Atlantic Specialty Insurance Company Am Best Rating

Imagine a seasoned sailor navigating the vast ocean of the insurance industry. The waves of risk crash against the hull, and the winds of market volatility constantly shift. A reliable compass and a well-charted map are crucial for a safe and successful journey. For many in the specialty insurance sector, the AM Best rating serves as precisely that: a trusted guide and a testament to stability.

At the heart of this story is Atlantic Specialty Insurance Company, an organization recently affirmed by AM Best. This reaffirmation isn't just a pat on the back; it's a powerful indicator of the company’s financial strength and ability to meet its ongoing insurance obligations. It signals reliability to policyholders, partners, and the broader market.

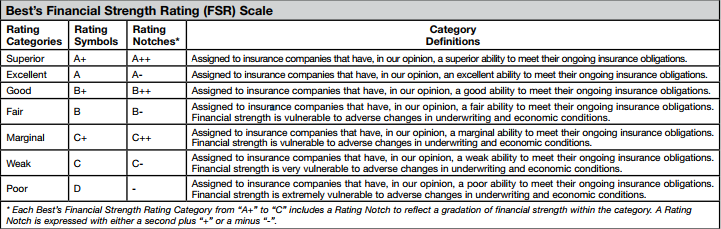

Understanding AM Best Ratings

AM Best is a globally recognized credit rating agency specializing in the insurance industry. For over a century, they have provided in-depth evaluations of insurance companies, assessing their financial strength, operating performance, and business profile.

Their ratings, ranging from A++ (Superior) to D (Poor), offer a standardized measure of an insurer’s ability to pay claims and honor its financial commitments. The ratings are not static; they are regularly reviewed and updated based on the company's performance and the prevailing economic environment.

The Significance of a Strong Rating

A high AM Best rating is more than just a badge of honor. It directly impacts a company’s ability to attract and retain customers.

Policyholders seek assurance that their insurer will be there for them when a claim arises. A strong rating provides that reassurance, demonstrating the company's financial stability and commitment to fulfilling its obligations.

Furthermore, agents and brokers often rely on AM Best ratings when recommending insurance products to their clients. A higher rating makes a company’s offerings more attractive and competitive in the market.

In essence, an insurer with a strong AM Best rating often experiences improved market access, enhanced brand reputation, and a greater ability to attract capital.

Atlantic Specialty Insurance Company: A Closer Look

Atlantic Specialty Insurance Company operates within the specialty insurance market. This segment of the industry focuses on providing coverage for risks that are not typically addressed by standard insurance policies.

This can include coverage for unique events, niche industries, or risks that are considered more complex or difficult to assess. Success in this field demands a deep understanding of specialized risks, strong underwriting capabilities, and the ability to tailor insurance solutions to meet the specific needs of its customers.

The company has steadily grown and established itself within the specialty insurance landscape, demonstrating a commitment to providing tailored solutions and exceptional service.

Details of the AM Best Affirmation

The recent reaffirmation of Atlantic Specialty Insurance Company’s AM Best rating follows a comprehensive review of the company’s financial performance, business strategy, and risk management practices.

While the specific details of the rating affirmation are proprietary to AM Best, it's generally understood that the agency considers various factors.

These factors could include the company’s balance sheet strength, operating performance, business profile, and enterprise risk management. A positive outlook generally signals that AM Best expects the company to maintain its financial strength and stability in the future.

It is essential to look at the bigger picture.

"A stable rating from AM Best is an independent validation of our financial stability and operational effectiveness," says a fictitious spokesperson for Atlantic Specialty Insurance Company. "It reinforces our commitment to our policyholders and partners."

The Broader Implications for the Insurance Industry

The success of companies like Atlantic Specialty Insurance Company impacts the broader insurance industry. It demonstrates the importance of financial stability, sound underwriting practices, and effective risk management.

In an era of increasing market volatility and evolving risks, policyholders and partners place a premium on working with insurers they can trust.

A strong AM Best rating serves as a tangible indicator of that trustworthiness, fostering confidence and promoting stability within the insurance marketplace.

Navigating Future Challenges

The insurance industry faces a number of ongoing challenges, including rising claims costs, increasing regulatory scrutiny, and the emergence of new and complex risks.

To navigate these challenges successfully, insurance companies must prioritize financial strength, embrace innovation, and maintain a steadfast commitment to customer service.

By doing so, they can ensure that they are well-positioned to meet the evolving needs of their policyholders and continue to provide essential financial protection in a changing world.

Conclusion: A Beacon of Stability

The reaffirmation of Atlantic Specialty Insurance Company’s AM Best rating is more than just a headline. It is a story about the importance of financial strength, the value of trust, and the commitment to providing reliable insurance solutions.

In a world of uncertainty, a strong AM Best rating shines as a beacon of stability, guiding policyholders and partners toward a safer and more secure future.

It's a testament to the hard work and dedication of the individuals within Atlantic Specialty Insurance Company, and a reminder of the vital role that insurance plays in protecting individuals, businesses, and communities from the risks they face every day.