Best Way To Keep Track Of Your Finances

Imagine sipping your morning coffee, not with a knot of anxiety in your stomach, but with a sense of calm knowing exactly where your money is going. Picture yourself confidently planning for that dream vacation, the down payment on a house, or simply a secure retirement. This isn't just a fantasy; it's the reality accessible to anyone who takes the reins of their financial life.

At its heart, the best way to keep track of your finances isn't about deprivation or complex spreadsheets. It's about fostering awareness, gaining control, and building a healthy relationship with your money. It is about understanding where your money goes and making informed decisions on how to spend or invest your money.

The Foundation: Understanding Your Cash Flow

The first step is to understand your cash flow. This means tracking both your income and your expenses.

Knowing exactly how much money comes in each month is critical for tracking your finances. Be sure to include all sources of income, even those that might seem insignificant.

Tracking expenses, however, is where many people stumble. According to a 2023 report by the Bureau of Labor Statistics, the average household underestimates their spending by as much as 20%.

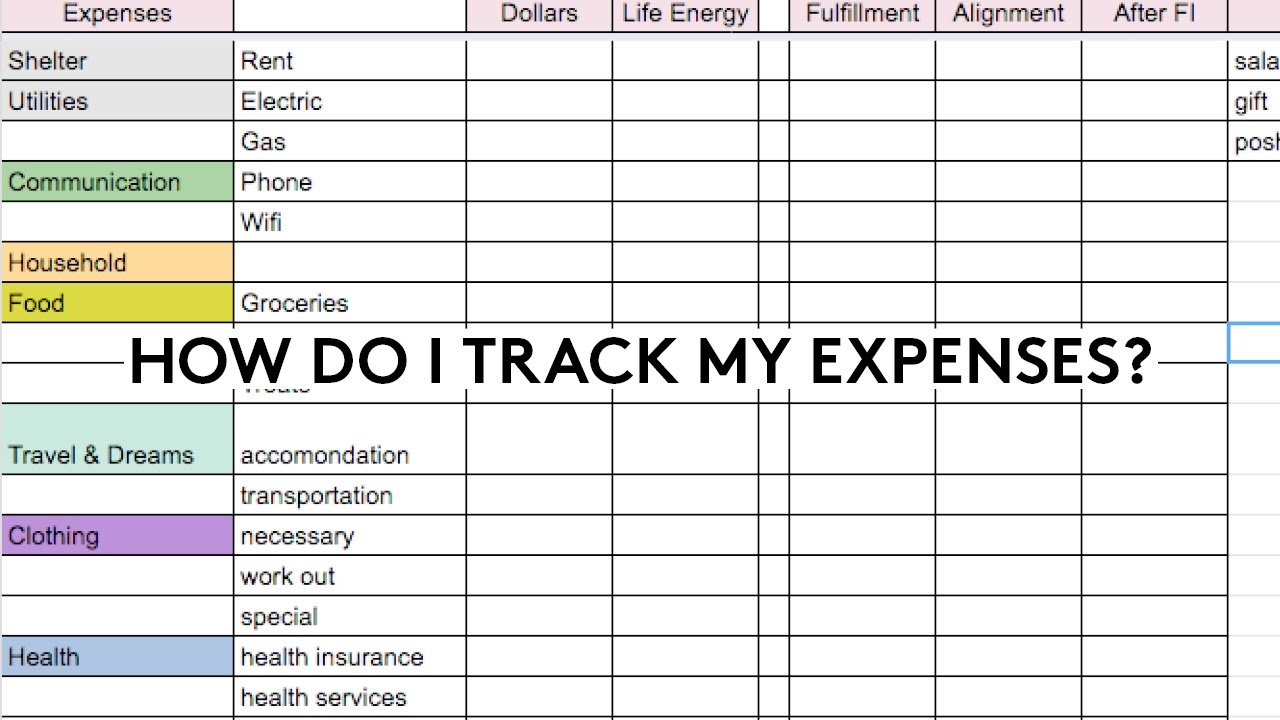

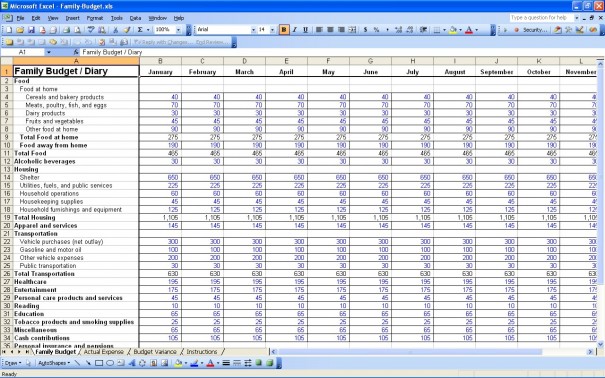

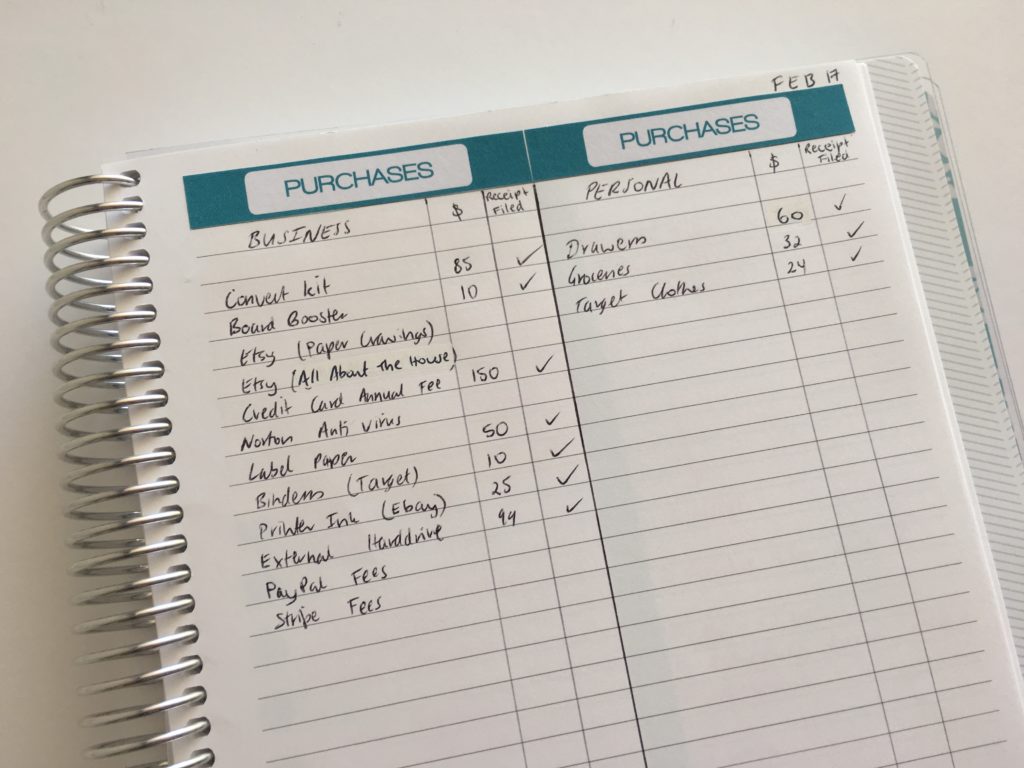

Methods for Tracking Expenses

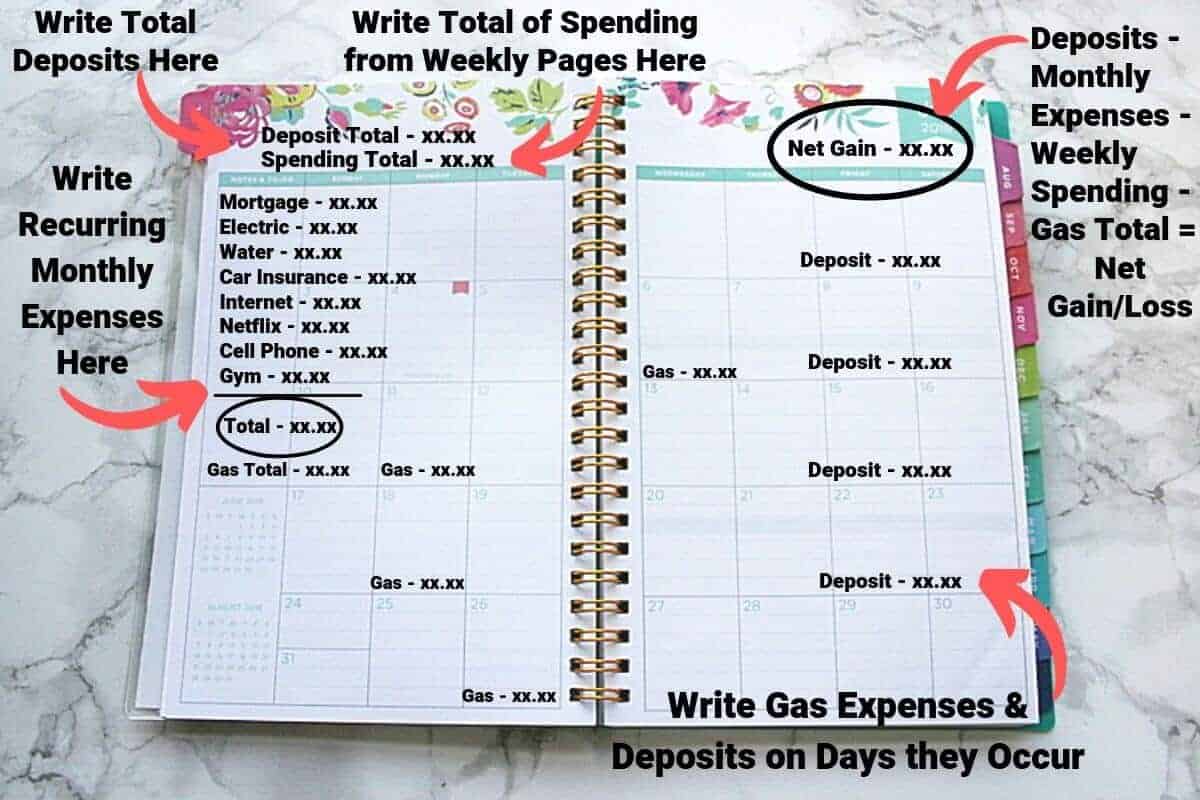

There are several methods you can use to keep track of your expenditures. There is a good option that fits most lifestyles.

One popular method is the traditional budget spreadsheet. Several spreadsheet programs, like Google Sheets or Microsoft Excel, offer free templates specifically designed for budgeting.

For a more automated approach, consider using budgeting apps like Mint, YNAB (You Need a Budget), or Personal Capital. These apps connect directly to your bank accounts and credit cards, automatically categorizing your transactions.

If you prefer a more hands-on approach, try the envelope system. This method involves allocating cash to different spending categories and physically placing the money in envelopes.

Building a Budget That Works for You

Once you have a handle on your income and expenses, it's time to create a budget. A budget is not about restricting yourself; it's about prioritizing your spending and aligning it with your goals.

The 50/30/20 rule is a popular budgeting framework. This method allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment.

For example, needs might include rent or mortgage payments, utilities, groceries, and transportation. Wants could include dining out, entertainment, and hobbies. Savings can be for your emergency fund, retirement, or a down payment on a house.

Review, Adjust, and Automate

Tracking your finances is not a one-time task; it’s an ongoing process. Regularly review your budget and track your progress toward your financial goals.

Life changes, and so will your financial needs. Be prepared to adjust your budget as your income, expenses, and goals evolve.

Automate your savings and bill payments to ensure you are consistently saving and avoid late fees. Setting up automatic transfers to your savings account and scheduling bill payments through your bank can streamline your finances.

The Long-Term Benefits

Taking control of your finances offers benefits beyond simply knowing where your money is going. It empowers you to make informed decisions, achieve your financial goals, and build a more secure future.

Improved financial literacy is a key benefit. According to a study by the Financial Industry Regulatory Authority (FINRA), individuals who actively manage their finances tend to have higher levels of financial knowledge and make better financial decisions.

This is why many people use resources such as the Federal Trade Commission and other government websites to improve their financial literacy.

Ultimately, the best way to keep track of your finances is the way that works best for you. Experiment with different methods, find what resonates with your lifestyle and preferences, and commit to the process. It will be worth it.