How Much Does It Cost To Start A Business Account

Opening a business account is crucial, but initial costs can vary widely. This report breaks down expenses for entrepreneurs eager to start.

Understanding the upfront investment needed to establish a business banking presence is essential for financial planning. Key costs include initial deposits, monthly fees, and potential charges for specific services.

Account Setup Fees: The Initial Hurdle

Some banks charge a one-time setup fee. While uncommon, these fees can range from $50 to $100, depending on the institution and account type.

According to a 2023 survey by ValuePenguin, nearly 80% of banks don't charge setup fees, but always confirm directly with the bank.

Minimum Deposit Requirements

Most business accounts require an initial minimum deposit. This deposit can range from $0 to $1,000 or more.

Many online banks require lower or no minimum deposits compared to traditional brick-and-mortar institutions. For instance, Chase Business Complete Banking often requires a minimum opening deposit.

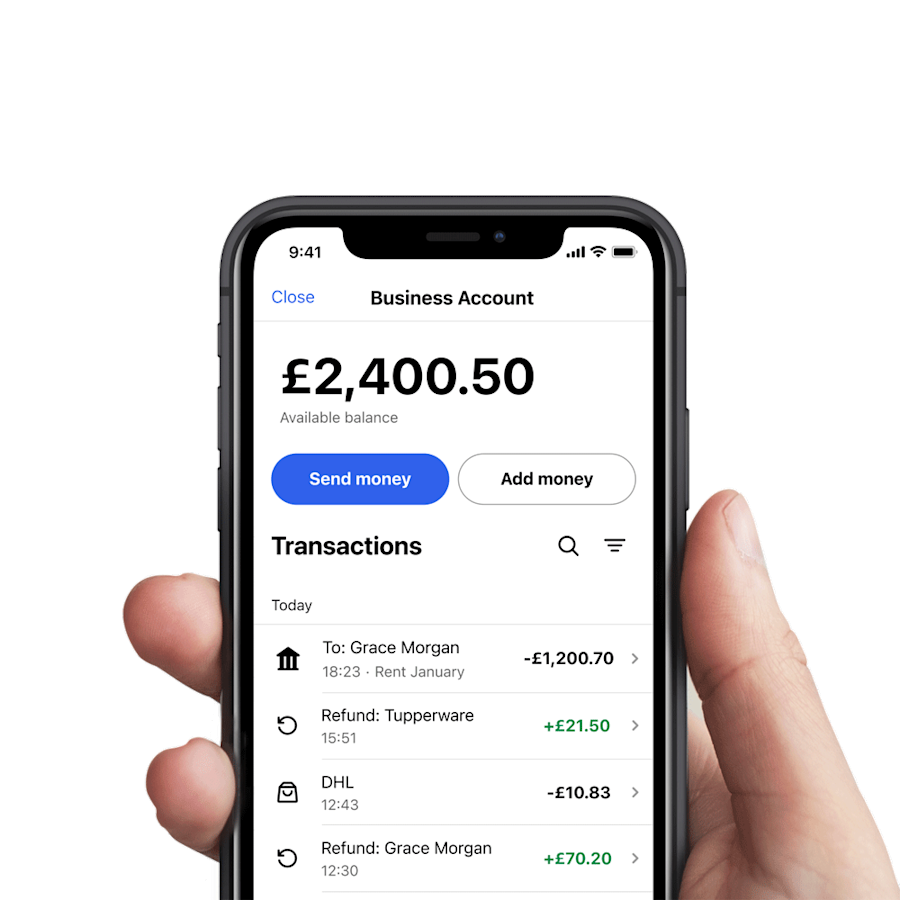

Monthly Maintenance Fees

Recurring monthly maintenance fees are a significant consideration. These fees typically range from $10 to $30 per month.

Fees may be waived if you maintain a certain minimum balance. Bank of America Business Advantage Banking waives monthly fees for accounts with combined balances above a certain threshold.

Transaction Fees

Transaction fees can quickly add up depending on business activity. Banks often limit the number of free transactions per month.

Excess transactions, such as wire transfers or large cash deposits, incur fees. These fees can range from $0.25 to $0.50 per transaction or higher for specialized services.

Hidden Costs and Overdraft Fees

Be aware of potential hidden costs. Overdraft fees can be particularly burdensome.

Overdraft fees often range from $30 to $40 per occurrence. Carefully review the bank's fee schedule to avoid unexpected charges.

Digital Banking and Service Fees

Utilizing digital banking services might come with additional costs. These include fees for online bill pay or ACH transfers.

While many banks offer basic online services for free, advanced features can incur fees. Check the specific fees associated with online banking features.

Choosing the Right Account: A Strategic Decision

Selecting the right account depends on your business needs and transaction volume. Consider factors such as monthly fees, transaction limits, and available services.

Compare accounts from different banks and credit unions. Factor in the size of your business, transaction frequency and whether you want a physical branch to visit or if online banking is sufficient.

The Bottom Line: Preparing Your Finances

Starting a business account could range from a few dollars to several hundred, factoring in minimum deposits and potential fees. Proper budgeting is crucial.

Entrepreneurs should research and compare options. Understanding the fine print is essential for managing finances effectively.

Next Steps

Contact several banks and credit unions directly to inquire about current rates and fees. Thorough research empowers you to make informed decisions.

Consult a financial advisor for personalized guidance. This step is essential, especially for complex business structures.