Can I Get A Payday Loan In A Different State

The allure of quick cash can be powerful, especially when facing unexpected expenses. For many, payday loans seem like a readily available solution. But what happens when you need such a loan and are currently located in a state different from your permanent residence? The answer isn't always straightforward, and understanding the complexities of interstate payday lending is crucial.

This article explores the legality and practicalities of obtaining a payday loan in a different state, detailing the patchwork of regulations and the potential hurdles borrowers might face. It aims to provide clarity on a topic often shrouded in confusion, empowering consumers to make informed decisions.

The Regulatory Landscape: A State-by-State Affair

Payday loans are heavily regulated, and these regulations vary significantly from state to state. Some states have completely banned payday lending, deeming it predatory. Others have established strict limits on interest rates, loan amounts, and loan terms.

The legality of obtaining a payday loan in a different state hinges primarily on whether both your state of residence and the state where you are applying permit payday lending. Furthermore, the specific rules within each state must be considered.

State Residency and Loan Eligibility

Many payday lenders require proof of residency within the state where they operate. This often includes a valid state-issued ID or driver's license and proof of address. A temporary visit, even for an extended period, may not suffice to meet these requirements.

However, the rise of online payday lenders complicates this issue. Some online lenders may operate across state lines, potentially offering loans to individuals residing in states where they are not physically located.

Online Lenders: A Gray Area

The internet has blurred geographical boundaries, making it easier to find lenders willing to provide loans across state lines. However, this convenience comes with its own set of risks. It's crucial to verify the legitimacy and licensing of any online lender, regardless of their location.

State regulations often extend to online lenders serving residents of that state. This means that even if a lender is based in a state with lax regulations, they may still be bound by the rules of the borrower's state of residence. This is where things can become tricky.

Before accepting a loan from an online lender, carefully research their licensing status and ensure they comply with the laws of your home state. Look for reviews and check with consumer protection agencies to avoid potential scams.

The Role of State Attorneys General

State Attorneys General play a crucial role in regulating payday lending and protecting consumers from predatory practices. They can investigate complaints against lenders and take legal action to enforce state laws.

If you encounter issues with a payday lender operating across state lines, consider filing a complaint with your state's Attorney General's office. This can help protect yourself and others from similar problems. For example, the California Department of Justice actively monitors payday lenders operating within its borders.

Potential Risks and Alternatives

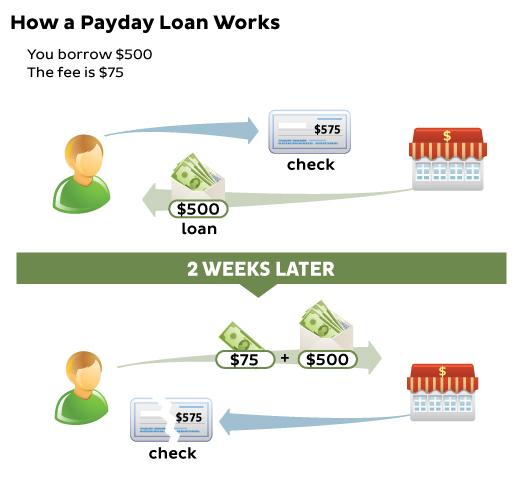

Regardless of whether you obtain a payday loan in your home state or another state, it's essential to understand the associated risks. Payday loans typically come with high interest rates and fees, which can lead to a cycle of debt.

Before resorting to a payday loan, explore alternative options such as personal loans from banks or credit unions, credit card cash advances, or borrowing from friends or family. These alternatives may offer more favorable terms and lower interest rates. Seeking assistance from local charities or non-profit organizations might also be a viable solution.

The Human Cost

The seemingly simple process of obtaining a small loan can quickly spiral into a complex financial burden. Stories abound of individuals trapped in a cycle of debt, constantly borrowing to repay previous loans.

Consider the experience of Sarah, a single mother who needed a small loan to cover an unexpected car repair. She obtained a payday loan online, thinking it was a quick fix. However, the high interest rates made it difficult to repay, and she soon found herself taking out additional loans to stay afloat.

Sarah's story highlights the potential dangers of payday lending and underscores the importance of exploring all available options before resorting to this type of loan. The Federal Trade Commission (FTC) provides valuable resources for consumers seeking financial assistance and information on avoiding predatory lending practices.

Conclusion: Proceed with Caution

While it may be possible to obtain a payday loan in a different state, it's crucial to proceed with caution and thoroughly research the legality and risks involved. Understand the regulations in both your state of residence and the state where you are applying for the loan.

Verify the legitimacy of any lender, especially online lenders operating across state lines. Explore alternative options before resorting to a payday loan, and be prepared for the potential consequences of high interest rates and fees. Informed decision-making is your best defense against the pitfalls of payday lending.