Archer-daniels-midland Institutional Buying Selling April 2025

Shares of Archer-Daniels-Midland (ADM) experienced notable fluctuations in April 2025, driven in part by significant institutional buying and selling activity. The agricultural commodities giant, a key player in global food processing and ingredient production, saw its stock price react to both positive and negative signals emanating from large investment firms.

This article examines the observed institutional trading patterns in ADM during April 2025, analyzing the potential reasons behind these movements and their implications for the company and its shareholders. Understanding these trends provides valuable insight into the market's perception of ADM's future performance and the broader agricultural sector.

Institutional Activity Overview

During April 2025, several major institutional investors adjusted their positions in ADM stock. These adjustments involved both large-scale purchases and significant sales, creating a complex picture of investor sentiment.

Data compiled from regulatory filings and market analysis reports revealed that some institutions increased their holdings, citing positive long-term growth prospects for ADM. Conversely, other institutions reduced their exposure, expressing concerns about factors such as commodity price volatility and global economic uncertainty.

Key Players and Their Actions

Vanguard Group, a major institutional shareholder, reportedly increased its stake in ADM by approximately 2% during the month. This move suggests confidence in ADM's long-term strategy and its ability to navigate challenging market conditions.

On the other hand, BlackRock Fund Advisors reportedly reduced their position by around 1.5%. Sources indicate that this decision was potentially linked to portfolio rebalancing strategies and concerns about short-term earnings pressure on agricultural companies.

Smaller hedge funds also contributed to the overall trading volume. Some engaged in short-term speculative trading, while others adopted a more cautious approach, waiting for clearer signals from the market.

Factors Influencing Trading Decisions

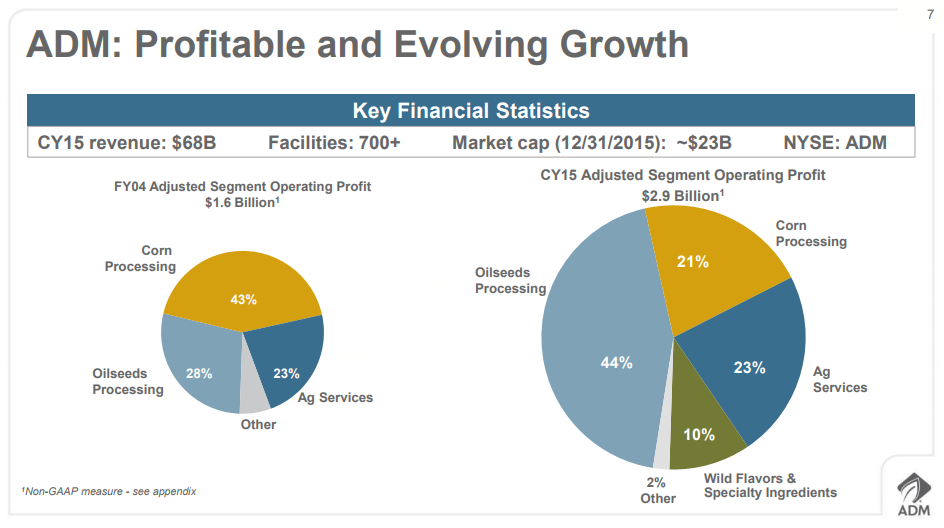

Several factors likely influenced institutional investors' decisions regarding ADM stock in April 2025. These include global commodity prices, earnings reports, and broader macroeconomic trends.

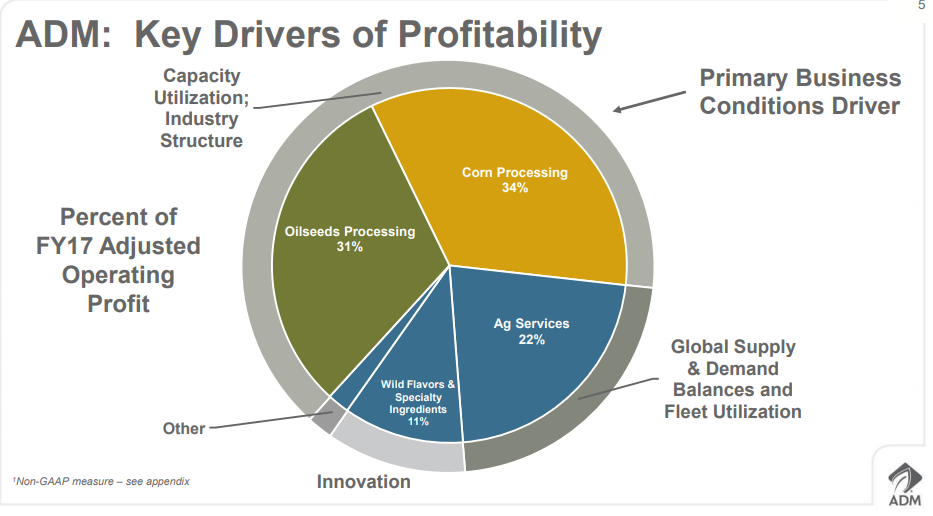

Fluctuations in the prices of key agricultural commodities, such as corn, soybeans, and wheat, directly impact ADM's profitability. Uncertainty surrounding trade agreements and geopolitical tensions also added to the complexity.

ADM's Q1 2025 earnings report, released in late April, presented a mixed picture. While revenue remained relatively stable, profit margins were under pressure due to rising input costs.

Impact on ADM and Shareholders

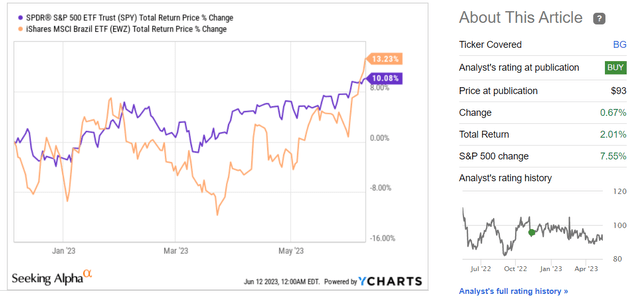

The institutional buying and selling activity had a noticeable impact on ADM's stock price during April 2025. The stock experienced periods of volatility, with intraday price swings reflecting the shifting sentiment of large investors.

While the overall impact was not dramatically negative, the increased trading volume heightened uncertainty for individual shareholders. Many retail investors likely found it challenging to interpret the mixed signals from the market.

“The institutional activity observed in ADM reflects the broader market sentiment toward the agricultural sector,” said Dr. Anya Sharma, an agricultural economist at the University of Illinois. “Investors are weighing the long-term growth potential against the short-term risks associated with commodity price volatility and global economic uncertainties.”

Looking Ahead

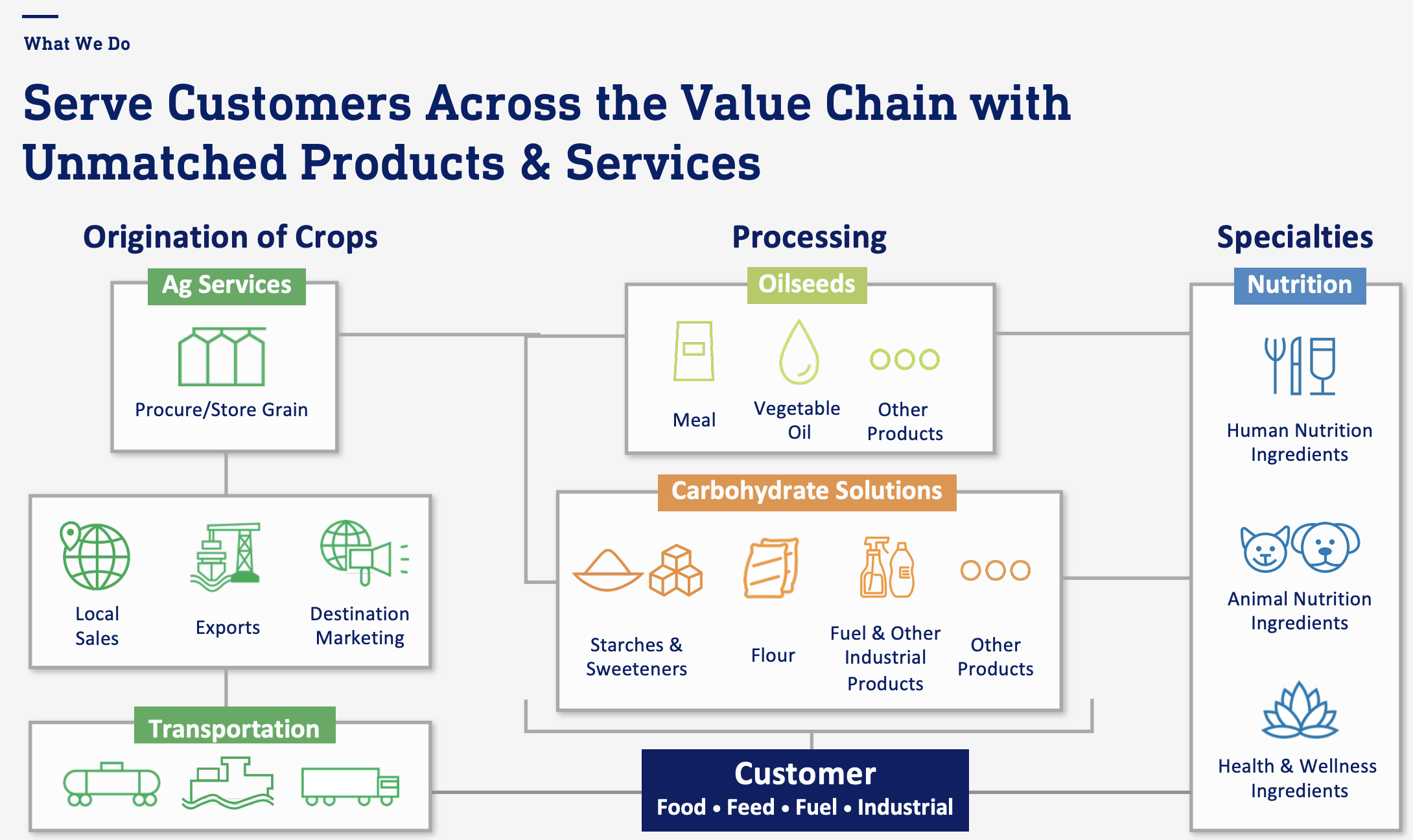

The trends observed in April 2025 suggest that institutional investors will continue to closely monitor ADM's performance and the broader agricultural landscape. Key factors to watch include commodity prices, global trade dynamics, and ADM's ability to manage costs and innovate its product offerings.

ADM's management team faces the challenge of reassuring investors and demonstrating the company's long-term resilience. Strategies aimed at diversifying revenue streams and improving operational efficiency will be crucial in navigating the evolving market environment.

Ultimately, the long-term success of ADM will depend on its ability to adapt to changing market conditions and maintain its competitive edge in the global agricultural industry. The coming months will be crucial in determining whether the positive institutional buying observed in some quarters will outweigh the selling pressure from others.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNFPZJCORZE3JO7PK76T25P3WA.png)