Sarbanes Oxley Act Requires Each Of The Following

Immediate action is required: The Sarbanes-Oxley Act (SOX) mandates stringent financial oversight and compliance measures for public companies, deadlines are looming for numerous organizations. Failure to comply can result in severe penalties, including hefty fines and criminal charges.

This article details the key requirements of SOX, providing a crucial checklist for companies to ensure they meet these standards and avoid potential legal and financial repercussions.

Key Requirements of the Sarbanes-Oxley Act

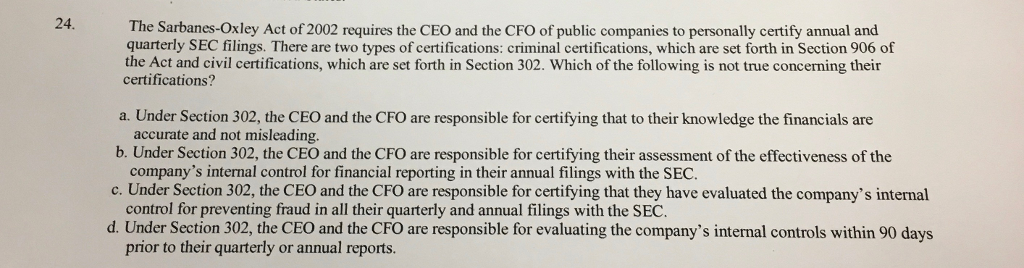

Section 302: Corporate Responsibility for Financial Reports

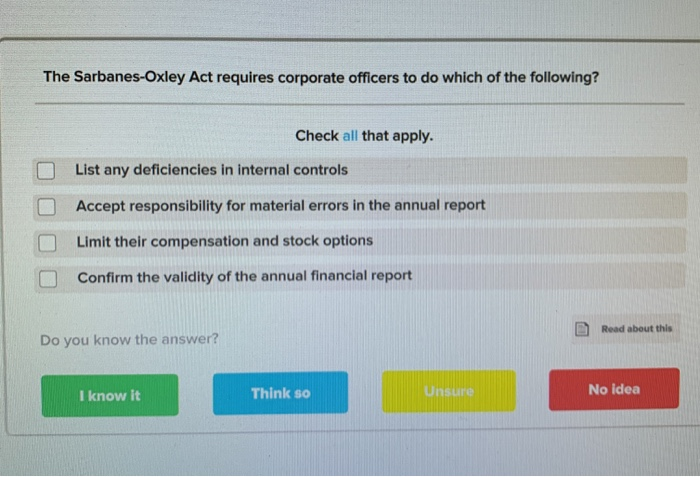

CEOs and CFOs must personally certify the accuracy of their company's financial reports. This certification confirms their review and the report's fair presentation of the company's financial condition. These officers are held directly accountable for any material misstatements.

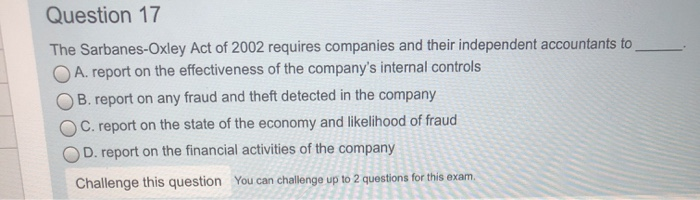

Section 404: Management Assessment of Internal Controls

This section is arguably the most demanding. Companies must establish and maintain internal controls over financial reporting (ICFR). Management must then assess the effectiveness of these controls annually.

An independent auditor must also attest to, and report on, management's assessment of ICFR. This creates a dual layer of assurance.

Establishment of an Audit Committee

SOX mandates the creation of an audit committee within the board of directors. This committee is responsible for overseeing the company's accounting and financial reporting processes. It also oversees the independent auditor.

Committee members must be independent, meaning they cannot be affiliated with the company in any way other than as a board member. Independence is paramount to ensure objective oversight.

Code of Ethics for Senior Financial Officers

Companies must establish a code of ethics for their senior financial officers, including the CEO, CFO, and controller. This code must promote honest and ethical conduct, including the ethical handling of conflicts of interest. It also ensures full, fair, accurate, timely, and understandable disclosure in reports.

Enhanced Financial Disclosures

SOX requires enhanced disclosures in financial reports. This includes disclosing all material off-balance sheet transactions, arrangements, obligations, and other relationships with unconsolidated entities. The intent is to provide greater transparency.

It also necessitates the disclosure of any material changes in the company's financial condition or operations. These disclosures must be both timely and accurate.

Internal Control Reporting

As part of Section 404 compliance, companies must provide a report on their internal control over financial reporting. This report must include management's assessment of the effectiveness of those controls as of the end of the fiscal year.

It also must identify any material weaknesses in internal controls. Furthermore, companies must disclose any significant changes to internal controls made during the fiscal year.

Auditor Independence

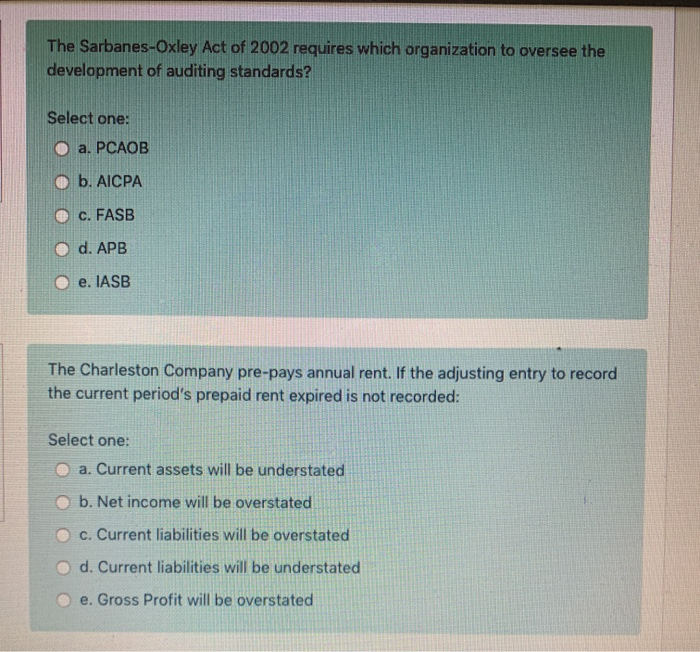

SOX places strict limits on the non-audit services that an auditor can provide to its audit client. These restrictions aim to prevent conflicts of interest. The Public Company Accounting Oversight Board (PCAOB) oversees auditors of public companies.

Auditor rotation is also required to ensure fresh perspectives. Lead audit partners must rotate off the engagement every five years.

Whistleblower Protection

SOX provides significant protections for whistleblowers. Employees who report suspected violations of securities laws are shielded from retaliation. This encourages the reporting of potential fraud and misconduct.

Companies must establish procedures for employees to report concerns anonymously. This facilitates the disclosure of information without fear of reprisal.

Penalties for Non-Compliance

The penalties for non-compliance with SOX are severe. CEOs and CFOs who knowingly certify false financial statements can face fines of up to $5 million and imprisonment of up to 20 years. Companies can also face civil penalties.

Furthermore, failure to comply can significantly damage a company's reputation and stock price. The legal and financial repercussions are extensive.

The Role of the PCAOB

The PCAOB plays a critical role in overseeing the audits of public companies. It sets auditing standards. It also conducts inspections of registered accounting firms.

The PCAOB's oversight helps to ensure the quality and reliability of financial reporting. This ultimately protects investors and promotes market integrity.

Companies must immediately review their internal controls and compliance procedures to ensure adherence to SOX requirements. Seek expert advice to navigate the complexities of the Act. Continuous monitoring and improvement of internal controls are essential to maintain compliance and protect against potential liabilities.

:max_bytes(150000):strip_icc()/Sarbanes-Oxley-V3-38f2829eee11440289b7ffeed192f342.jpg)