Can You Take Money Off Capital One Credit Card

For millions of Americans, credit cards are a lifeline, offering purchasing power and building credit history. But what happens when you need cash, and your Capital One credit card is sitting in your wallet? Can you directly withdraw funds from it? The answer is complex and fraught with potential costs.

This article explores the intricacies of accessing cash from your Capital One credit card, detailing the options available, associated fees, and potential alternatives. We will delve into the mechanics of cash advances, balance transfers, and other methods, offering a comprehensive guide to understanding the financial implications of each choice. Understanding these options is crucial for making informed decisions about managing your credit and avoiding costly mistakes.

Cash Advances: A Quick but Expensive Option

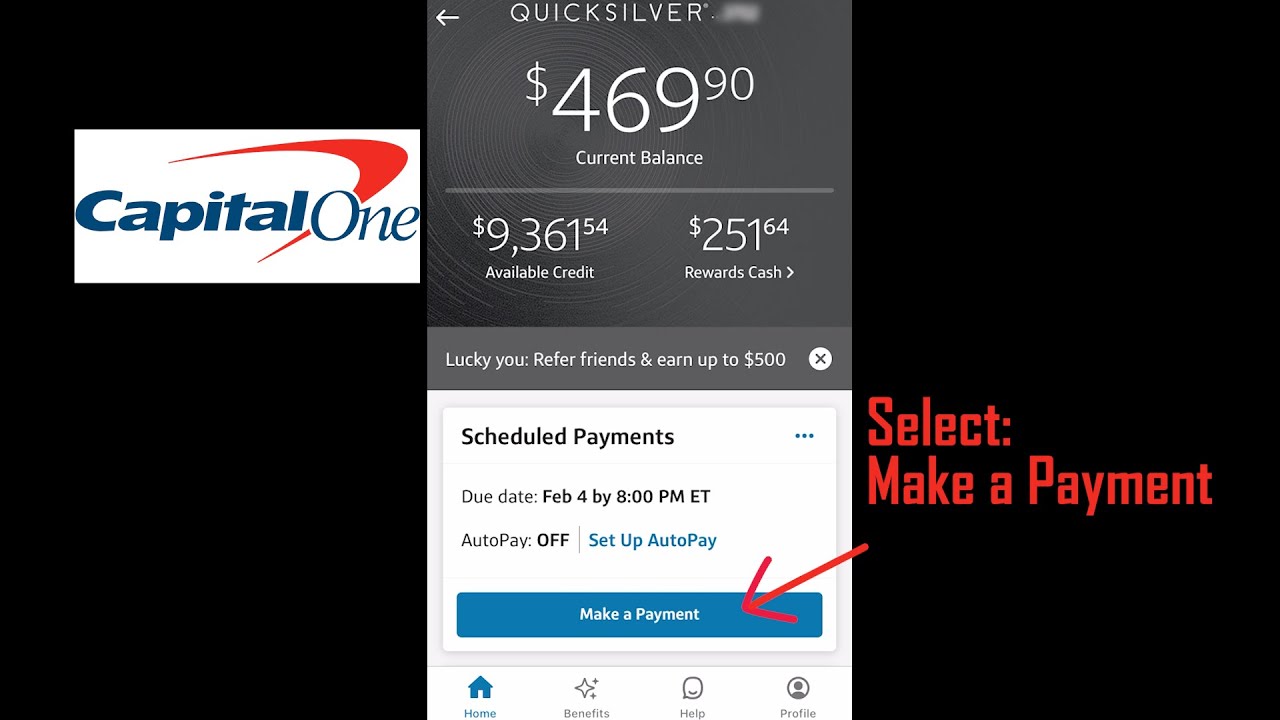

The most direct way to get cash from your Capital One credit card is through a cash advance. This allows you to withdraw cash from an ATM, bank teller, or through a convenience check linked to your account. However, cash advances are generally the most expensive way to access funds from your credit card.

Typically, Capital One charges a cash advance fee, often a percentage of the withdrawn amount or a flat fee, whichever is greater. Interest rates on cash advances are also usually higher than those for regular purchases and accrue immediately, without a grace period. This means you'll start paying interest from the moment you withdraw the cash.

Example: Imagine you take out a $500 cash advance with a 5% fee and a 25% APR. You'll immediately owe $525, and interest will start accruing on that amount daily until the balance is paid in full. Due to these fees and high-interest rates, cash advances should be considered a last resort.

Understanding Cash Advance Limits and Fees

Capital One sets a specific cash advance limit on each credit card, which is usually lower than the overall credit limit. You can find your cash advance limit on your monthly statement or by contacting Capital One directly.

Fees and interest rates for cash advances can vary depending on the specific card and your creditworthiness. It's essential to carefully review your cardholder agreement to understand the exact costs associated with taking out a cash advance. Being aware of these details can help you avoid unexpected charges.

"Always check your cardholder agreement for the specific fees and interest rates associated with cash advances," advises a financial advisor. "These can significantly impact the overall cost of borrowing."

Balance Transfers: Shifting Debt for Potential Savings

While not directly withdrawing cash, a balance transfer can indirectly free up cash. This involves transferring high-interest debt from another credit card to your Capital One card, ideally one with a lower interest rate or a promotional 0% APR period.

If you have available credit on your Capital One card after the balance transfer, you can then use the freed-up credit on your other card for cash withdrawals, or you have money available for other uses. However, balance transfers often come with fees, typically a percentage of the transferred amount.

Carefully calculate whether the balance transfer fee and any potential interest charges outweigh the benefits of the lower interest rate. A 0% introductory APR can be attractive, but be mindful of the rate that will apply after the promotional period ends.

Alternative Options: Exploring Other Ways to Access Funds

Before resorting to cash advances, consider alternative ways to access funds. A personal loan from a bank or credit union might offer lower interest rates and more favorable repayment terms. Explore options like a secured loan if you own assets.

If you need cash for an emergency, consider reaching out to family or friends for assistance. Explore the possibility of a payment plan with the entity you owe. Sometimes they will work with you.

Important Note: Using your credit card for purchases instead of cash advances is generally a more financially sound strategy. Many cards offer rewards programs and a grace period before interest accrues on purchases. This avoids fees of cash advance.

The Bottom Line: Proceed with Caution

While it's possible to take money off a Capital One credit card through cash advances and other methods, it's generally an expensive option. The high fees and interest rates associated with cash advances can quickly lead to debt accumulation.

Carefully weigh the costs and benefits before deciding to access cash from your credit card. Consider alternatives and prioritize responsible credit card usage to avoid unnecessary financial burdens. Remember to review your cardholder agreement for specific terms and conditions related to cash advances and other transactions.

Looking ahead, increased awareness of responsible credit card management and the availability of alternative financing options may reduce reliance on costly cash advances. The key is informed decision-making and a proactive approach to managing your financial well-being.

:max_bytes(150000):strip_icc()/credit-one-bank-unsecured-platinum-visa_blue-e89647ef74b94458963d038fa600cc1f.jpg)

:max_bytes(150000):strip_icc()/capital-one-spark-classic-for-business_blue-b5291405f90242d599c574ca51b4fa44.jpg)