Basic Financial Management For Small Business

Imagine Sarah, a talented baker with a passion for sourdough. Her small bakery, "Sarah's Sweet Surrender," is a local gem, filled with the aroma of freshly baked bread and the happy chatter of customers. Yet, behind the scenes, Sarah struggles. She often finds herself scrambling to pay bills, unsure if her business is truly profitable. This isn't just Sarah's story; it's a familiar narrative for many small business owners who excel at their craft but find the financial side of things daunting.

This article aims to provide essential financial management tips for small business owners, like Sarah, to help them navigate the complexities of business finances, ensuring long-term stability and growth. Understanding and implementing basic financial principles is crucial for any small business to not only survive but thrive in today's competitive market.

Understanding Your Cash Flow

Cash flow is the lifeblood of any business. It represents the movement of money in and out of your business. Positive cash flow means you have more money coming in than going out, while negative cash flow indicates the opposite.

To manage cash flow effectively, start by creating a cash flow forecast. This involves projecting your expected income and expenses over a specific period, usually monthly or quarterly. This can be as simple as a spreadsheet where you list expected revenues and subtract anticipated expenses like rent, utilities, and supplies.

Regularly monitoring your actual cash flow against your forecast allows you to identify potential shortfalls early on and take corrective action. According to the Small Business Administration (SBA), poor cash flow management is a significant reason why many small businesses fail.

Budgeting: Planning for Success

A budget is a financial roadmap that outlines your expected income and expenses for a specific period, typically a year. Creating a budget helps you allocate resources effectively and track your progress towards your financial goals.

Start by analyzing your historical financial data to identify trends and patterns in your income and expenses. Then, set realistic and achievable financial goals for your business.

According to a study by the National Federation of Independent Business (NFIB), businesses with a formal budget are more likely to experience growth and profitability. Regularly compare your actual performance against your budget to identify areas where you're overspending or falling short of your revenue targets.

Bookkeeping Basics

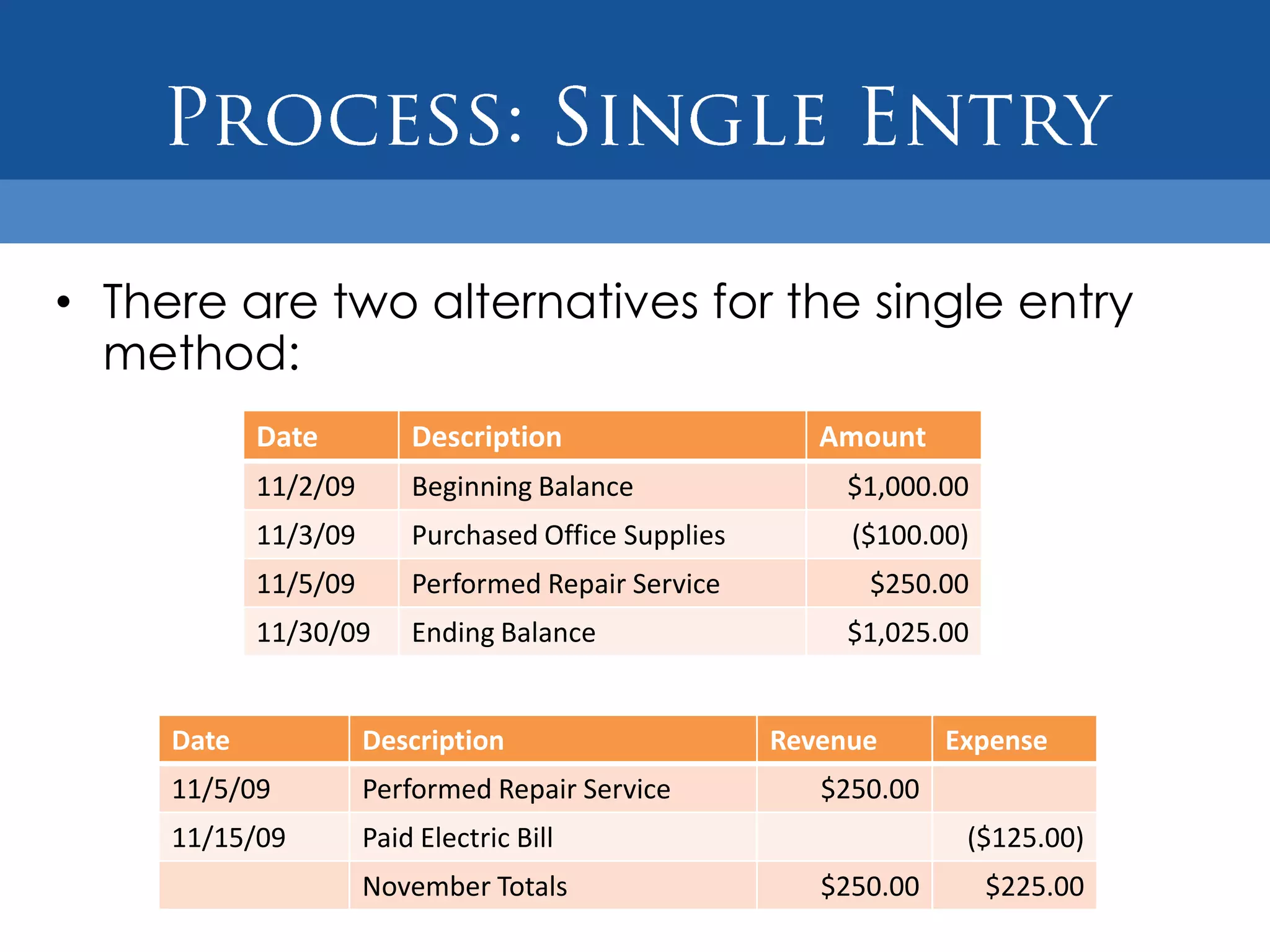

Effective bookkeeping is the foundation of sound financial management. It involves recording all your business transactions accurately and systematically. This includes tracking income, expenses, assets, and liabilities.

You can choose to handle your bookkeeping manually, using spreadsheets or accounting software. Popular options include QuickBooks, Xero, and FreshBooks. These tools automate many bookkeeping tasks, making it easier to track your finances and generate financial reports.

Consider hiring a bookkeeper or accountant, especially if you're unfamiliar with accounting principles or overwhelmed by the task. A professional can ensure your books are accurate and compliant with tax regulations.

Managing Debt Wisely

Debt can be a valuable tool for funding growth and expansion, but it's crucial to manage it wisely. Before taking on debt, carefully evaluate your ability to repay it. Consider the interest rates, repayment terms, and any associated fees.

According to the U.S. Chamber of Commerce, many small businesses struggle with debt because they don't adequately plan for repayment. Avoid taking on more debt than you can comfortably afford. Explore alternative financing options, such as grants, angel investors, or crowdfunding.

Focus on building a strong credit score for your business. This will improve your chances of securing favorable loan terms in the future. Make timely payments on all your debts and avoid maxing out your credit cards.

Financial Reporting and Analysis

Financial reports provide valuable insights into your business's financial performance. The most important reports include the income statement (profit and loss statement), the balance sheet, and the cash flow statement.

The income statement shows your revenues, expenses, and net profit or loss over a specific period. The balance sheet provides a snapshot of your assets, liabilities, and equity at a particular point in time. The cash flow statement tracks the movement of cash in and out of your business.

Regularly analyzing these reports can help you identify trends, assess profitability, and make informed business decisions. Look for key performance indicators (KPIs) that are relevant to your business, such as gross profit margin, net profit margin, and return on investment (ROI).

Looking Ahead

Mastering basic financial management is an ongoing process. It requires dedication, discipline, and a willingness to learn. By implementing the tips outlined in this article, small business owners can gain control of their finances, improve their profitability, and build a sustainable future for their business.

Back in her bakery, Sarah started implementing these strategies. She created a cash flow forecast, started tracking her expenses meticulously, and even consulted with a local accountant. The scent of sourdough still fills "Sarah's Sweet Surrender," but now it's accompanied by the sweet taste of financial confidence. And that's a recipe for lasting success.