Bath And Body Works Net Worth

Bath & Body Works' financial footing is under scrutiny as market conditions shift and consumer spending habits evolve, demanding a closer look at the company's current net worth. Recent performance indicators suggest a fluctuating valuation, sparking concerns and interest among investors and industry analysts alike.

This article provides an updated analysis of Bath & Body Works' net worth, examining contributing factors, recent financial performance, and future projections.

Bath & Body Works: A Snapshot of Net Worth

Estimating the precise net worth of a publicly traded company like Bath & Body Works (BBWI) requires evaluating assets and liabilities detailed in financial statements. As of the latest reports, various financial analysis sites offer differing figures, impacted by real-time stock performance.

It's essential to note that net worth, in this context, is often used interchangeably with market capitalization - calculated by multiplying the company's outstanding shares by the current share price. Market capitalization is a dynamic figure, fluctuating constantly with market activity.

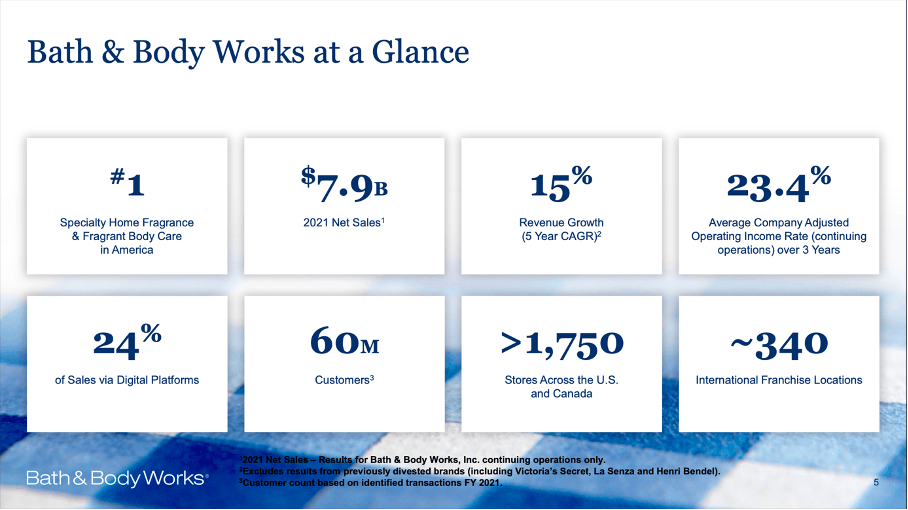

Recent analysis indicates a market capitalization range fluctuating around $8 billion USD as of late 2024, but this figure is subject to constant change.

Key Factors Influencing Net Worth

Several factors significantly impact BBWI's net worth, primarily focusing on sales performance and shifts in consumer spending.

Sales Trends

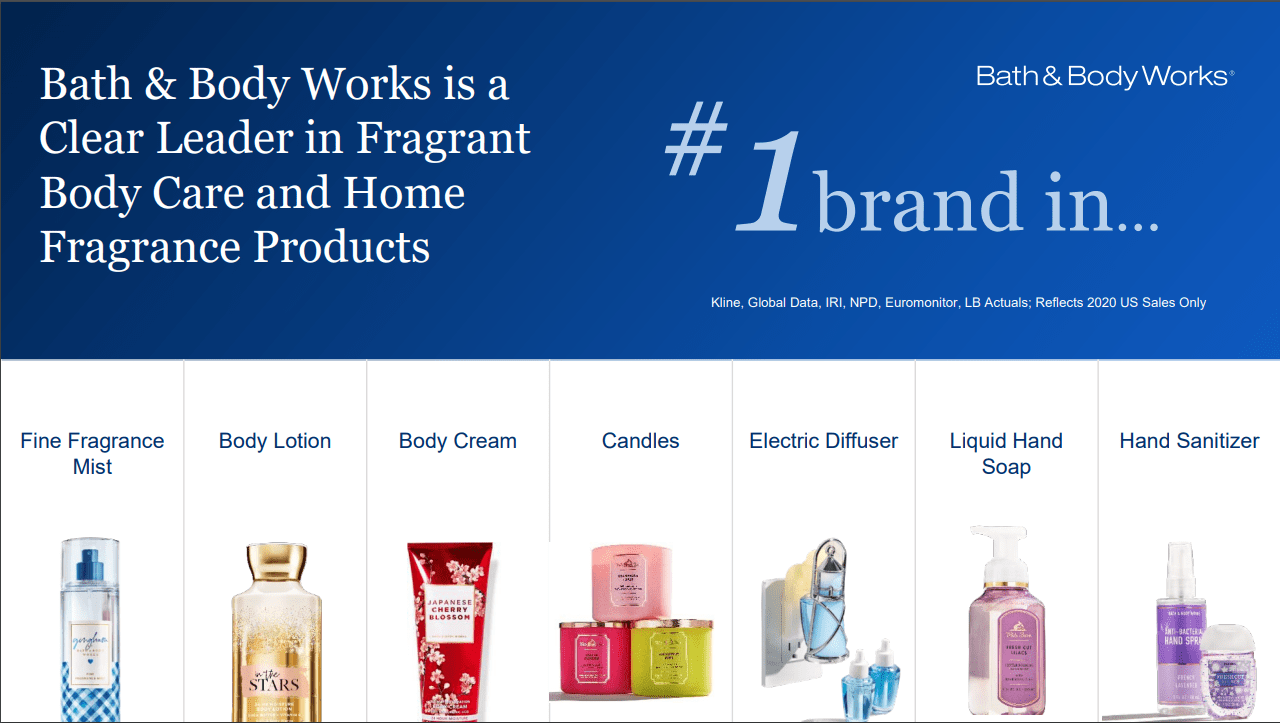

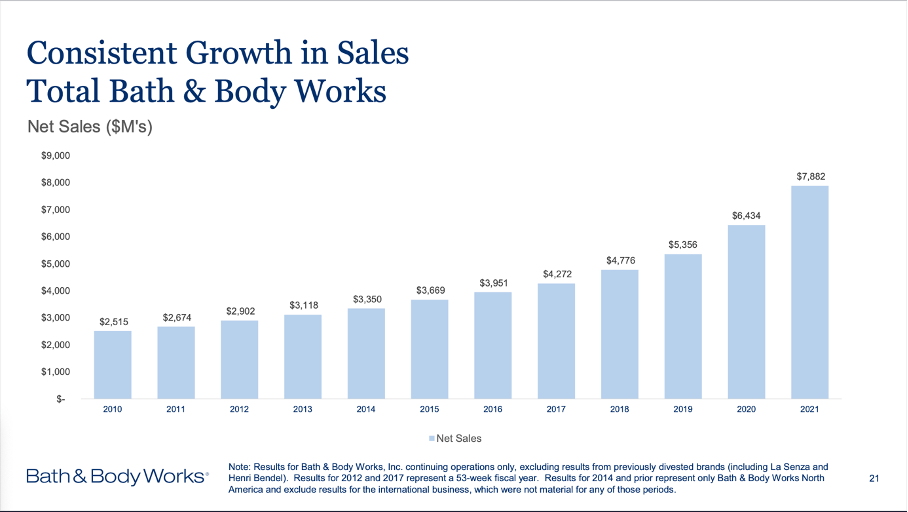

Bath & Body Works relies heavily on seasonal sales and promotional events. Declining or inconsistent sales directly affect revenue and ultimately, investor confidence, impacting stock price and market cap.

Increased competition from online retailers and other fragrance and personal care brands places added pressure on maintaining sales volume.

Consumer Spending Habits

Changes in disposable income and consumer confidence play a significant role. When economic uncertainty rises, discretionary spending often decreases, impacting sales of non-essential items like fragrances and lotions.

Bath & Body Works must adapt to evolving consumer preferences and digital shopping trends to maintain market share.

Supply Chain Dynamics

Global supply chain disruptions, including rising raw material costs and shipping delays, can impact profitability. Increased costs can lower profit margins, affecting the company's financial performance and investor sentiment.

Recent Financial Performance

Bath & Body Works' recent financial performance has shown mixed results. While the company has undertaken initiatives to streamline operations and enhance the customer experience, challenges remain.

Recent earnings reports reveal fluctuations in revenue and profitability, reflecting the competitive landscape and changing consumer behavior. The brand has also faced difficulties maintaining price points amid rising costs.

Cost-cutting measures and store optimization efforts are underway to improve overall financial health.

Future Projections

Future projections for Bath & Body Works' net worth hinge on several factors, including successful execution of strategic initiatives and macroeconomic trends.

Analysts' expectations vary. Some anticipate moderate growth driven by e-commerce expansion and targeted marketing campaigns.

Others express concern about potential headwinds, including increased competition, inflationary pressures, and potential shifts in consumer preferences.

Analyst Perspectives

Financial analysts offer diverse opinions on BBWI's future performance.

"The company's ability to innovate with new products and effectively manage costs will be crucial for sustained growth," notes a recent report from a leading financial firm.

Another analyst highlights the importance of Bath & Body Works adapting to changing consumer preferences and enhancing its digital presence.

Ongoing Developments and Next Steps

Bath & Body Works is actively pursuing various initiatives to strengthen its financial position. This includes expanding its online presence, streamlining its supply chain, and introducing new product lines.

Investors and industry observers will closely monitor the company's performance in upcoming quarters to gauge the effectiveness of these strategies.

Key areas to watch include sales figures, profit margins, and the company's ability to adapt to changing market conditions. Further updates will be provided as new information becomes available.