An Adjusting Entry For Accrued Expenses Involves

The often-overlooked world of accrual accounting recently garnered attention as businesses of all sizes grapple with understanding and implementing adjusting entries for accrued expenses. The process, while seemingly technical, plays a crucial role in accurately reflecting a company’s financial position.

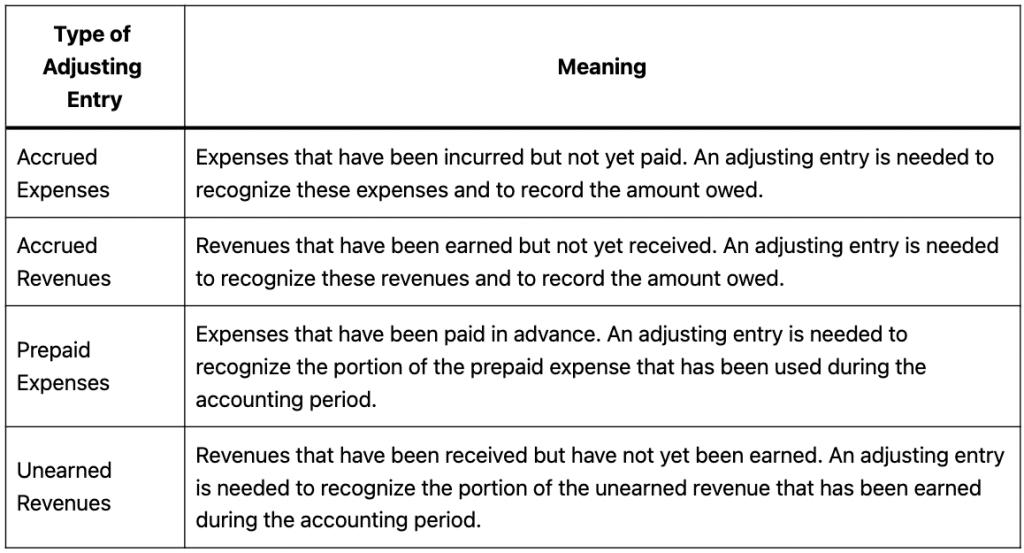

Accrued expenses, costs that have been incurred but not yet paid, require careful handling to comply with generally accepted accounting principles (GAAP). This article delves into the intricacies of adjusting entries for these expenses, exploring their significance, mechanics, and impact on financial reporting.

Understanding Accrued Expenses

An accrued expense represents a liability for a company. It signifies that a service or good has been received, but the corresponding payment is still outstanding. Common examples include salaries owed to employees, utilities used but not billed, and interest accrued on loans.

Without proper accounting for these accruals, a company's financial statements would paint an incomplete and potentially misleading picture. This can lead to inaccurate profitability calculations and skewed balance sheet figures.

Why Adjusting Entries Matter

The primary purpose of an adjusting entry is to recognize an expense in the period it was incurred, regardless of when the cash payment is made. This aligns with the accrual basis of accounting, which mandates recognizing revenues when earned and expenses when incurred. GAAP principles dictate this approach.

Failing to make these adjustments violates the matching principle, a cornerstone of accrual accounting. The matching principle aims to match expenses with the revenues they helped generate in the same accounting period.

The Mechanics of an Adjusting Entry

An adjusting entry for an accrued expense typically involves two accounts: an expense account and a liability account. The expense account is debited, increasing the expense for the period.

Simultaneously, the corresponding liability account is credited, increasing the amount owed. This creates a liability on the balance sheet representing the outstanding obligation.

For example, consider a company that owes $5,000 in salaries to its employees at the end of the month. The adjusting entry would debit Salaries Expense for $5,000 and credit Salaries Payable for $5,000. Salaries Expense would appear on the income statement, while Salaries Payable would be listed as a current liability on the balance sheet.

Potential Impact on Financial Statements

Accurate adjusting entries directly influence the accuracy of both the income statement and the balance sheet. By recognizing expenses in the correct period, the income statement provides a more realistic view of the company's profitability.

The balance sheet, on the other hand, presents a clearer picture of the company's assets, liabilities, and equity. Understating liabilities by neglecting to accrue expenses can distort the company's financial health.

Challenges and Best Practices

One common challenge in accounting for accrued expenses lies in estimating the amount to be accrued. Some expenses, like salaries, are relatively straightforward to calculate. Others, such as accrued warranty expenses, require more complex estimations based on historical data and statistical analysis.

Companies often rely on past experience and industry benchmarks to estimate these amounts. However, it's crucial to regularly review and update these estimates as new information becomes available.

Another best practice is to maintain thorough documentation to support all adjusting entries. This documentation should include the rationale behind the accrual, the method used to calculate the amount, and any supporting evidence.

Proper documentation not only ensures accuracy but also facilitates auditing and provides transparency to stakeholders. It is also important to note that the Sarbanes-Oxley Act emphasizes the importance of internal controls and documentation in financial reporting.

Expert Perspectives

Professor Anya Sharma, an accounting professor at State University, emphasized the crucial role of adjusting entries in maintaining the integrity of financial statements. "Adjusting entries are not just technicalities; they are fundamental to presenting a true and fair view of a company's financial performance and position," she stated.

CPA firm Miller & Zois issued a statement highlighting the increasing scrutiny of accrued expenses by auditors. "We are seeing a greater focus on the accuracy and documentation of accrued expenses during audits," the statement read. "Companies should ensure they have robust processes in place to identify and account for these accruals."

Conclusion

Adjusting entries for accrued expenses are an indispensable part of accrual accounting. While they might appear complex, they are essential for providing accurate and reliable financial information.

By understanding the principles behind these entries and implementing best practices, businesses can ensure compliance with GAAP, improve financial transparency, and make more informed decisions. A proper accounting for accrued expenses ultimately contributes to better financial health and sustainable growth.

![An Adjusting Entry For Accrued Expenses Involves [ANSWERED] An adjusting entry to record an accrued expense involves a](https://media.kunduz.com/media/sug-question-candidate/20240215202200094707-3652001.jpg?h=512)