Bank Of America Cash Rewards Platinum Honors

Imagine strolling through a sun-drenched farmers market, the aroma of freshly baked bread mingling with the vibrant colors of ripe fruits and vegetables. As you reach for your wallet to support local artisans, wouldn't it be wonderful if that simple act could also earn you valuable rewards, tailored precisely to the rhythm of your life? Bank of America seems to think so, with a refresh to a card that is a bit more exclusive.

The Bank of America Cash Rewards Platinum Honors credit card offers a compelling proposition: personalized rewards based on your spending habits, coupled with enhanced benefits for loyal Bank of America customers. This isn't just another credit card; it's a potentially powerful tool for maximizing your financial gains while enjoying the convenience of everyday spending.

A History of Rewarding Loyalty

Bank of America has long recognized the value of customer loyalty, weaving it into the fabric of its products and services. The Cash Rewards program, in its various forms, has been a cornerstone of this strategy, providing tangible incentives for customers to choose Bank of America for their financial needs.

The Platinum Honors tier, however, elevates this concept to a new level. It's specifically designed for customers who maintain a significant relationship with Bank of America, through their banking and investment accounts.

The Platinum Honors Advantage

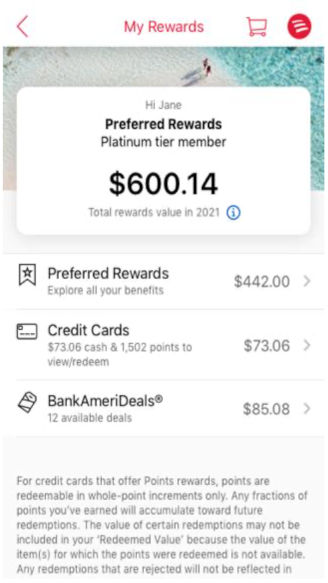

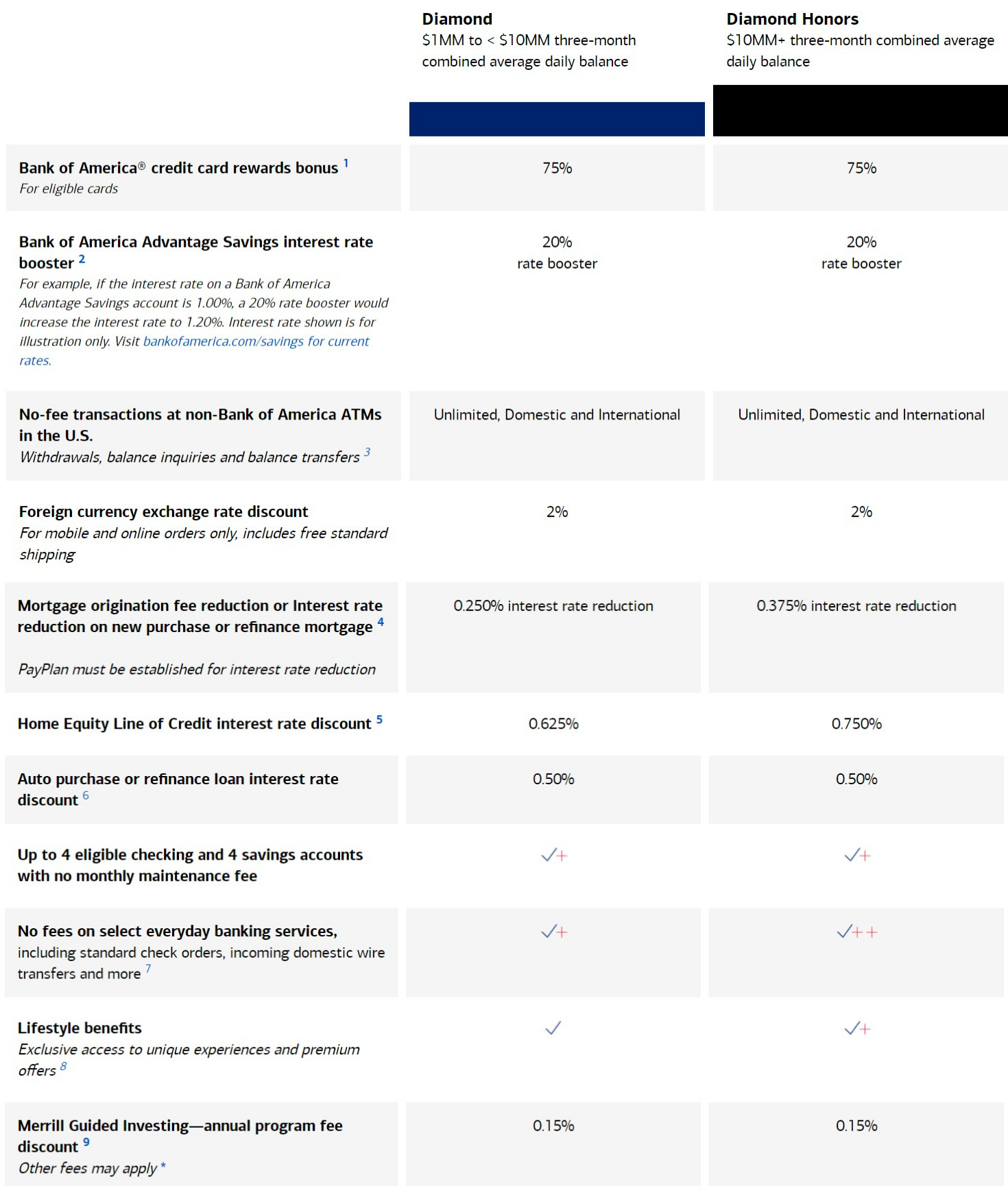

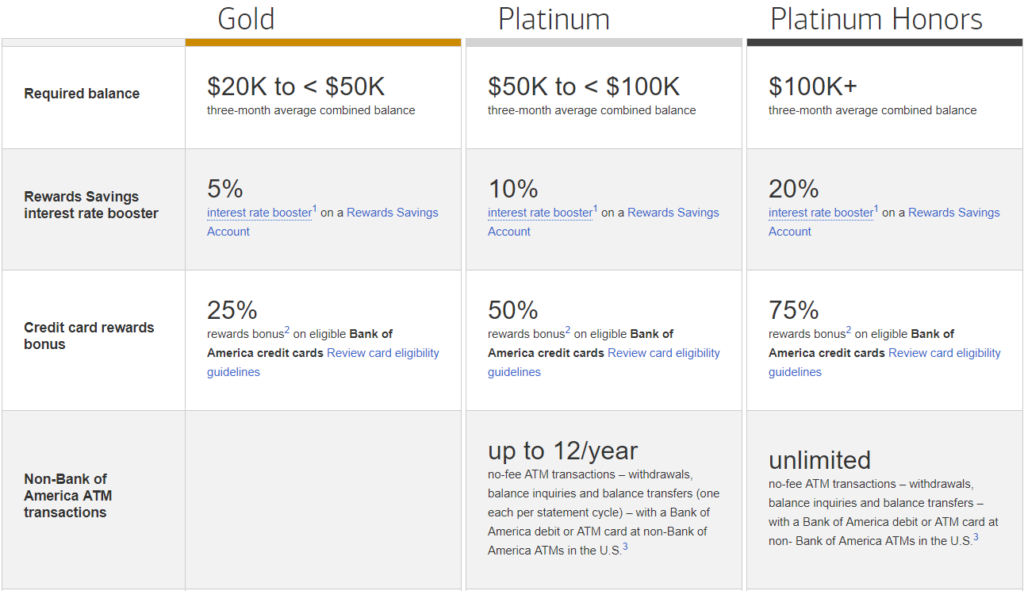

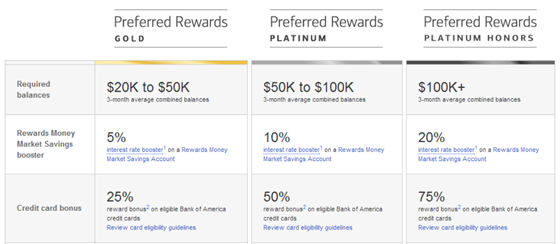

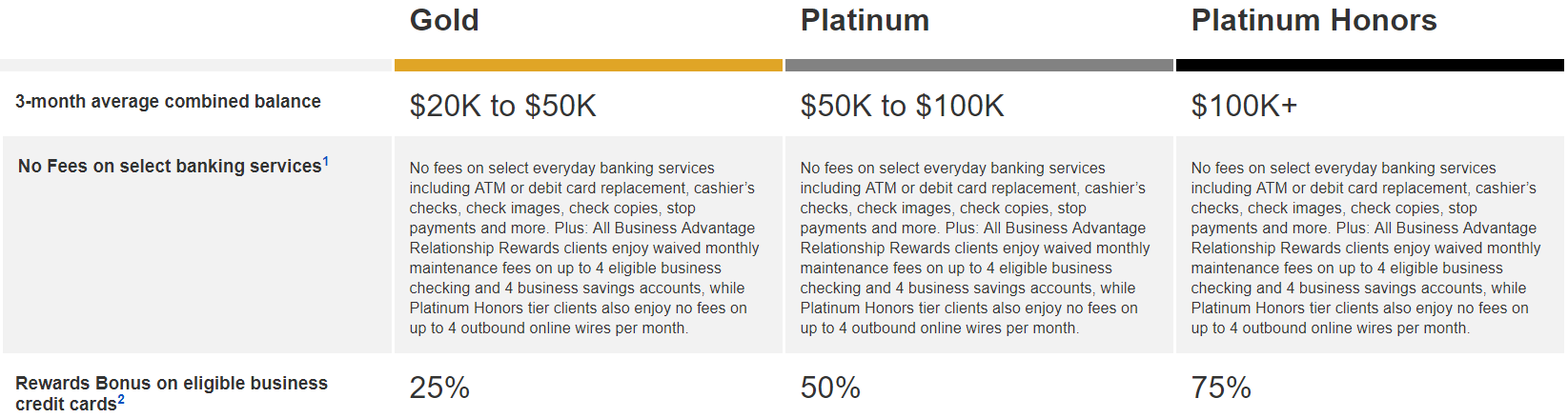

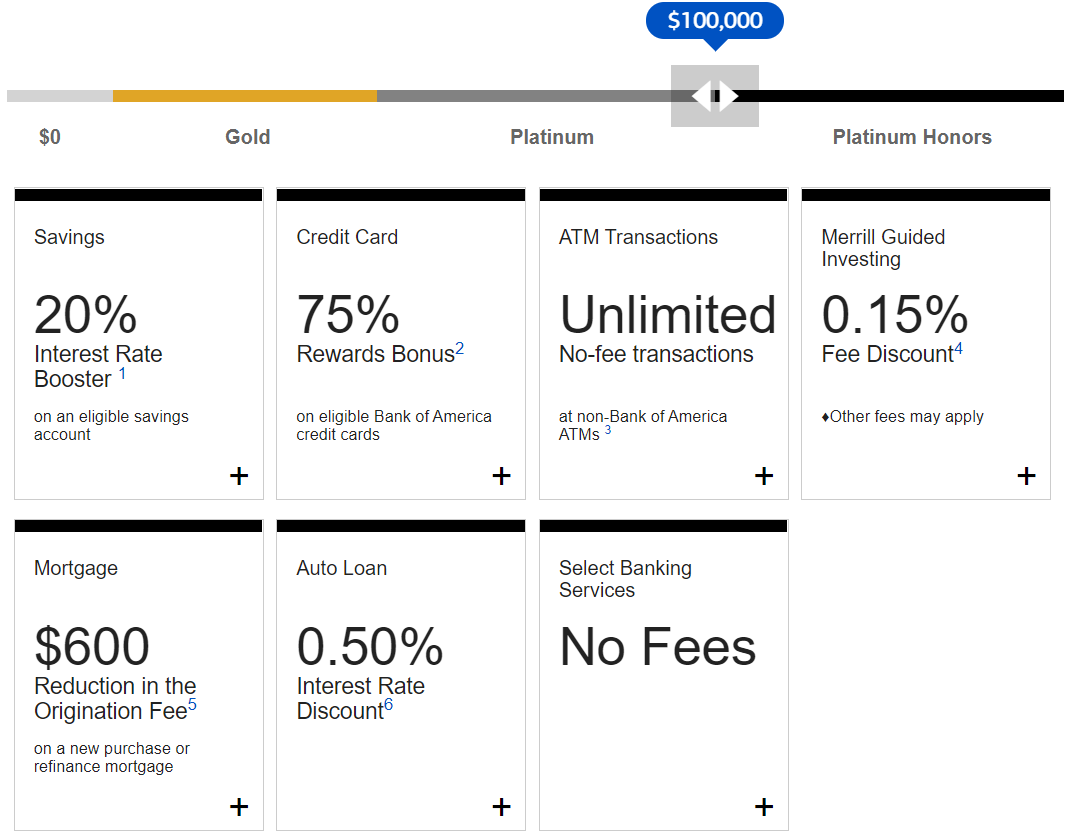

What exactly sets the Platinum Honors card apart? The answer lies in its enhanced rewards structure. Cardholders receive a boost to their earned rewards based on their qualifying Bank of America and Merrill investment balances. This boost can significantly increase the cash back earned on purchases.

As stated on Bank of America’s website, the cash rewards can be maximized with tiered bonus based on assets in Bank of America accounts.

Furthermore, the Platinum Honors status often unlocks additional perks, such as interest rate discounts on loans and other banking products. The enhanced rewards and benefits aren't merely a perk; they're a reflection of the bank's commitment to rewarding its most valued customers.

How the Card Works

The core of the card revolves around its cash back program. Cardholders earn cash back on every purchase, with bonus categories that can be customized to fit their spending habits. This personalization ensures that the card actively rewards users for the purchases they’re already making.

A standard earning structure might look something like this: 3% cash back in a category of your choice (e.g., gas, online shopping, dining), 2% at grocery stores and wholesale clubs, and 1% on all other purchases. However, the Platinum Honors bonus significantly amplifies these rewards.

For example, a Preferred Rewards member with Platinum Honors status can earn a 75% rewards bonus. This means the 3% category could jump to 5.25%, greatly increasing your total cash back earnings. This kind of boost makes a tangible difference over time.

Considerations and Alternatives

While the Bank of America Cash Rewards Platinum Honors card offers attractive benefits, it's important to consider whether it's the right fit for your financial situation.

The primary requirement for Platinum Honors status is maintaining a qualifying balance in Bank of America or Merrill investment accounts. If you don't already have a substantial relationship with Bank of America, achieving this status might not be feasible.

Also it's essential to consider alternative cash back cards that may offer higher rewards in specific categories or simpler rewards structures. Researching and comparing different cards will help you make an informed decision based on your individual needs and spending patterns.

A Rewarding Partnership

The Bank of America Cash Rewards Platinum Honors credit card presents a compelling case for customers seeking to maximize their rewards and enjoy enhanced banking benefits. It is more than just a piece of plastic; it's a potential key to unlocking greater financial value through your everyday spending.

The key lies in understanding the program's requirements and carefully evaluating whether the benefits align with your financial profile. If you're a loyal Bank of America customer with substantial balances, this card could be a rewarding addition to your wallet, transforming your purchases into a stream of tangible rewards.

![Bank Of America Cash Rewards Platinum Honors Amex Platinum vs. Bank of America Premium Rewards Card [2025]](https://upgradedpoints.com/wp-content/uploads/2023/05/Amex-Platinum-vs-Bank-of-America-Premium-Rewards-Upgraded-Points-1.jpg?auto=webp&disable=upscale&width=1200)