Average Mortgage Interest Rate For 750 Credit Score

The dream of homeownership, a cornerstone of the American ideal, is becoming increasingly complex amid fluctuating economic landscapes. Navigating the mortgage market requires careful consideration, especially as interest rates continue to impact affordability. A key factor influencing these rates is an individual's credit score, with a 750 credit score often considered a benchmark for favorable terms.

This article delves into the average mortgage interest rates available to borrowers with a 750 credit score. We will explore the current market conditions, the factors that influence these rates, and what prospective homebuyers can expect when seeking financing.

Understanding the Landscape: Mortgage Rates and Credit Scores

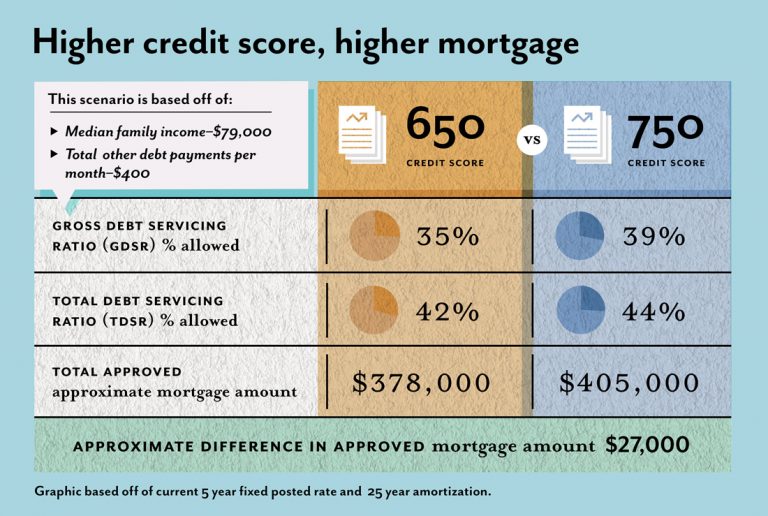

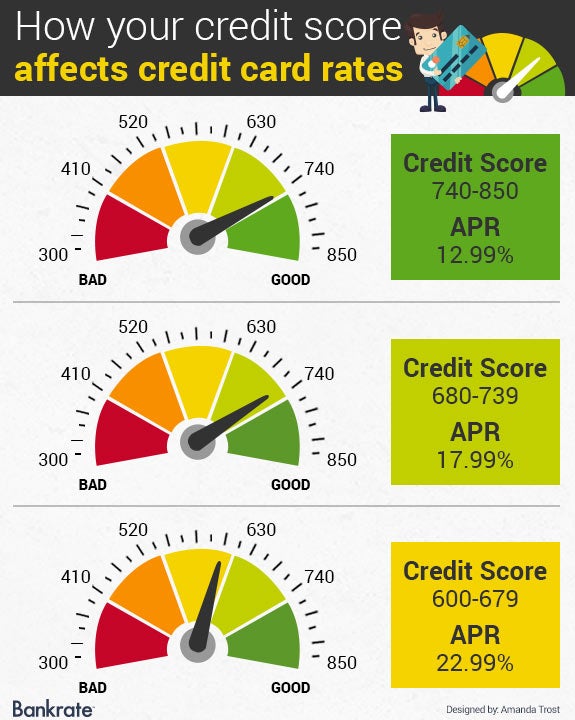

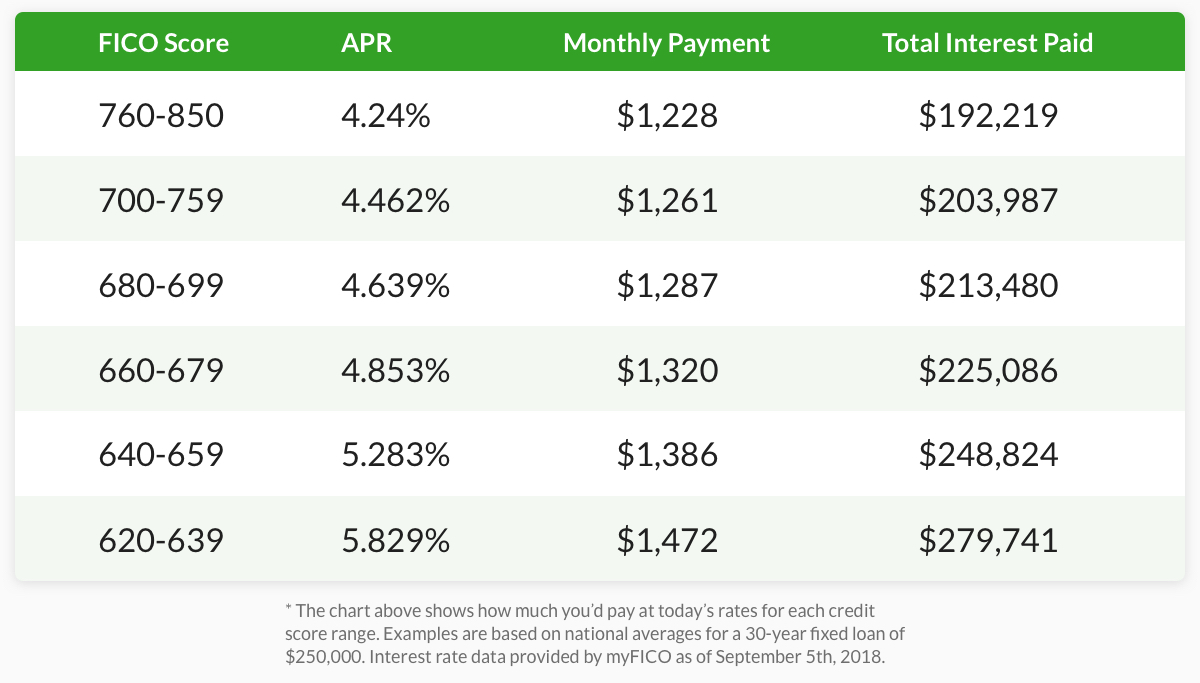

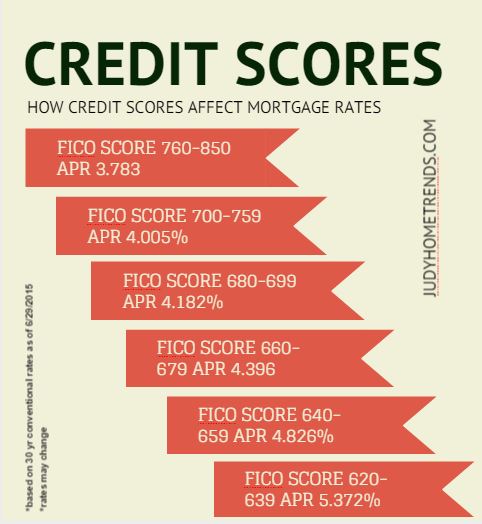

The "nut graf": Achieving a 750 credit score generally unlocks access to more competitive mortgage interest rates compared to lower scores. However, the exact rate hinges on a confluence of factors beyond just the credit score, including the loan type (e.g., conventional, FHA, VA), the size of the down payment, and prevailing economic conditions.

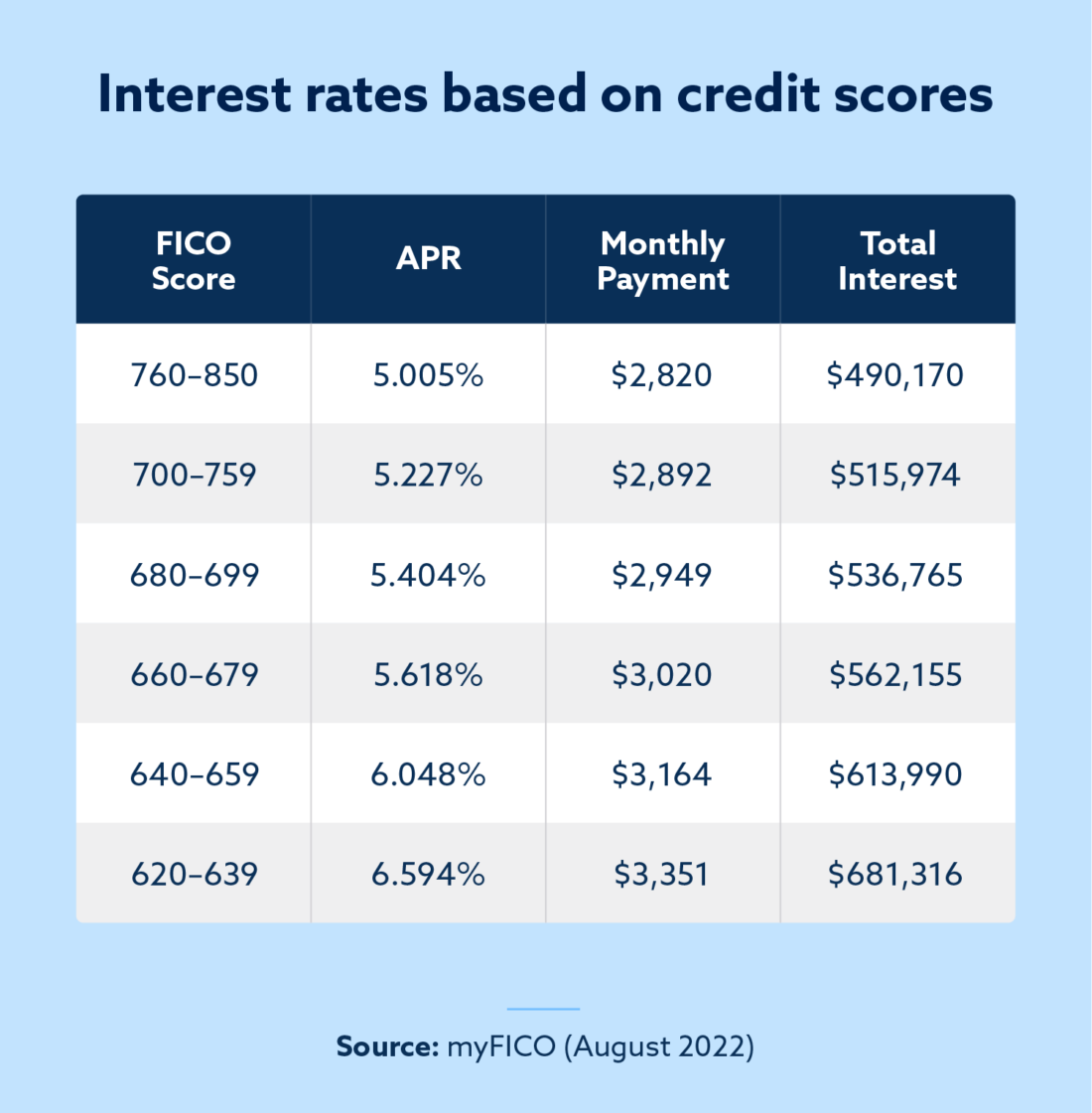

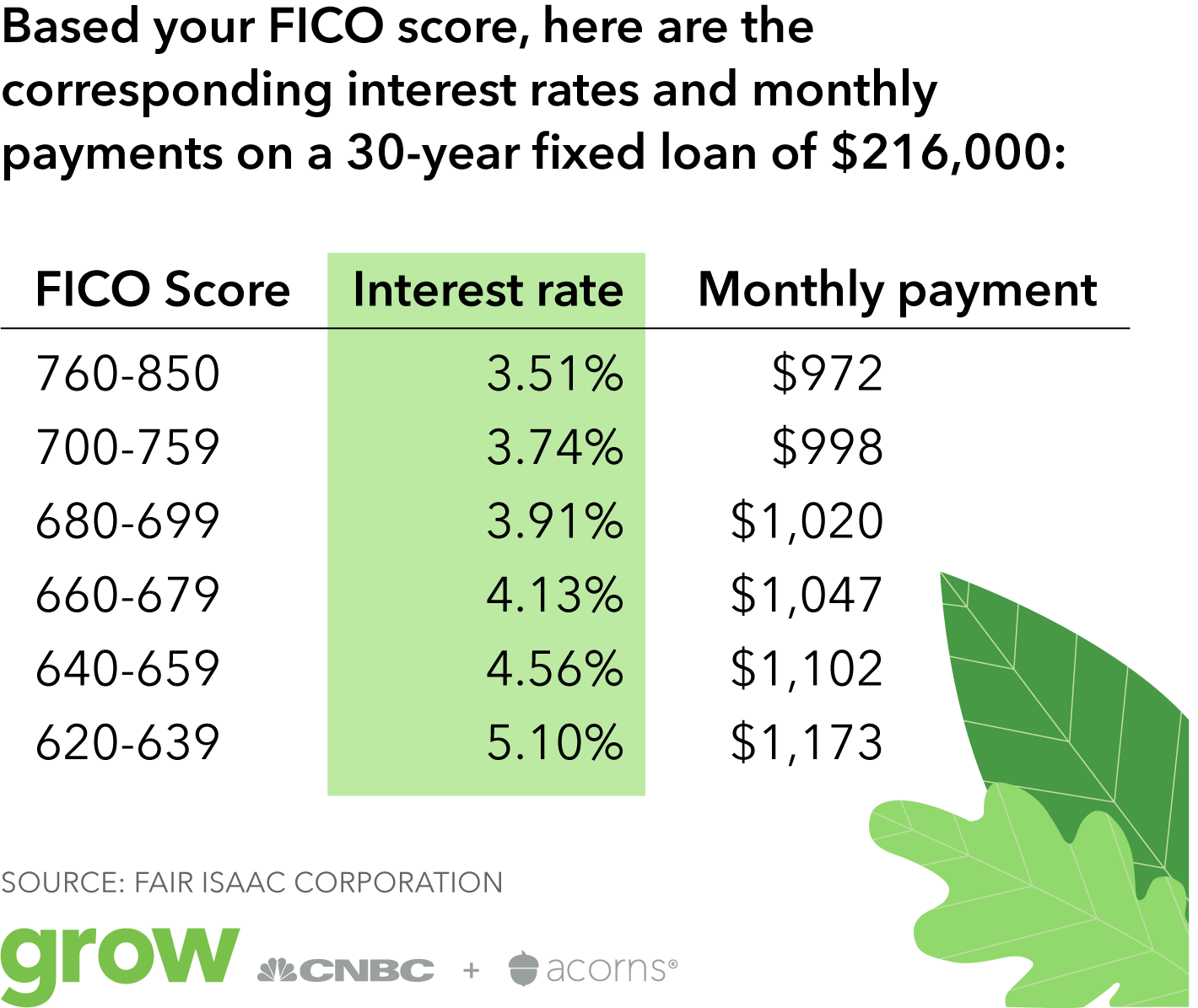

According to recent data from Freddie Mac, as of [Insert Current Date - Example: October 26, 2023], the average 30-year fixed-rate mortgage hovers around [Insert Current Average Rate - Example: 7.79%]. This is a significant increase compared to the previous year and even the previous month.

While this is the average across all borrowers, those with a 750 credit score typically see rates that are slightly lower, potentially in the range of [Insert Specific Rate Range - Example: 7.50% to 7.70%]. These numbers are constantly shifting based on market volatility and economic news.

Factors Influencing Mortgage Rates for a 750 Credit Score

Several elements, besides a 750 credit score, play crucial roles in determining the final mortgage interest rate offered to a borrower.

Loan Type

Conventional loans, often requiring larger down payments and stricter credit standards, might offer slightly lower rates to borrowers with excellent credit. FHA loans, backed by the Federal Housing Administration, cater to borrowers with lower down payments and less-than-perfect credit, but may come with higher interest rates or mortgage insurance premiums, even with a good credit score.

VA loans, guaranteed by the Department of Veterans Affairs, are available to eligible veterans and active-duty service members. These loans often come with competitive rates and no down payment requirements, making them an attractive option for qualifying individuals.

Down Payment

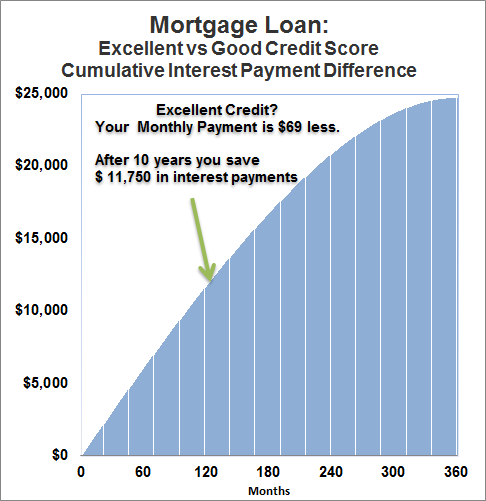

A larger down payment reduces the lender's risk, often translating to a lower interest rate. Putting down 20% or more can significantly improve the terms of a mortgage, even for someone with a solid 750 credit score.

Loan Term

The length of the mortgage term impacts the interest rate. Shorter-term mortgages, like 15-year loans, generally have lower interest rates compared to 30-year loans. However, the monthly payments on shorter-term loans are substantially higher.

Economic Conditions

The overall economic climate, including inflation rates, Federal Reserve policies, and the health of the bond market, heavily influences mortgage rates. When the economy is strong and inflation is under control, interest rates tend to be lower.

Securing the Best Rate: Strategies for Borrowers

Even with a commendable 750 credit score, borrowers can take proactive steps to secure the most favorable mortgage interest rate. Comparison shopping is paramount.

Obtain quotes from multiple lenders, including banks, credit unions, and mortgage brokers. Each lender may have different underwriting criteria and pricing strategies.

Review your credit report carefully and address any errors or inaccuracies. Even minor discrepancies can impact your credit score and, consequently, your mortgage rate.

Consider improving your debt-to-income ratio by paying down existing debts. A lower DTI demonstrates financial stability and reduces the lender's perceived risk.

Lock in your interest rate once you find an offer you're comfortable with. Rate lock periods typically range from 30 to 60 days, providing protection against potential rate increases during the underwriting process.

The Future Outlook: Navigating an Evolving Market

The future of mortgage interest rates remains uncertain, heavily influenced by unpredictable economic factors. Experts at institutions like the Mortgage Bankers Association (MBA) predict that rates will [Insert predictions - Example: remain elevated in the near term before potentially moderating later in the year].

Prospective homebuyers should carefully assess their financial situation, explore various loan options, and consult with a mortgage professional to navigate the complexities of the current market. A 750 credit score is a valuable asset, but understanding the broader economic context and employing strategic planning are essential for achieving the dream of homeownership.