Axa Land Acquisitions And Transactions 2027

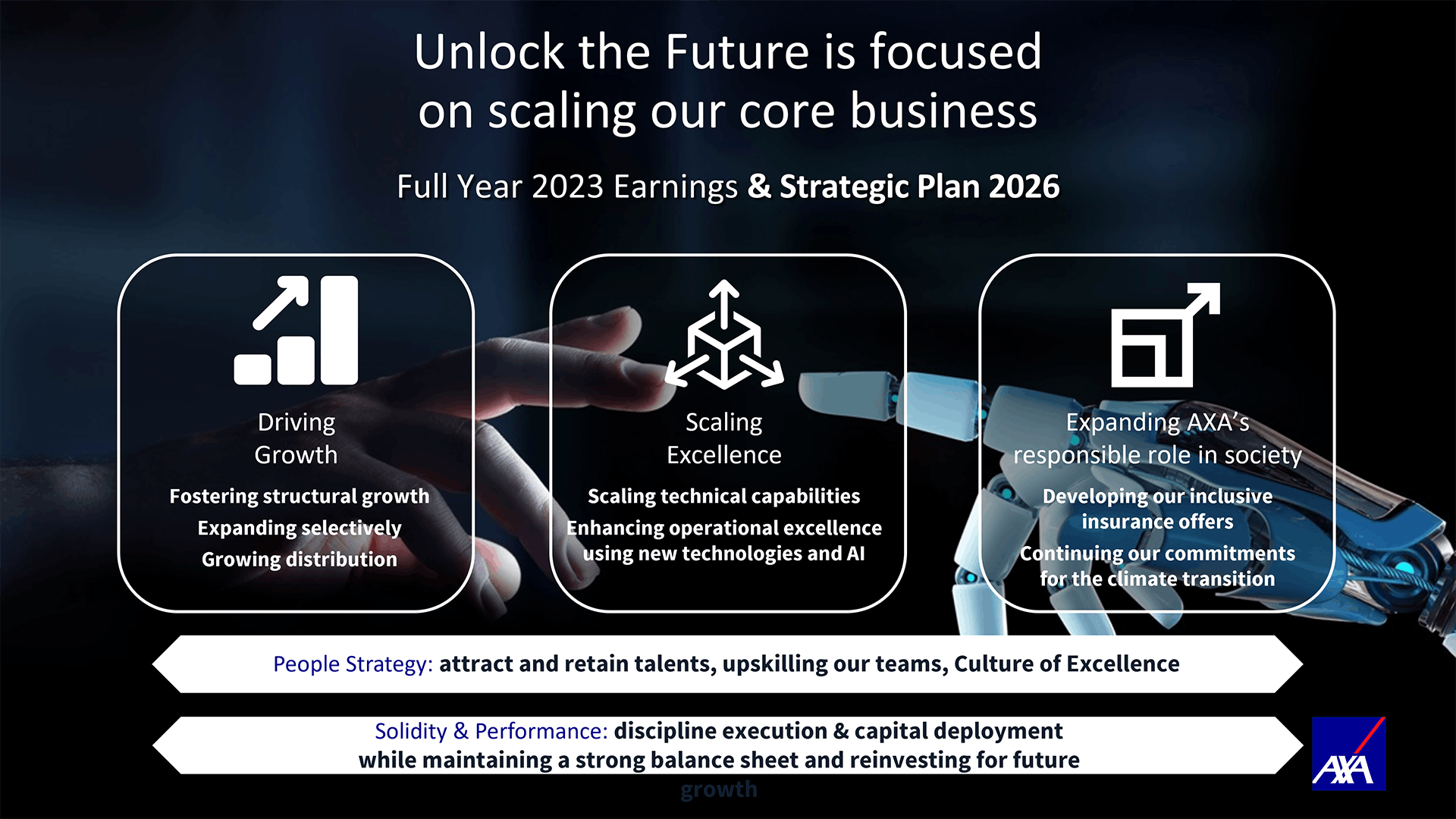

Real estate giant Axa Land executes a series of high-profile acquisitions and strategic transactions across key global markets, signaling aggressive expansion and portfolio reshaping in 2027.

These deals, totaling over $7 billion, involve prime commercial properties, residential developments, and strategic land banks, solidifying Axa Land's position as a dominant player in the international real estate landscape.

Key Acquisitions & Transactions of 2027

North America

Axa Land finalized the acquisition of the "Innovation Tower" in downtown San Francisco for $1.8 billion. The deal, closed on July 15, 2027, adds a state-of-the-art office complex to their portfolio.

The tower, boasting over 1.2 million square feet of leasable space, is currently 95% occupied by tech firms and financial institutions. This deal underscores Axa Land's focus on premium assets in high-growth markets.

In New York City, Axa Land completed the purchase of a prime residential development site in Manhattan's Upper West Side for $950 million. The agreement, signed on August 2, 2027, paves the way for a luxury condominium project slated for completion in 2030.

Europe

Axa Land made a significant move in London by acquiring a portfolio of logistics properties for $1.5 billion. The acquisition, finalized on September 20, 2027, includes five strategically located distribution centers.

These properties are crucial for e-commerce and supply chain operations. Axa Land gains immediate access to a robust network of logistics infrastructure.

In Paris, Axa Land divested its stake in a secondary office building located in La Défense. The sale, completed on October 5, 2027, generated $600 million. Axa Land cited a strategic shift towards higher-yielding assets as the reason for the divestiture.

Asia-Pacific

Axa Land expanded its presence in Singapore with the acquisition of a mixed-use development project for $1.2 billion. The project, expected to be completed in 2029, will include retail spaces, offices, and residential units.

The deal, closed on November 10, 2027, reflects Axa Land's confidence in the long-term growth prospects of the Singaporean market.

In Tokyo, Axa Land acquired a substantial land bank in the city's emerging technology district for $1 billion. The purchase, finalized on December 1, 2027, positions Axa Land to capitalize on the growing demand for commercial space in the area.

Financial Implications and Market Impact

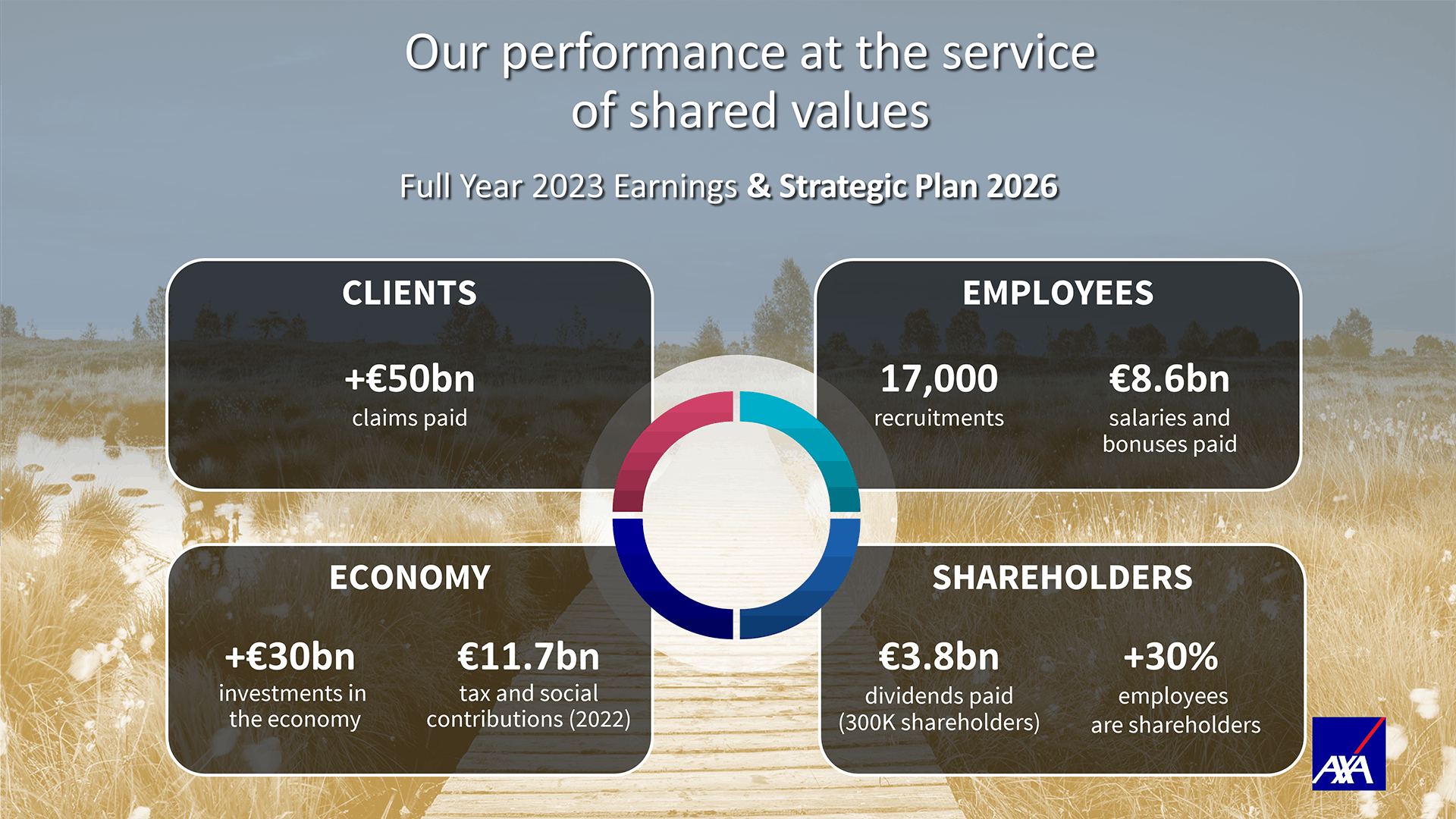

These acquisitions and transactions significantly bolster Axa Land's asset base. The increased activity diversifies its portfolio across different geographies and asset classes.

The strategic divestiture in Paris provides Axa Land with additional capital to fund future investments. It is expected that the company will continue to pursue opportunistic deals in 2028.

According to a report from Real Estate Analytics Firm (REAF), Axa Land's aggressive acquisition strategy has solidified its position among the top three global real estate investors. The company's financial performance in 2027 is projected to exceed initial forecasts.

Next Steps and Ongoing Developments

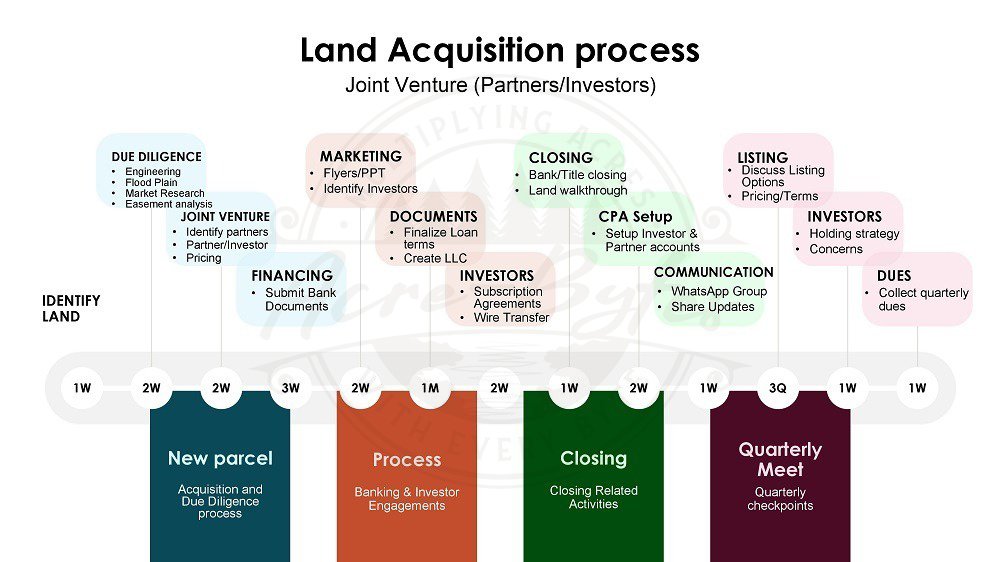

Axa Land is currently conducting due diligence on potential acquisitions in Sydney and Frankfurt. These deals are expected to close in the first half of 2028.

The company is also actively seeking partnerships with local developers to expand its reach into emerging markets. Key executives are scheduled to provide a detailed update on the company's strategic outlook at an investor conference in January 2028.