Average Cost Of Optima Tax Relief

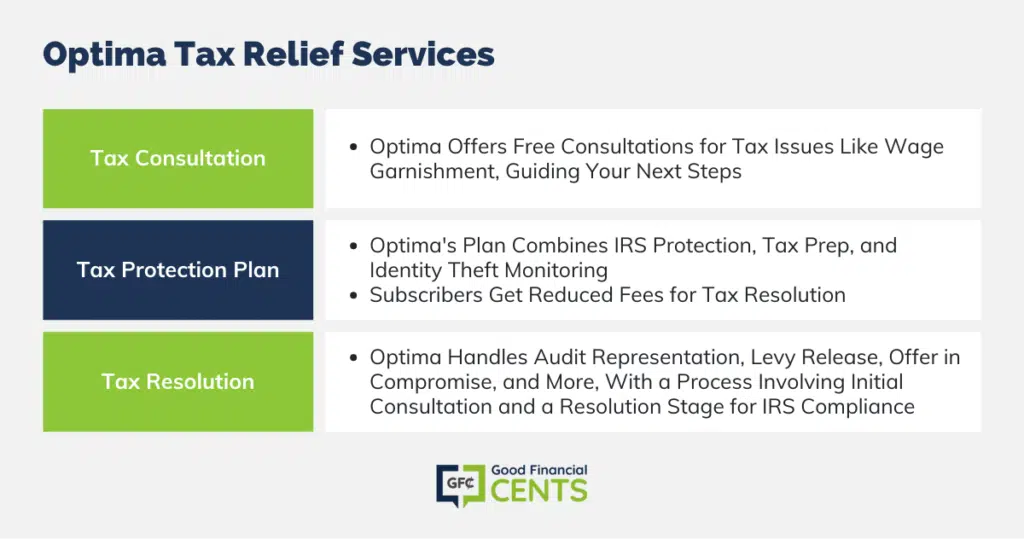

Optima Tax Relief, a major player in the tax resolution industry, faces scrutiny regarding its average service costs. Understanding these costs is crucial for taxpayers seeking assistance with IRS debt.

Optima Tax Relief: Unveiling the Average Cost

The average cost of services from Optima Tax Relief varies significantly. This fluctuation depends heavily on the complexity of the taxpayer's situation and the specific services required.

Generally, clients should anticipate an initial consultation fee. This fee is charged before any detailed analysis or representation begins, and ranges from $295-$495.

Service Fees: A Breakdown

Investigation Phase: The initial phase involves analyzing the taxpayer's debt and eligibility for various resolution options. This process can range from $2,000 to $3,500.

Resolution Phase: This encompasses negotiation and representation with the IRS. Costs can vary dramatically, potentially ranging from $2,500 to upwards of $7,000 or more.

The total cost can therefore range from $4,500 to $10,500, or possibly higher depending on the case complexity.

These figures are estimates. Clients should always seek a personalized quote from Optima Tax Relief.

Factors Influencing Cost

Several factors influence the total cost of Optima Tax Relief's services. These include the amount of tax debt, the taxpayer's income and assets, and the complexity of their tax situation.

For instance, a taxpayer with a straightforward offer in compromise (OIC) case might pay less. Conversely, a taxpayer facing complex issues such as unfiled returns or payroll tax problems could incur higher fees.

The time required to resolve the case is also a critical factor. Lengthier negotiations with the IRS will typically increase the overall expense.

Transparency Concerns

Some clients have raised concerns about the transparency of Optima Tax Relief's pricing. Some claim that the initial estimates do not fully reflect the final cost.

"I was quoted one price, but the final bill was much higher," one former client reported.

It's crucial to understand the scope of services covered and potential additional charges before engaging their services.

Alternatives to Optima Tax Relief

Taxpayers should consider alternative options for tax relief assistance. This includes consulting with local CPAs or enrolled agents.

Non-profit organizations often provide free or low-cost assistance. Examples are Low Income Taxpayer Clinics (LITCs).

Directly negotiating with the IRS is also an option, though it requires significant time and understanding of tax law.

Due Diligence is Key

Before hiring any tax relief company, thoroughly research their reputation and track record. Check with the Better Business Bureau and online review sites.

Ask for a detailed written agreement outlining the services to be provided and the associated costs. Understand all fees before signing any contract.

Be wary of companies making guarantees or promises of unrealistic outcomes. Effective tax resolution requires realistic expectations.

Always compare quotes from multiple providers to ensure you're getting a fair price. Doing so enables one to make the best decision for their individual scenario.

Ongoing Scrutiny

The tax resolution industry is subject to ongoing scrutiny. Consumer protection agencies are keeping a close watch on companies like Optima Tax Relief.

Pay close attention to their advertising practices. Stay informed about potential complaints and regulatory actions.

Taxpayers must remain vigilant and proactive in protecting their rights.

For further information, consult with a qualified tax professional. Review the IRS website for resources on tax debt resolution.