Best Auto Insurance For First Time Buyers

For first-time car buyers, the excitement of owning a vehicle can quickly be tempered by the often-confusing world of auto insurance. Navigating policy options, understanding coverage levels, and finding affordable rates can feel overwhelming, leaving many new drivers unsure where to start.

This article aims to demystify the process by outlining key considerations and highlighting some of the top auto insurance providers for first-time buyers, based on factors like affordability, coverage options, customer service, and ease of use. We'll explore how to make informed decisions and secure the best possible insurance coverage without breaking the bank.

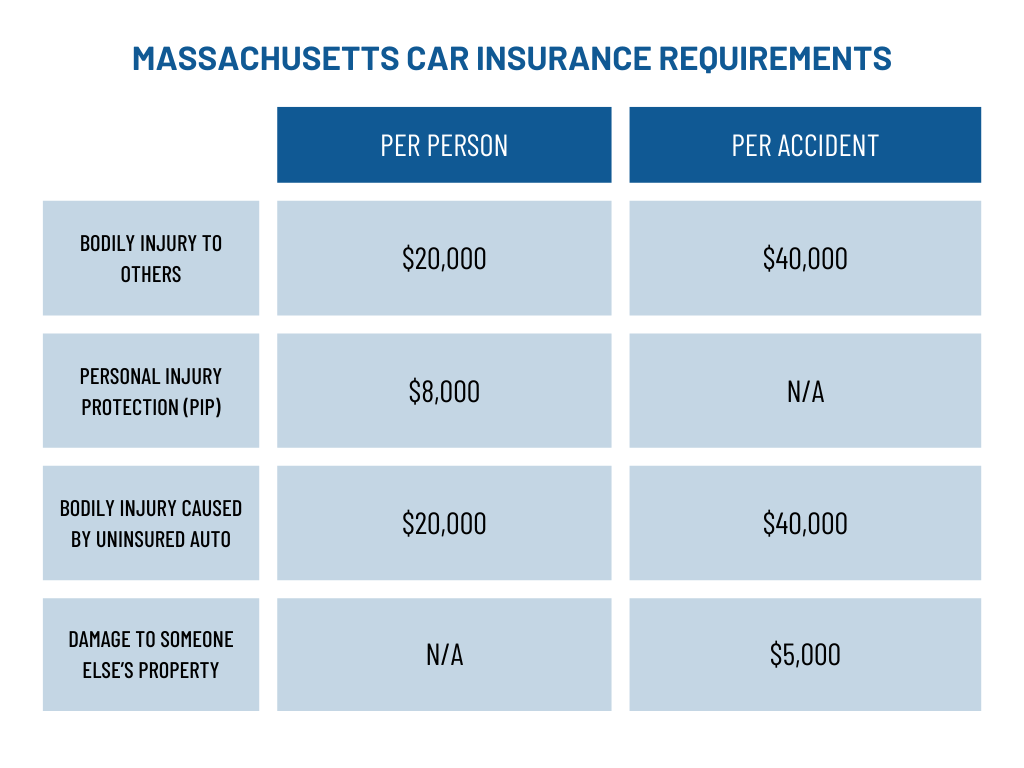

Choosing the right auto insurance is crucial, not only because it's legally required in most states, but also because it provides financial protection in case of accidents, theft, or other unforeseen events. The specific needs of a first-time buyer, such as limited driving experience or budget constraints, should significantly influence their choice of insurer.

Understanding Your Needs

Before diving into specific insurance companies, it’s essential to understand the different types of coverage available and which ones are most important for a new driver. Liability coverage is a must, as it covers damages and injuries you may cause to others in an accident.

Collision coverage pays for damage to your vehicle resulting from a collision, regardless of who is at fault. Comprehensive coverage, on the other hand, protects against non-collision events like theft, vandalism, or natural disasters.

Consider your budget and the value of your vehicle when deciding on coverage levels. A higher deductible will result in lower premiums, but you’ll need to pay more out of pocket in the event of a claim.

Top Insurance Providers for First-Time Buyers

Several insurance companies stand out for offering competitive rates and tailored solutions for new drivers. State Farm is frequently cited for its strong customer service and wide range of coverage options.

GEICO is another popular choice, known for its aggressive pricing and user-friendly online platform. The company often offers discounts for students and those with good grades.

Progressive is also worth considering, particularly for its Snapshot program, which allows drivers to potentially lower their rates based on their driving habits monitored through a mobile app. These usage-based programs can be particularly beneficial for safe, new drivers.

Factors Considered in Our Recommendations

The recommendations above are based on a combination of factors, including average premium costs for young drivers, customer satisfaction ratings (as measured by organizations like J.D. Power), and the availability of discounts for new drivers.

The ease of filing a claim and the overall user experience are also important considerations. Companies with well-designed websites and mobile apps can simplify the insurance process for first-time buyers.

It is also crucial to review the policy exclusions and limitations. A seemingly cheap policy might not cover the situations you need it to.

Tips for Saving Money on Auto Insurance

First-time buyers can take several steps to lower their auto insurance premiums. One of the most effective is to shop around and compare quotes from multiple insurers.

Taking a defensive driving course can often lead to discounts, as it demonstrates a commitment to safe driving habits. Maintaining a good driving record is also crucial for keeping rates low in the long run.

Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often result in significant savings. Explore the potential discounts offered by insurers.

The Importance of Understanding Policy Details

It's crucial to read and understand the fine print of any insurance policy before signing up. Pay close attention to the coverage limits, deductibles, and exclusions.

Make sure you understand what is and isn't covered by your policy. If you have any questions, don't hesitate to contact the insurance company and ask for clarification.

Ignorance is not bliss when it comes to insurance. You need to know your protection coverage and limitations.

Conclusion

Choosing the right auto insurance as a first-time buyer can be a daunting task, but by understanding your needs, comparing quotes, and taking advantage of available discounts, you can find affordable and comprehensive coverage. State Farm, GEICO, and Progressive are all strong contenders, but it's essential to do your research and choose the provider that best fits your individual circumstances.

Remember, the cheapest policy isn't always the best. Consider the level of coverage, customer service, and claims handling process before making a final decision.

Investing time upfront to find the right auto insurance can provide peace of mind and protect you financially on the road. Drive safe!

![Best Auto Insurance For First Time Buyers How To Get Car Insurance For First Timers [2023]](https://www.mountshine.com/wp-content/uploads/2022/11/Car-Insurance-For-First-Time-Buyers-768x549.jpg)