Best Credit Monitoring Service For Couples

In today's increasingly digital world, financial security is paramount, and for couples, it's a shared responsibility. With identity theft and data breaches on the rise, protecting both individual and joint financial health has become a necessity. Choosing the right credit monitoring service can provide peace of mind and early detection of potential fraud, safeguarding your collective financial future.

This article delves into the critical aspects of selecting the best credit monitoring service for couples. We will explore key features, pricing considerations, and expert opinions to help you make an informed decision. Ultimately, the goal is to find a service that provides robust protection and supports financial harmony within your relationship.

Understanding the Need for Joint Credit Monitoring

Why should couples consider a joint approach to credit monitoring? Individual credit scores are often intertwined, especially when applying for mortgages, loans, or credit cards together. A negative event on one partner's credit report can significantly impact the other's ability to secure favorable terms.

Moreover, some forms of fraud, like synthetic identity theft, can be difficult to detect without a comprehensive monitoring system. A service designed for couples can offer a more holistic view of their combined financial picture, enabling them to address issues promptly.

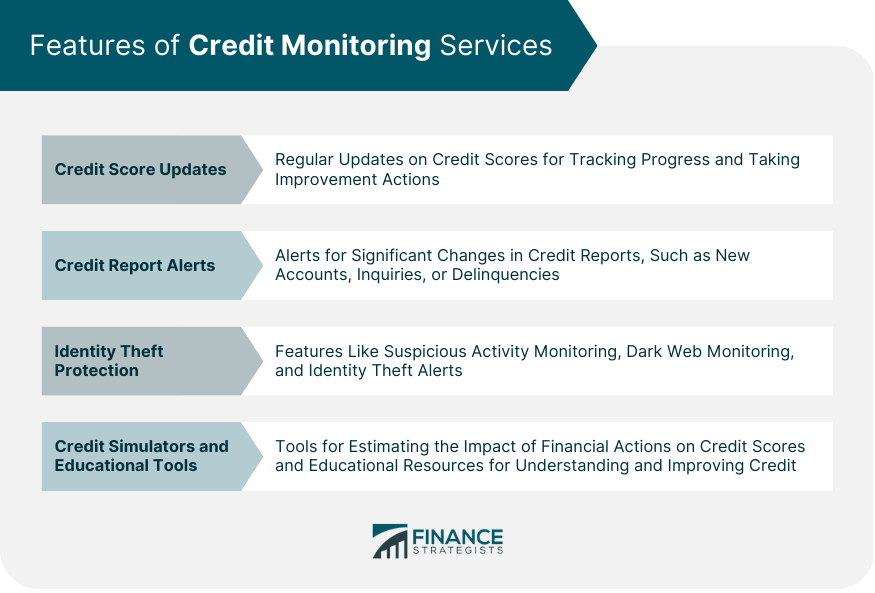

Key Features to Look For

The ideal credit monitoring service for couples should offer a suite of features that go beyond basic credit report tracking. This includes real-time alerts for suspicious activity, identity theft protection, and dark web monitoring.

Specifically, look for:

- Dual Credit Reports and Scores: Access to credit reports and scores from all three major credit bureaus (Equifax, Experian, and TransUnion) for both partners.

- Real-Time Alerts: Immediate notifications of changes to credit reports, such as new accounts opened, credit inquiries, or changes in address.

- Identity Theft Protection: Features like identity theft insurance, fraud resolution support, and lost wallet assistance.

- Dark Web Monitoring: Scans of the dark web for compromised personal information, such as Social Security numbers and bank account details.

- Credit Score Tracking: Monitoring of credit score fluctuations over time, providing insights into financial health.

Popular Credit Monitoring Services for Couples

Several companies offer credit monitoring services suitable for couples, each with its own strengths and weaknesses. It’s crucial to evaluate your specific needs and budget before making a decision.

Experian CreditWorks Premium

Experian CreditWorks Premium is often cited for its comprehensive features and user-friendly interface. It provides daily credit monitoring from Experian, Equifax, and TransUnion, along with identity theft insurance and dark web surveillance.

However, some users have reported that the customer service experience could be improved. The pricing might be a bit higher compared to some competitors, but the extensive features justify the cost for many.

IdentityForce UltraSecure+Credit

IdentityForce UltraSecure+Credit stands out for its robust identity theft protection features, including advanced fraud detection and recovery services. It offers credit monitoring from all three bureaus, as well as public records monitoring and social media monitoring.

While it provides excellent protection, the interface might be considered less intuitive than some other options. The higher price point may also be a deterrent for some couples.

TransUnion Credit Monitoring

TransUnion Credit Monitoring offers a straightforward and affordable option for couples who primarily want to track changes to their TransUnion credit report. It provides credit scores, credit reports, and alerts for suspicious activity.

However, it lacks some of the advanced features offered by other services, such as identity theft insurance and comprehensive dark web monitoring. It's best suited for couples seeking basic credit monitoring at a lower cost.

Pricing Considerations

The cost of credit monitoring services for couples can vary significantly, ranging from around $20 to $50 per month or more. Be sure to carefully compare pricing plans and features before making a decision.

Many companies offer discounts for annual subscriptions. Consider the long-term cost and the value of the features provided when evaluating different options.

Expert Opinions and Recommendations

"Protecting your credit health as a couple is just as important as managing your finances together," says John Ulzheimer, a credit expert and former credit bureau executive. "A comprehensive credit monitoring service can provide an early warning system against fraud and help you maintain a strong financial foundation."

Financial advisors often recommend that couples regularly review their credit reports together and consider enrolling in a credit monitoring service. "It's an investment in your financial security and peace of mind," notes Sarah Jones, a certified financial planner.

Conclusion: Securing Your Shared Financial Future

Choosing the right credit monitoring service for couples requires careful consideration of your individual needs and budget. Evaluate the key features, compare pricing plans, and read reviews from other users to make an informed decision.

By taking proactive steps to protect your credit health, you can safeguard your shared financial future and build a stronger foundation for your relationship. Regularly reviewing your credit reports and utilizing a comprehensive credit monitoring service can provide peace of mind and help you navigate the complexities of the financial world together.

:max_bytes(150000):strip_icc()/youngcouplecreditmonitoring-9228447685c34e8c847734bf77c6ef8f.jpg)

/images/2024/12/05/credit_sesame_review_1224_refresh_03.png)