Bank Accounts For Under 18 Year Olds

Imagine a crisp autumn afternoon, the scent of freshly fallen leaves filling the air. A young girl, maybe 14, clutches a newly printed bank statement, her eyes wide with a mixture of excitement and dawning responsibility. This isn't just a piece of paper; it's a key, unlocking a world of financial literacy and independence.

Opening a bank account before the age of 18 is becoming increasingly common, and for good reason. These accounts offer more than just a safe place to store money; they are powerful tools that can teach young people valuable life skills about budgeting, saving, and financial management. It is crucial that young adults learn about finances and good money management before they are fully independent.

Historically, children relied on piggy banks or parents' accounts to manage their funds. This system often lacked the educational component needed to foster financial responsibility. According to a recent survey by the JumpStart Coalition for Personal Financial Literacy, only a small percentage of high school students demonstrate a solid understanding of basic financial concepts.

The shift towards encouraging early banking began gaining momentum in the late 20th century, fueled by a growing awareness of the importance of financial literacy. Banks started offering specialized accounts tailored to younger customers, often with lower fees and educational resources. This trend continues today, with many institutions offering attractive incentives and online platforms designed for young users.

One of the main benefits of these accounts is the opportunity to learn practical budgeting skills. By tracking deposits and withdrawals, young account holders can see where their money is going. This hands-on experience helps them develop a sense of value and encourages thoughtful spending habits.

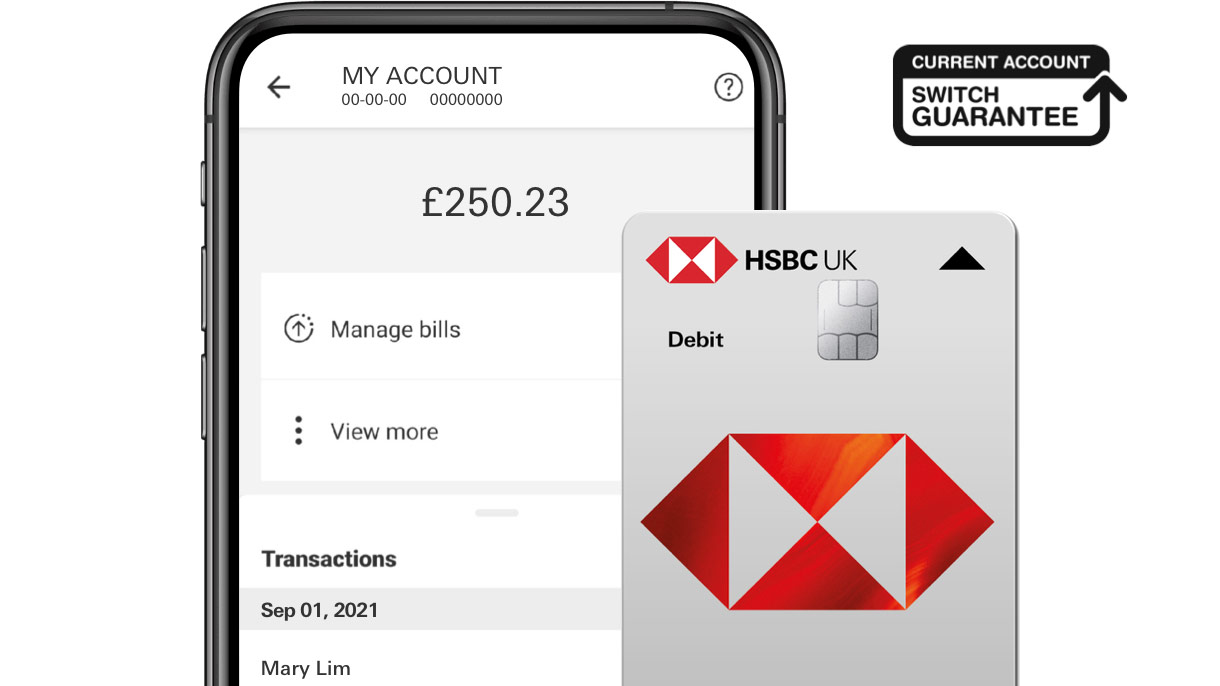

Saving money becomes more tangible and rewarding when young people can visually see their balance grow. Many banks offer online tools and apps that make it easy to set savings goals and monitor progress. This gamified approach can be particularly effective in motivating teenagers to save for larger purchases or future goals.

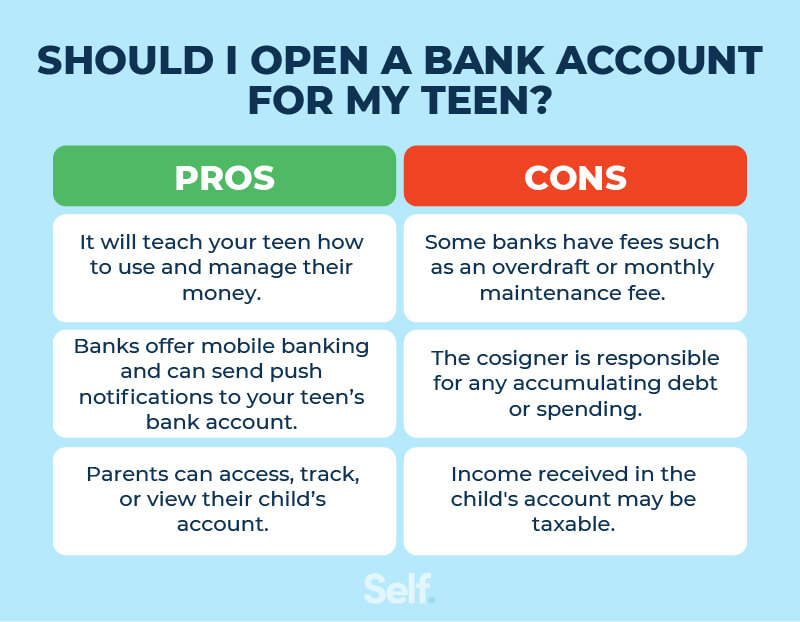

Opening a bank account can also be a significant step toward establishing credit. While a debit card doesn't directly build credit, responsible money management can pave the way for future credit-building opportunities. Learning to avoid overdraft fees and maintaining a healthy balance demonstrates financial maturity.

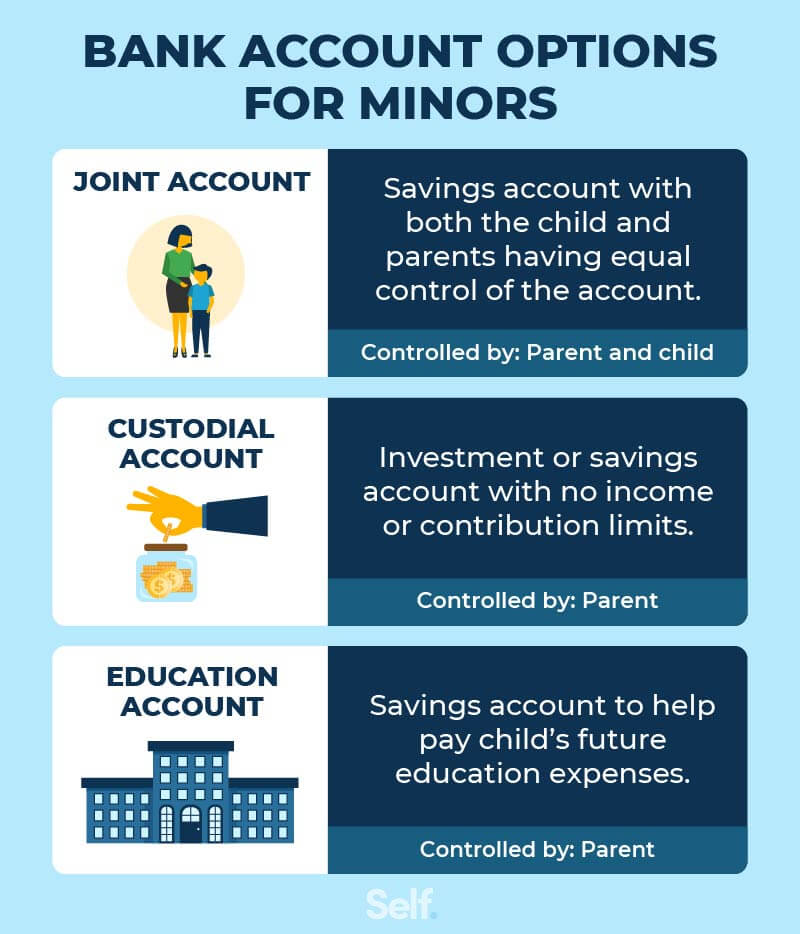

Several types of accounts are available for minors. Custodial accounts, typically managed by a parent or guardian until the child reaches a certain age (often 18 or 21), offer greater control. Joint accounts, where both the parent and child have access and responsibility, provide a collaborative approach to money management. There are also teen checking accounts, which are typically controlled by the teen.

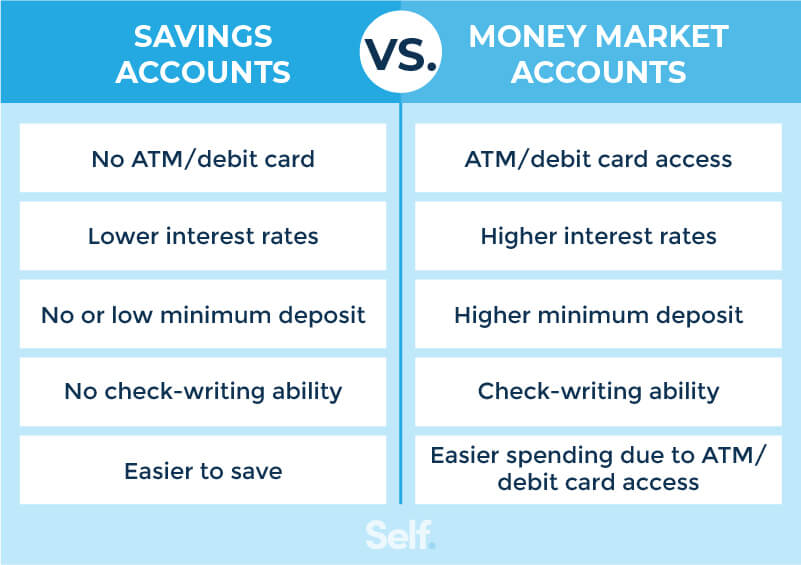

When choosing an account, it's important to consider fees, interest rates, and accessibility. Look for accounts with low or no monthly fees, and consider options that offer online and mobile banking. Check if the bank offers educational resources that can help young people learn about personal finance.

Opening a bank account for a minor isn't just about storing money; it's about instilling a lifelong habit of financial responsibility. By empowering young people with the tools and knowledge they need to manage their money effectively, we can help them build a more secure and prosperous future. It is a gift that will empower them for the rest of their lives.

Think back to that young girl with her bank statement. The lessons she learns today, about budgeting, saving, and responsible spending, will shape her financial future for years to come. Financial literacy is a gift that keeps on giving, empowering the next generation to navigate the complexities of the modern world with confidence and wisdom.