Application Does Not Meet Lender's Risk Threshold

Loan applications are facing unprecedented scrutiny as lenders tighten their risk tolerance. A significant increase in application denials citing failure to meet lenders' risk thresholds has sent shockwaves through the housing and small business sectors.

This tightening of credit conditions, detailed in reports released this morning, is impacting access to capital for individuals and businesses alike, raising concerns about potential economic slowdown.

Lender's Risk Threshold

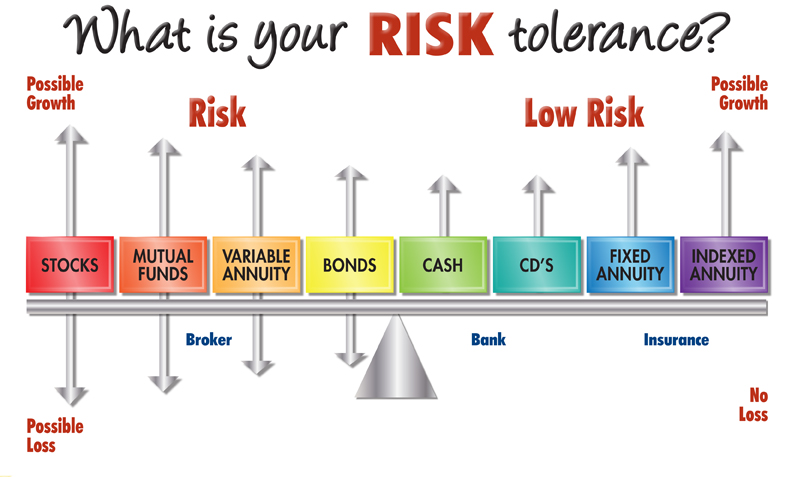

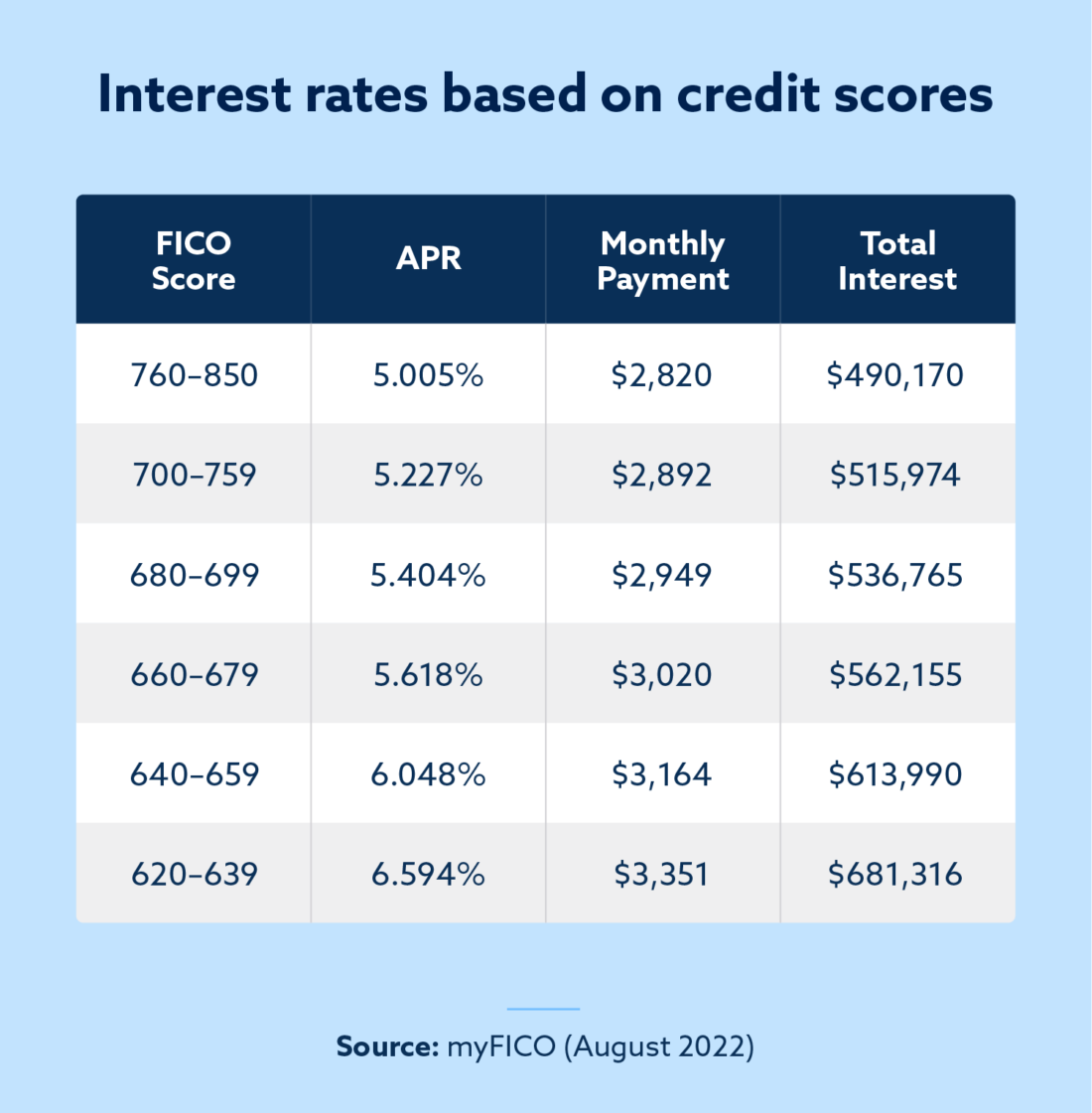

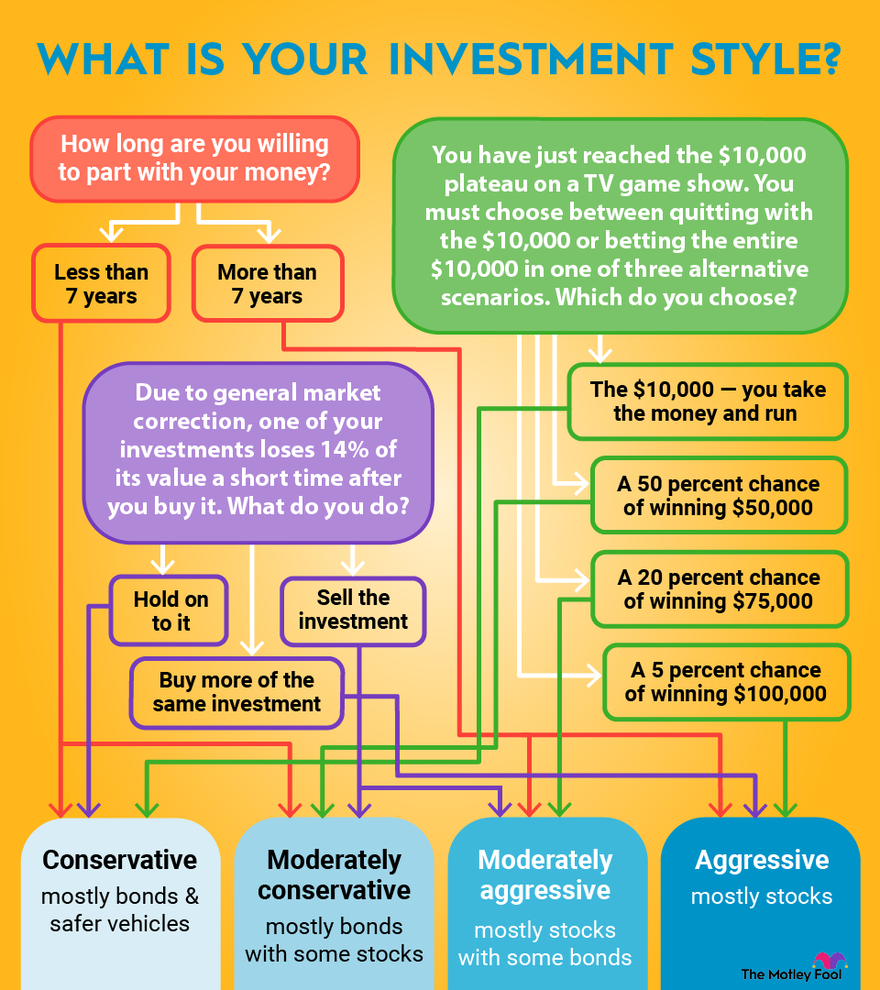

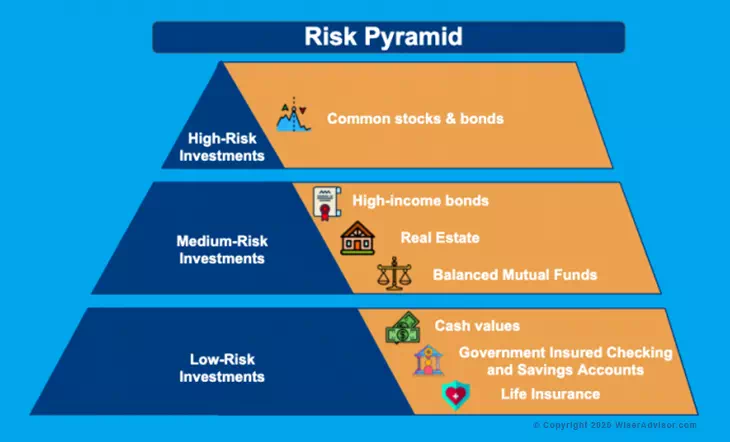

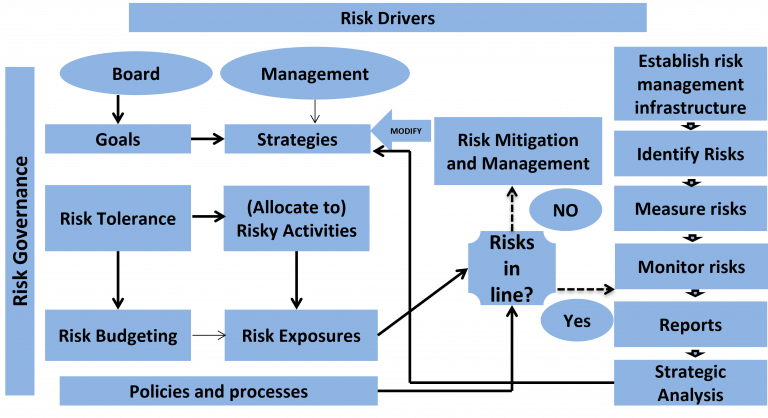

The core issue revolves around revised risk assessment models employed by major lending institutions. According to a statement released by the American Banking Association (ABA), these models now place greater emphasis on factors like debt-to-income ratios, credit scores, and industry-specific vulnerabilities.

"Our members are operating in a climate of increased economic uncertainty," explained ABA spokesperson Jane Doe. "Prudent risk management is paramount to ensuring the long-term stability of the financial system."

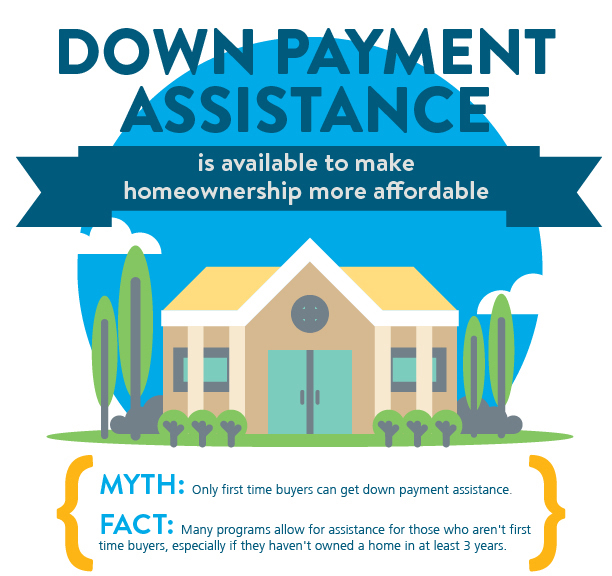

Data from the Mortgage Bankers Association (MBA) indicates that the denial rate for mortgage applications citing risk concerns has jumped 15% in the last quarter. This sharp increase is particularly pronounced among first-time homebuyers and those with less-than-perfect credit histories.

Similarly, the Small Business Administration (SBA) reports a 12% rise in loan application rejections for small businesses. Businesses in sectors deemed high-risk, such as retail and hospitality, are facing the steepest hurdles.

Impact on Housing Market

The tougher lending standards are already cooling the housing market. Fewer approved mortgages translate directly to reduced home sales and potential downward pressure on property values. The National Association of Realtors (NAR) is closely monitoring the situation.

"We are concerned that these tighter credit conditions will disproportionately impact aspiring homeowners," stated Lawrence Yun, NAR's Chief Economist. "Affordability is already a major challenge, and this will only exacerbate the problem."

Real estate agents report increased frustration among potential buyers. Many are finding themselves unable to secure financing despite having sufficient down payments and stable employment histories.

Small Business Struggles

For small businesses, access to capital is often the lifeblood of growth and survival. The increased loan denial rate is raising fears of business closures and job losses.

John Smith, owner of a local restaurant, shared his recent experience. "I applied for a loan to expand my outdoor seating area, but I was denied due to perceived risk in the restaurant industry. It's incredibly frustrating."

The National Federation of Independent Business (NFIB) is urging lenders to adopt a more nuanced approach to risk assessment. They argue that blanket denials based on industry classifications are unfair and detrimental to the economy.

Who, What, Where, When, How

Who: Individuals and small businesses seeking loans.

What: Loan applications being denied due to lenders' increased risk aversion.

Where: United States, impacting both housing and small business sectors.

When: Reports released this morning reflect trends in the last quarter.

How: Lenders are using revised risk assessment models that place greater emphasis on factors like debt-to-income ratios and industry risk.

Expert Analysis

Financial analysts are divided on the long-term implications of these tightened lending standards. Some argue that they are a necessary corrective measure to prevent another financial crisis. Others fear that they will stifle economic growth and exacerbate existing inequalities.

"There is a delicate balance between responsible lending and creating unnecessary barriers to economic opportunity," noted Dr. Emily Carter, an economist at the Brookings Institution. "We need to ensure that these risk models are not overly restrictive and that borrowers have access to fair and transparent credit."

She suggested exploring alternative lending models and government-backed loan programs to mitigate the impact on vulnerable borrowers.

Next Steps

The ABA and SBA are scheduled to meet next week to discuss potential solutions to address the growing concerns. Lawmakers are also considering legislation to provide additional support for small businesses and first-time homebuyers.

Individuals and businesses facing loan denials are encouraged to explore alternative lending options, improve their credit scores, and seek financial counseling. This situation requires immediate attention from borrowers.

Further updates will be provided as the situation develops. The financial landscape is rapidly changing, and constant vigilance is now required.