Average Cost Of Sr22 Insurance In Texas

For Texas drivers requiring SR-22 insurance, often after a driving-related offense, understanding the associated costs is crucial. The price of this certification, which demonstrates financial responsibility to the state, can vary significantly depending on several factors. This article explores the average costs of SR-22 insurance in Texas and the elements influencing these premiums.

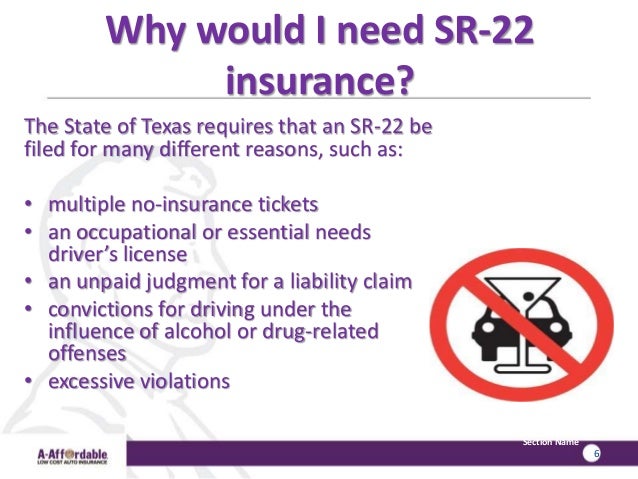

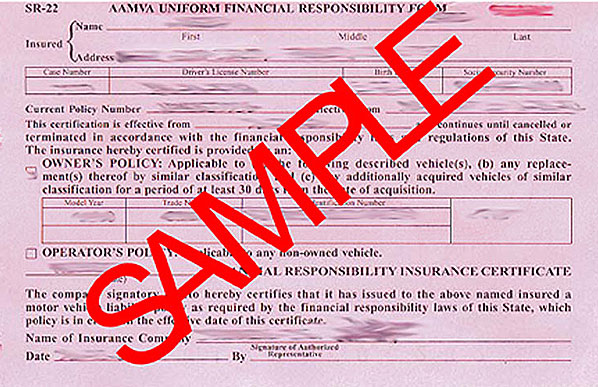

The SR-22 is not actually an insurance policy itself, but a certificate of financial responsibility mandated by the state. It's essentially proof that a driver has the minimum required auto insurance coverage. The cost of obtaining an SR-22 stems from the increased risk a driver poses after offenses like DUI/DWI, driving without insurance, or accumulating too many points on their driving record.

Factors Affecting SR-22 Insurance Costs

Several factors determine the average cost of SR-22 insurance in Texas. These include the underlying offense requiring the SR-22, the driver's overall driving history, the insurance company providing the coverage, and the minimum liability coverage required by the state.

The more severe the driving offense, the higher the insurance premiums will likely be. A DUI/DWI conviction, for instance, typically leads to a more substantial increase in insurance rates compared to a suspended license due to unpaid tickets.

A driver with a clean driving record prior to the offense requiring the SR-22 might see a smaller premium increase than someone with multiple prior violations. Insurance companies assess the driver's overall risk profile when determining rates.

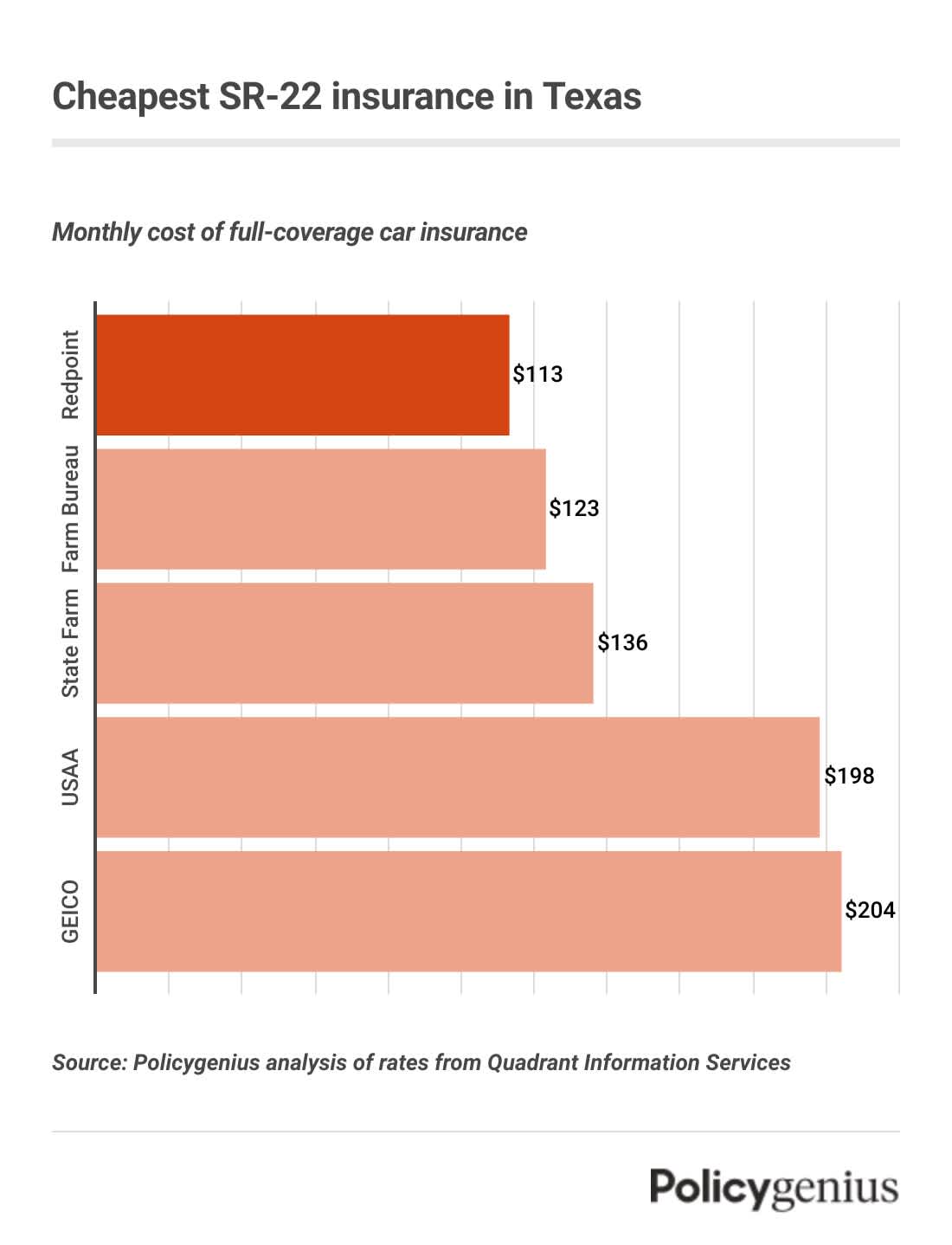

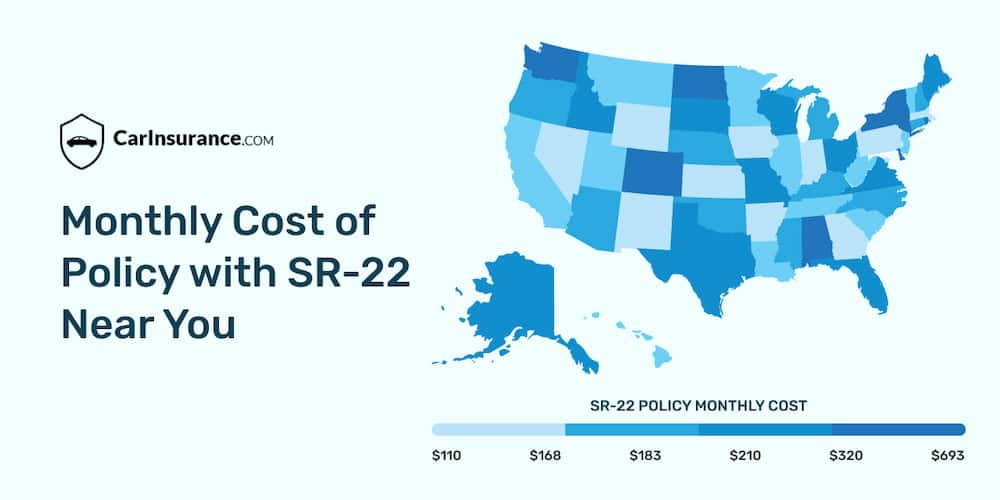

Insurance companies in Texas offer varying rates for SR-22 insurance. Shopping around and comparing quotes from multiple providers is strongly recommended to secure the best possible price.

Texas law requires drivers to carry minimum liability coverage. The specific coverage limits chosen can impact the overall cost of the insurance policy.

Average Cost Estimates

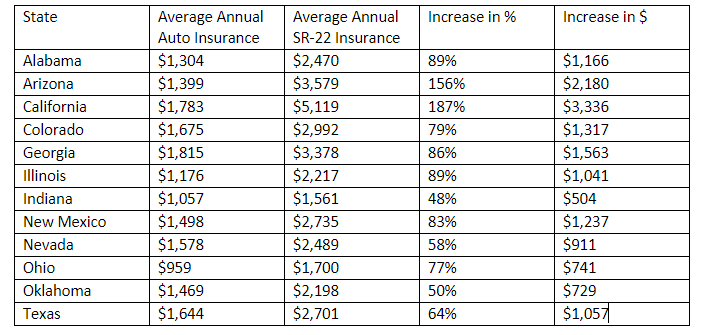

While precise figures fluctuate based on individual circumstances, studies indicate that drivers needing an SR-22 in Texas can expect to see their insurance rates increase significantly. Many sources suggest that on average, drivers with an SR-22 pay significantly more than drivers with a clean record. However, these figures are averages and do not represent the specific price a driver will encounter.

The cost of the SR-22 filing itself is generally a small, one-time fee, often less than $50. The substantial increase is due to the higher insurance premiums associated with the driver's risk profile.

Some insurance companies specialize in high-risk drivers and may offer more competitive rates for SR-22 insurance. Researching these specialized providers is advisable.

Navigating SR-22 Requirements in Texas

Obtaining an SR-22 in Texas requires contacting an insurance provider licensed in the state. The insurance company will then file the SR-22 certificate with the Texas Department of Public Safety (DPS).

Drivers must maintain continuous SR-22 coverage for a specified period, usually three years, as mandated by the DPS. Failure to maintain coverage can result in a license suspension.

Important: Drivers should consult with the Texas Department of Public Safety or a qualified legal professional to fully understand their specific SR-22 requirements and obligations.

The Human Cost of Risky Driving

Beyond financial implications, requiring an SR-22 often stems from events that have deeply impacted individuals and communities. DUIs, reckless driving, and uninsured accidents can leave a trail of emotional and physical scars.

The SR-22 requirement serves not only as a financial responsibility mechanism but also as a reminder of the importance of safe driving practices. Focusing on responsible driving habits can help drivers avoid situations leading to SR-22 requirements and keep our roads safer for everyone.

Driving is a privilege, not a right. Understanding that every decision behind the wheel has the potential to impact many lives underscores the significance of prioritizing safe driving.

Conclusion

The average cost of SR-22 insurance in Texas varies based on individual circumstances and driving history. Drivers requiring an SR-22 should shop around for the best rates and maintain continuous coverage to avoid license suspension. More importantly, they should prioritize safe driving habits to prevent future offenses and ensure the safety of themselves and others on the road.