An Accrued Revenue Can Best Be Described As An Amount

Breaking now: Businesses face critical accounting clarification. An accrued revenue is officially defined as an amount representing earned income not yet billed, impacting balance sheets nationwide.

The re-emphasis, prompted by rising discrepancies in financial reporting, is designed to provide a clearer understanding of a fundamental accounting principle. This has triggered immediate calls for internal audits and revised financial strategies across multiple sectors.

Accrued Revenue: A Closer Look

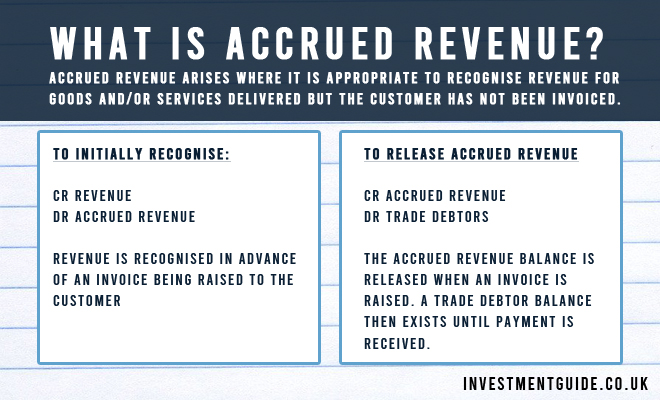

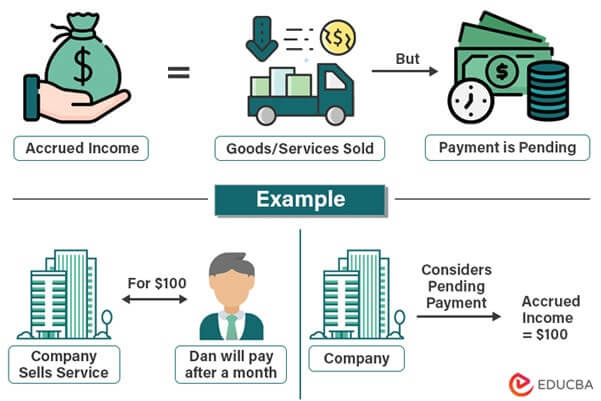

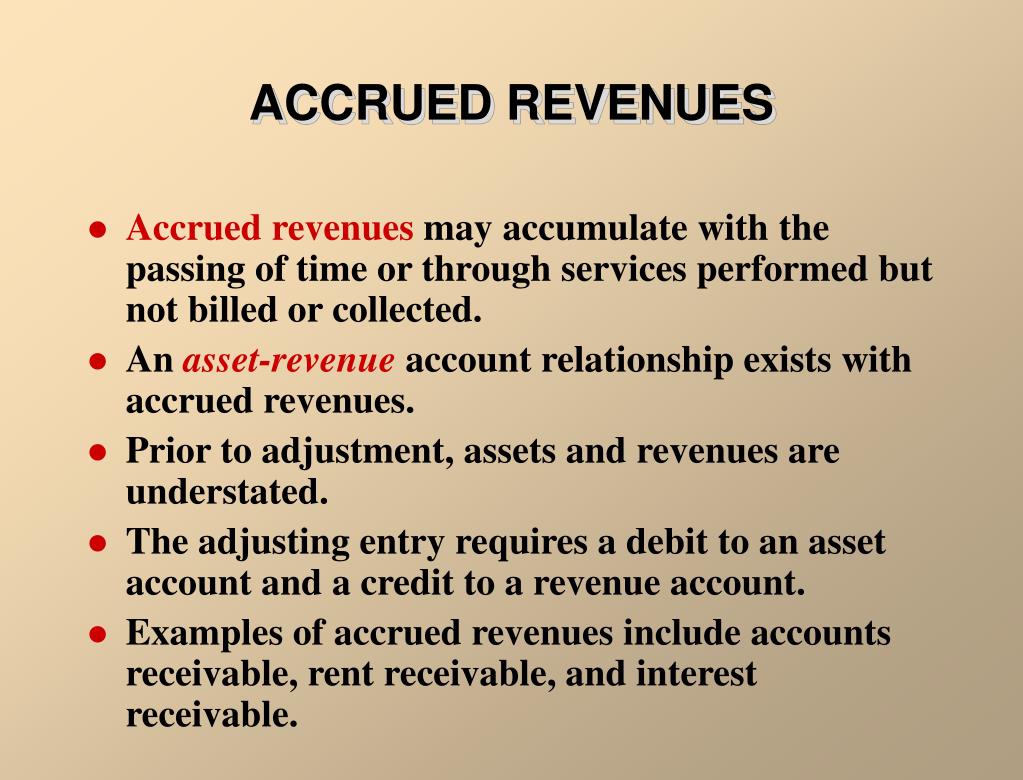

The core of the matter: an accrued revenue is the monetary value of services rendered or goods delivered for which payment has not yet been received. Think of a lawyer completing work in December but billing the client in January. The revenue is *accrued* in December.

This contrasts sharply with cash-basis accounting, where revenue is recognized only upon receipt of payment. The accrual method, mandated for publicly traded companies and many larger businesses, provides a more accurate snapshot of financial performance.

What's Changed?

While the definition itself isn't new, the renewed focus comes in response to widespread misinterpretations. Recent reports indicate a significant number of businesses are either overlooking or miscalculating accrued revenues, leading to inaccurate financial statements.

The Securities and Exchange Commission (SEC) has subtly increased its scrutiny of companies' accounting practices. This re-evaluation aims to improve transparency and reduce the potential for financial manipulation.

Sources close to the Financial Accounting Standards Board (FASB) confirm discussions are underway to issue further guidance on specific scenarios. This could include complexities related to long-term contracts and variable pricing models.

Impact Across Industries

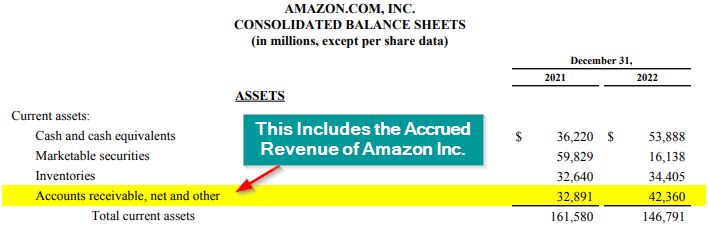

The emphasis on accurate accrued revenue recognition spans numerous industries. From tech companies with subscription-based services to construction firms with ongoing projects, all are impacted.

Consider a software company. They might provide a year's worth of service, billed quarterly. At the end of any given quarter, the portion of the annual fee already earned but not yet billed represents accrued revenue.

In the construction industry, accrued revenue often arises from percentage-of-completion accounting. This complex method requires firms to estimate the amount of revenue earned based on the progress of a project, even before final invoicing.

Expert Analysis

"The definition is clear, but the application is where companies often stumble," states Dr. Anya Sharma, a leading accounting professor at the Wharton School of the University of Pennsylvania.

“Implementing robust systems to track project milestones and accurately estimate costs is crucial. Failing to do so can lead to significant errors and potential regulatory issues," Sharma emphasized.

Small and medium-sized enterprises (SMEs) are particularly vulnerable. They often lack the specialized expertise and sophisticated accounting software needed to manage accrued revenues effectively.

Potential Pitfalls

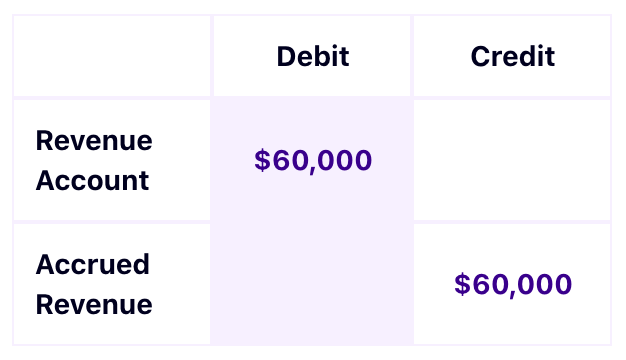

Incorrectly calculating accrued revenue can have far-reaching consequences. Overstating revenue can artificially inflate profits, misleading investors and stakeholders.

Understating revenue, while less common, can also distort financial performance. This can impact access to credit and investment opportunities.

Moreover, consistent errors in accrued revenue reporting can trigger SEC investigations. This carries the risk of fines, penalties, and reputational damage.

Immediate Actions and Next Steps

Businesses are advised to immediately review their existing accounting procedures. Special attention should be given to the policies and systems used to calculate and track accrued revenues.

Companies should consider seeking guidance from qualified accountants or consultants. Ensuring compliance with accounting standards is crucial for maintaining financial integrity.

The FASB's potential future guidance on specific accrued revenue scenarios should be closely monitored. Staying informed and adapting accounting practices accordingly is essential.

Ongoing Developments: The AICPA is expected to release updated best practices recommendations for small businesses within the next quarter. This aims to simplify accrued revenue accounting for smaller operations.

:max_bytes(150000):strip_icc()/accrued-revenue-Final-ae2075d1acbb46d18adb27838b33751c.jpg)