Best Cash Advance Apps Without Direct Deposit

Imagine this: It's a Thursday evening. Your stomach growls a little louder than usual, a reminder that rent is due tomorrow, and your bank account is looking tragically empty. That unexpected car repair wiped you out, and you're facing the all-too-familiar pre-payday panic. If only you could tap into those wages you've already earned, without having to jump through hoops involving direct deposit.

For millions of Americans living paycheck to paycheck, accessing small amounts of cash quickly can be a lifeline. This article explores the landscape of cash advance apps that don't require direct deposit, offering a practical guide to navigating these services and understanding their benefits and potential drawbacks.

The Rise of Cash Advance Apps

Cash advance apps have exploded in popularity in recent years, offering an alternative to traditional payday loans and overdraft fees. They provide a way to access earned wages before payday, typically with lower fees or interest rates than traditional lending options.

According to a 2023 report by the Financial Health Network, a significant portion of the US population experiences income volatility, making it challenging to manage unexpected expenses. This volatility fuels the demand for short-term financial solutions like cash advance apps.

Why No Direct Deposit Matters

Many people, particularly those with irregular employment or who work in the gig economy, may not have a consistent direct deposit setup. This can be a barrier to accessing traditional cash advance apps that rely on direct deposit verification.

Furthermore, some individuals may prefer not to link their bank account to a third-party app for privacy or security reasons. The availability of apps that don't require direct deposit opens up these services to a wider audience.

Top Cash Advance Apps Without Direct Deposit

While direct deposit is a common requirement, some apps offer alternative verification methods, allowing users to access funds without it.

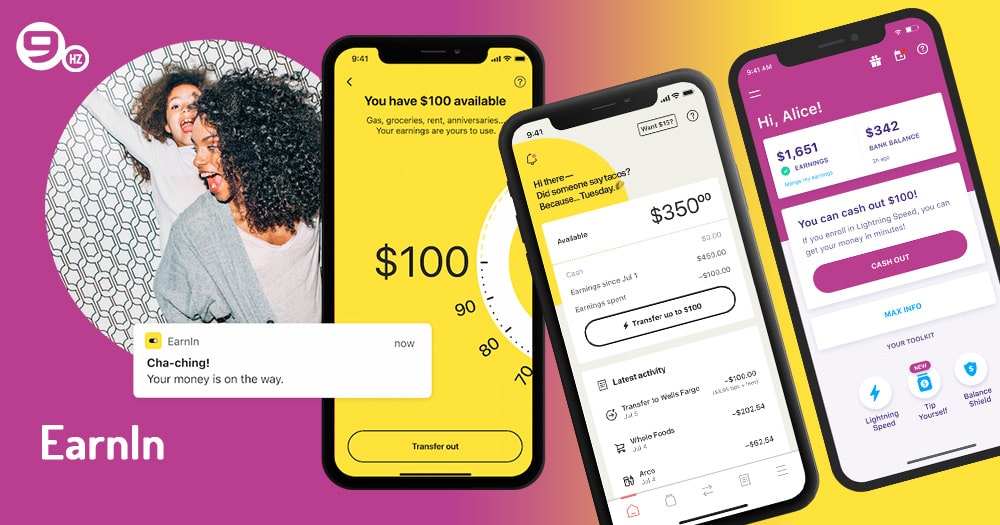

Earnin: A Pioneer in the Field

Earnin was one of the first apps to offer cash advances without requiring mandatory direct deposit. Users verify their employment by submitting timesheets or location data, allowing Earnin to track their working hours.

Instead of charging interest or fees, Earnin operates on a tipping model, where users can voluntarily contribute an amount they deem appropriate. This makes it a potentially more affordable option than some other cash advance services.

Branch: Focused on Hourly Workers

Branch is another app that caters to hourly workers and offers cash advances without direct deposit. Similar to Earnin, Branch verifies employment through timesheets and location data.

They offer features like instant transfers, making it possible to access funds quickly. However, some instant transfers may incur a small fee.

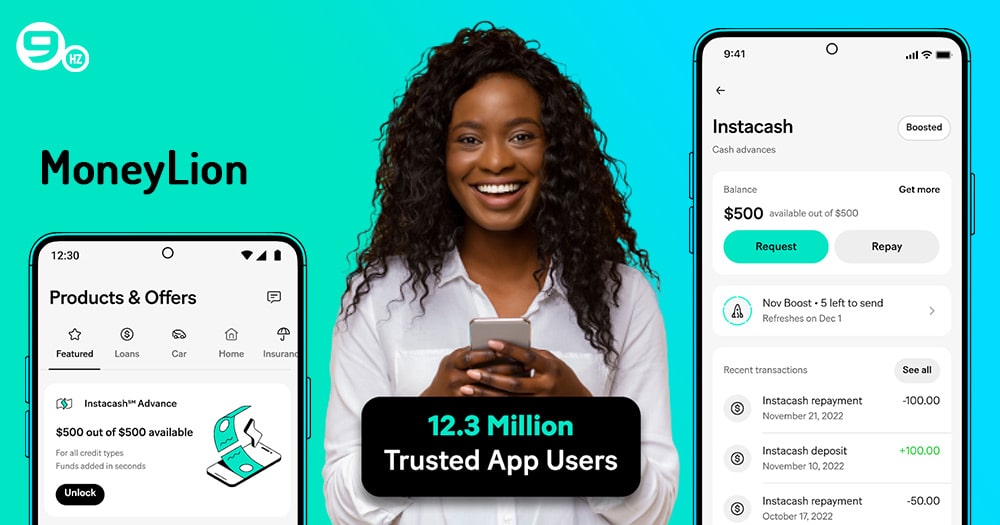

MoneyLion: A Comprehensive Financial Platform

MoneyLion offers a range of financial services, including cash advances through its Instacash feature. While direct deposit can increase the advance limit, it's not strictly required.

MoneyLion may use alternative methods to verify income and employment. They also offer other financial products, such as checking accounts and investment options.

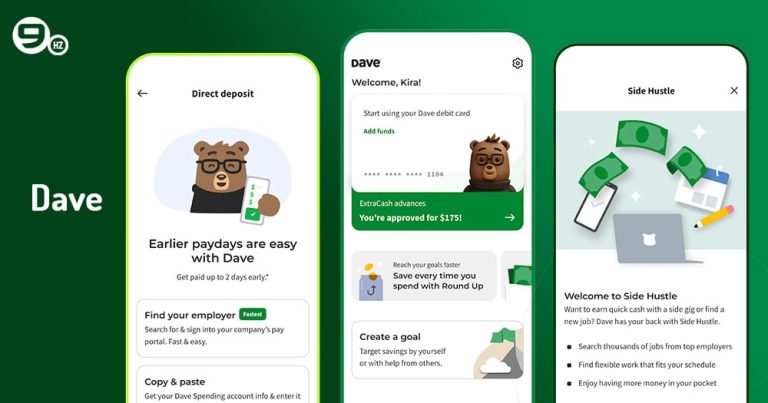

Dave: Budgeting and Cash Advances Combined

Dave is a popular budgeting app that also offers cash advances to help users avoid overdraft fees. While Dave prefers direct deposit, they may consider alternative verification methods on a case-by-case basis.

Dave charges a small monthly membership fee to access its features, including cash advances. They also offer side hustle opportunities to help users earn extra income.

How to Choose the Right App

With several options available, selecting the right cash advance app requires careful consideration. Start by evaluating your individual needs and financial situation.

Consider factors such as the advance amount you require, the speed of funding, and any associated fees or membership costs. Read reviews from other users to get an idea of their experiences with the app.

Understanding the Fine Print

It's crucial to thoroughly understand the terms and conditions of any cash advance app before signing up. Pay attention to any hidden fees or charges, such as late fees or transfer fees.

Be aware of the repayment schedule and ensure that you can comfortably repay the advance on time. Failure to repay can result in penalties or damage to your credit score.

Alternative Verification Methods

Apps that don't require direct deposit typically rely on alternative methods to verify your income and employment. These methods may include submitting timesheets, providing location data, or linking your bank account to verify recent transactions.

Ensure that you are comfortable sharing this information with the app before proceeding. Review the app's privacy policy to understand how your data will be used and protected.

The Ethical Considerations

While cash advance apps can be a helpful tool for managing short-term financial needs, it's important to use them responsibly. Relying on cash advances too frequently can create a cycle of debt.

Consider exploring other options, such as creating a budget, building an emergency fund, or seeking assistance from nonprofit organizations. Remember, these apps are designed to be a short-term solution, not a long-term financial strategy.

The Importance of Financial Literacy

Ultimately, improving your financial literacy is the best way to avoid relying on cash advance apps altogether. Learning how to manage your money effectively, save for emergencies, and plan for the future can help you achieve financial stability.

Numerous resources are available to help you improve your financial knowledge, including online courses, books, and workshops. Take the time to educate yourself and empower yourself to make informed financial decisions.

Conclusion

Cash advance apps without direct deposit offer a valuable service to individuals who need quick access to funds but may not have a traditional direct deposit setup. By understanding the available options, carefully evaluating the terms and conditions, and using these apps responsibly, you can leverage them to navigate short-term financial challenges.

However, remember that these apps are not a substitute for sound financial planning. By prioritizing financial literacy and building healthy financial habits, you can create a more secure and stable future for yourself and your family. Ultimately, the goal is to reach a point where you no longer need to rely on cash advances, and instead, you have the financial resources to weather any storm.