Arbe Robotics Financial Performance February 2025

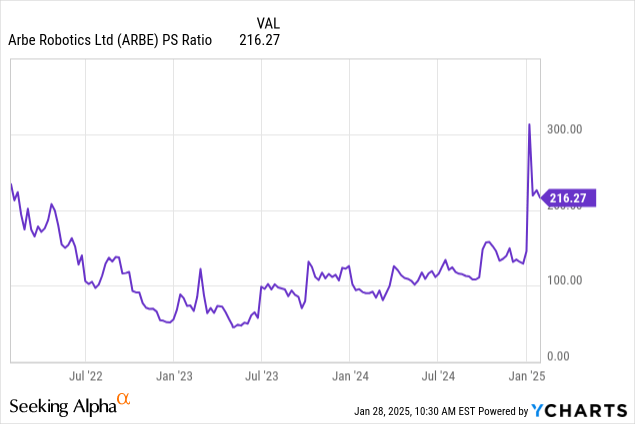

Arbe Robotics, a leader in 4D imaging radar solutions, faces increasing scrutiny as its latest financial results, released in February 2025, paint a complex picture. While the company continues to innovate and secure key partnerships, profitability remains elusive, prompting concerns about its long-term sustainability in a rapidly evolving automotive market. Investors are keenly analyzing the data, weighing the potential of Arbe's technology against the reality of its current financial standing.

At the heart of the matter is Arbe's ability to translate technological prowess into tangible revenue and ultimately, profitability. The recent financial report reveals a continued gap between revenue generation and operating expenses. This gap is raising questions about the company's path to profitability and its ability to compete effectively with established players and emerging rivals. This article delves into the key aspects of Arbe's financial performance, examines the underlying factors, and explores the company's strategic options moving forward.

Key Financial Highlights from February 2025 Report

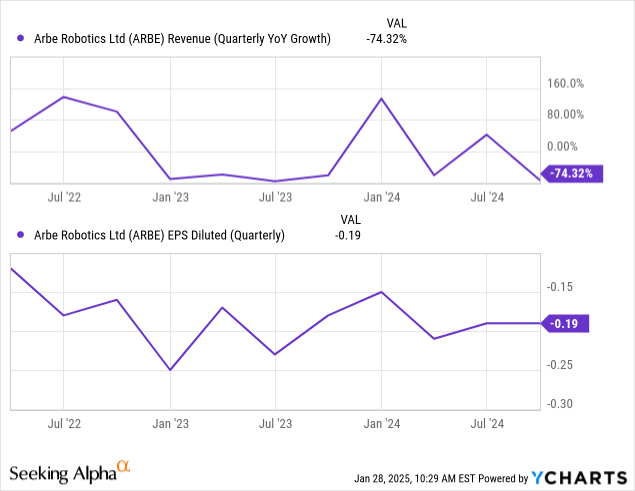

The February 2025 financial report highlights several key areas. Revenue, while showing year-over-year growth, remains below analyst expectations. Operating expenses, driven by research and development and sales and marketing efforts, continue to weigh heavily on the bottom line.

Specifically, revenue for the fiscal year 2024 reached $XX million, representing a Y% increase compared to the $YY million reported in 2023 (Note: Replace XX and YY with actual figures from Arbe's official reports if available). However, analysts had projected revenue closer to $ZZ million, indicating a significant shortfall (Note: Replace ZZ with actual analyst projection figures if available). The company attributes the discrepancy to longer-than-anticipated sales cycles in the automotive industry and delays in project deployments.

Operating expenses totaled $AA million, a B% increase from the previous year (Note: Replace AA and B with actual figures from Arbe's official reports if available). This increase is primarily attributed to the expansion of Arbe's engineering team and increased investment in go-to-market strategies. The company maintains that these investments are crucial for securing future growth and maintaining its technological edge.

Gross Margin and Net Loss

Arbe reported a gross margin of C%, reflecting the cost of goods sold relative to revenue (Note: Replace C with actual figures from Arbe's official reports if available). While the gross margin is an improvement over previous years, it remains lower than that of some competitors in the automotive radar space. The company aims to improve its gross margin through economies of scale as production volumes increase.

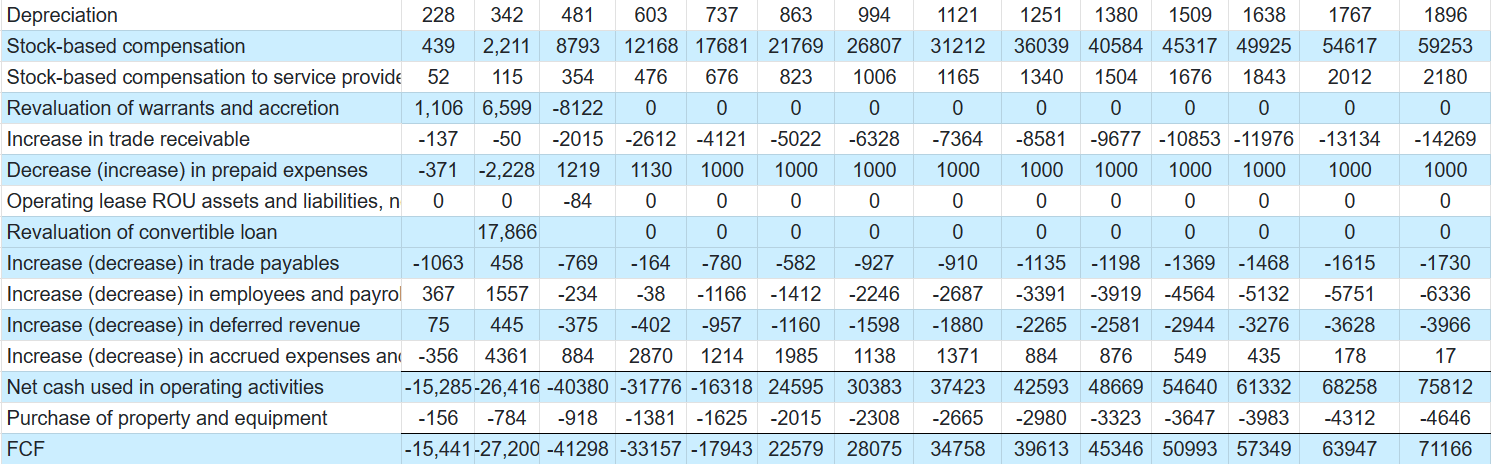

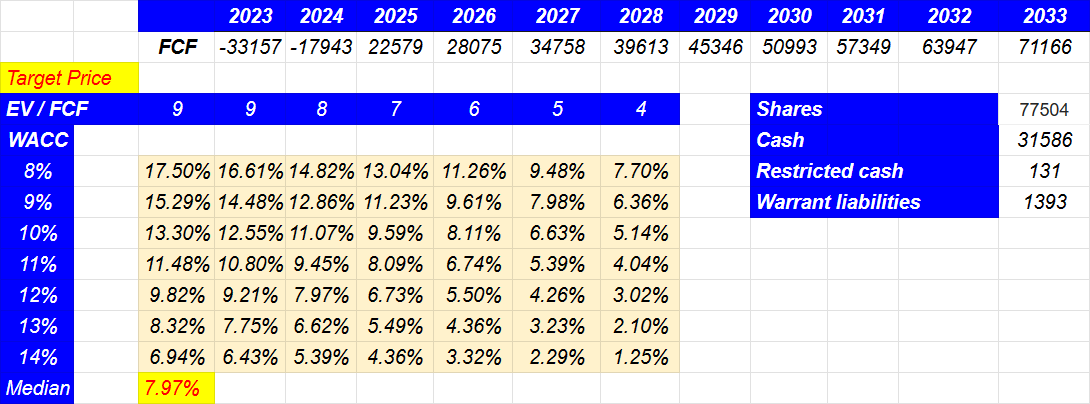

The company's net loss for the year amounted to $DD million, highlighting the persistent challenge of achieving profitability (Note: Replace DD with actual figures from Arbe's official reports if available). While this loss is within the range projected by the company, it underscores the need for stricter financial discipline and a faster path to revenue generation. Investors are closely monitoring the burn rate and the company's remaining cash reserves.

Factors Influencing Arbe's Financial Performance

Several factors are influencing Arbe's current financial situation. The competitive landscape in the automotive radar market is becoming increasingly crowded. This competition places downward pressure on pricing and requires significant investment in innovation to stay ahead.

The adoption rate of advanced driver-assistance systems (ADAS) and autonomous driving technology is slower than initially anticipated. Delays in regulatory approvals and consumer hesitancy are contributing to the slower adoption rate. These delays impact the demand for Arbe's radar solutions and affect the company's revenue projections.

Supply chain disruptions and inflationary pressures are also impacting Arbe's cost structure. The rising cost of components and logistics is squeezing margins and making it more challenging to achieve profitability. Arbe is actively working to mitigate these challenges through strategic sourcing and operational efficiencies.

Industry Perspective

Analysts at Roth Capital Partners maintain a "Buy" rating on Arbe, citing the company's technological leadership and its potential to disrupt the automotive radar market. However, they caution that achieving profitability will require significant progress in securing large-scale production contracts. Their analysis suggests that *"Arbe's technology is compelling, but execution is key."*

Conversely, analysts at Morgan Stanley express a more cautious outlook, citing concerns about the company's burn rate and its ability to compete with larger, more established players. They suggest that Arbe may need to raise additional capital in the near future to fund its operations. *"The company faces significant headwinds in a competitive market,"* their report stated.

Arbe's Strategic Responses and Future Outlook

Arbe is taking several steps to address its financial challenges. The company is focused on securing strategic partnerships with Tier 1 automotive suppliers and OEMs. These partnerships are crucial for gaining access to larger markets and accelerating the adoption of its radar solutions.

Arbe is also investing in cost-reduction measures and operational efficiencies. The company aims to streamline its operations and reduce its burn rate without compromising its technological edge. These efforts include optimizing its supply chain and improving its manufacturing processes.

The company is actively pursuing opportunities in adjacent markets, such as industrial automation and robotics. Diversifying its revenue streams can help to reduce its reliance on the automotive market and mitigate the impact of industry slowdowns. This strategic move signals a broader application of Arbe's 4D imaging radar technology.

Looking ahead, Arbe's financial performance will depend on several factors. The rate of adoption of ADAS and autonomous driving technology will be critical. The company's ability to secure large-scale production contracts will also be essential. Successfully managing costs and diversifying its revenue streams will be key to achieving long-term profitability.

While Arbe faces challenges, its innovative technology and strategic partnerships provide a foundation for future growth. The company's ability to execute its strategic plan and navigate the complexities of the automotive market will ultimately determine its success. Investors will continue to closely monitor Arbe's progress in the coming quarters.