Beginning Inventory Plus Net Purchases Is

The seemingly simple formula of Beginning Inventory plus Net Purchases has become a flashpoint in ongoing debates about inventory valuation and cost of goods sold (COGS) calculations. Businesses across industries are grappling with the implications of its proper application and interpretation. This formula, at the heart of understanding a company's operational efficiency and profitability, is now under increased scrutiny.

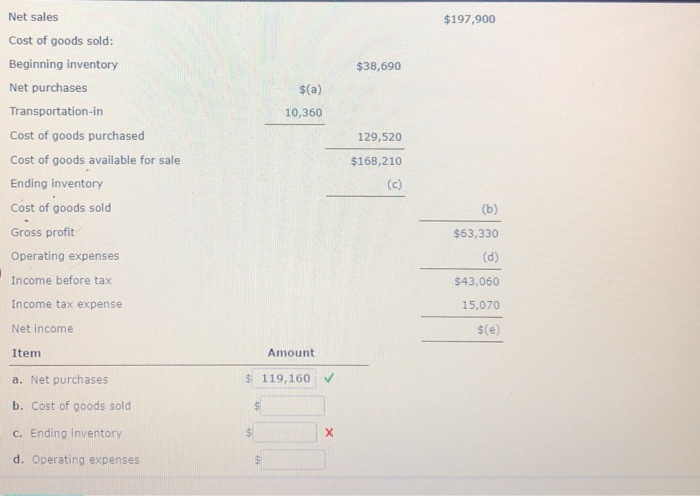

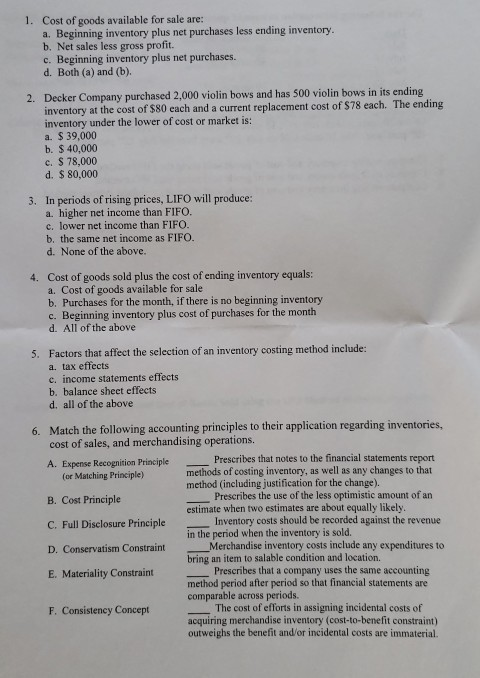

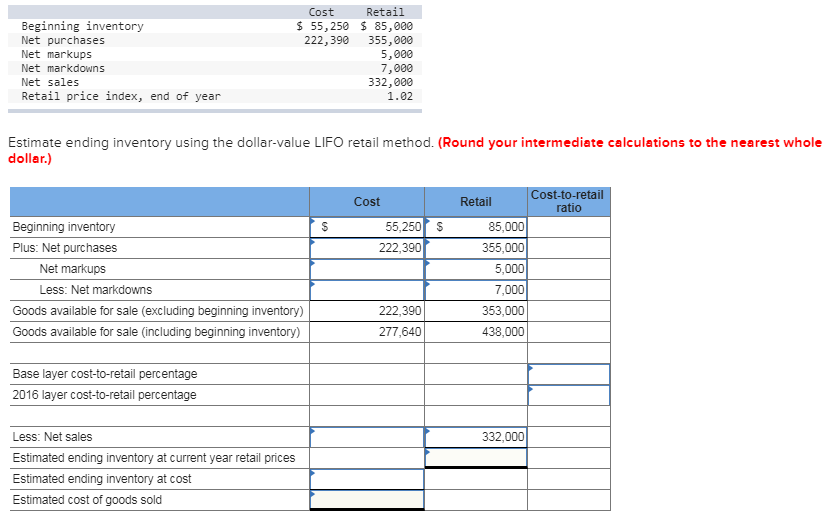

At its core, the formula *Beginning Inventory + Net Purchases* represents the total value of goods available for sale during a specific period. It acts as a critical component in determining the *Cost of Goods Sold (COGS)*. Understanding this formula is crucial for accurately reflecting a company's financial health, influencing everything from tax liabilities to investor confidence.

Understanding the Formula's Components

Beginning Inventory refers to the value of goods a company has in stock at the start of an accounting period. It directly reflects the ending inventory of the previous period.

Net Purchases encompass all goods bought for resale during the period, adjusted for purchase returns, allowances, and discounts. This is not simply the amount spent on new inventory, but rather, the actual value of what was added to stock.

The Calculation and Its Implications

The sum of these two components determines the total goods available for sale. From this total, we subtract ending inventory to arrive at the Cost of Goods Sold (COGS). COGS is a key figure deducted from revenue to calculate gross profit, a critical metric for profitability.

The Importance of Accurate Valuation

The accuracy of both beginning inventory and net purchases is paramount. Any errors in these figures cascade through the financial statements, impacting COGS, gross profit, net income, and ultimately, shareholder equity.

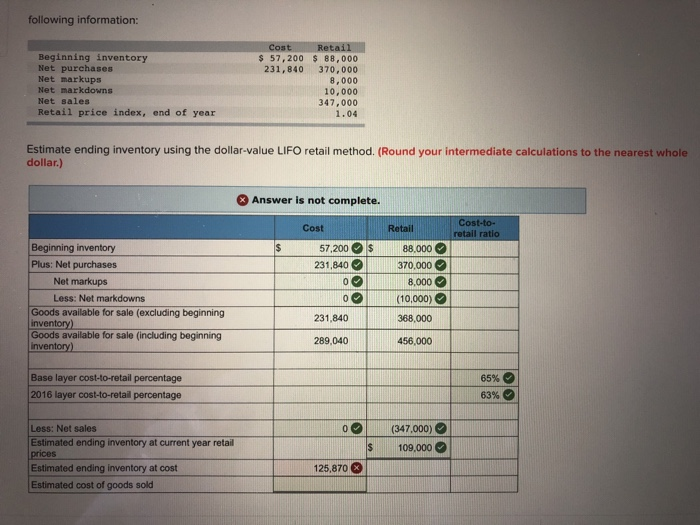

Different inventory valuation methods, such as FIFO (First-In, First-Out) and weighted-average cost, can significantly impact the values assigned to both beginning and ending inventory. Selecting the most appropriate method for a particular business is crucial for reflecting true costs.

Common Challenges in Calculation

Tracking purchase returns and allowances accurately can be challenging, especially for businesses with high transaction volumes. Implementing robust accounting systems and processes is essential for mitigating errors.

Inventory shrinkage, encompassing loss due to theft, damage, or obsolescence, also poses a significant problem. Periodic physical inventory counts are essential to identify and account for shrinkage.

Perspectives on Inventory Management

From a managerial accounting perspective, understanding this formula allows for better inventory management. By closely monitoring net purchases in relation to sales, businesses can optimize stock levels and reduce holding costs.

Financial analysts view this formula as an indicator of a company's operational efficiency. High COGS relative to revenue may signal inefficiencies in supply chain management or inventory control.

"Understanding the interplay between beginning inventory and net purchases is not just an accounting exercise, it's a critical element of sound business strategy," says Dr. Anya Sharma, Professor of Accounting at the University of Metropolitan Business School.

Real-World Examples

For a retail business, accurately tracking purchase returns is vital. If returns are not properly accounted for, net purchases will be overstated, leading to an inflated COGS and understated gross profit.

In the manufacturing sector, direct materials, direct labor, and manufacturing overhead are crucial elements that impact the valuation of net purchases. Efficient supply chain management is critical for accurately determining the purchase price of raw materials.

Impact on Financial Statements

An overstatement of beginning inventory results in a lower COGS and a higher gross profit. Conversely, an understatement of beginning inventory leads to a higher COGS and a lower gross profit.

Similarly, errors in calculating net purchases directly affect COGS. An inaccurate COGS figure distorts the entire income statement and potentially impacts key financial ratios used by investors.

The Role of Technology

Modern accounting software plays a crucial role in accurately tracking inventory and calculating net purchases. These systems automate many of the manual processes, reducing the risk of human error.

Real-time inventory tracking and data analytics further enhance a company's ability to manage inventory levels and optimize purchasing decisions. This leads to better inventory turnover and improved profitability.

Future Trends in Inventory Management

Advanced technologies like AI and machine learning are being increasingly used to forecast demand and optimize inventory levels. These technologies can help businesses make more informed purchasing decisions and reduce the risk of stockouts or excess inventory.

The adoption of blockchain technology is also gaining traction in supply chain management. Blockchain can improve transparency and traceability, allowing businesses to accurately track the movement of goods from origin to sale.

Conclusion: A Foundation for Financial Health

The simple formula of Beginning Inventory plus Net Purchases holds significant weight in a company's financial reporting and operational efficiency. By understanding its components, potential challenges, and the impact of technology, businesses can ensure accurate inventory valuation and drive profitability. Proper management of these elements is vital for long-term financial health and sustainable growth in an increasingly competitive marketplace.