Fidelity Investments Roth Ira Reviews

Choosing the right Roth IRA is a pivotal financial decision that can significantly impact one's retirement savings. Fidelity Investments, a major player in the financial services industry, offers a Roth IRA that garners considerable attention.

But sifting through the marketing jargon and understanding the real-world performance and user experience is crucial for prospective investors.

Fidelity Roth IRA: A Deep Dive

The core question potential investors grapple with is whether the Fidelity Roth IRA lives up to its reputation. This article will dissect the offering, examining its features, fees, investment options, and customer reviews to provide a comprehensive and balanced assessment.

We'll explore the perspectives of financial experts, independent analysts, and everyday users to equip readers with the knowledge needed to make an informed decision about their retirement savings strategy.

Key Features and Benefits

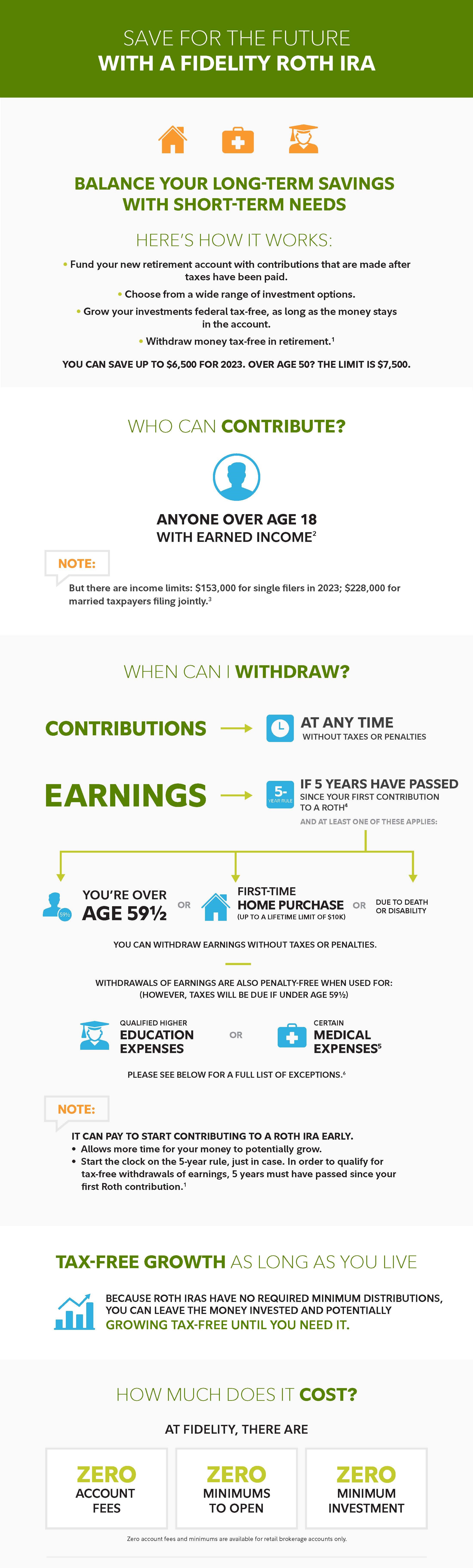

One of Fidelity's primary selling points is its broad selection of investment options. Investors can choose from a wide array of stocks, bonds, mutual funds, and exchange-traded funds (ETFs), including many with zero expense ratios.

This allows for a highly diversified portfolio tailored to individual risk tolerance and financial goals. Fidelity also provides access to fractional shares, enabling investors to purchase portions of expensive stocks without needing to buy a full share.

This lowers the barrier to entry for new investors with limited capital.

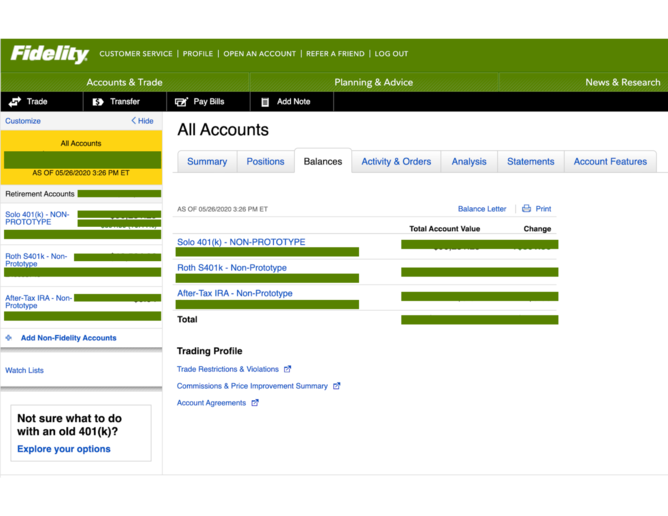

Fee Structure and Account Minimums

Fidelity's Roth IRA stands out for its low-cost structure. There are no account maintenance fees, and many of Fidelity's own index funds boast expense ratios of 0%.

The absence of account minimums is also a significant advantage, making it accessible to investors of all income levels. This makes it an attractive option for those just starting their retirement savings journey.

However, it's important to note that some third-party funds available through Fidelity may have their own expense ratios, so careful due diligence is essential.

User Reviews and Customer Service

Customer reviews of Fidelity's Roth IRA are generally positive, with users praising the platform's ease of use and the quality of its research tools. Many appreciate the intuitive interface and the availability of educational resources that help them make informed investment decisions.

However, some users have reported occasional difficulties with customer service, particularly during peak hours. These complaints typically revolve around longer wait times or perceived inconsistencies in the information provided by representatives.

Despite these isolated incidents, Fidelity consistently receives high ratings for its overall customer service experience, a testament to its commitment to supporting its clients.

Expert Opinions and Industry Analysis

Financial experts often highlight Fidelity's strong reputation and long track record as key advantages. Independent analysts consistently rank Fidelity among the top Roth IRA providers, citing its comprehensive investment options and competitive fees.

Many experts recommend Fidelity for both novice and experienced investors seeking a reliable and low-cost retirement savings solution. They also point to Fidelity's robust security measures as a crucial benefit in protecting investors' assets.

Furthermore, its commitment to innovation, such as the integration of fractional shares, further solidifies its position as a leading player in the retirement savings market.

Potential Drawbacks

While Fidelity's Roth IRA offers many benefits, it's not without potential drawbacks. Some investors may find the sheer volume of investment options overwhelming, especially if they lack experience in navigating the financial markets.

While Fidelity offers a wealth of educational resources, some users may prefer a more personalized approach to investment guidance. The platform might not be the best fit for those seeking a highly customized investment strategy tailored to their unique circumstances.

Individuals who prioritize hands-on advice from a financial advisor might want to explore other options that offer more personalized support.

The Verdict

Overall, the Fidelity Roth IRA is a strong contender for individuals seeking a low-cost and flexible retirement savings solution. Its wide range of investment options, zero-fee index funds, and lack of account minimums make it accessible and attractive to a broad range of investors.

While some users have reported occasional issues with customer service, the platform generally receives high marks for its ease of use and educational resources.

Looking Ahead

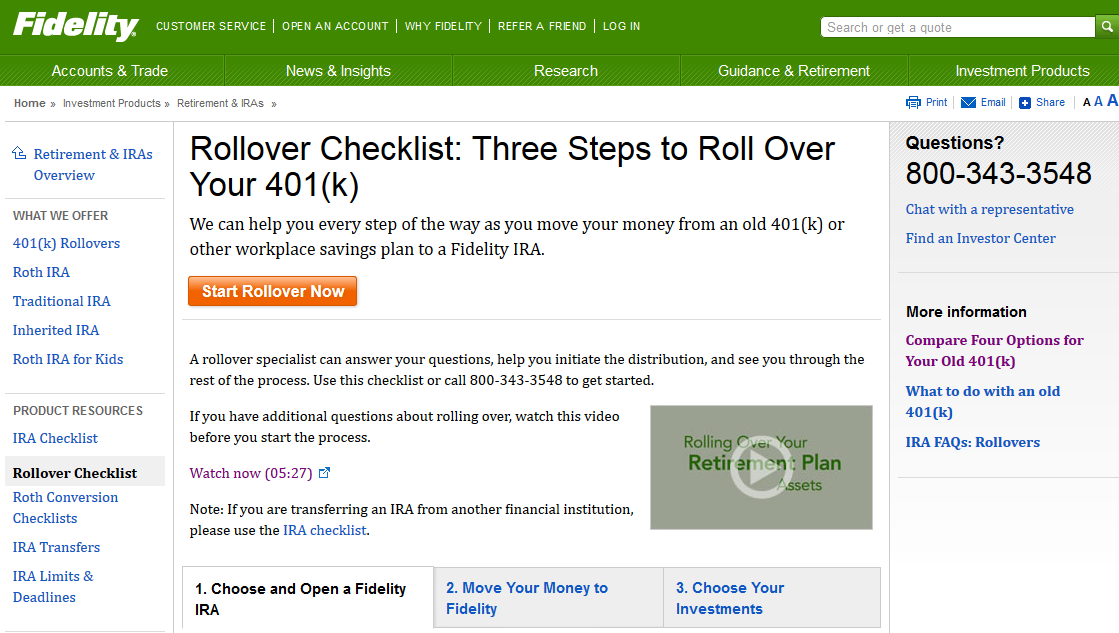

The landscape of retirement savings is constantly evolving, and Fidelity will need to continue innovating to maintain its competitive edge. One area to watch is the growing popularity of automated investing platforms, or robo-advisors.

Fidelity already offers its own robo-advisor service, Fidelity Go, which could attract investors seeking a more hands-off approach to portfolio management. The company's ability to adapt to changing investor preferences and technological advancements will be crucial to its continued success in the Roth IRA market.

Ultimately, the decision of whether to invest in a Fidelity Roth IRA depends on individual circumstances and financial goals. However, based on its features, fees, and user reviews, it remains a compelling option for those seeking a secure and cost-effective way to build their retirement savings.

![Fidelity Investments Roth Ira Reviews Backdoor Roth IRA Fidelity Tutorial [With Screenshots] | White Coat](https://i.pinimg.com/originals/d6/17/81/d61781f098a553f3c70d5c14a9936abc.png)