Amounts Received In Advance From Customers For Future Products

Imagine a bustling farmer's market on a sunny Saturday morning. The air is filled with the aroma of freshly baked bread and ripe berries. A small chalkboard sign at one stall reads: "Strawberry Preserves - Reserve Yours Now! Pick-up Next Week." Eager customers, trusting in the quality of the farmer's produce, happily hand over their money, securing their jar of future deliciousness.

This simple transaction, multiplied across industries and continents, illustrates the financial concept of amounts received in advance from customers for future products. It's a practice that allows businesses to secure capital, gauge demand, and foster customer loyalty, but also requires careful management and accounting to ensure transparency and fulfill promises made.

Understanding Advance Payments: A Deep Dive

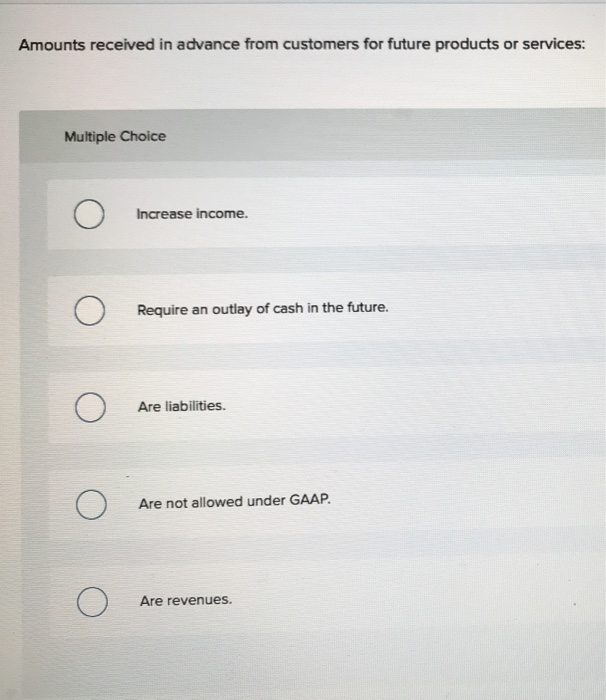

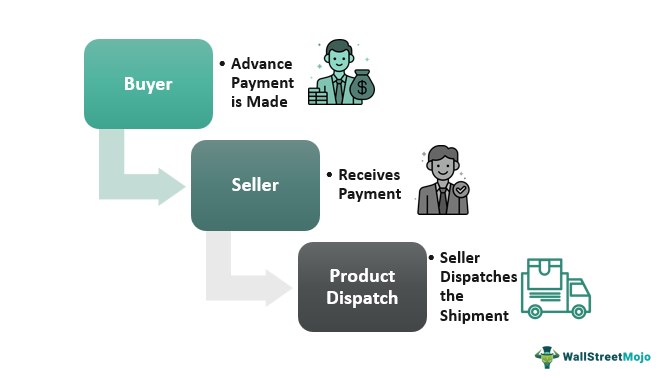

So, what exactly are these “amounts received in advance,” and why are they so important? Essentially, they represent payments a company receives for goods or services that will be delivered or performed at a later date. These payments create a liability on the company's balance sheet, as the company owes the customer either the product or the service, or a refund of the payment.

Think of a magazine subscription. You pay upfront for a year's worth of magazines. The publishing company receives your money immediately but has an obligation to deliver the magazines over the next twelve months. Only when each magazine is delivered can the company recognize a portion of that initial payment as revenue.

The Significance of Advance Payments

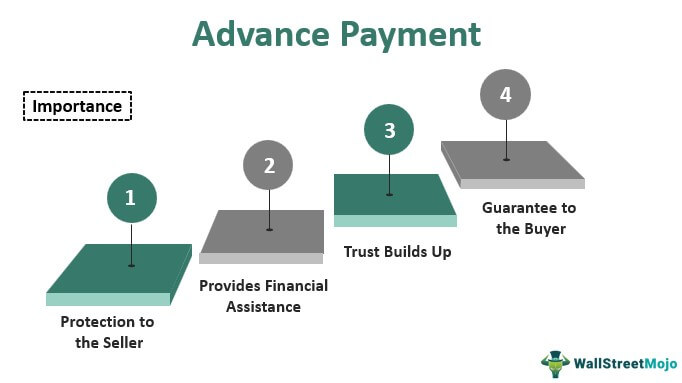

Advance payments are more than just accounting entries. They are a vital financial tool for many businesses, offering several key benefits.

First, they provide a source of immediate cash flow. This can be particularly helpful for startups or companies with seasonal sales cycles. This influx of funds can be used for everything from purchasing raw materials to funding research and development.

Second, advance payments offer a valuable gauge of customer demand. By tracking the number of pre-orders or reservations, businesses can get a clear picture of which products or services are generating the most interest. This information can then be used to optimize production, marketing, and inventory management.

Third, this practice can foster customer loyalty and engagement. Customers who pre-pay for a product or service are more likely to be invested in the company's success. This sense of ownership can lead to increased brand advocacy and repeat business.

Industries Reliant on Advance Payments

While advance payments can be used in various sectors, certain industries rely on them more heavily than others. These industries often involve long lead times, customized products, or services delivered over an extended period.

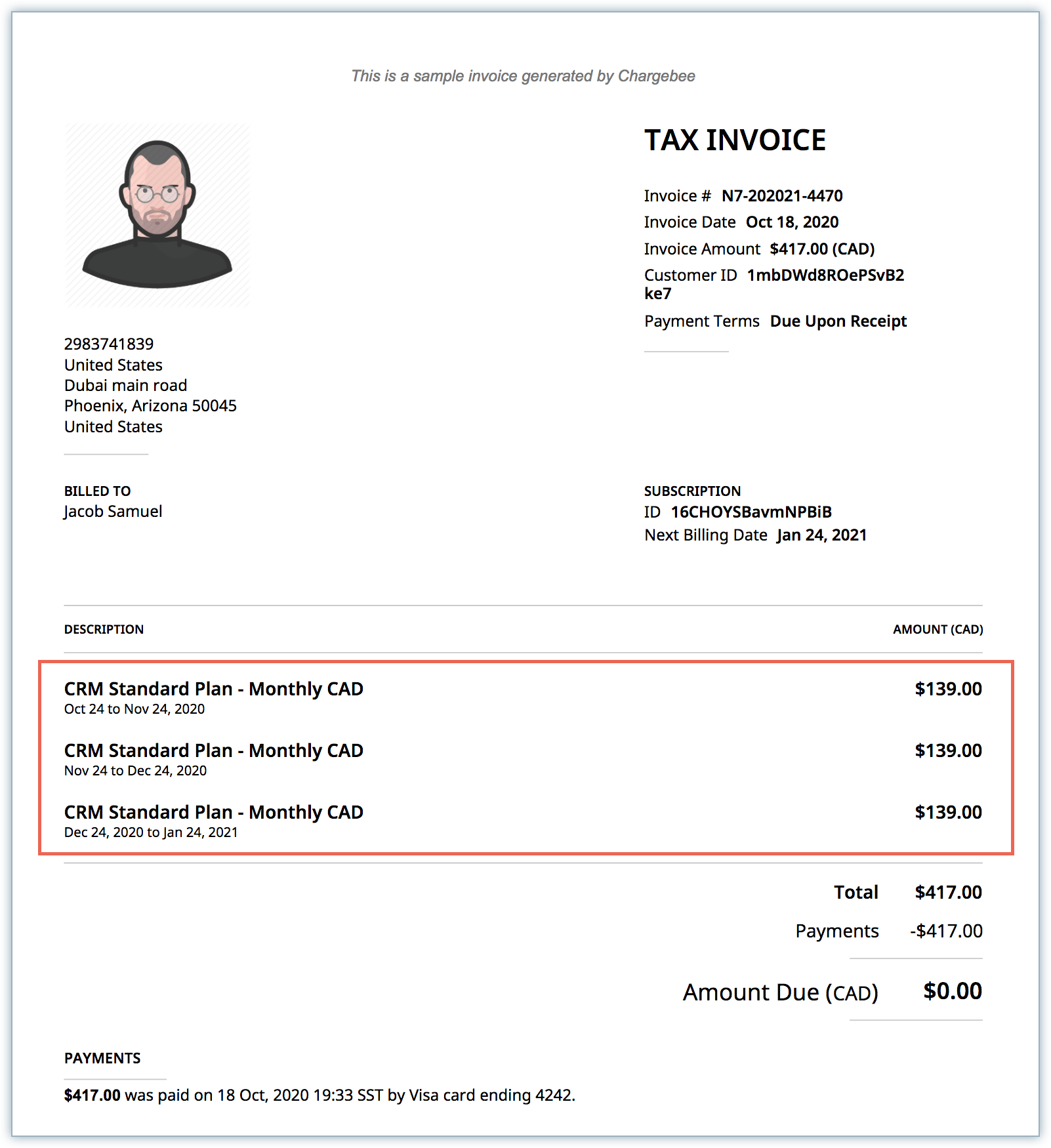

The software industry is a prime example. Software companies often offer subscriptions or licenses that are paid for in advance. According to a report by Statista, the global software-as-a-service (SaaS) market is projected to reach hundreds of billions of dollars in revenue in the coming years, much of which is generated through advance payments.

The construction industry is another significant player. Contractors often require deposits or progress payments before starting a project. These payments help cover the upfront costs of materials, labor, and equipment. The National Association of Home Builders provides resources and best practices for managing these payments.

The travel and hospitality industry is also heavily reliant on advance payments. Airlines, hotels, and tour operators often require customers to pay in advance for flights, rooms, and packages. These payments help these businesses manage their cash flow and guarantee occupancy or bookings.

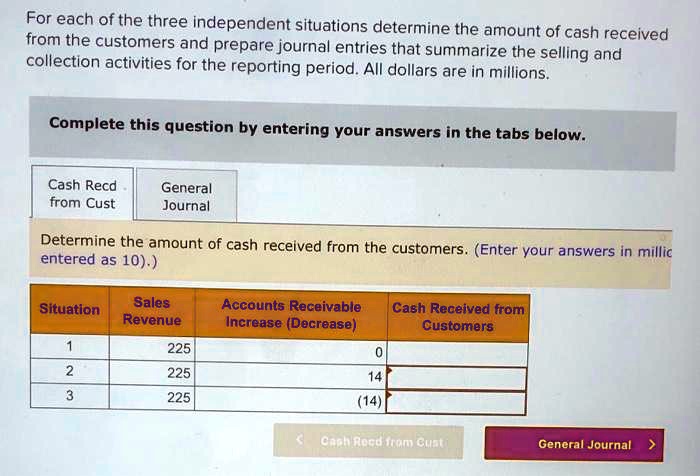

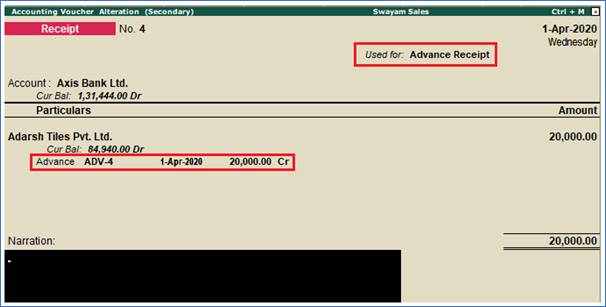

Accounting for Advance Payments: A Balancing Act

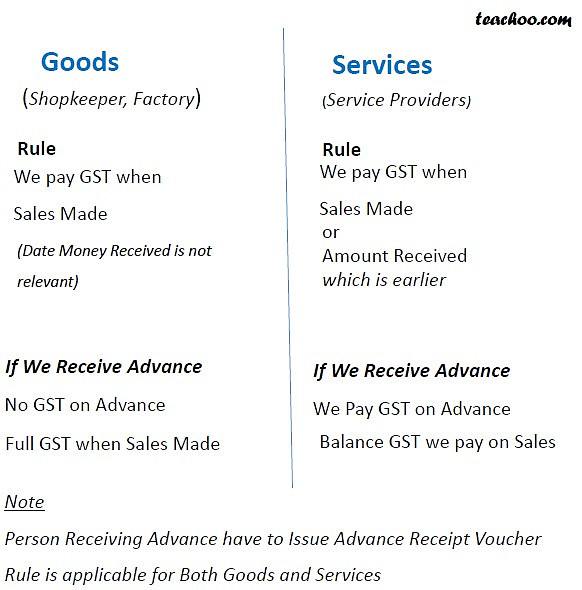

Proper accounting for advance payments is crucial for maintaining financial transparency and compliance. Failure to do so can lead to inaccurate financial statements, regulatory penalties, and even legal issues.

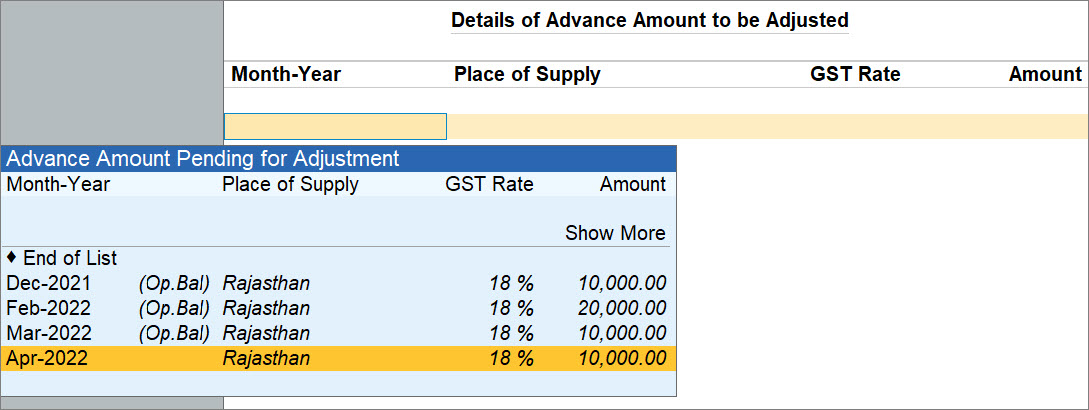

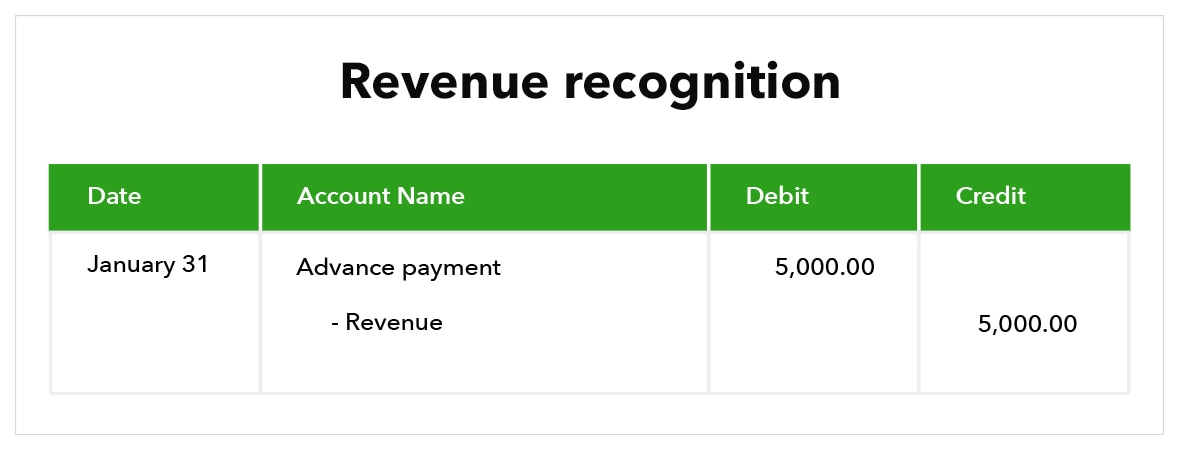

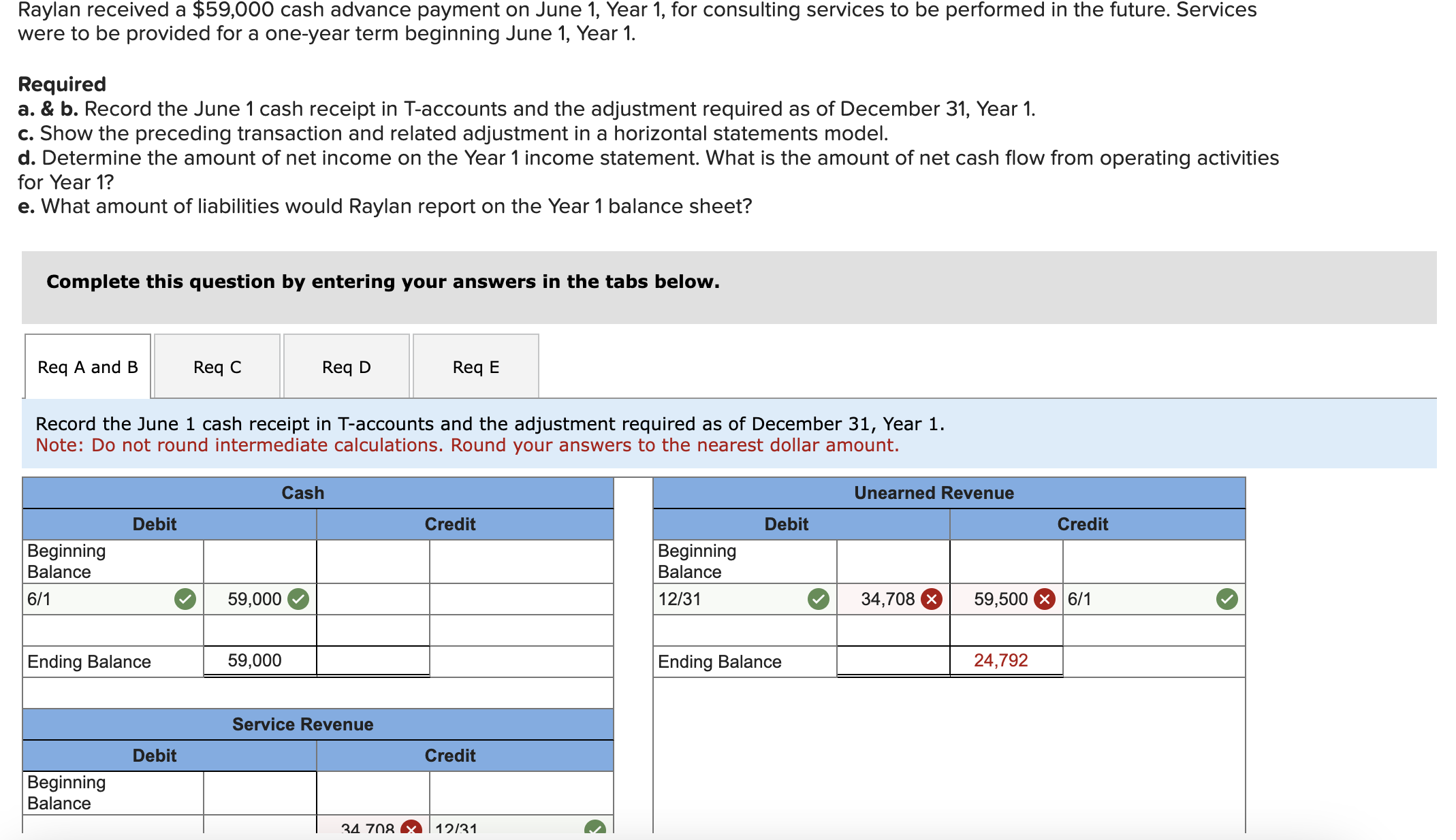

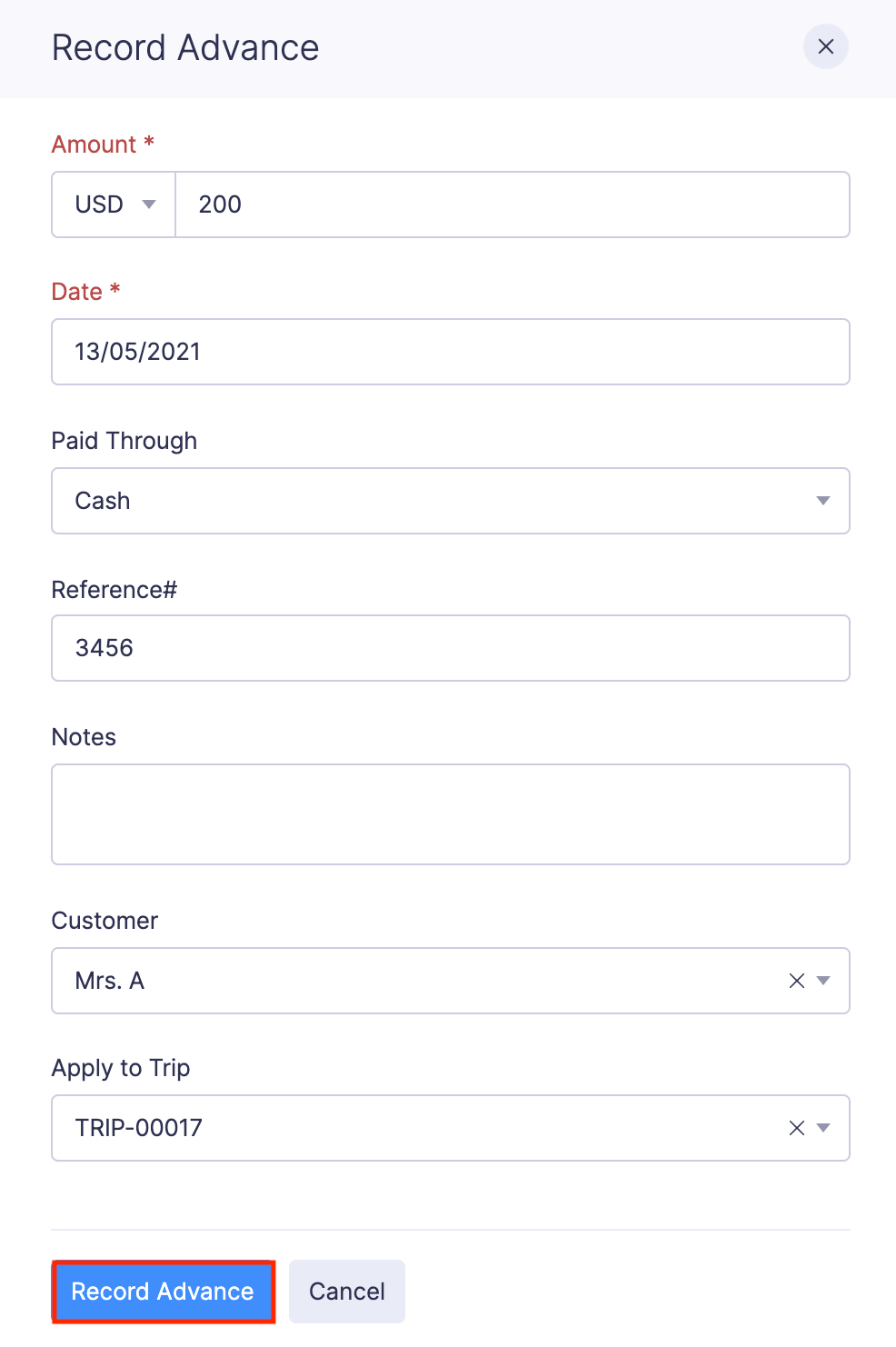

The generally accepted accounting principles (GAAP) and the International Financial Reporting Standards (IFRS) provide specific guidelines for recognizing revenue. These standards require companies to defer revenue recognition until the goods or services have been delivered or performed. This means that the advance payment is initially recorded as a liability on the balance sheet, specifically as "unearned revenue" or "deferred revenue."

As the company fulfills its obligation to the customer, a portion of the deferred revenue is recognized as earned revenue on the income statement. This process ensures that revenue is recognized only when it has been actually earned, providing a more accurate picture of the company's financial performance.

Potential Challenges and Considerations

While advance payments offer many benefits, they also come with potential challenges and risks that businesses need to be aware of.

One of the biggest challenges is managing customer expectations. If a company fails to deliver the promised goods or services on time or to the required quality, it can damage its reputation and lose customer trust. Effective communication and proactive problem-solving are essential for mitigating this risk.

Another challenge is managing cash flow. While advance payments provide an immediate influx of cash, companies need to ensure that they have sufficient resources to fulfill their obligations. Over-reliance on advance payments can lead to financial difficulties if the company is unable to deliver on its promises.

The Securities and Exchange Commission (SEC) pays close attention to companies' revenue recognition practices, including the treatment of advance payments. Companies that are found to be manipulating their revenue recognition practices can face significant penalties.

Looking Ahead: The Future of Advance Payments

As technology continues to evolve, the use of advance payments is likely to become even more widespread. The rise of e-commerce and subscription-based business models has made it easier than ever for companies to collect payments in advance.

Furthermore, the increasing popularity of crowdfunding platforms has provided a new avenue for companies to raise capital through pre-sales and pledges. These platforms allow businesses to connect directly with potential customers and secure funding for innovative projects. Kickstarter and Indiegogo are prominent examples.

However, with this increased use comes increased responsibility. Companies need to be transparent and accountable in their dealings with customers. They also need to be vigilant in managing their cash flow and ensuring that they can deliver on their promises.

In conclusion, amounts received in advance from customers are a powerful financial tool that can benefit both businesses and consumers. By understanding the benefits, challenges, and accounting implications of this practice, businesses can use it effectively to grow their operations and build lasting customer relationships. The key is to approach these transactions with integrity, transparency, and a commitment to delivering on promises made, fostering a climate of trust and mutual benefit.