Bad Credit Need A Car Asap

The car is essential for many Americans, a gateway to employment, healthcare, and basic necessities. But for those with bad credit, the road to vehicle ownership can feel like an insurmountable obstacle. Millions find themselves stuck in a cycle: needing a car to improve their financial situation, yet unable to secure financing due to their poor credit history.

This article delves into the challenges faced by individuals with bad credit seeking auto loans. It explores the high costs and limited options available to them. Further, it examines the potential predatory lending practices they may encounter and potential paths towards securing reliable transportation and rebuilding their creditworthiness.

The Predicament: Bad Credit and Limited Options

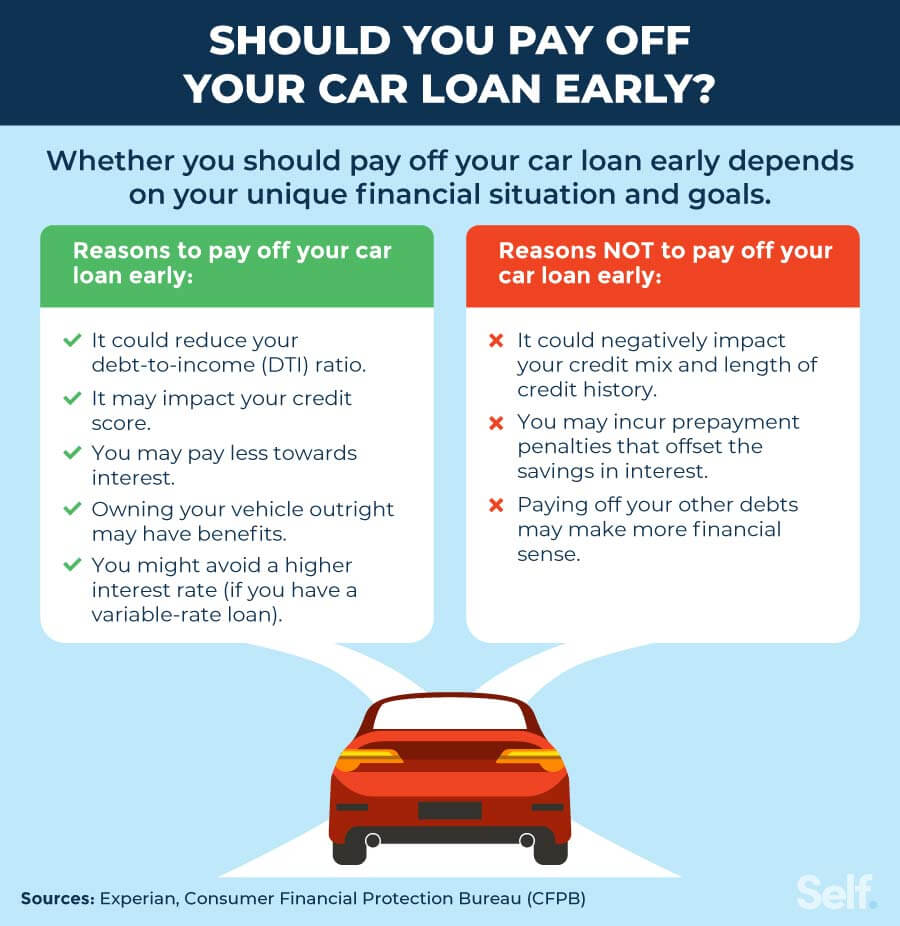

A low credit score severely restricts access to traditional auto loans. Banks and credit unions typically reserve their best interest rates for borrowers with excellent credit, often defined as a FICO score of 700 or higher.

Those with scores below that threshold face significantly higher interest rates. According to data from Experian, the average interest rate for a new car loan in Q4 2023 for those with credit scores between 501 and 600 was over 12%, compared to around 7% for those with scores above 781.

This translates to thousands of dollars in extra interest paid over the life of the loan. Furthermore, individuals with bad credit may be limited to smaller loan amounts and shorter repayment terms, further increasing their monthly payments.

The Subprime Auto Loan Market

The subprime auto loan market caters to borrowers with less-than-ideal credit. While it offers a lifeline to some, it is often fraught with peril.

These loans typically come with exorbitant interest rates, sometimes exceeding 20%, and hidden fees that can quickly inflate the total cost of the vehicle. Some lenders may also require borrowers to purchase add-on products like extended warranties or GAP insurance, regardless of need.

"Buy here, pay here" dealerships, which finance car purchases directly, often target individuals with bad credit. While they offer easy approval, their interest rates and vehicle prices are typically much higher than those offered by traditional lenders.

Predatory Lending Concerns

The subprime auto loan market has attracted scrutiny due to concerns about predatory lending. Some lenders may take advantage of borrowers' desperation by offering loans with unaffordable terms and deceptive practices.

These practices can include hiding fees, misrepresenting loan terms, and using aggressive collection tactics. Borrowers may find themselves trapped in a cycle of debt, unable to repay their loans and at risk of repossession.

Consumer advocacy groups like the National Consumer Law Center (NCLC) have long warned about the dangers of predatory auto lending. They advocate for stronger regulations and greater transparency in the subprime auto loan market.

Alternatives and Strategies

Despite the challenges, individuals with bad credit are not entirely without options when seeking a car.

Improving credit scores is crucial. This can be achieved by paying bills on time, reducing debt, and correcting errors on credit reports. Even a small increase in credit score can significantly improve loan terms.

Consider securing a co-signer with good credit. A co-signer agrees to be responsible for the loan if the borrower defaults, which can make lenders more willing to approve the loan and offer better rates.

Explore credit union options. Credit unions often offer more favorable loan terms to their members, particularly those with less-than-perfect credit. They may also be more willing to work with borrowers on a case-by-case basis.

Consider a secured auto loan. This type of loan uses the car itself as collateral. This reduces the lender's risk and may make it easier to qualify for a loan, even with bad credit.

Save for a larger down payment. A larger down payment reduces the loan amount and the lender's risk, which can improve the chances of approval and lead to lower interest rates.

The Future of Auto Lending for Bad Credit Borrowers

The future of auto lending for bad credit borrowers is uncertain. Increased regulatory scrutiny and consumer awareness are putting pressure on lenders to offer more transparent and affordable loan products.

The rise of online lenders and fintech companies is also disrupting the auto loan market. Some of these companies are using alternative data and algorithms to assess creditworthiness, which could potentially expand access to loans for borrowers with bad credit.

However, it is important for borrowers to exercise caution and carefully research any lender before applying for a loan. Reading reviews, comparing offers, and understanding the loan terms are essential steps in avoiding predatory lending practices.

Ultimately, the best path towards securing a car with bad credit is to improve creditworthiness and explore all available options. With careful planning and financial discipline, it is possible to navigate the challenges and find a safe and affordable way to get back on the road.

![Bad Credit Need A Car Asap How To Buy Car With Bad Credit 🇺🇸 [TOP 5] | No Credit Check - Credit](https://i.ytimg.com/vi/0677AR9wYuI/maxresdefault.jpg)