At What Credit Score Can You Buy A House

Imagine standing at the threshold of a place to call your own, keys jingling in your hand, ready to turn the lock on a new chapter. The scent of fresh paint and the promise of countless memories fill the air. But before you can unpack your boxes, there's a crucial step – understanding the role your credit score plays in making this dream a reality.

This article delves into the heart of that question: At what credit score can you realistically buy a house? We'll explore the different credit score tiers, the types of loans available, and how to position yourself for homeownership success, turning a seemingly daunting process into an achievable goal.

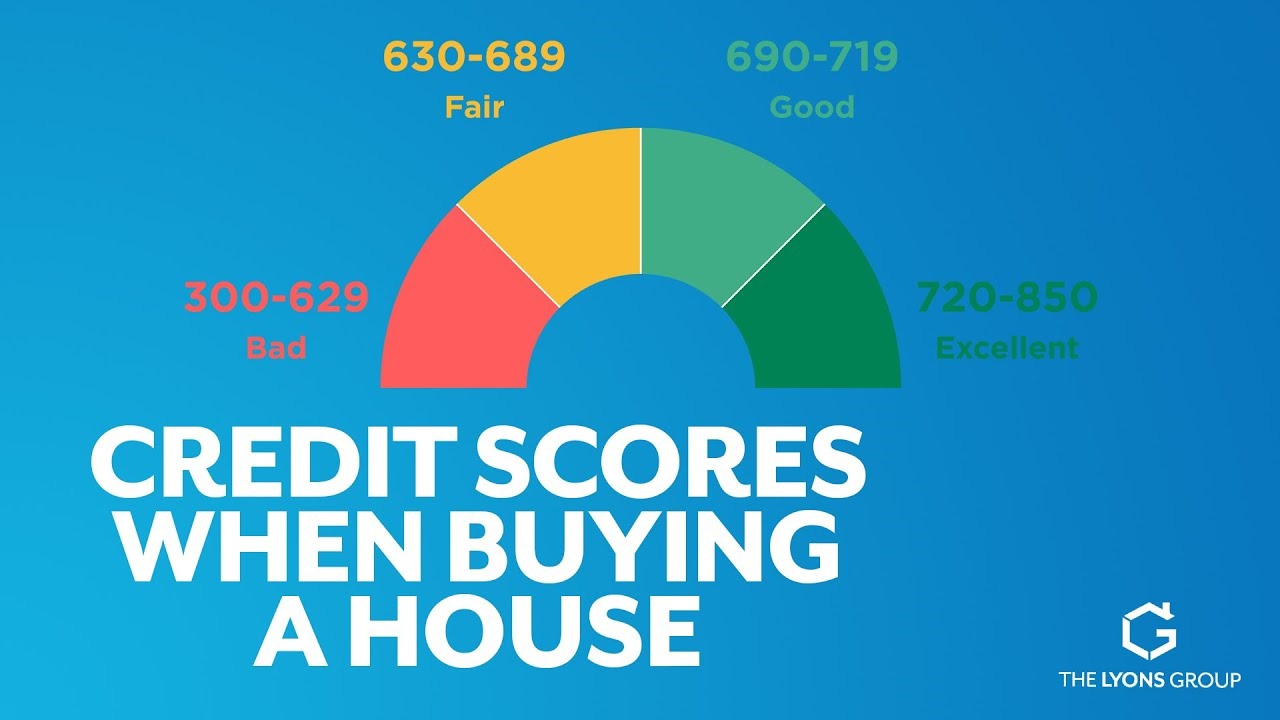

Understanding Credit Score Tiers

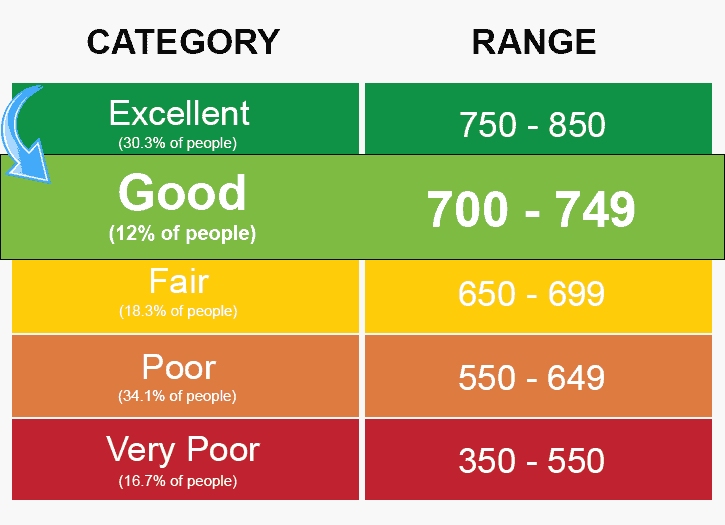

Credit scores are categorized into different tiers, each influencing your chances of mortgage approval and the interest rates you'll receive. Generally, a score of 700 or higher is considered good, opening doors to more favorable loan terms.

A score between 700 and 749 is considered good. Scores between 750 to 799 is very good. Finally, scores of 800 or higher is considered excellent.

On the other end of the spectrum, scores below 620 might present challenges but aren't necessarily a dead end. A score below 620 is considered poor.

The Minimum Credit Score Requirements

While a higher credit score is always beneficial, the minimum score required to buy a house varies depending on the type of mortgage you're seeking. For example, Federal Housing Administration (FHA) loans are often accessible to borrowers with scores as low as 500, albeit with a larger down payment.

Conventional loans, however, typically require a minimum score of 620, although some lenders may prefer higher scores.

Veterans Affairs (VA) loans, backed by the U.S. Department of Veterans Affairs, generally don't have a minimum credit score requirement, but lenders might impose their own standards.

The Impact of Credit Score on Mortgage Rates

Your credit score doesn't just determine whether you qualify for a mortgage; it also significantly impacts the interest rate you'll pay. Even a slight difference in interest rate can translate to tens of thousands of dollars over the life of the loan.

According to data from MyFICO, borrowers with higher credit scores consistently receive lower interest rates. This underlines the importance of building and maintaining a good credit history.

Lenders view borrowers with lower credit scores as higher risk, which is why they charge higher interest rates to compensate for that risk.

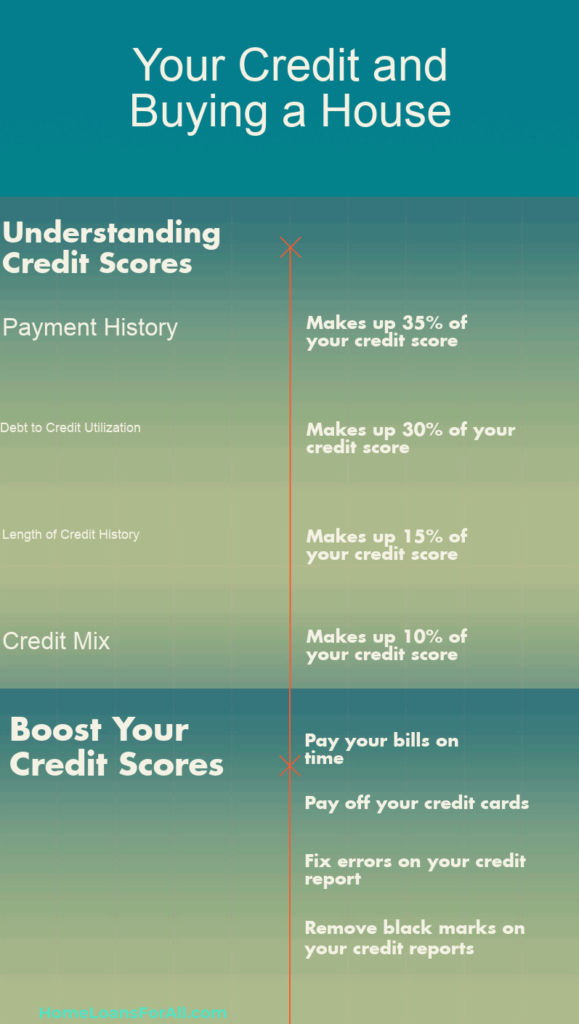

Steps to Improve Your Credit Score

If your credit score isn't where you'd like it to be, don't despair. There are several steps you can take to improve it.

First and foremost, pay your bills on time, every time. Payment history is the single most important factor in your credit score, and missed payments can have a significant negative impact.

Keep your credit utilization low, ideally below 30% of your available credit. This shows lenders that you're responsible with credit and not overextended.

Regularly review your credit report for errors and dispute any inaccuracies you find. You're entitled to a free copy of your credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – annually.

Consider becoming an authorized user on a credit card held by someone with good credit. This can help boost your score, but make sure the cardholder uses the card responsibly.

Beyond the Credit Score: Other Factors

While your credit score is undoubtedly crucial, it's not the only factor lenders consider. They'll also assess your debt-to-income ratio (DTI), employment history, and down payment amount.

A lower DTI demonstrates that you have a manageable level of debt compared to your income, making you a less risky borrower. A stable employment history provides lenders with confidence in your ability to repay the loan.

A larger down payment can not only reduce your monthly payments but also increase your chances of approval, especially if your credit score is less than perfect.

The Takeaway

Buying a house is a significant milestone, and understanding the role of your credit score is essential for a smooth and successful journey. While a higher credit score can unlock better loan terms, it's not the only factor that matters.

By taking proactive steps to improve your credit, managing your debt responsibly, and exploring different loan options, you can increase your chances of achieving your homeownership dreams. Remember, with careful planning and a bit of effort, that dream home is within reach.