Auto Repair Loan Bad Credit Instant Approval

Facing an unexpected car repair can be financially devastating, especially for individuals with less-than-perfect credit. A growing number of lenders are now offering "auto repair loans bad credit instant approval," promising quick access to funds for essential vehicle repairs. But what are these loans, and what are the potential pitfalls for borrowers?

This article will delve into the world of auto repair loans for individuals with bad credit, examining their features, benefits, risks, and alternatives. We will explore the realities behind the "instant approval" claims and provide guidance for borrowers to make informed decisions when faced with urgent car repair needs.

The Rise of Auto Repair Loans for Bad Credit

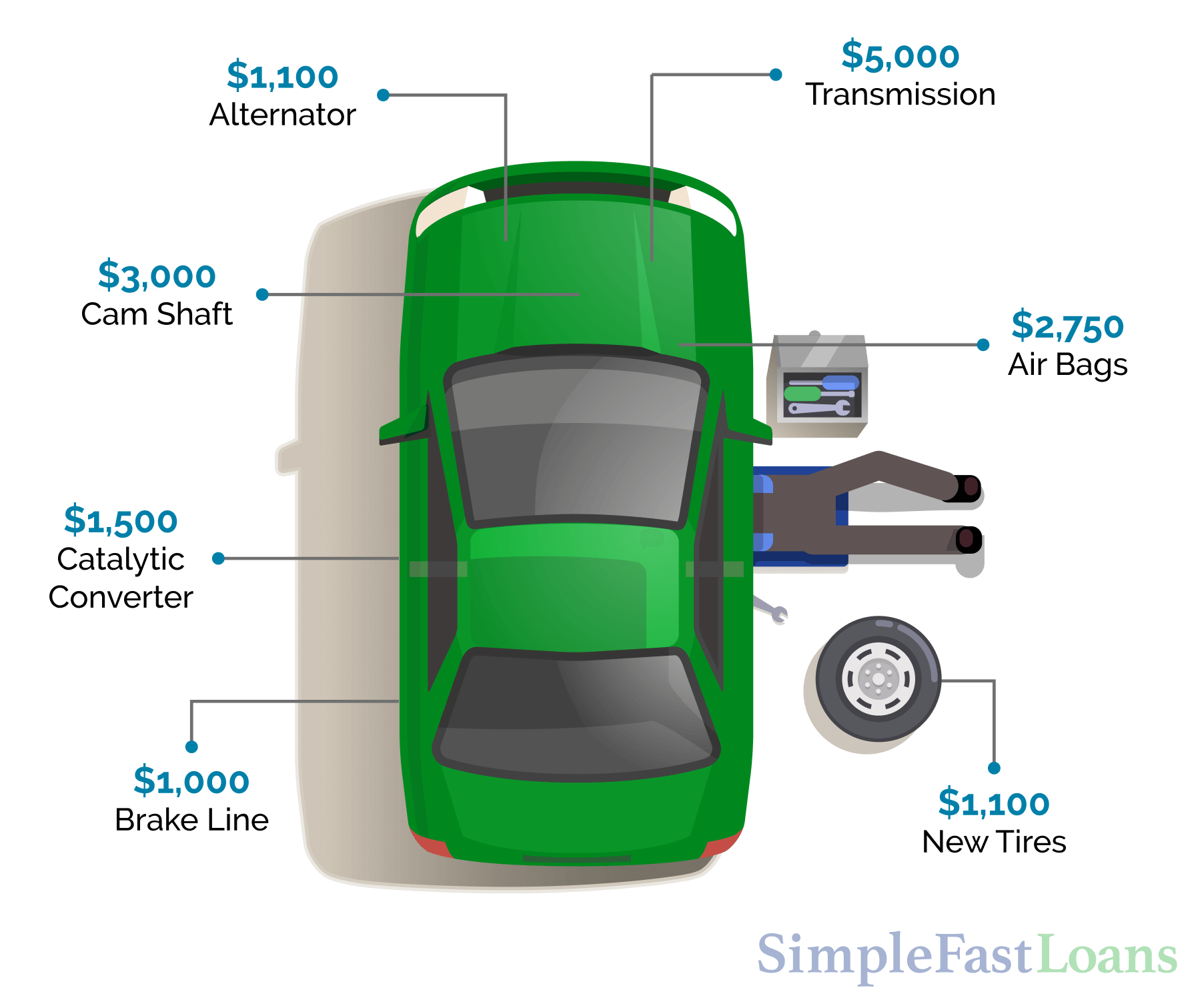

The market for auto repair loans has expanded significantly in recent years, driven by the increasing age of vehicles on the road and the rising cost of repairs. According to data from the Bureau of Transportation Statistics, the average age of light vehicles in the United States is over 12 years, increasing the likelihood of mechanical issues and the need for repairs.

For individuals with poor credit histories, traditional loans from banks and credit unions are often difficult to obtain. This has created a niche market for lenders specializing in "auto repair loans bad credit instant approval," targeting borrowers who need immediate access to funds.

Understanding "Instant Approval"

The term "instant approval" can be misleading. While some lenders may provide a preliminary decision within minutes based on limited information, full approval typically requires a more comprehensive review of the borrower's financial situation.

This review may include verification of income, employment history, and a more detailed credit check. Therefore, borrowers should be wary of lenders who guarantee instant approval without any verification process.

Key Features and Benefits

Auto repair loans can provide a crucial lifeline for individuals who rely on their vehicles for work, family obligations, or daily errands. These loans can cover the cost of essential repairs, allowing borrowers to get back on the road quickly.

Some lenders offer flexible repayment terms, allowing borrowers to choose a payment schedule that fits their budget. The loans are often unsecured, meaning borrowers don't have to put up their car as collateral.

Potential Risks and Drawbacks

Despite the convenience, auto repair loans for bad credit come with significant risks. The most prominent is the high interest rates. Lenders targeting borrowers with bad credit often charge significantly higher interest rates than traditional lenders to compensate for the increased risk of default.

These high interest rates can make the loan much more expensive over the long term, potentially leading to a cycle of debt. It is also important to be aware of hidden fees. Some lenders may charge origination fees, prepayment penalties, or other fees that can increase the overall cost of the loan.

Failure to repay the loan can damage your credit score further and potentially lead to legal action from the lender. Borrowers should carefully review the loan terms and understand the consequences of default before accepting a loan.

The Role of Credit Scores

A poor credit score significantly limits borrowing options and increases interest rates. According to Experian, a credit score below 670 is generally considered fair or poor.

Individuals with lower credit scores may find it challenging to qualify for traditional loans or credit cards with favorable terms. Consequently, they may turn to lenders specializing in "auto repair loans bad credit instant approval."

Alternatives to High-Interest Loans

Before resorting to a high-interest loan, explore alternative options. Consider asking the repair shop about payment plans. Some shops offer in-house financing or allow customers to pay in installments.

Check if you have access to a credit union. Credit unions often offer lower interest rates and more flexible terms than traditional banks or online lenders.

Explore personal loans, which may offer lower interest rates than auto repair loans specifically designed for bad credit. You could also consider asking friends or family for a loan or assistance with the repair costs.

If you’re comfortable with crowdfunding, consider online fundraising. Platforms like GoFundMe can help you raise money to cover repair costs.

Making Informed Decisions

Before accepting any loan, compare offers from multiple lenders. Don't settle for the first offer you receive. Compare interest rates, fees, and repayment terms to find the most affordable option.

Read the fine print carefully. Understand all the terms and conditions of the loan before signing any documents. Ask questions if anything is unclear.

Create a budget and ensure that you can comfortably afford the monthly payments. Factor in other expenses and financial obligations to avoid overextending yourself.

Consider credit counseling. Non-profit credit counseling agencies can provide guidance on managing debt and improving your credit score.

Conclusion

Auto repair loans for bad credit can provide a quick solution to urgent vehicle repair needs. However, borrowers must be aware of the potential risks and drawbacks associated with these loans, particularly the high interest rates and fees.

By exploring alternative options, comparing offers, and carefully reviewing loan terms, borrowers can make informed decisions that minimize financial risk and ensure a manageable repayment plan. Remember to prioritize improving your credit score to access more favorable loan options in the future.