Jim Cramer's Charitable Trust Portfolio

Alert: Jim Cramer's charitable trust portfolio, tracked under the ticker symbol CBL, recently underwent significant adjustments. Investors are keenly watching these moves for insights into market sentiment.

The Cramer Charitable Trust serves as a real-time demonstration of investment strategies favored by the CNBC personality. Its performance and holdings offer a window into his market outlook.

Recent Portfolio Changes

Recent filings reveal notable shifts in the portfolio's composition. These changes reflect Cramer's current views on various sectors and individual companies.

Key Additions

One significant addition was a substantial increase in shares of Nvidia (NVDA). This move signals continued confidence in the AI and semiconductor sectors. NVDA's prominent position in the trust underscores the growing importance of technology.

Another noteworthy addition includes increased investment in Microsoft (MSFT). This investment suggests a bullish outlook on the stability and growth potential of established tech giants.

Significant Reductions

The trust significantly reduced its stake in Apple (AAPL). Market analysts are closely observing this decision for possible insight on challenges to Apple's valuation.

A considerable portion of shares in Amazon (AMZN) were also sold. These sales could indicate a strategic shift toward other sectors or a profit-taking maneuver.

Other Adjustments

Minor adjustments included trimming positions in select healthcare and consumer discretionary stocks. These adjustments are part of the continuous management of the portfolio.

Portfolio Allocation

As of the latest filings, technology remains a dominant sector in the trust's allocation. Healthcare and financials continue to hold significant weight.

The trust maintains a diversified approach, spreading investments across various sectors and asset classes. The allocation reflects risk management and diversification strategies.

Performance Overview

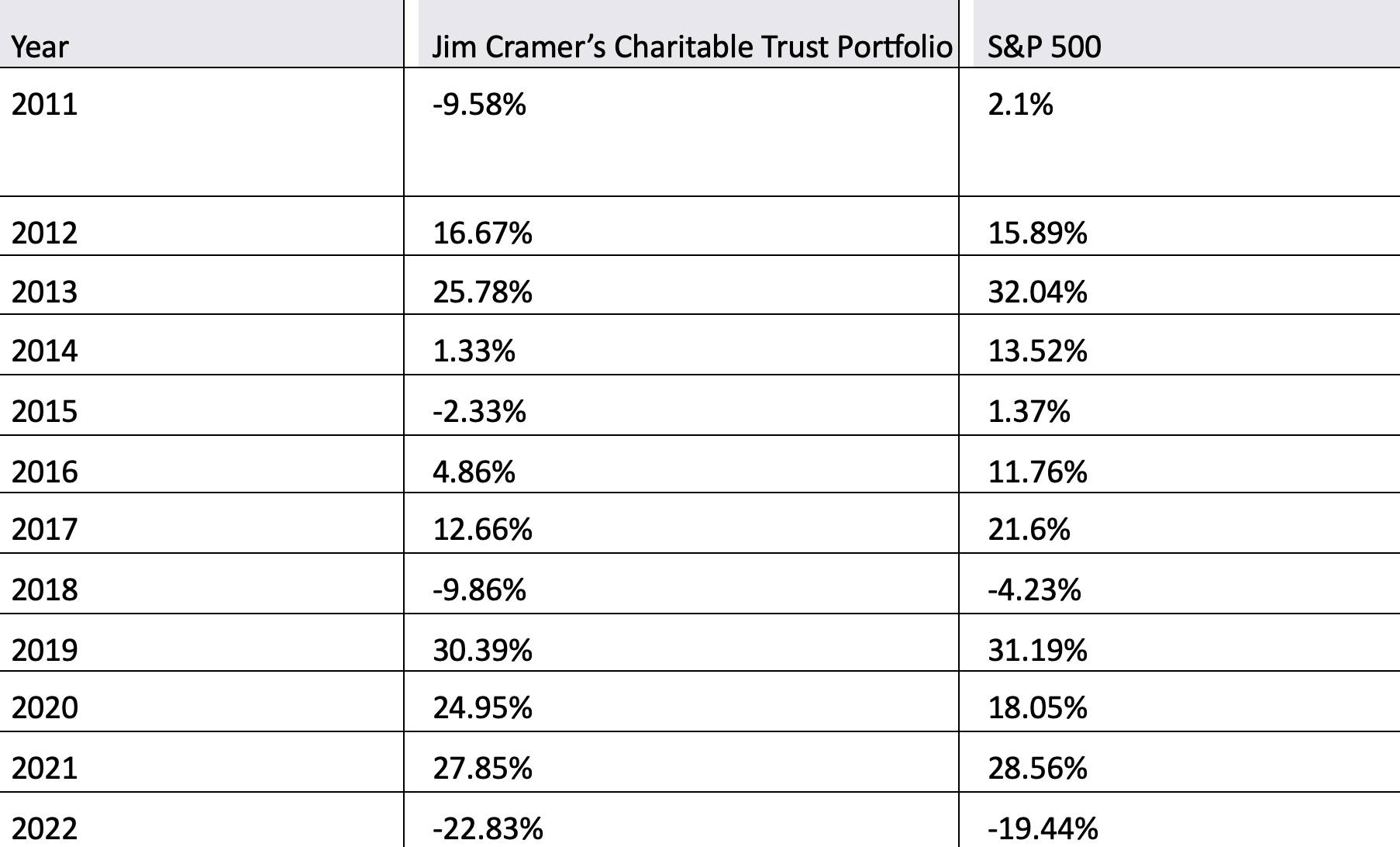

The Cramer Charitable Trust's performance is closely monitored by market observers. Its returns are frequently compared to benchmark indices, such as the S&P 500.

While past performance is not indicative of future results, it provides a context for understanding Cramer's investment philosophy. Recent performance data can be found on CNBC and other financial news outlets.

Implications for Investors

These portfolio changes often influence retail investors who closely follow Cramer's recommendations. However, investors should remember that the Cramer Charitable Trust reflects one individual's strategy.

It is crucial to conduct thorough research and consult with a financial advisor before making investment decisions. Always consider personal risk tolerance and financial goals.

Next Steps

Future portfolio changes will be closely scrutinized by analysts and investors alike. Keep an eye on the ticker CBL for ongoing updates to the holdings.

CNBC will likely provide continuing coverage and analysis of the trust's activities. Stay tuned for further developments.