Best Brokerage Firms For Index Funds

Imagine a tranquil lake, its surface mirroring the vast sky above. Now, picture your investment portfolio as a boat gently sailing on that lake, steadily growing over time. Index funds can be that reliable vessel, offering a simple yet powerful way to participate in the market's overall growth.

For investors seeking straightforward, low-cost strategies, choosing the right brokerage to access index funds is paramount. This article delves into the top brokerage firms for index fund investing, highlighting their strengths and helping you navigate the options available to build a well-diversified portfolio.

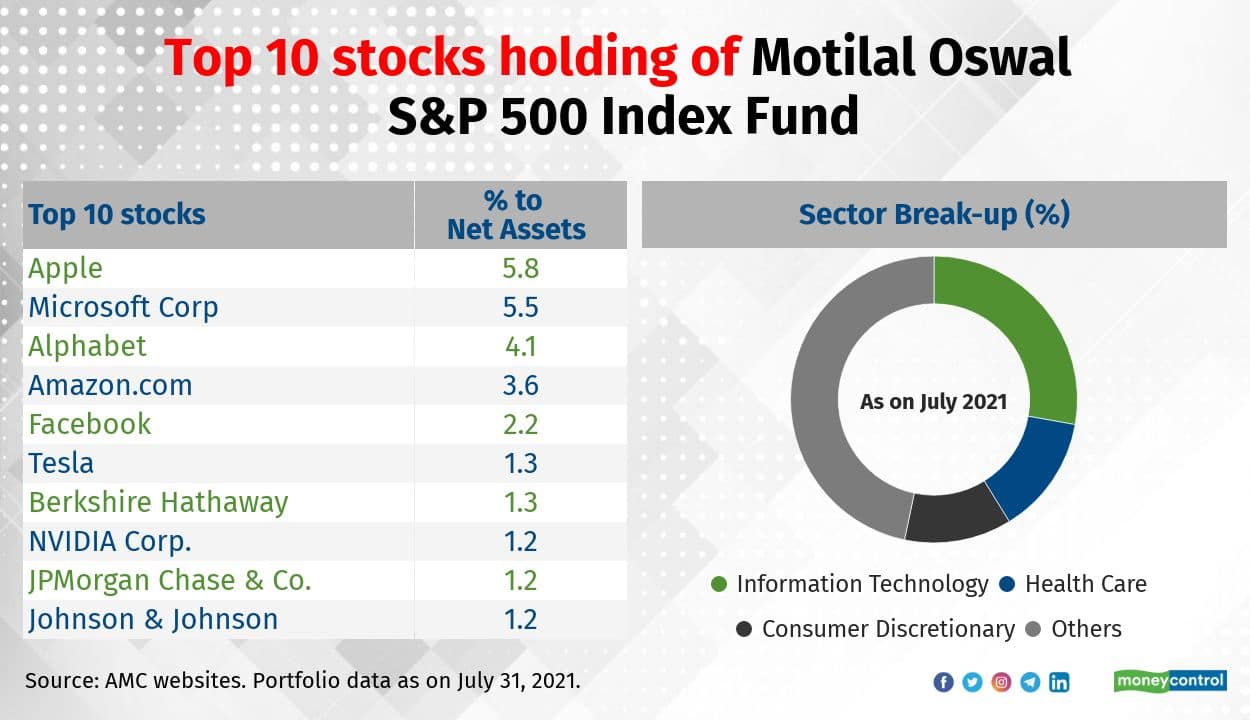

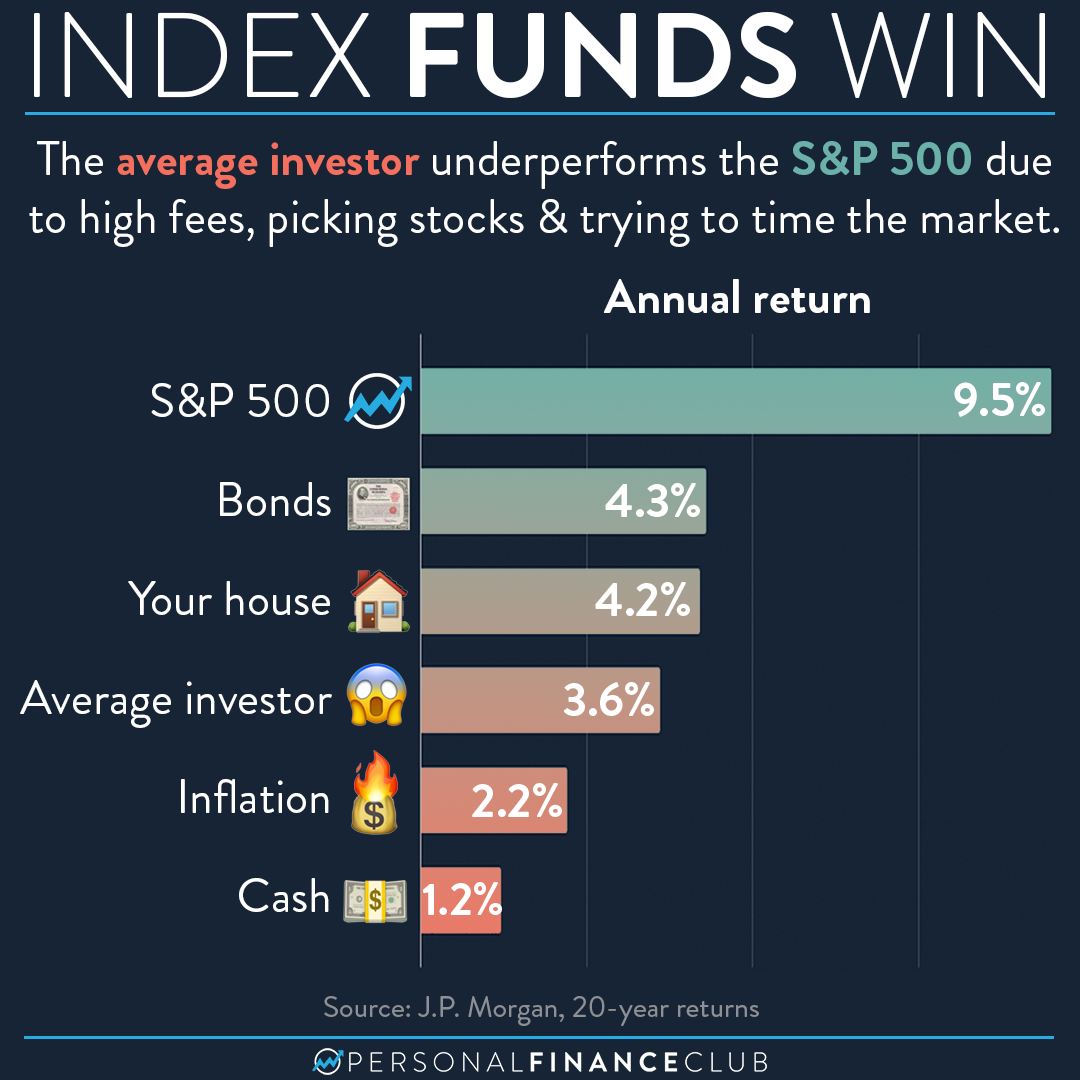

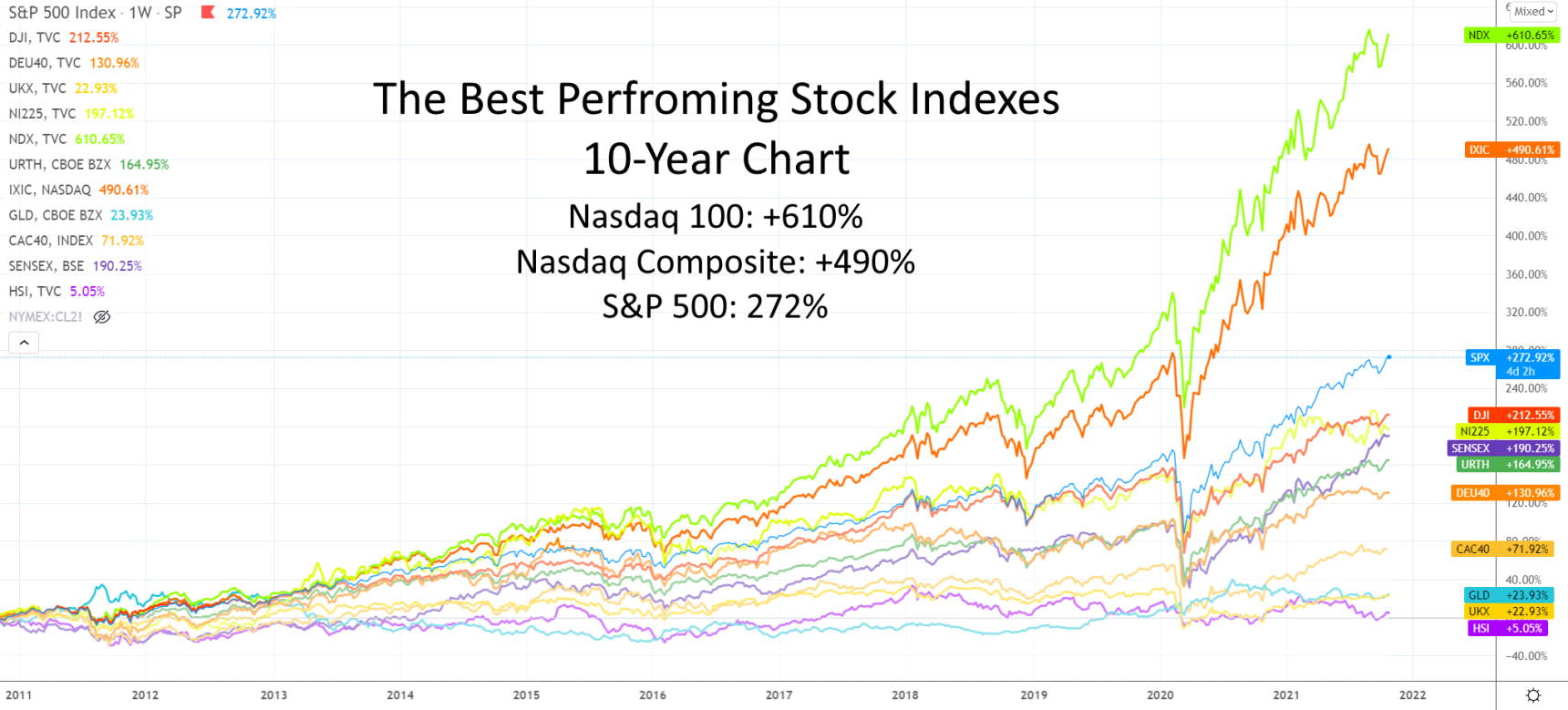

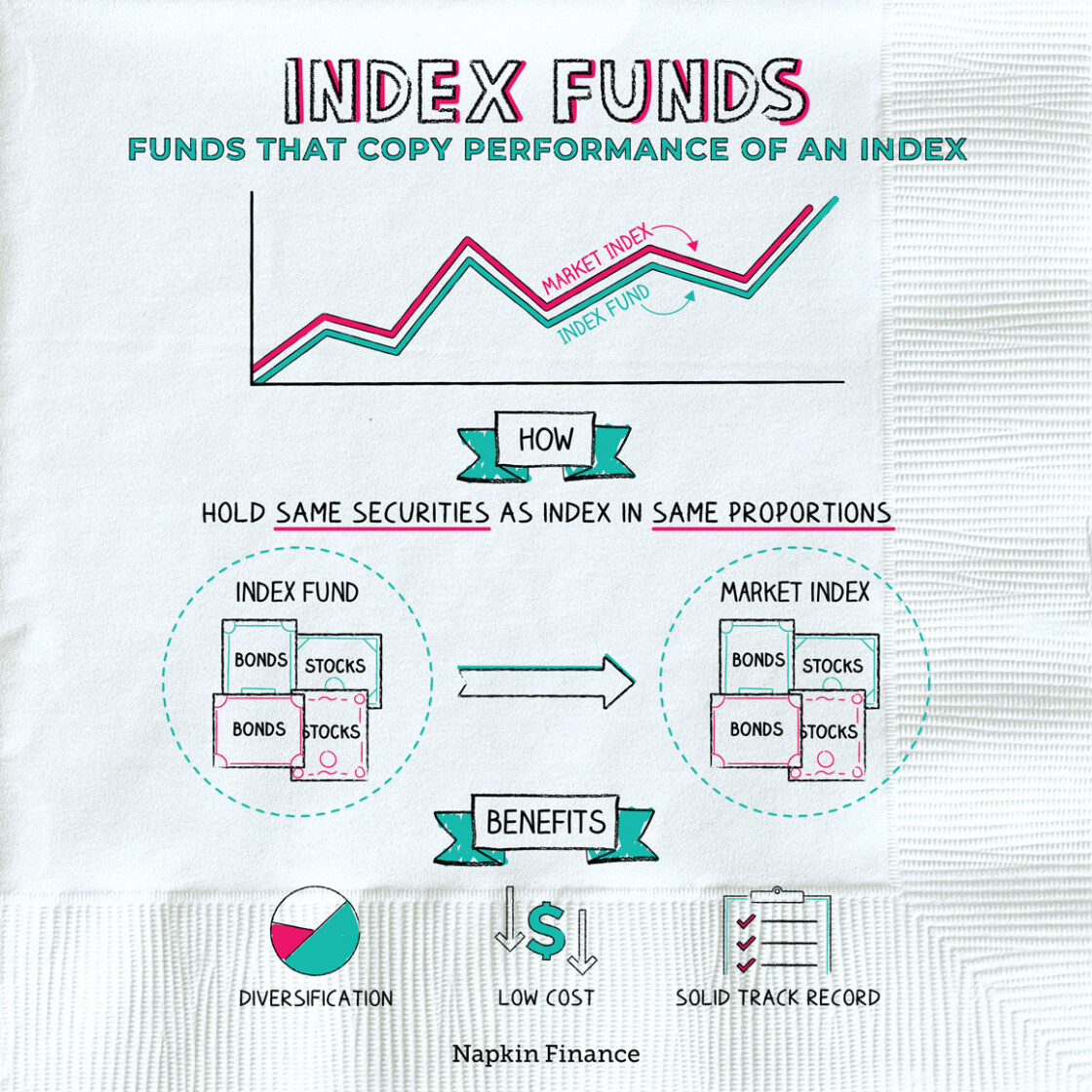

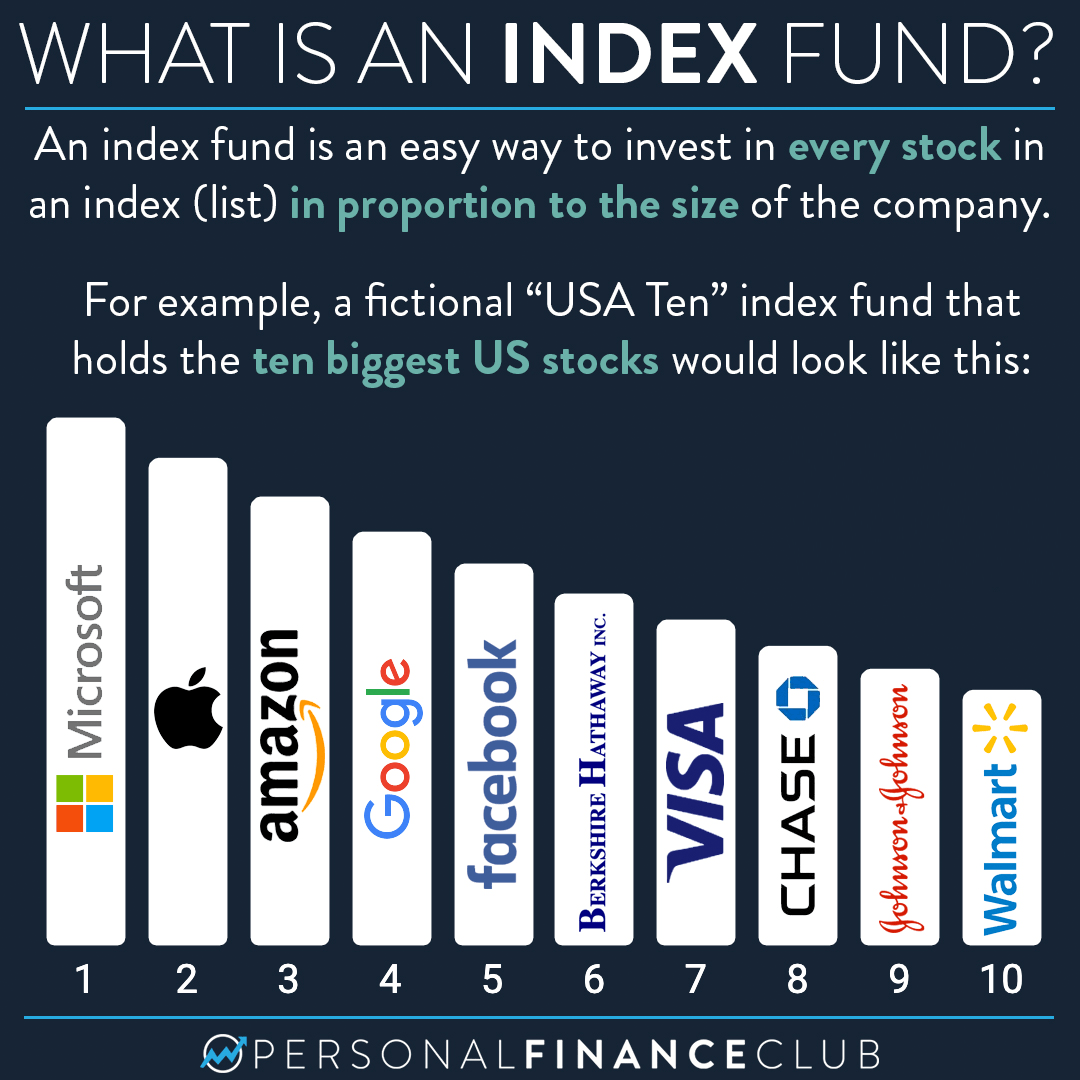

Index funds have surged in popularity, and for good reason. Unlike actively managed funds, which rely on fund managers to pick individual stocks, index funds aim to replicate the performance of a specific market index, such as the S&P 500.

This passive approach typically translates to lower expense ratios, meaning more of your investment dollars stay invested. According to a 2023 report by the Investment Company Institute (ICI), index funds have seen significant inflows over the past decade, reflecting investors' increasing preference for cost-effective, broad-market exposure.

Key Considerations When Choosing a Brokerage

Selecting a brokerage involves evaluating several factors. Expense ratios are crucial. The lower the expense ratio, the better the long-term returns.

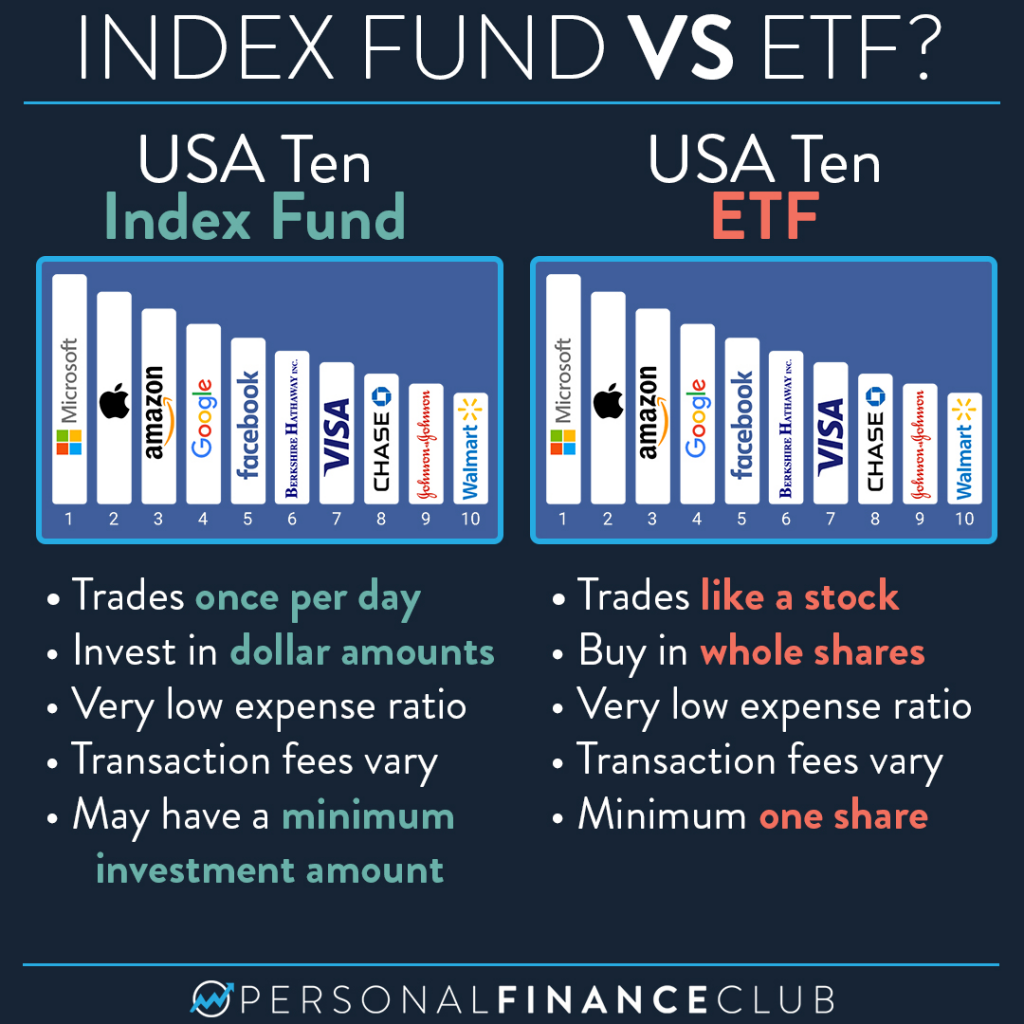

Commission-free trading has become the norm, but check for any hidden fees. Account minimums can be another consideration. Some brokerages require a minimum investment to open an account or access certain funds.

The range of index funds offered is another important factor. A good brokerage should offer a diverse selection of index funds covering various market segments. Consider also the brokerage's platform, including its user-friendliness and the availability of research tools.

Top Brokerage Firms for Index Funds

Vanguard is often lauded as a top choice for index fund investors. Known for its investor-owned structure, Vanguard prioritizes keeping costs low. They offer a wide range of Vanguard-branded index funds with some of the lowest expense ratios in the industry.

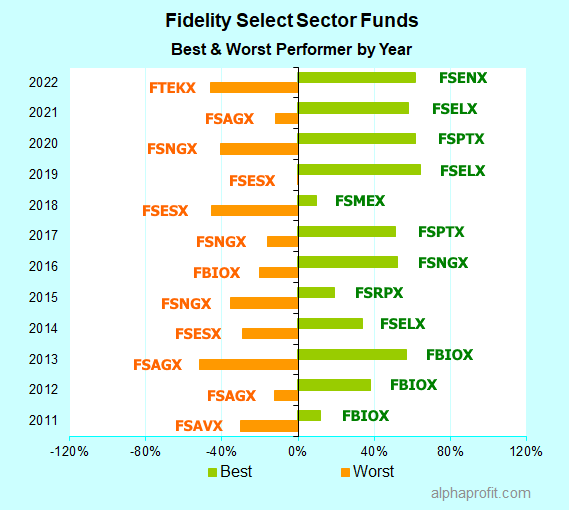

Fidelity is another strong contender, offering a vast selection of index funds, including its own zero-fee options. Fidelity also provides robust research tools and a user-friendly platform, making it appealing to both beginners and experienced investors.

Charles Schwab is a well-established brokerage with a solid reputation. They provide a comprehensive suite of investment services, including a variety of index funds and ETFs, alongside excellent customer service and educational resources. Many investors appreciate Schwab's broad offering.

Interactive Brokers might appeal to more active traders, providing access to a wide range of markets and investment products, including index funds. Though more complex, it offers competitive pricing and advanced trading tools.

Each brokerage has its strengths, so carefully consider your investment goals, risk tolerance, and preferred platform features. Do your homework and compare your options.

Building a Diversified Portfolio with Index Funds

Index funds are a powerful tool for building a well-diversified portfolio. Diversification is key to managing risk and achieving long-term investment goals.

Consider allocating your investments across different asset classes, such as stocks, bonds, and real estate. Within each asset class, further diversification can be achieved through various index funds tracking different market segments.

For example, you might invest in an S&P 500 index fund for broad U.S. equity exposure. Supplement this with a small-cap index fund, an international index fund, and a bond index fund for a well-rounded portfolio.

Remember to periodically review and rebalance your portfolio to maintain your desired asset allocation. This ensures that your portfolio remains aligned with your long-term investment goals.

Investing in index funds is not a get-rich-quick scheme, but rather a long-term strategy for wealth accumulation. By choosing the right brokerage and building a diversified portfolio, you can set yourself on a path toward financial security.

As you embark on your investment journey, remember that consistency and patience are key. Like a boat steadily sailing across the lake, your investment portfolio can grow over time, bringing you closer to your financial aspirations.