Best Vanguard Mutual Funds To Buy Now

Amidst ongoing market volatility and fluctuating interest rates, investors are increasingly seeking stable and reliable investment options. Vanguard, known for its low-cost index funds and mutual funds, remains a popular choice for both novice and experienced investors.

This article explores some of the top-rated Vanguard mutual funds currently favored by financial analysts, focusing on factors such as historical performance, expense ratios, and investment objectives.

Understanding Vanguard's Appeal

Vanguard’s commitment to low-cost investing stems from its unique structure. As a mutual company owned by its fund shareholders, Vanguard is able to prioritize investor returns over profits, typically resulting in lower expense ratios compared to its competitors.

This low-cost advantage can significantly impact long-term investment returns, especially in volatile market conditions. Many investors are attracted to Vanguard's index funds, which track specific market indexes such as the S&P 500, offering broad market exposure at minimal cost.

Top Vanguard Mutual Funds to Consider

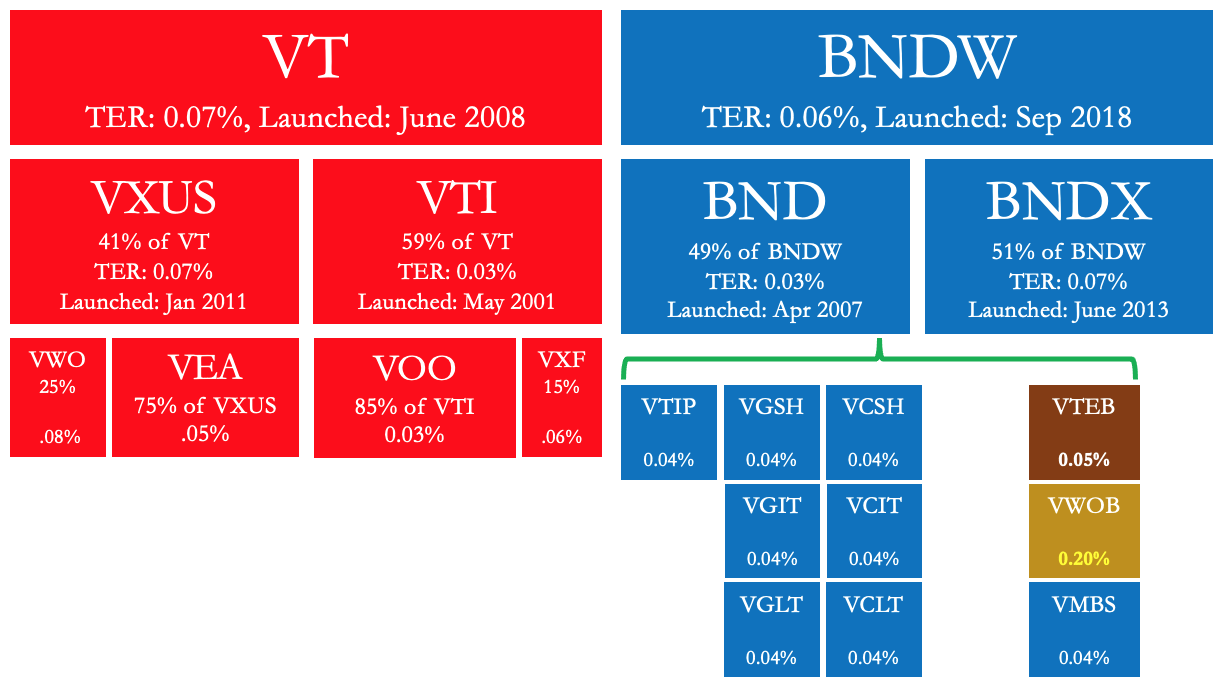

One of the most frequently recommended Vanguard funds is the Vanguard Total Stock Market Index Fund (VTSAX). This fund offers comprehensive exposure to the entire U.S. stock market, encompassing large-, mid-, and small-cap companies.

Its extremely low expense ratio, often cited as a major advantage, makes it an attractive core holding for many portfolios. VTSAX aims to mirror the performance of the CRSP U.S. Total Market Index, providing a diversified and passively managed investment option.

For investors seeking international exposure, the Vanguard Total International Stock Index Fund (VTIAX) is another popular choice. This fund invests in a broad range of international stocks, excluding U.S. companies, offering diversification beyond domestic markets.

Like VTSAX, VTIAX boasts a low expense ratio, making it cost-effective for investors seeking global diversification. This fund tracks the FTSE Global All Cap ex US Index.

Investors with a lower risk tolerance may consider the Vanguard Total Bond Market Index Fund (VBTLX). This fund invests in a wide array of investment-grade U.S. bonds, providing a more conservative investment option compared to stocks.

VBTLX seeks to track the performance of the Bloomberg U.S. Aggregate Float Adjusted Index. Bonds are often considered a stabilizing force within a portfolio, particularly during periods of stock market uncertainty.

Analyzing Performance and Risk

While past performance is not indicative of future results, it's crucial to analyze a fund's historical performance alongside its risk metrics. Investors should consider factors such as standard deviation and Sharpe ratio to understand the fund's volatility and risk-adjusted returns.

Vanguard's website and other financial data providers offer detailed information on fund performance, expense ratios, and risk metrics. Consulting with a qualified financial advisor is recommended to determine the most suitable investment strategy based on individual circumstances and risk tolerance.

The Importance of Diversification

Regardless of the specific funds chosen, diversification remains a cornerstone of sound investment strategy. Spreading investments across different asset classes and sectors can help mitigate risk and potentially enhance long-term returns.

Vanguard's diverse range of mutual funds and ETFs allows investors to easily create a well-diversified portfolio. A balanced approach considering stocks, bonds, and international investments is generally recommended.

The current economic climate underscores the importance of careful investment decisions. By focusing on low-cost, diversified options like those offered by Vanguard, investors can position themselves for long-term financial success.

.png)