How To Trade Options On Thinkorswim Desktop

For investors seeking to navigate the complexities of the options market, TD Ameritrade's thinkorswim desktop platform offers a robust suite of tools. This guide provides a detailed walkthrough on how to trade options using this popular platform, focusing on practical steps and key features. Mastering the interface and order entry process can empower investors to execute their options strategies with greater precision.

Thinkorswim provides a comprehensive platform for trading various securities, including options. This guide will cover the essential steps involved in placing options trades on the desktop application. It will focus on locating option chains, analyzing potential trades, and executing orders efficiently.

Accessing the Options Chain

The first step is to access the options chain for the underlying asset you wish to trade. Begin by entering the ticker symbol in the search bar located at the top of the thinkorswim platform. After entering the ticker, a dropdown menu will appear, select the desired underlying asset from the list.

Once the underlying asset is selected, navigate to the "Trade" tab. Within the "Trade" tab, locate and click on the "Options Chain" sub-tab. This will display the available options contracts for the selected asset.

The options chain displays calls and puts, along with their corresponding strike prices and expiration dates. You can customize the expiration dates displayed by using the expiration date filter at the top of the options chain. Choose the appropriate expiration date that aligns with your trading strategy.

Analyzing the Options Chain

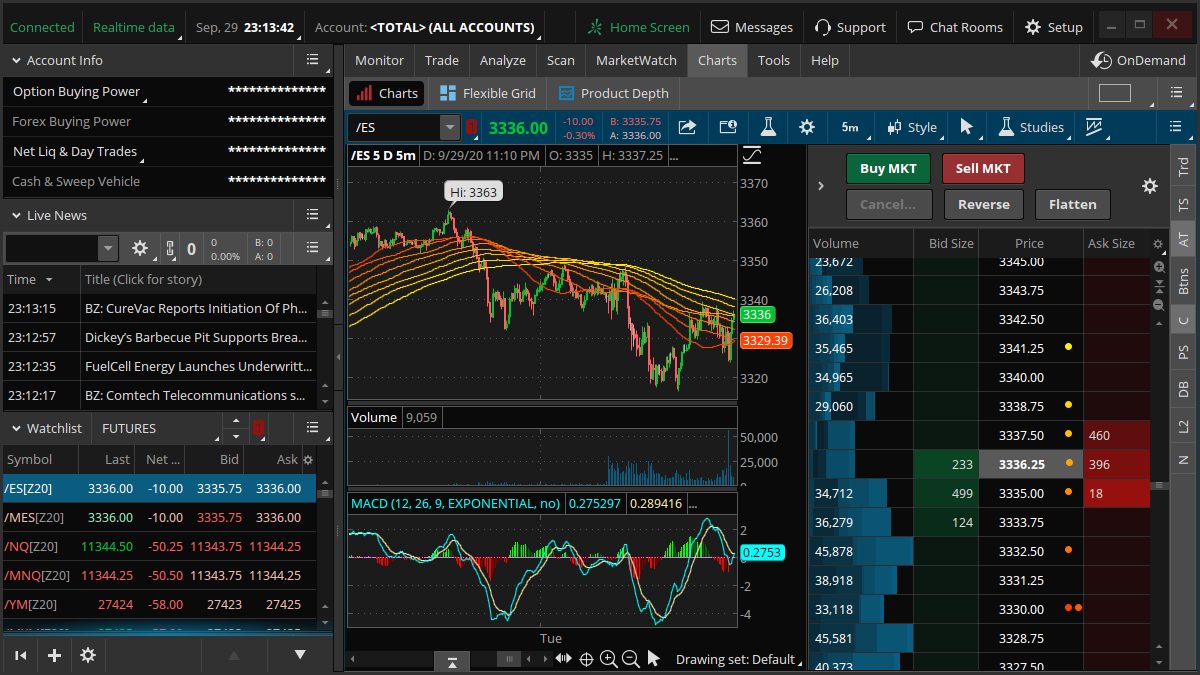

Thinkorswim offers several tools to analyze the options chain before placing a trade. Key data points include the bid and ask prices, volume, open interest, and implied volatility. Carefully review these metrics to assess the liquidity and potential profitability of the option.

The platform also provides access to Greeks such as Delta, Gamma, Theta, and Vega. These values provide insights into how an option's price might change in response to various factors, such as changes in the underlying asset's price or time decay. Understanding these Greeks can significantly enhance your risk management strategies.

Consider using the "Analyze" tab to visualize potential profit and loss scenarios based on different price movements of the underlying asset. This feature allows you to project how your options position might perform under various market conditions.

Placing an Options Trade

To initiate an options trade, click on the bid or ask price of the desired option contract within the options chain. Clicking the bid price will create a sell order, while clicking the ask price will create a buy order. This action populates the order entry window at the bottom of the platform.

In the order entry window, verify all the details of the trade including the option contract, quantity, order type (e.g., market, limit), and price. It is crucial to double-check these details before submitting the order. Using a limit order can help you control the price at which your order is executed.

Select your preferred order type from the available options. For example, a market order executes the trade immediately at the best available price. A limit order, in contrast, only executes if the price reaches the specified limit. Consider the urgency and risk tolerance associated with your trade when choosing an order type.

After verifying all the details, click the "Confirm and Send" button to submit the order. A confirmation window will appear, providing a final opportunity to review the trade. Once you are satisfied, click "Send" to transmit the order to the market.

Monitoring Your Positions

Once the order is executed, you can monitor your options positions in the "Monitor" tab. This tab provides real-time information on the profit or loss of your positions. It also displays the current market value of your holdings.

You can also use the "Monitor" tab to adjust or close your options positions. To close a position, right-click on the options contract and select "Create Closing Order." This will populate the order entry window with the details necessary to close the position.

Remember to regularly monitor your positions and make adjustments as necessary based on market conditions and your risk tolerance. The thinkorswim platform provides the tools necessary to actively manage your options trades.

Conclusion

Trading options on thinkorswim requires a thorough understanding of the platform's features and functionality. By following these steps, investors can effectively navigate the options market and execute their trading strategies. Proper risk management and continuous learning are essential for success in options trading.

Before engaging in options trading, ensure you fully understand the risks involved. Options trading is not suitable for all investors and can result in significant losses.