Are Gfci Outlets Required For Fha Loans

For prospective homebuyers relying on Federal Housing Administration (FHA) loans, understanding property requirements is crucial. A frequently asked question revolves around Ground Fault Circuit Interrupter (GFCI) outlets: Are they mandatory for properties financed with FHA loans? The answer, while seemingly straightforward, requires a nuanced understanding of FHA guidelines.

This article clarifies the FHA's stance on GFCI outlets, detailing the specific requirements and offering insights into how these electrical safety devices can affect loan approval. Understanding these regulations is essential for both buyers and sellers to navigate the FHA loan process successfully and ensure the safety of the property.

FHA Property Requirements: Safety First

The FHA's primary concern is ensuring the safety, security, and soundness of the properties it insures. This translates into a set of minimum property standards that all homes financed with FHA loans must meet. These standards cover various aspects of the property, including electrical systems.

GFCI Outlets: The FHA Position

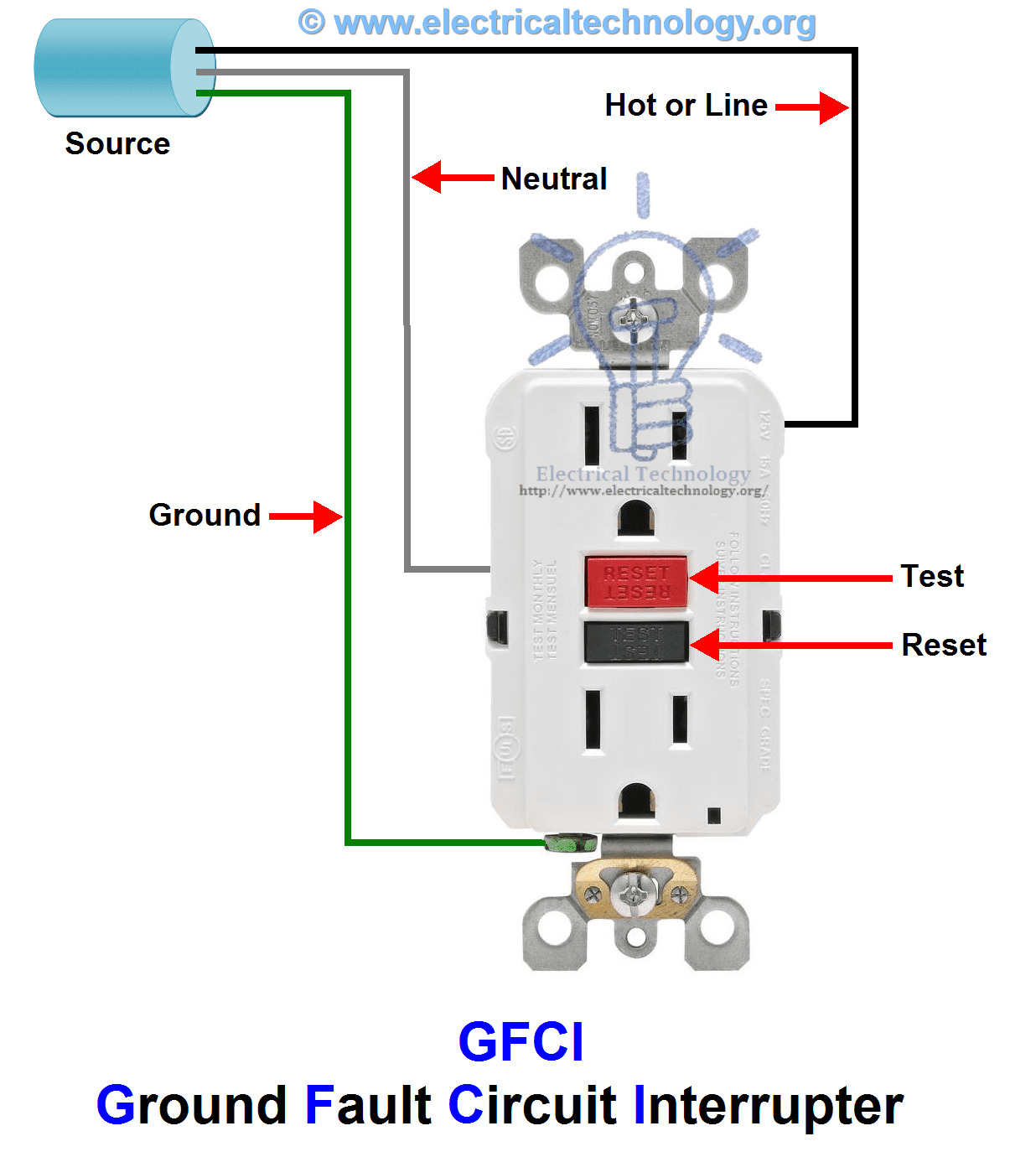

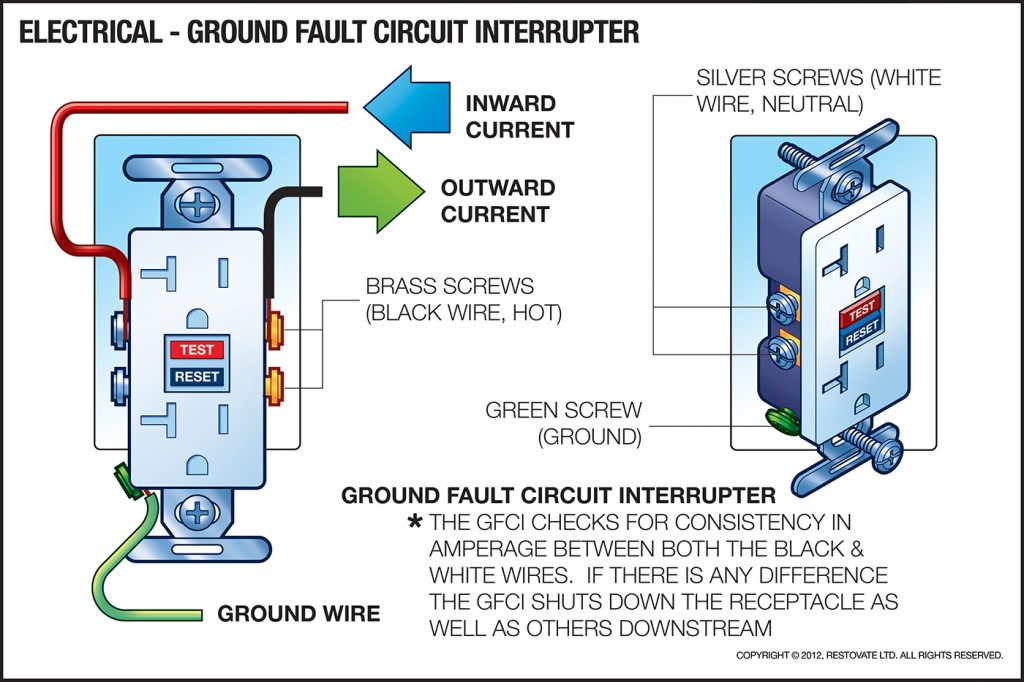

The FHA does not explicitly mandate GFCI outlets in all locations. However, the FHA guidelines require that the electrical system must be safe and functioning properly. This is where GFCI outlets often come into play.

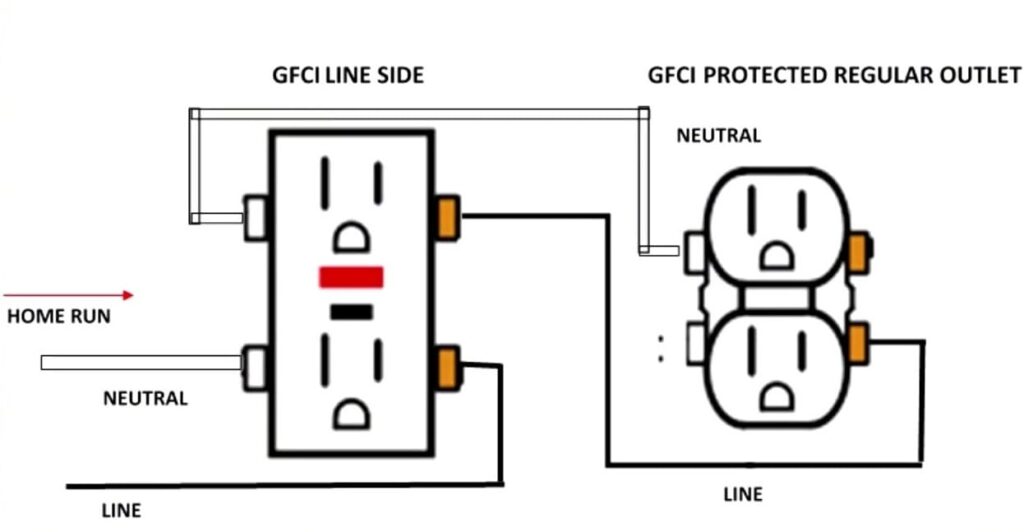

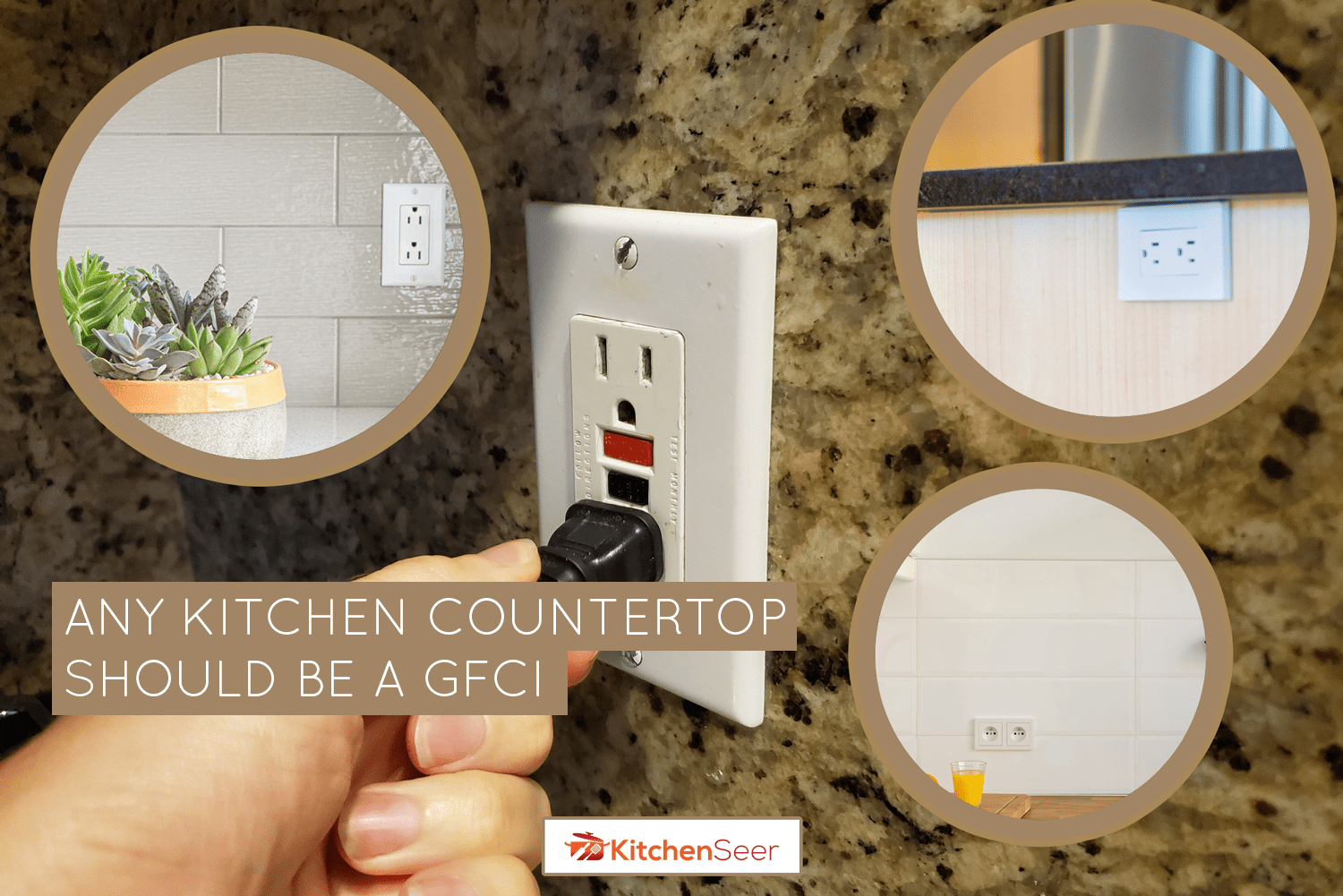

Generally, GFCI outlets are required in areas prone to moisture, such as bathrooms, kitchens, garages, and outdoor locations. This is in accordance with the National Electrical Code (NEC), which most local building codes follow. The FHA appraisal process usually involves ensuring compliance with prevailing local codes, which effectively leads to the requirement of GFCI outlets in those moisture-prone locations.

Simply put, if local code requires GFCI outlets in specific areas, the FHA appraisal will likely flag the property if they are missing.

The Role of the Appraiser

The FHA appraiser plays a pivotal role in determining whether a property meets FHA standards. They are tasked with identifying any potential safety hazards or deficiencies that could impact the property's value or the borrower's safety. During the appraisal, the appraiser will inspect the electrical system, noting any potential code violations or safety concerns, including the absence of GFCI outlets in required locations.

If the appraiser identifies missing or non-functioning GFCI outlets in areas where they are mandated by local code, this will be noted in the appraisal report. This deficiency could result in the loan being conditioned upon the installation of the required GFCI outlets.

The buyer will be responsible for the installation of the required GFCI outlets. It is important to have an electrician perform this type of work to ensure the system is properly installed and functioning.

Impact on Buyers and Sellers

For buyers, knowing about the GFCI outlet requirements can help them assess the condition of a property before making an offer. Identifying potential issues beforehand can prevent delays and added expenses during the loan process. For sellers, ensuring that GFCI outlets are properly installed in the appropriate locations can help avoid appraisal-related complications and facilitate a smoother sale.

Buyers and sellers should consult with their real estate agents and experienced FHA lenders to navigate the process effectively.

Staying Informed

FHA guidelines are subject to change, and it's crucial to stay informed about the latest updates. Borrowers should consult with an FHA-approved lender and a qualified real estate professional to ensure compliance with current requirements.

You can also find information on the U.S. Department of Housing and Urban Development (HUD) website. This way, both buyers and sellers can confidently navigate the FHA loan process.