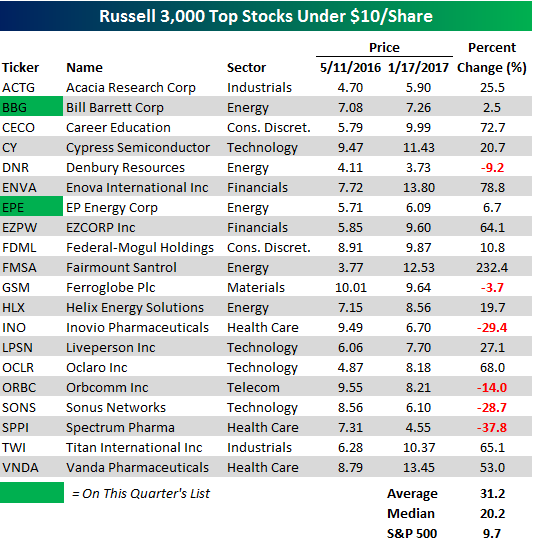

Best Stocks Between 5 And 10 Dollars

Urgent alert for investors seeking high-potential, low-cost entries: select stocks priced between $5 and $10 are showing significant upward momentum.

This article highlights companies demonstrating strong financials or disruptive innovation, offering a balanced risk-reward profile for savvy investors aiming for substantial gains.

Potential Gainers in the $5-$10 Range

Sundial Growers Inc. (SNDL)

Sundial Growers, a Canadian cannabis producer, currently trades within the specified price range. The company is focusing on strategic acquisitions and partnerships to bolster its market position.

Recent financial reports indicate improved cost management and a pathway to profitability, potentially attracting investors looking for a turnaround story.

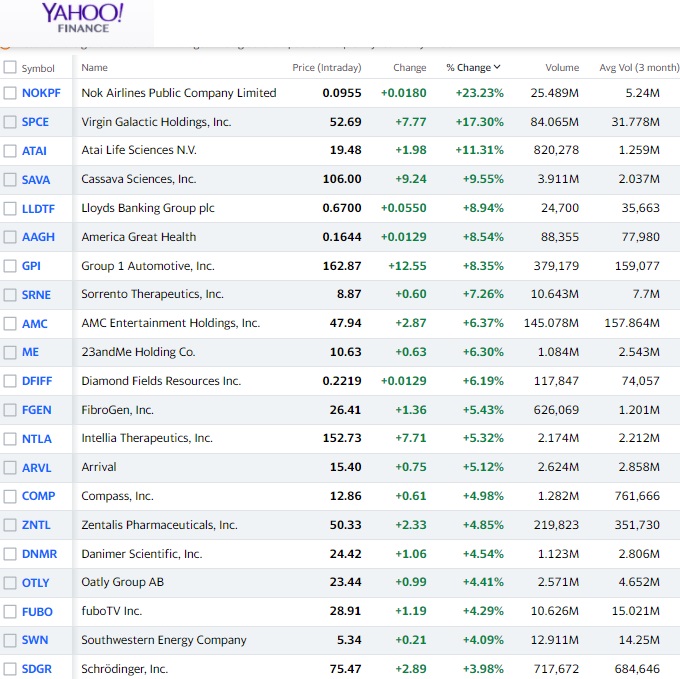

Nokia (NOK)

Nokia, a global telecommunications giant, presents a stable option within this price bracket. Their advancements in 5G technology and network infrastructure position them favorably for future growth.

Analyst ratings suggest a buy or hold stance, reflecting confidence in Nokia's long-term prospects.

Castor Maritime Inc. (CTRM)

Castor Maritime Inc., a diversified dry bulk shipping company, operates in the global transportation sector. The company's performance is closely tied to global trade volumes and shipping rates.

Increased demand for commodities could translate to revenue gains for CTRM, making it an interesting, albeit riskier, investment option.

ContextLogic Inc. (WISH)

ContextLogic Inc., operating as the e-commerce platform Wish, is undergoing a transformation phase, focusing on improving user experience and logistics.

While facing competition, a successful turnaround could lead to significant stock appreciation, appealing to investors with a high-risk tolerance.

Due Diligence is Key

Investing in stocks within this price range inherently carries a higher level of risk.

Thorough research into each company's financials, industry trends, and competitive landscape is crucial before making any investment decisions.

Important Considerations

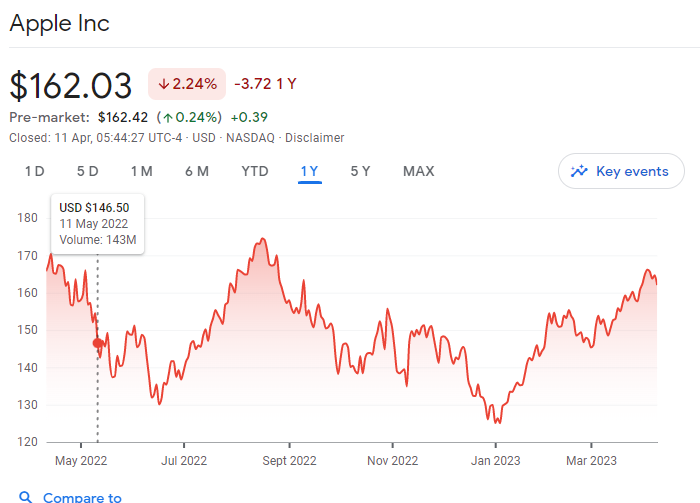

Market volatility can significantly impact the price of these stocks. Monitor market conditions and adjust your investment strategy accordingly.

Diversification remains a cornerstone of prudent investing. Don't allocate an excessive portion of your portfolio to any single stock, especially those in the $5-$10 range.

Next Steps

Investors should consult with a qualified financial advisor to determine the suitability of these investments based on their individual risk tolerance and financial goals. Follow up on quarterly earnings reports for updates regarding financials.

Stay informed about industry news and company announcements to make well-informed investment decisions.