How Can I Get All My W2 Forms Online

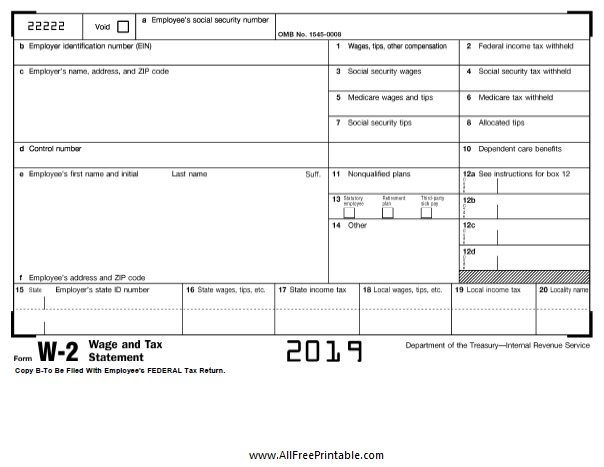

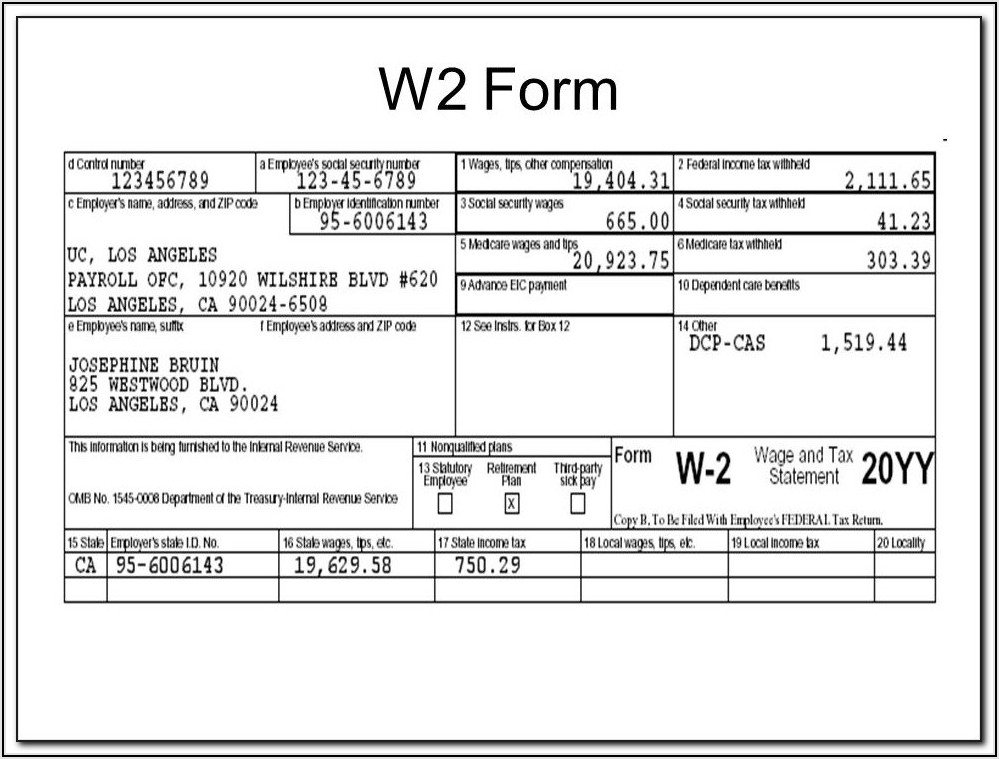

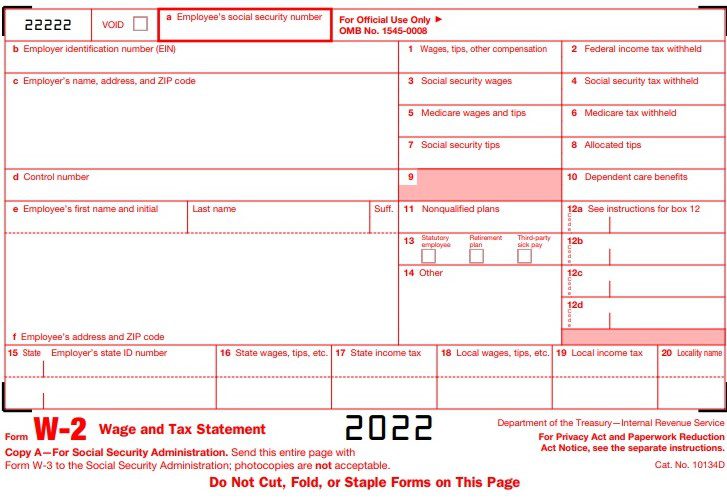

Tax season looms, and for millions of Americans, the annual scramble for W-2 forms is about to begin. But gone are the days of solely relying on snail mail. The digital age offers numerous ways to access these crucial documents online, simplifying the filing process and potentially speeding up your refund.

This article provides a comprehensive guide to obtaining your W-2 forms online, exploring various methods from employer portals to the Internal Revenue Service (IRS) itself. It also addresses potential challenges and offers solutions to ensure a smooth and efficient tax filing experience. Ultimately, navigating the online W-2 landscape can save you time and reduce the stress associated with tax preparation.

Accessing W-2s Through Your Employer

The most direct route to obtaining your W-2 online is through your employer. Many companies now provide electronic access to tax forms via their internal systems. This is usually the fastest and most convenient option.

Check your company's HR portal or payroll system. Look for a section labeled "Tax Forms," "Payroll Documents," or something similar. You may need to consent to receive your W-2 electronically.

If you cannot locate your W-2 online through your employer's system, contact your HR department or payroll administrator directly. They can guide you through the process or provide assistance if you are experiencing technical difficulties.

The IRS and Your Online W-2

The IRS provides several options for taxpayers to access their tax information online, including W-2 data. While they don’t directly provide downloadable W-2 forms, they offer methods to access the information contained within them.

You can create an account on the IRS website and utilize their Get Transcript tool. This allows you to view or download a transcript that summarizes your tax information, including data reported on W-2 forms. Keep in mind this is a transcript of information, not a replica of your W-2.

"The Get Transcript tool is a valuable resource for taxpayers who need to verify their income or address information," states an official IRS publication.

Another option is to use the IRS's free file program. This allows eligible taxpayers to file their taxes online for free, and the software often imports W-2 information directly from employers.

Navigating Third-Party Payroll Services

Many employers utilize third-party payroll services like ADP or Paychex. These platforms often provide employees with online access to their pay stubs and tax forms.

If your employer uses such a service, you should have received login credentials when you were hired. Visit the platform's website and log in to access your W-2. If you’ve forgotten your password or username, use the platform's recovery options.

These platforms typically offer secure access to your tax documents and provide customer support if you encounter any issues.

Troubleshooting and Potential Issues

Even with these online options, problems can arise. You may not be able to access your W-2 if your employer has incorrect contact information, or if there are technical glitches.

If you haven't received your W-2 by mid-February, contact your employer immediately. If you still don't receive it, contact the IRS. They can assist you in obtaining the necessary information and may contact your employer on your behalf.

Keep records of all your attempts to obtain your W-2, including dates, times, and names of individuals you spoke with.

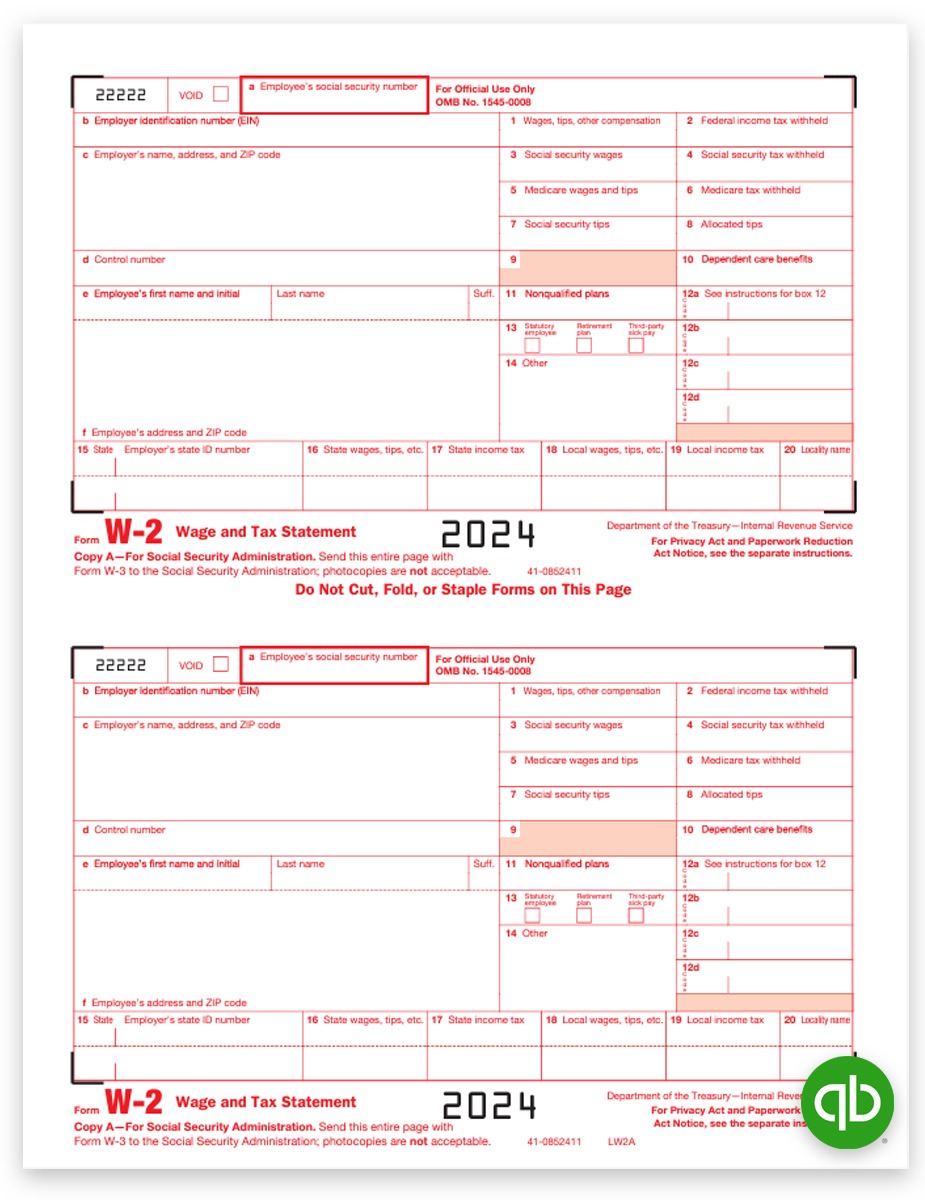

Looking Ahead: The Future of Online Tax Forms

The trend toward online access to tax forms is likely to continue. The IRS is constantly working to improve its online services and make it easier for taxpayers to access their information.

Expect to see more employers offering electronic W-2 delivery and increased integration between payroll systems and tax preparation software. This will further streamline the tax filing process and reduce reliance on paper documents.

By embracing these digital tools and understanding the available resources, taxpayers can confidently navigate the online W-2 landscape and simplify their tax preparation each year.