Assurance Services Involve All Of The Following Except

In the complex world of financial oversight and corporate accountability, the phrase "assurance services" often surfaces, promising a level of confidence and reliability. But what exactly constitutes assurance, and more crucially, what falls outside its boundaries? Misconceptions abound, and understanding the true scope of assurance is critical for investors, auditors, and businesses alike, especially in an environment demanding ever-greater transparency.

This article delves into the intricacies of assurance services, clarifying its components and pinpointing elements that are definitively *not* included within its domain. Understanding these boundaries is crucial for maintaining the integrity of financial reporting and avoiding costly misunderstandings about the protections assurance provides.

Defining Assurance Services: A Closer Look

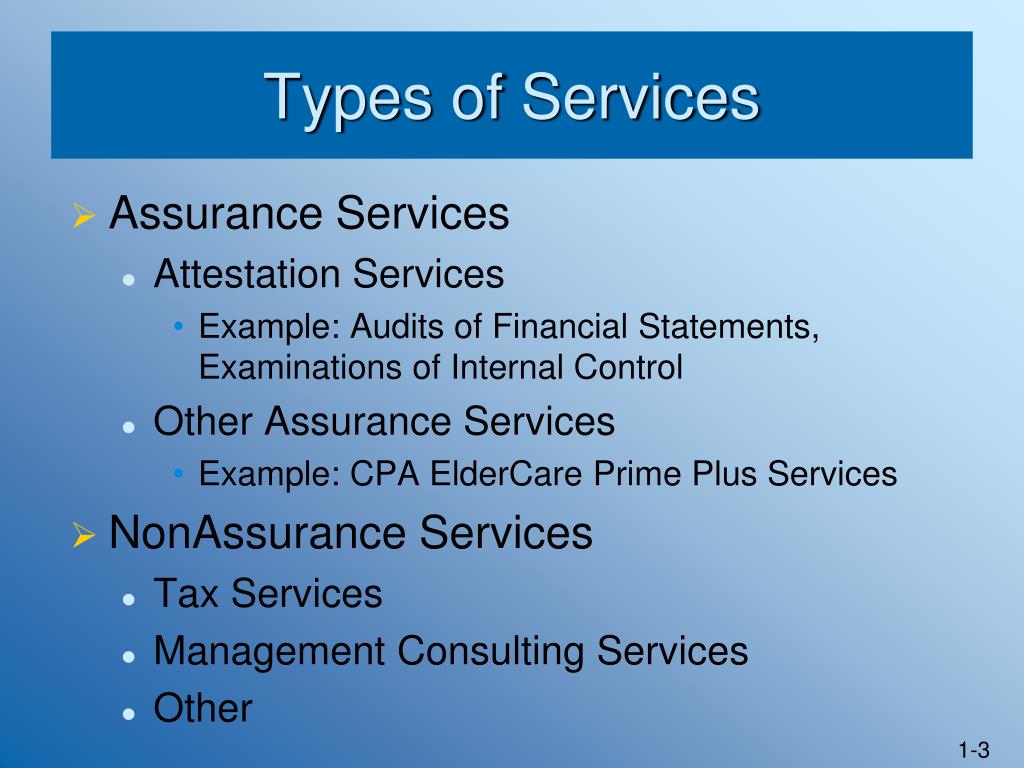

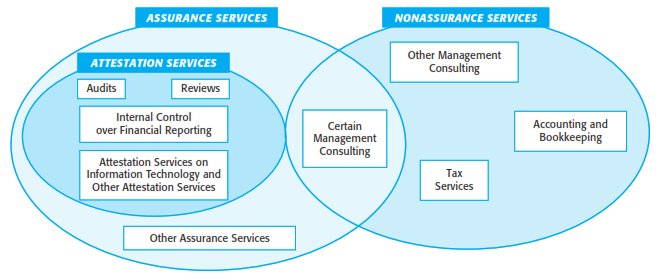

Assurance services are independent professional services that improve the quality of information, or its context, for decision makers. They aim to enhance the credibility and reliability of information, enabling users to make more informed judgments.

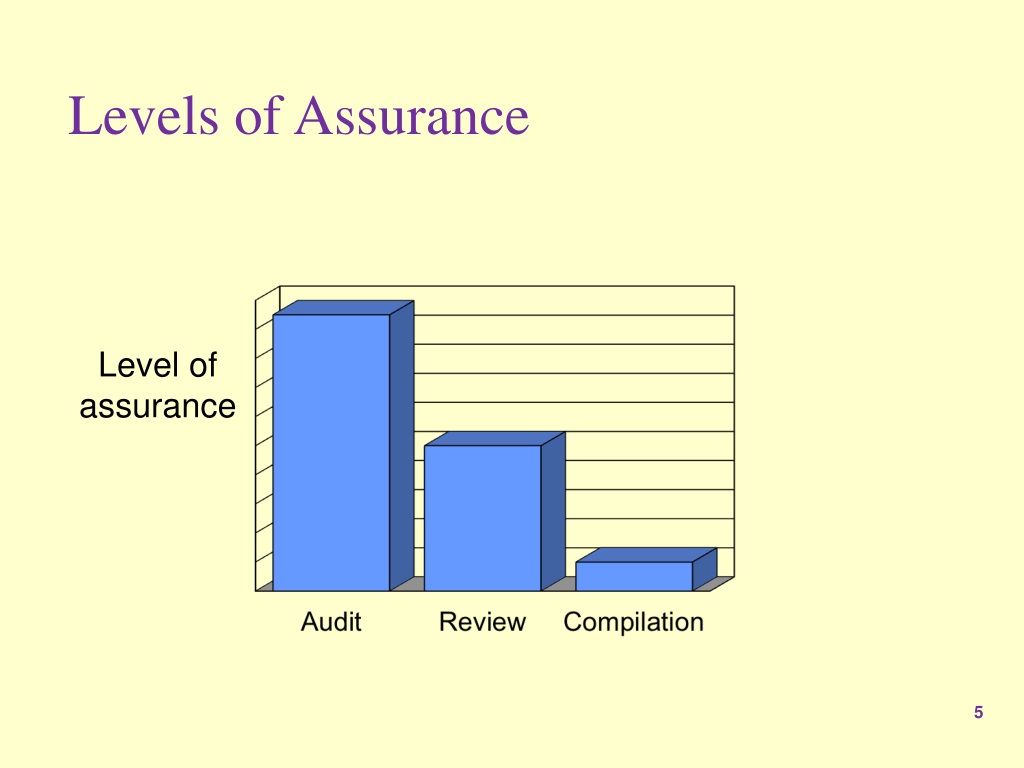

These services involve an objective assessment of information, evaluating whether it conforms to established criteria. This evaluation provides assurance, or confidence, to the users of that information. Common examples include financial statement audits, internal control audits, and compliance audits.

Key Components of Assurance Services

The core of assurance rests on several fundamental components. Objectivity is paramount; the professional must maintain an unbiased perspective throughout the engagement. Competence is also a necessity; the professional needs the skills, knowledge, and experience required to perform the service effectively.

Independence is another bedrock. The professional must be free from any influence that could compromise their judgment. And a well-defined scope is crucial, outlining the specific subject matter and criteria against which it is being evaluated.

Verification and Validation

A cornerstone of assurance is the verification and validation of information. This process involves gathering evidence to support the assertions being made about the subject matter. This evidence should be sufficient, appropriate, and reliable, providing a reasonable basis for the professional's opinion.

This may include physical inspection, analytical procedures, confirmation with third parties, and examination of relevant documentation.

Reporting and Communication

A clear and concise report communicating the findings of the engagement is a critical deliverable of assurance services. This report should state the scope of the engagement, the criteria used, and the professional's opinion or conclusion.

Transparency is key, allowing users to understand the basis for the opinion and the limitations of the engagement.

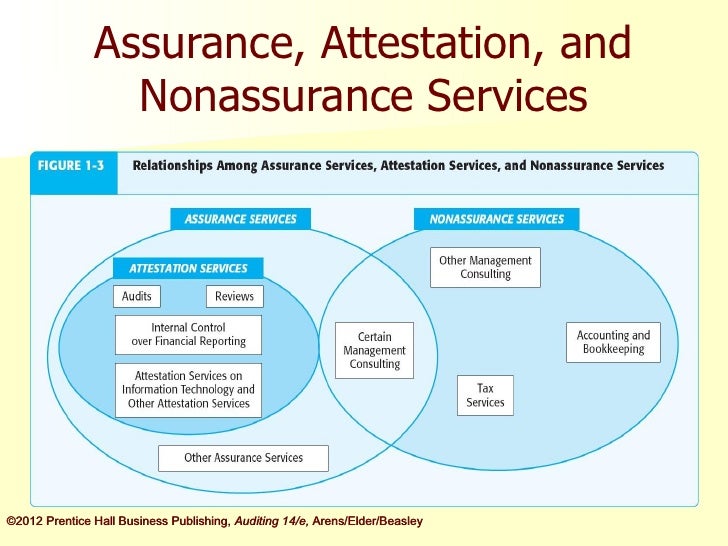

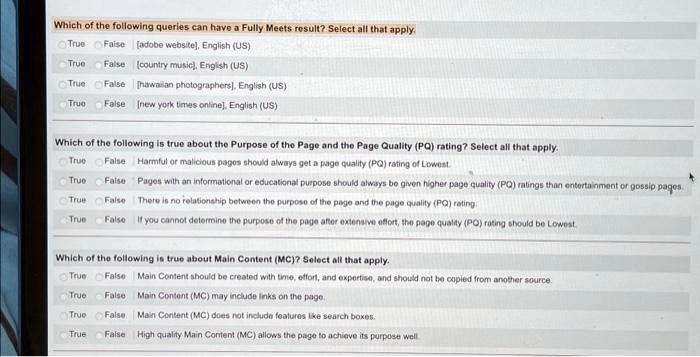

What Assurance Services Do *Not* Encompass

While assurance services provide valuable benefits, it is vital to acknowledge their limitations. There are specific activities that fall outside the scope of assurance, regardless of their potential relevance to financial health or decision-making. This could easily be a trap during certification exams. The following are all not considered assurance services.

Management Consulting

Management consulting services, while potentially valuable, are distinct from assurance. Consulting focuses on providing advice and recommendations to improve an organization's operations, strategy, or performance.

Unlike assurance, consulting typically does not involve an independent assessment of information against established criteria. Instead, it focuses on developing and implementing solutions to specific business problems.

Although a consultant may review and analyze data, the primary goal is not to provide assurance over its accuracy or reliability, but to inform the advice given.

Tax Preparation

Preparing tax returns is a compliance function, not an assurance service. While tax professionals must adhere to tax laws and regulations, their role is primarily to prepare and file accurate tax returns on behalf of their clients.

This is different from providing assurance, which involves an independent assessment of information against established criteria to provide confidence to users.

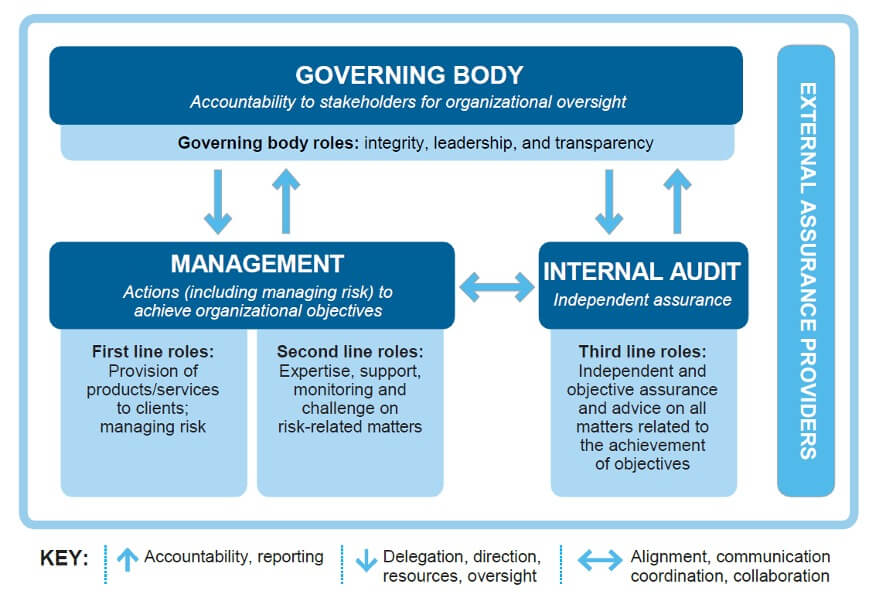

Internal Audit (Sometimes)

Internal audit functions can sometimes be confused with assurance services. If the internal audit team is providing their opinion to external users of the financial statement information, this is an assurance service.

More often, the internal audit team performs internal risk assessments and reports findings to management or the audit committee. In this case, the audit is performed to provide recommendations to management.

Bookkeeping

Bookkeeping, the daily task of recording financial transactions, is not an assurance service. It is a fundamental process for maintaining accurate financial records.

While accurate bookkeeping is essential for producing reliable financial statements, the bookkeeping process itself does not involve an independent assessment of information against established criteria to provide assurance to users.

Advocacy

Assurance services require independence and objectivity. Therefore, any activity that involves advocacy on behalf of a client cannot be considered an assurance service. Advocacy involves representing a client's interests, potentially compromising the professional's objectivity.

Examples of advocacy include representing a client in a tax dispute or negotiating a contract on their behalf.

The Importance of Understanding the Boundaries

Distinguishing between assurance services and other professional services is vital for several reasons. It ensures that users of information have a clear understanding of the level of confidence they can place in that information.

It also helps to prevent misunderstandings about the scope of the services being provided, managing expectations and avoiding potential disputes. Furthermore, understanding the boundaries of assurance helps maintain the integrity and credibility of the profession.

Looking Ahead: The Future of Assurance

The demand for assurance services is likely to continue to grow as stakeholders seek greater confidence in the information they rely on. As the business environment becomes increasingly complex and interconnected, the need for reliable and trustworthy information will become even more crucial.

The evolution of technology, such as blockchain and artificial intelligence, is likely to have a significant impact on the future of assurance. These technologies may offer new opportunities to improve the efficiency and effectiveness of assurance services, but also present new challenges related to data security and privacy.

Ultimately, a deep understanding of what assurance services encompass—and what they explicitly do not—will be critical for navigating the future of financial reporting and corporate governance.