Financial Questions For Entrepreneurs

Entrepreneurs face a constant barrage of financial decisions that can make or break their ventures. Mastering these critical areas is the difference between soaring success and crashing failure.

Navigating the financial landscape requires a clear understanding of key concepts and meticulous planning. This article breaks down the essential financial questions every entrepreneur must answer, providing a roadmap to stability and growth.

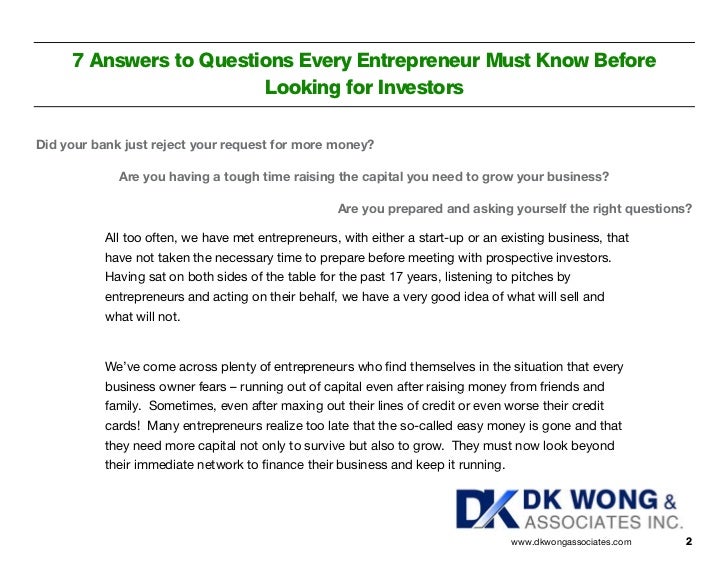

Bootstrapping vs. Seeking Funding: The Initial Decision

Should you self-fund your business or seek external investment? According to a 2023 report by the Small Business Administration, approximately 77% of new businesses are initially funded through personal savings and loans from friends and family.

Bootstrapping offers complete control but can limit growth speed. Seeking funding, like venture capital or angel investment, provides capital for faster expansion but dilutes ownership and introduces external pressures.

Consider the pros and cons of each, weighing your personal financial risk tolerance against your growth aspirations. It's a tough balance.

Cash Flow Management: The Lifeblood of Your Business

Do you understand your cash flow cycle? In a recent study by U.S. Bank, 82% of business failures are attributed to poor cash flow management.

Track incoming and outgoing cash meticulously. Implement a forecasting system to anticipate shortfalls and surpluses.

Cash flow is king, and even profitable businesses can fail if they run out of cash to meet obligations.

Pricing Strategy: Finding the Sweet Spot

How do you determine your product or service pricing? Pricing should cover costs, generate profit, and remain competitive.

Research your competitors, calculate your breakeven point, and consider the perceived value your offering provides to customers. A survey by McKinsey revealed that a 1% improvement in pricing can increase profits by up to 11%.

Experiment with different pricing models, such as cost-plus, value-based, or competitive pricing, to find the optimal strategy.

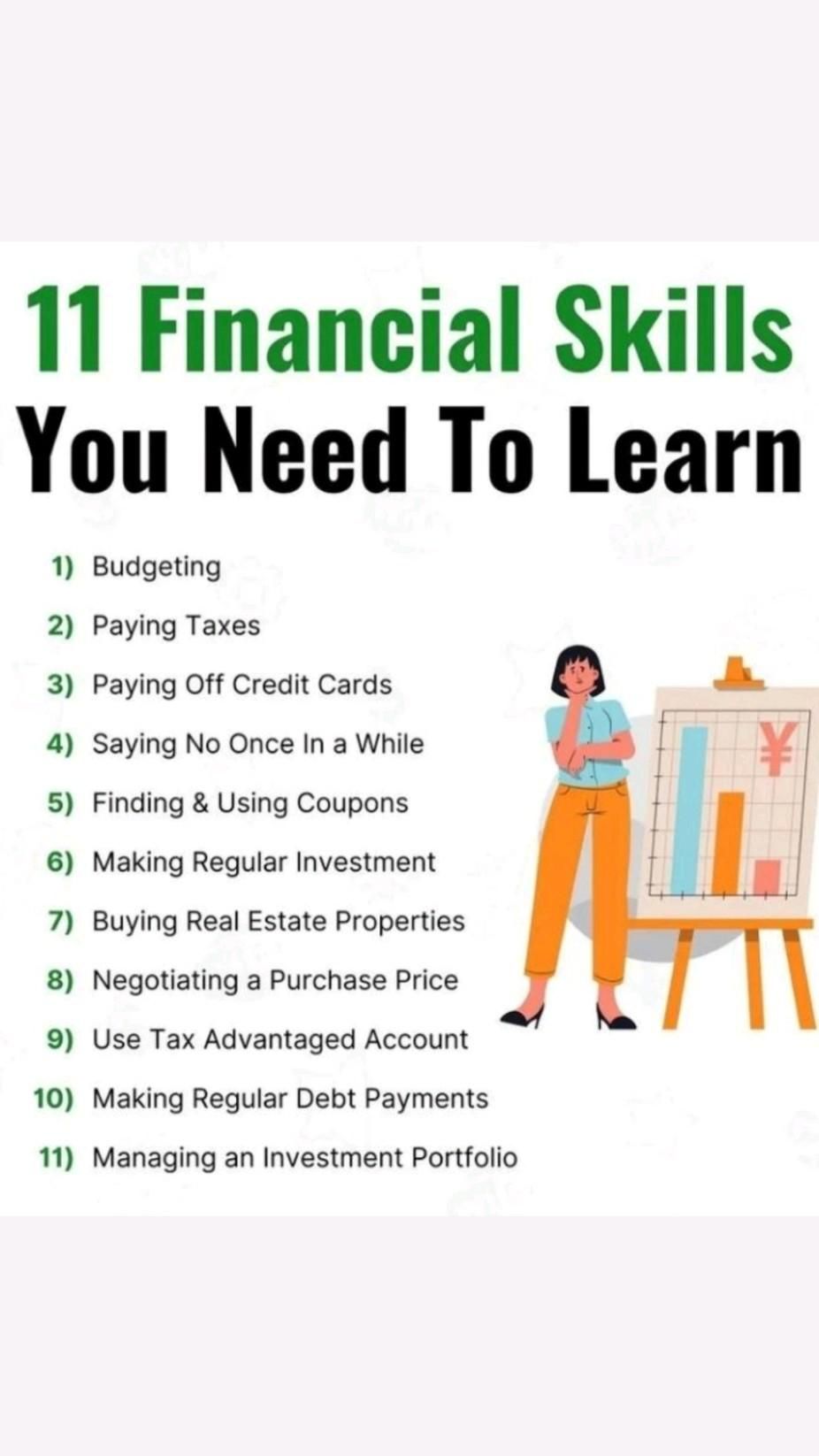

Tax Planning: Minimizing Your Burden

Are you proactively planning for taxes? Entrepreneurs often overlook the complexities of tax obligations.

Consult with a tax professional to understand applicable deductions, credits, and reporting requirements. Estimated tax payments are crucial to avoid penalties.

According to the IRS, small businesses face significant penalties for underpayment of taxes. Tax planning should be an integral part of your financial strategy.

Financial Forecasting: Projecting Your Future

Do you have a detailed financial forecast? A financial forecast projects future revenues, expenses, and profits.

It helps you anticipate funding needs, identify potential risks, and set realistic goals. Investors often require detailed forecasts before committing capital.

Use tools like spreadsheets or financial modeling software to create scenarios based on different assumptions. A well-developed forecast provides a roadmap for growth and aids in decision-making.

Managing Debt: Balancing Leverage and Risk

How are you managing debt? Debt can be a powerful tool for growth, but it also carries risk.

Assess your ability to repay loans before taking on debt. Monitor interest rates and seek opportunities to refinance when advantageous. The Federal Reserve tracks small business loan delinquency rates, offering insight into the overall health of small business debt.

Avoid excessive debt that could jeopardize your business during economic downturns. Use debt strategically to fuel expansion and increase profitability.

Exit Strategy: Planning for the Future

Have you considered your exit strategy? Although it might seem premature, planning your exit early allows you to build value and maximize your return.

Options include selling to another company, passing the business to family members, or going public. According to a study by Harvard Business Review, businesses with a well-defined exit strategy attract higher valuations.

Consider the timing, financial implications, and personal goals associated with your exit. Exit planning is a crucial aspect of long-term financial success.

Next Steps: Ongoing Financial Review

Entrepreneurs should regularly review their financial performance, identify areas for improvement, and adapt their strategies as needed.

Consider establishing a relationship with a financial advisor who can provide ongoing guidance and support. Prioritize financial literacy and continuous learning to stay ahead of the curve.