Is Atai A Good Stock To Buy

The mental health crisis is reaching a fever pitch, with traditional treatments often falling short. Investors are increasingly turning their attention to novel approaches, particularly those involving psychedelic medicine. Atai Life Sciences, a leading biopharmaceutical company focused on developing psychedelic and non-psychedelic compounds for various mental health disorders, has become a focal point of both hope and scrutiny.

The question on many investors' minds: Is Atai a good stock to buy? This isn't a simple yes or no answer. It requires a deep dive into the company's pipeline, financial health, regulatory landscape, and the inherent risks and potential rewards of investing in a nascent and rapidly evolving industry.

Atai Life Sciences: A Pipeline Overview

Atai boasts a diverse pipeline of drug candidates targeting a range of mental health conditions, including depression, anxiety, PTSD, and substance use disorders. This portfolio approach is designed to mitigate risk, as success in one area can significantly bolster the company's overall value.

Key programs include PCN-101 (R-ketamine) for treatment-resistant depression, which is being developed by Perception Neuroscience, an Atai platform company. Another promising candidate is RL-007, targeting cognitive impairment associated with schizophrenia, developed by another platform company, Reviva Pharmaceuticals.

The company's strategy centers around acquiring or incubating companies with promising early-stage assets. This provides Atai with access to a wider range of innovative therapies and scientific expertise.

Financial Health and Investment

Atai, like many biotech companies, is currently operating at a loss. This is typical during the drug development phase, as significant capital is required for research, clinical trials, and regulatory approvals.

The company's cash runway is a critical factor for investors to consider. As of the last reported quarter, Atai has sufficient cash reserves to fund operations into the foreseeable future, giving them ample time to progress their pipeline. Continued access to capital through future funding rounds will be crucial for long-term success.

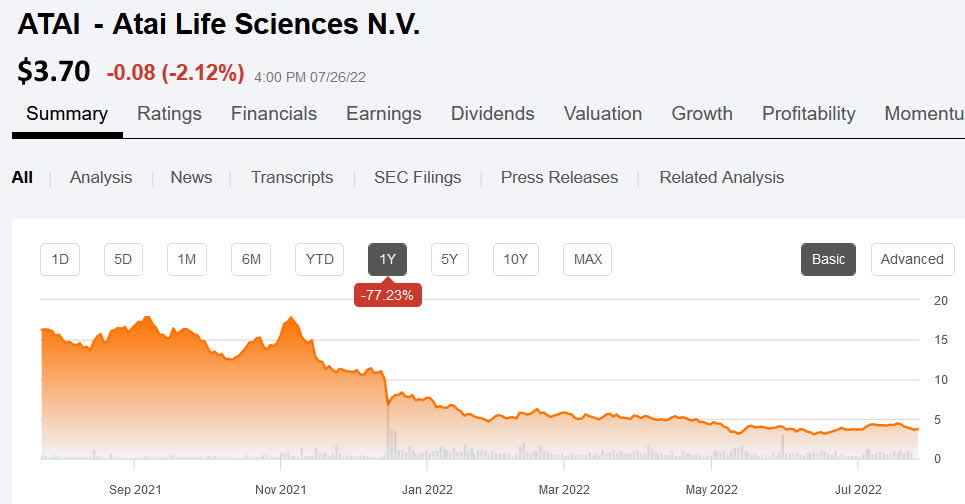

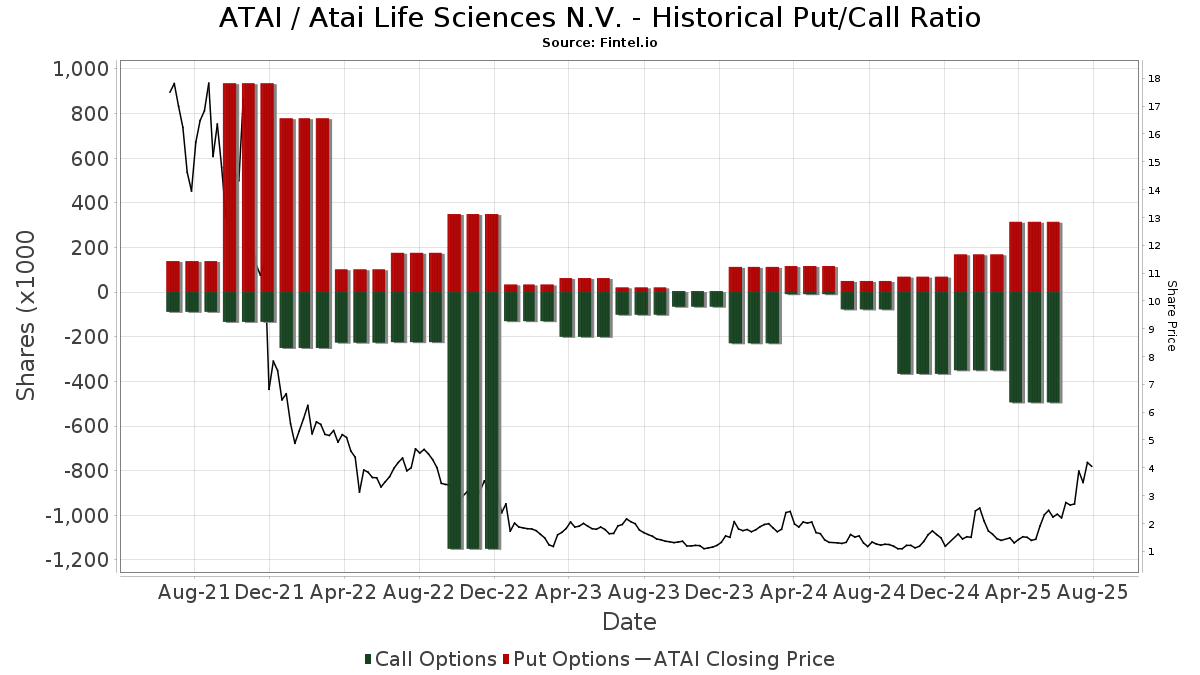

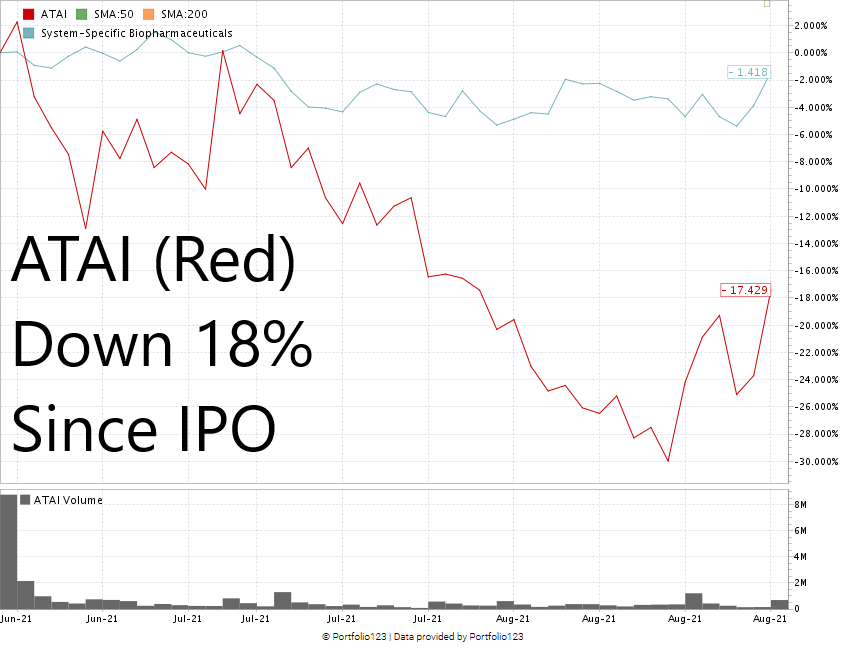

Several institutional investors have taken positions in Atai, signaling confidence in the company's long-term potential. However, the stock's volatility reflects the speculative nature of the psychedelic medicine industry.

Regulatory Landscape and Market Potential

The regulatory environment surrounding psychedelic medicine is evolving rapidly. While substances like psilocybin and MDMA are still federally illegal in the United States, there is growing momentum for decriminalization and regulated therapeutic use.

The FDA has granted Breakthrough Therapy designation to certain psychedelic-assisted therapies, indicating the agency's recognition of their potential to address unmet medical needs. This designation can expedite the development and review process.

The market for mental health treatments is enormous, and the demand for novel therapies is increasing. If Atai can successfully bring its drug candidates to market, the potential revenue streams are substantial.

Risks and Challenges

Investing in Atai, like any biotech company, comes with inherent risks. Clinical trial failures are a major concern. Even promising drug candidates can fail to demonstrate efficacy or safety in clinical trials, leading to significant stock price declines.

Regulatory hurdles also pose a significant challenge. Obtaining regulatory approval for psychedelic-assisted therapies is a complex and uncertain process.

Competition in the psychedelic medicine space is increasing. Numerous companies are developing their own psychedelic therapies, and Atai will need to differentiate itself to succeed.

Analyst Perspectives

Wall Street analysts have mixed opinions on Atai. Some analysts are bullish on the company's long-term prospects, citing its diverse pipeline and strong management team.

Other analysts are more cautious, citing the regulatory uncertainties and clinical trial risks associated with the psychedelic medicine industry. Their price targets vary widely, reflecting the speculative nature of the stock.

Investors should conduct their own due diligence and consult with a financial advisor before making any investment decisions.

The Future of Psychedelic Medicine and Atai's Role

The field of psychedelic medicine is still in its early stages, but it holds immense promise for transforming mental healthcare. Atai is at the forefront of this movement, pioneering the development of novel therapies for a wide range of mental health disorders.

The company's success will depend on its ability to navigate the regulatory landscape, successfully complete clinical trials, and secure funding for its ongoing operations.

Whether Atai is a "good" stock to buy ultimately depends on an investor's risk tolerance, investment horizon, and belief in the potential of psychedelic medicine. It is a high-risk, high-reward investment that requires careful consideration.

.jpg)