Top 20 Mutual Funds For Sip To Invest In 2018

Time is running out! Investors looking to maximize returns through Systematic Investment Plans (SIPs) in 2018 must act now. This report reveals the top 20 mutual funds poised for significant growth, offering a data-driven guide to navigate the investment landscape before the year ends.

This list, compiled by independent financial analysts, pinpoints funds with consistently strong performance and promising potential for continued success. These options cater to diverse risk appetites and investment goals, making them suitable for both seasoned and novice investors.

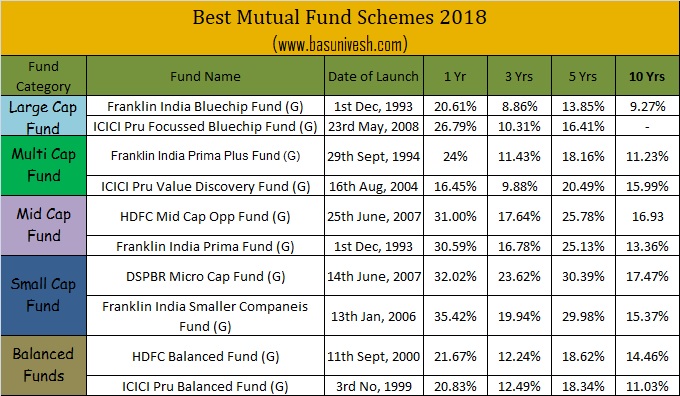

Equity Funds Leading the Charge

Equity funds dominate the list, reflecting the robust market performance of 2018. Several large-cap funds have demonstrated consistent growth, offering stable returns with relatively lower risk.

HDFC Top 100 Fund secured a top spot, known for its diversified portfolio of blue-chip companies. Its consistent performance and experienced fund management team make it a reliable choice for long-term investors.

Another strong contender is ICICI Prudential Bluechip Fund. The fund's disciplined approach and focus on quality stocks have yielded impressive results.

For investors seeking higher growth potential, mid-cap funds present appealing opportunities. However, they also come with increased volatility.

SBI Magnum Midcap Fund has consistently outperformed its benchmark, making it a favorite among risk-tolerant investors. Its exposure to emerging companies positions it for future growth.

Diversified Funds: A Balanced Approach

Diversified equity funds offer a blend of stability and growth. These funds allocate investments across various market caps and sectors, reducing overall portfolio risk.

Franklin India Prima Fund stands out for its balanced approach and strong track record. Its diversified holdings provide a cushion against market fluctuations.

L&T Equity Fund is another noteworthy option, known for its active fund management and ability to generate alpha.

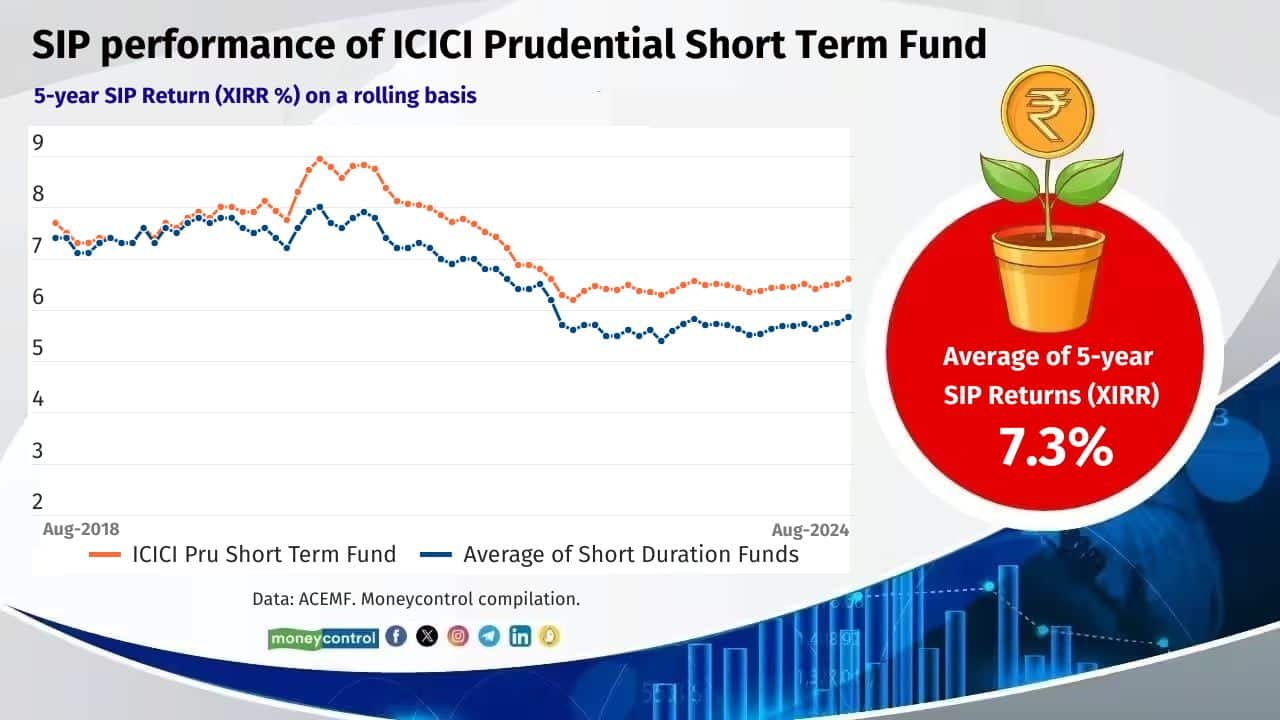

Debt Funds: Stability in Uncertain Times

While equity funds offer higher growth potential, debt funds provide stability and income. They are particularly attractive in volatile market conditions.

HDFC Corporate Bond Fund consistently delivers stable returns with minimal risk. It invests primarily in high-quality corporate bonds.

ICICI Prudential Long Term Bond Fund offers exposure to longer-duration bonds, potentially yielding higher returns. However, it also carries a higher interest rate risk.

Important Considerations Before Investing

Before investing in any mutual fund, carefully consider your risk tolerance and investment goals. Consult with a financial advisor to determine the best options for your individual circumstances.

Remember to review the fund's historical performance, expense ratio, and fund manager's experience. Do not solely rely on past performance as an indicator of future returns.

Diversification is key to mitigating risk. Consider investing in a mix of equity and debt funds to create a well-rounded portfolio.

The Clock is Ticking

With 2018 drawing to a close, now is the time to act. Don't miss the opportunity to capitalize on these top-performing mutual funds through SIPs.

Research these funds thoroughly and make informed investment decisions to secure your financial future. Staying informed and acting promptly are crucial for maximizing returns.

Track the performance of these funds and adjust your portfolio as needed based on market conditions and your evolving financial goals. Continued diligence is key to long-term investment success.