Best Buy Credit Limit Increase Hard Or Soft Pull

The question of whether a Best Buy credit limit increase results in a hard or soft credit inquiry has become a source of considerable anxiety for consumers. Understanding the impact on credit scores is paramount, especially in today's economy where credit health is intrinsically linked to financial well-being.

This article dives deep into the complexities surrounding Best Buy credit limit increases and their potential effects on your credit report. We aim to clarify the procedures involved, differentiate between hard and soft credit pulls, and provide insights for consumers seeking to improve their credit standing without jeopardizing their scores.

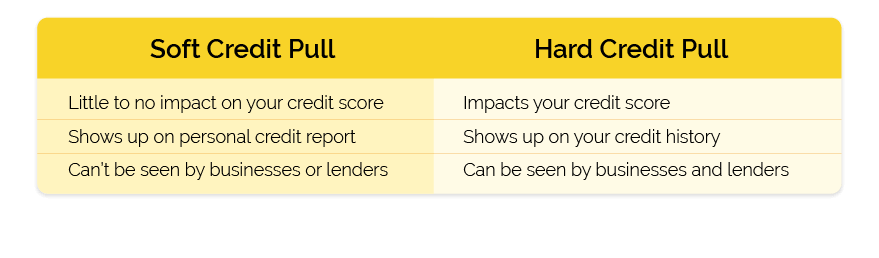

Understanding Hard vs. Soft Credit Inquiries

A hard credit inquiry occurs when a lender reviews your credit report to make a lending decision. This type of inquiry can slightly lower your credit score, particularly if you have several hard inquiries within a short period. Applying for a new credit card, a loan, or a mortgage typically triggers a hard pull.

On the other hand, a soft credit inquiry, also known as a soft pull, happens when you check your own credit report or when a lender does a background check for pre-approved offers. Soft inquiries do not affect your credit score and are often used for informational purposes.

Best Buy Credit Limit Increases: The Credit Pull Controversy

The crucial question is: does requesting a credit limit increase from Best Buy result in a hard or soft pull? The answer, unfortunately, isn't always straightforward, and experiences can vary among cardholders.

Historically, anecdotal evidence from online forums and consumer reports suggests that Best Buy, through its credit card issuer Citibank, may conduct a hard pull for credit limit increase requests. This means your credit score could potentially be affected.

Conflicting Reports and Data Points

However, some users have reported receiving credit limit increases from Best Buy without a hard inquiry appearing on their credit report. These instances often occur when the increase is initiated by Citibank rather than requested by the cardholder.

Data points from various credit monitoring websites and forums indicate a mixed bag of experiences. Some individuals report a hard pull even for relatively small increase requests, while others claim to have received substantial increases without any negative impact on their credit score.

This inconsistency underscores the need for caution and thorough understanding before requesting a credit limit increase.

Official Statements and Citibank's Policy

Obtaining official statements from Best Buy or Citibank regarding their credit limit increase policies is challenging. Publicly available information on their websites often lacks specific details about the type of credit inquiry conducted.

Generally, Citibank reserves the right to perform a hard pull when evaluating a credit limit increase request. Their decision likely depends on various factors, including your creditworthiness, payment history, and overall relationship with the bank.

It's advisable to contact Citibank's customer service directly to inquire about their current policy before submitting a request. While a representative might not provide a definitive answer, it can offer some insight into their usual practices.

Factors Influencing the Type of Credit Inquiry

Several factors could influence whether a hard or soft pull is performed for a Best Buy credit limit increase.

Creditworthiness and Payment History

A strong credit score and a history of on-time payments significantly increase the likelihood of a soft pull or approval with a minimal impact on your credit score. Citibank is more likely to view you as a low-risk borrower in such cases.

Request Amount

The amount of the requested credit limit increase could also play a role. Requesting a significant increase might trigger a more thorough review, potentially leading to a hard pull. A smaller, more reasonable request might be processed with a soft pull.

Account Tenure and Spending Habits

Long-term cardholders with consistent spending and payment patterns may be viewed more favorably. Citibank may be more inclined to grant an increase without a hard inquiry if you have a well-established account.

Mitigating the Risk of a Hard Pull

Before requesting a credit limit increase from Best Buy, consider several strategies to mitigate the risk of a hard pull and its potential impact on your credit score.

Check Your Credit Report

Review your credit report for any errors or discrepancies before applying. Addressing any negative marks beforehand can improve your chances of approval and potentially influence the type of inquiry performed.

Consider a Balance Transfer

If your primary goal is to increase your available credit, consider transferring balances from other high-interest cards to your Best Buy card. This approach can free up credit without requiring a credit limit increase.

Time Your Request Carefully

Avoid requesting a credit limit increase around the same time you're applying for other credit products, such as a mortgage or auto loan. Multiple hard inquiries within a short period can negatively impact your credit score.

Ask About the Inquiry Type

While it's not always possible to get a guaranteed answer, ask Citibank customer service representatives about the likelihood of a hard pull before submitting your request. Their response can provide valuable insight.

The Future of Credit Limit Increase Policies

The landscape of credit limit increase policies is constantly evolving, driven by advancements in credit scoring models and changing economic conditions. It's possible that Citibank, like other credit card issuers, may adopt more transparent and predictable practices in the future.

Increased transparency and communication from financial institutions regarding credit inquiry practices would benefit consumers, allowing them to make informed decisions about managing their credit. Continual monitoring of your credit report remains crucial for tracking any changes and maintaining good financial health.

Ultimately, understanding the potential impact of credit limit increase requests is essential for responsible credit management. While the Best Buy credit limit increase policy remains somewhat ambiguous, proactive measures and careful consideration can help you navigate the process without jeopardizing your credit score.

:max_bytes(150000):strip_icc()/pros-cons-increasing-credit-limit-realsimple-GettyImages-1210077033-10a80f5da7a34cd39323d8d78dc55502.jpg)