Apply For Second Capital One Credit Card

Imagine a cozy corner café, the aroma of freshly brewed coffee filling the air. A woman, Sarah, sips her latte, scrolling through her phone with a thoughtful expression. She's not browsing social media; she's exploring the possibility of expanding her financial toolkit with another Capital One credit card.

For many, like Sarah, navigating the world of credit can feel overwhelming. This article aims to shed light on the option of applying for a second Capital One credit card, exploring its benefits, potential drawbacks, and how to determine if it's the right move for your financial situation.

Understanding Capital One's Credit Card Offerings

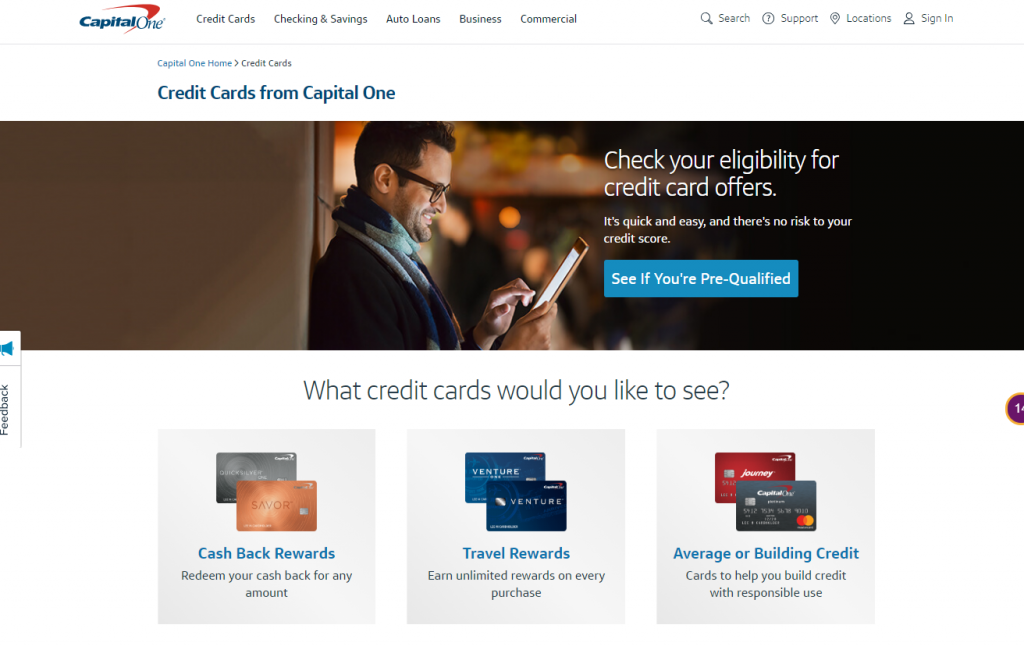

Capital One is a major player in the credit card industry, renowned for its diverse range of cards catering to various needs and credit profiles. From rewards cards offering cashback or travel points to secured cards designed for those building or rebuilding credit, Capital One provides options for a broad spectrum of consumers.

The company prides itself on its user-friendly online platform and commitment to customer service. This accessibility makes managing your accounts and understanding your credit options relatively straightforward.

Why Consider a Second Capital One Card?

There are several reasons why someone might consider adding another Capital One card to their wallet. One common motivation is to diversify their rewards strategy.

For example, if Sarah currently has a card that earns excellent rewards on travel, she might consider a second card that maximizes cashback on everyday purchases like groceries and dining. This strategic approach can help her accumulate more rewards overall.

Another reason is to increase overall credit limit. A higher combined credit limit can improve credit utilization ratio, a key factor in credit score calculation.

Eligibility and Application Process

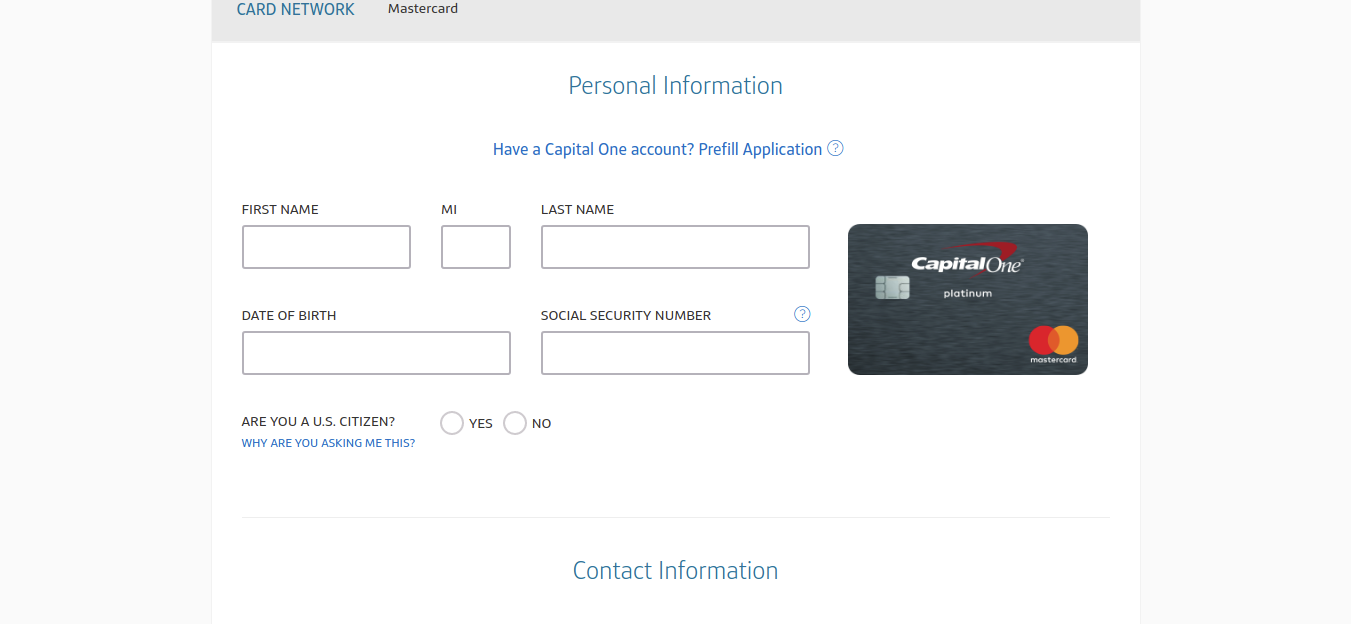

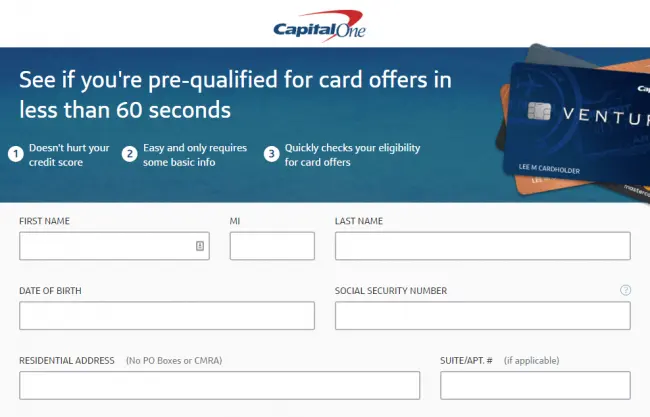

Capital One, like all credit card issuers, has specific eligibility requirements. Factors such as credit score, income, and existing debt are all considered during the application process. According to Capital One's website, each application is reviewed on an individual basis.

While Capital One generally allows individuals to have multiple credit cards, it's crucial to ensure you can manage the payments responsibly. The application process is typically straightforward, often completed online in a matter of minutes.

Potential Benefits and Drawbacks

The benefits of a second card, like enhanced rewards and improved credit utilization, can be significant. However, there are potential drawbacks to consider.

Opening multiple accounts can lead to increased temptation to overspend, potentially leading to debt. It's also important to be mindful of annual fees, which can offset the rewards earned if not carefully managed.

Furthermore, applying for multiple credit cards within a short period can slightly lower your credit score due to hard inquiries.

Making the Right Decision

Before applying for a second Capital One credit card, take a moment for honest self-assessment. Analyze your spending habits and consider your ability to manage multiple credit accounts responsibly.

Consider using online resources such as credit score simulators to estimate the impact of opening a new account. It's important to compare different card options to find the one that best aligns with your financial goals.

Ultimately, the decision to apply for a second credit card is a personal one. By carefully weighing the potential benefits and drawbacks, you can make an informed choice that supports your financial well-being. It's about empowering yourself with knowledge and making choices that lead to long-term financial success.