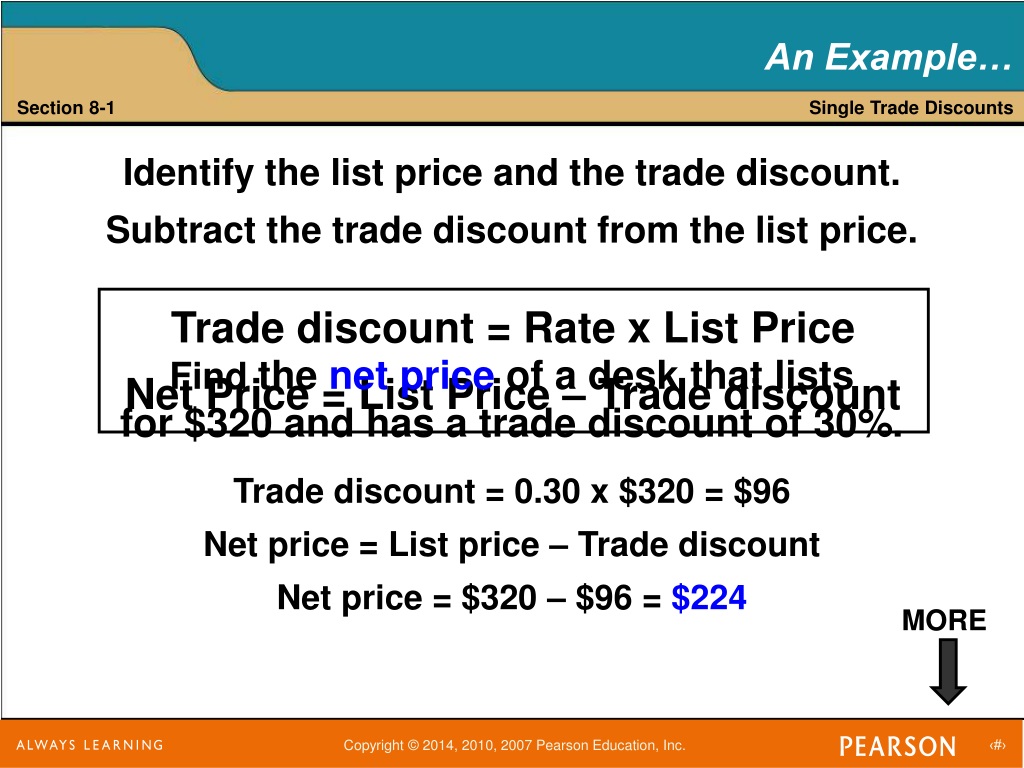

Direct Reduction from List Price

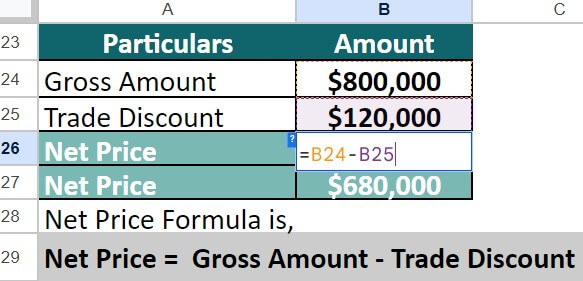

This method involves simply subtracting the discount amount from the original list price before recording the transaction.

For example, if a product lists for $100 and has a trade discount of $20, the transaction is recorded at $80.

This is the simplest method, but it obscures the original list price and the discount amount, making it difficult to analyze pricing trends or track discount effectiveness.

Separate Line-Item Accounting

This method involves recording both the list price and the discount as separate line items in the transaction record.

Using the same example, the record would show a $100 sale and a $20 discount.

This provides greater transparency and allows for more detailed analysis of pricing strategies and discount effectiveness, but requires more complex accounting procedures.

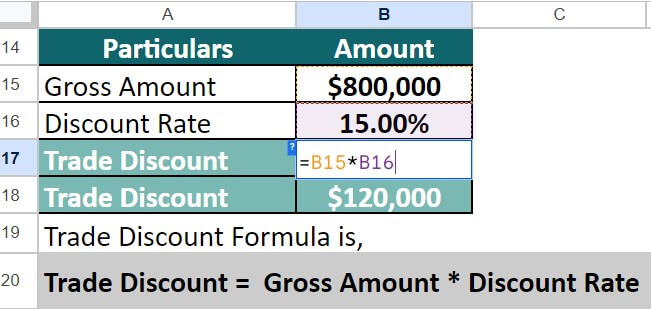

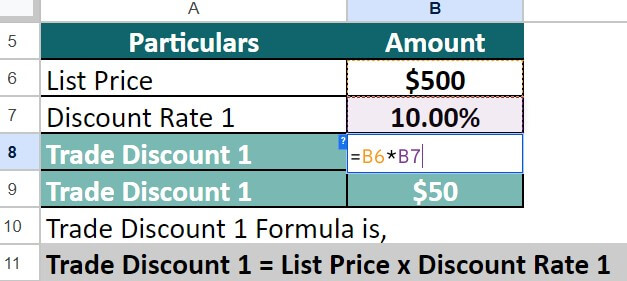

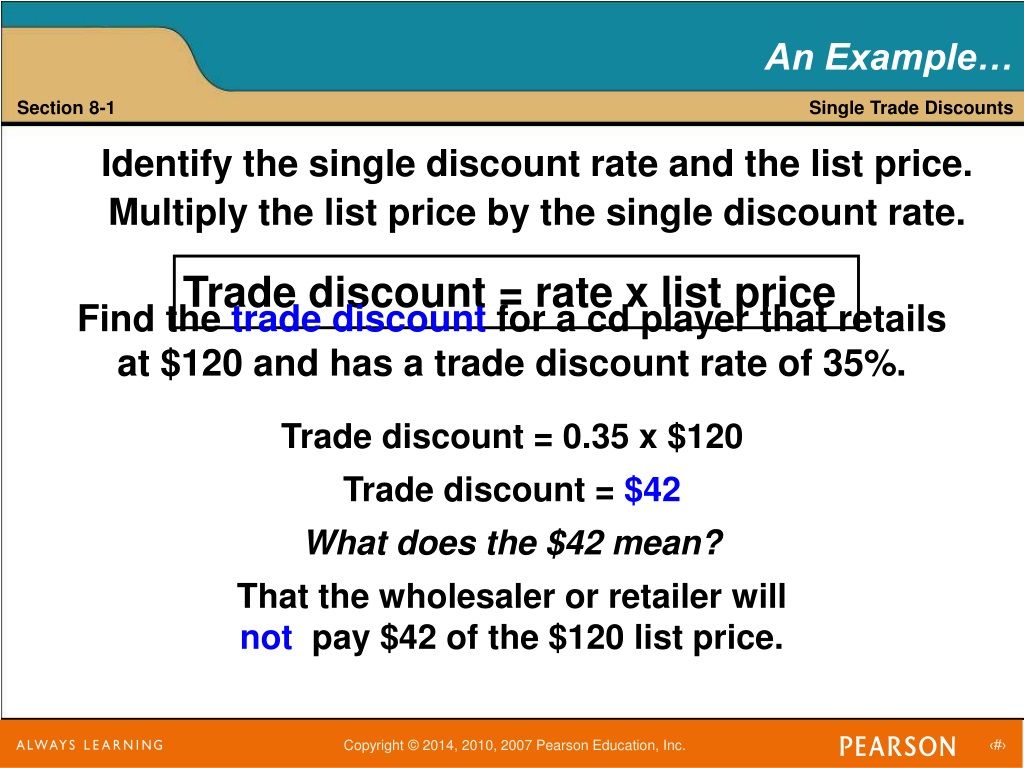

Percentage-Based Calculations

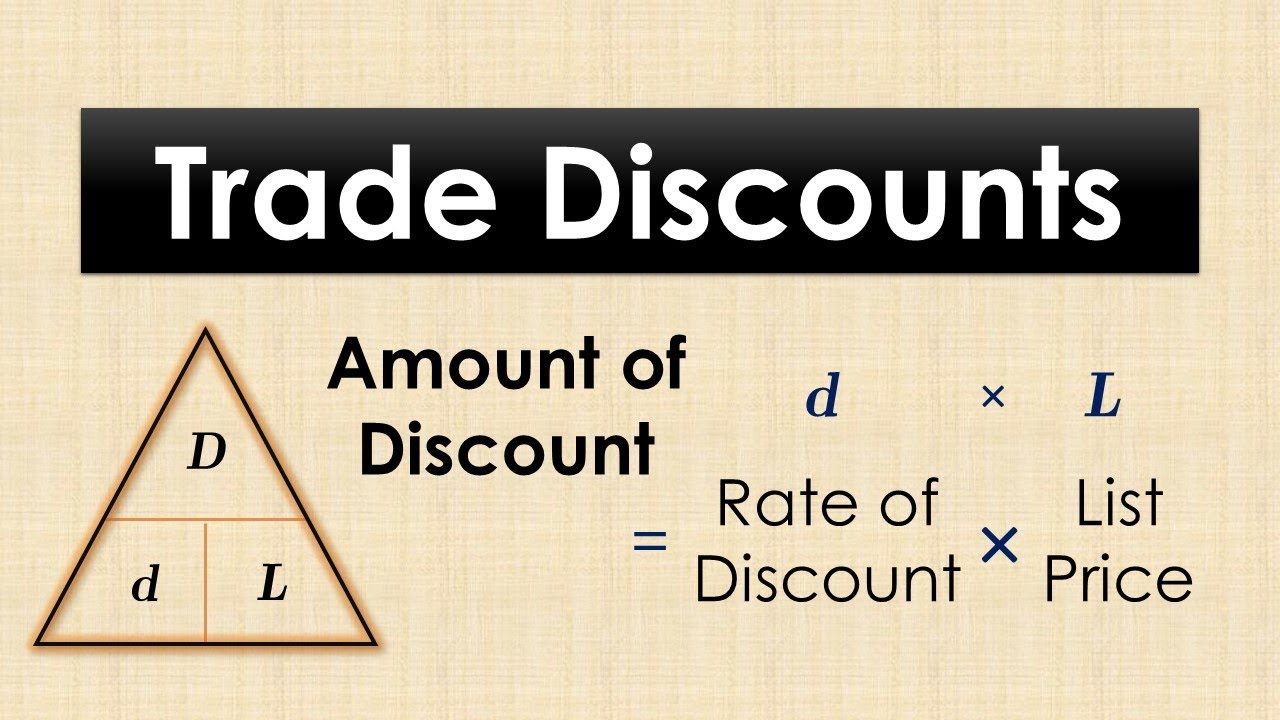

This method expresses the trade discount as a percentage of the list price.

In the previous example, the discount would be represented as a 20% trade discount.

This allows for easy comparison of discounts across different products and suppliers, but can be less precise than using specific dollar amounts.

The Impact on Financial Reporting and Analysis

The method used to represent trade discounts can have a significant impact on financial reporting and analysis.

For example, using direct reduction can understate revenue and gross profit margins, while separate line-item accounting provides a more accurate picture of the true value of sales.

This can affect key financial ratios and influence investment decisions.

Professor Anya Sharma, a leading accounting expert at the University of California, Berkeley, emphasizes the importance of consistency.

"Regardless of the method chosen, consistency is crucial for accurate financial reporting. Businesses must adhere to a clearly defined policy for representing trade discounts to ensure comparability and avoid misinterpretations."

International Variations and Trade Agreements

The issue of trade discount representation is further complicated by international variations in accounting standards and trade agreements.

Different countries may have different regulations regarding how discounts must be reported, leading to discrepancies in financial data and potential trade disputes.

The World Trade Organization (WTO) works to harmonize trade practices, but significant differences still exist.

According to a report by the International Chamber of Commerce (ICC), "A lack of standardization in trade discount representation creates barriers to international trade, as businesses struggle to compare pricing and profitability across different markets."

The Role of Technology and Automation

Technology is playing an increasingly important role in managing and representing trade discounts.

Accounting software and enterprise resource planning (ERP) systems can automate the process of tracking and reporting discounts, reducing the risk of errors and improving efficiency.

These tools also allow for more sophisticated analysis of discount effectiveness and pricing strategies.

The Future of Trade Discount Representation

The ongoing debate surrounding trade discount representation highlights the need for greater standardization and transparency.

Efforts are underway to develop clearer guidelines and best practices for accounting for these discounts, both domestically and internationally.

As technology continues to evolve, it will likely play an even greater role in simplifying and streamlining the process.

Ultimately, the goal is to create a system that accurately reflects the true economic value of transactions and promotes fair and transparent trade practices for all stakeholders.

This requires a collaborative effort from businesses, accounting professionals, and regulatory bodies to establish a common understanding and a consistent approach to representing the amount of trade discounts.