Best Reit Stocks That Pay Monthly Dividends

In an era defined by economic uncertainty and fluctuating market conditions, the allure of steady, reliable income streams has intensified. Investors are increasingly seeking investments that provide consistent returns, especially those that offer the added benefit of monthly dividend payouts. Real Estate Investment Trusts (REITs), known for their income-generating potential, have become a focal point for those pursuing this strategy.

This article delves into the realm of REITs that distinguish themselves by distributing dividends on a monthly basis. We will explore some of the most promising options, analyzing their financial health, dividend yields, and long-term growth prospects. We will also consider the risks and rewards associated with investing in these vehicles, offering readers a balanced perspective to inform their investment decisions.

Understanding the Appeal of Monthly Dividend REITs

The primary appeal of monthly dividend REITs lies in their ability to provide a consistent and predictable income stream. This can be particularly attractive to retirees or those seeking to supplement their regular income with investment returns.

Furthermore, the monthly payout frequency allows for easier budgeting and reinvestment opportunities, potentially accelerating the compounding effect of returns over time.

Spotlight on Promising Monthly Dividend REITs

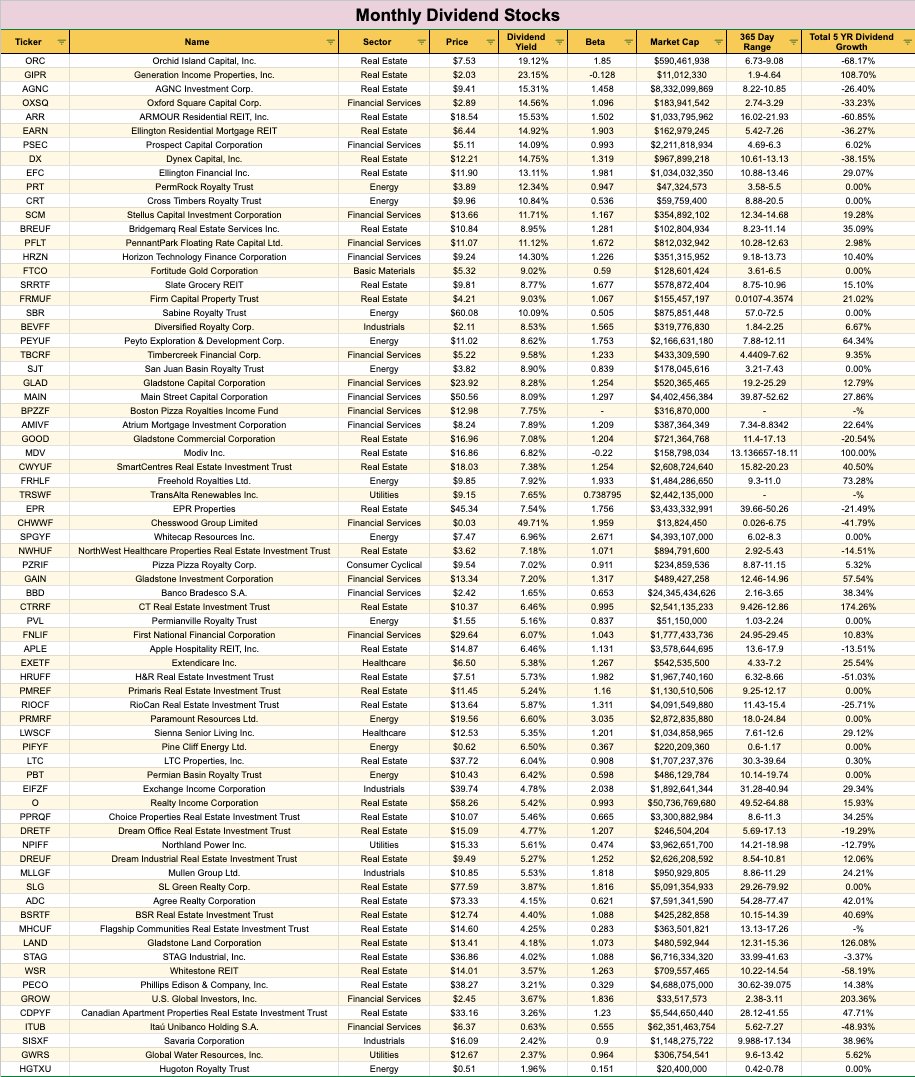

AGNC Investment Corp. (AGNC)

AGNC Investment Corp. is a mortgage REIT (mREIT) that primarily invests in agency mortgage-backed securities (MBS). These securities are guaranteed by U.S. government agencies or government-sponsored enterprises, such as Fannie Mae and Freddie Mac, making them relatively low-risk.

While AGNC's dividend yield is typically high, it's crucial to remember that mREITs are sensitive to interest rate fluctuations. Rising rates can negatively impact their profitability and dividend payouts.

Gladstone Commercial Corporation (GOOD)

Gladstone Commercial Corporation is a diversified REIT that owns and operates a portfolio of net-leased industrial, commercial, and retail properties. Their focus is on acquiring single-tenant properties leased to creditworthy tenants.

This diversified approach offers some protection against economic downturns in specific sectors. Their monthly dividend payout is a core part of their investment strategy.

STAG Industrial (STAG)

STAG Industrial specializes in the acquisition and operation of single-tenant industrial properties across the United States. They focus on properties that are essential to their tenants' businesses, often located in secondary markets.

STAG's consistent dividend history and focus on the growing e-commerce sector make it an attractive option for income-seeking investors. However, it's essential to analyze their tenant base and lease terms.

Evaluating the Risks and Rewards

Investing in monthly dividend REITs presents both opportunities and challenges. While the consistent income stream is a major draw, it's crucial to carefully assess the underlying financial health and stability of each REIT.

Interest rate sensitivity, tenant risk, and management effectiveness are all factors that can impact a REIT's ability to maintain its dividend payouts. Diversification is key to mitigating these risks.

"It's crucial to do your due diligence and understand the underlying assets and business model of any REIT before investing," advises financial analyst Sarah Miller from MarketWatch. "Don't solely focus on the dividend yield. Look at the REIT's financial health, tenant base, and management team."

Conversely, the rewards can be significant. REITs offer exposure to the real estate market without the hassle of direct property ownership. The monthly dividend payouts can provide a stable source of income and potentially enhance overall portfolio returns.

The Future of Monthly Dividend REITs

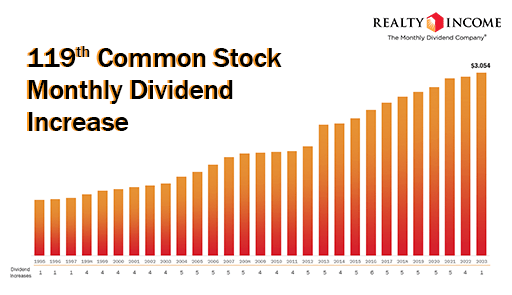

The demand for income-generating investments is likely to remain strong in the foreseeable future. As a result, monthly dividend REITs are positioned to continue attracting investors seeking stable and predictable cash flows.

However, the evolving economic landscape, including changes in interest rates and inflation, will undoubtedly impact the performance of these investments. Investors should remain vigilant and adapt their strategies accordingly.

Careful research and diversification remain the cornerstones of successful REIT investing. Understanding the nuances of each REIT and its underlying assets is crucial for making informed investment decisions.