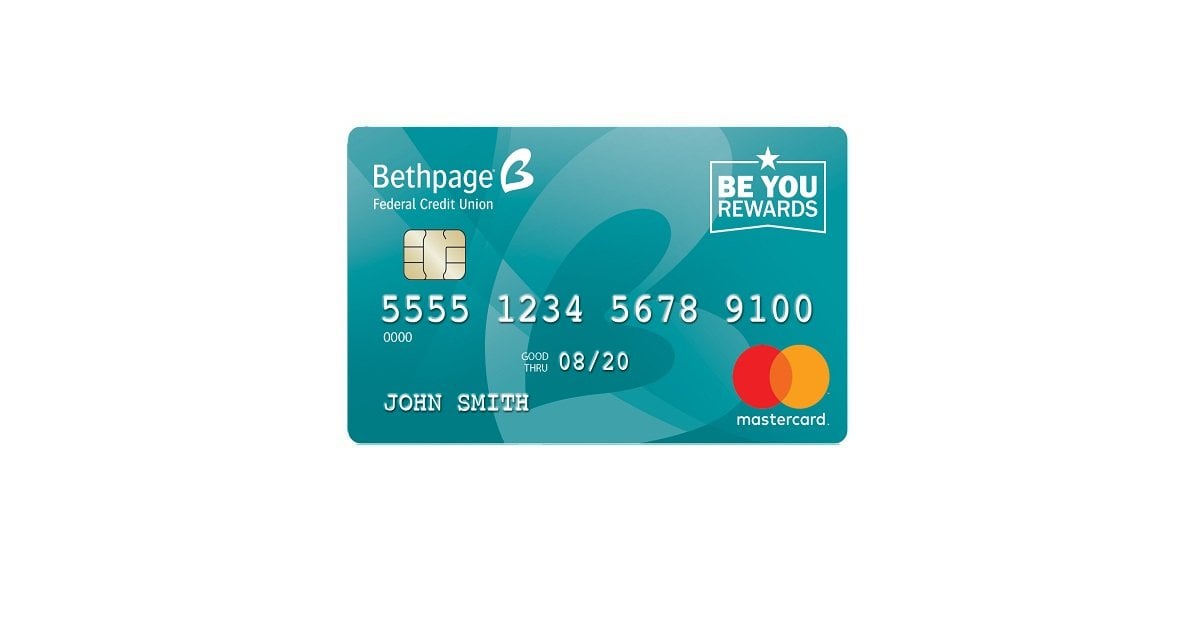

Bethpage Federal Credit Union Credit Card

In an era defined by escalating credit card debt and a relentless search for value, the Bethpage Federal Credit Union's credit card offerings have quietly emerged as a significant player, capturing the attention of consumers seeking lower fees and competitive rewards programs.

But with an increasingly saturated market and ever-evolving consumer expectations, the question remains: Can Bethpage maintain its competitive edge and continue to deliver value that truly resonates with its membership?

This article delves into the nuances of Bethpage Federal Credit Union's credit card portfolio, examining its key features, comparing it to industry benchmarks, and assessing its overall impact on cardholders.

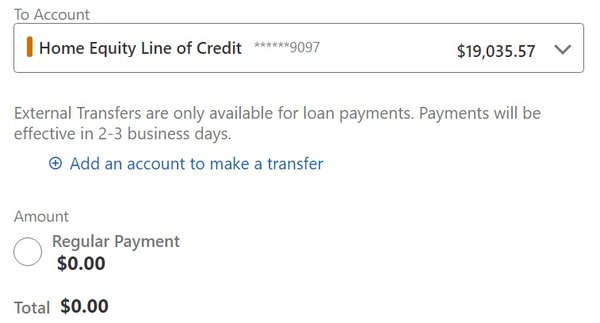

Bethpage's Credit Card Lineup: A Detailed Overview

Bethpage Federal Credit Union offers a range of credit cards designed to meet diverse financial needs.

These cards typically include options with varying APRs, reward structures, and credit limit ranges.

The specific offerings may include cash-back cards, low-interest rate cards, and secured cards for those with limited or damaged credit histories.

Key Features and Benefits

One of the primary draws of Bethpage's credit cards is its commitment to lower fees compared to traditional banks.

Many of their cards boast no annual fees, foreign transaction fees, or balance transfer fees, potentially saving cardholders a significant amount of money over time.

Furthermore, Bethpage's reward programs, particularly on their cash-back cards, offer competitive rates on everyday purchases, allowing cardholders to accumulate points or cash back that can be redeemed for statement credits, merchandise, or travel.

The credit union also emphasizes its member-centric approach, providing personalized customer service and financial education resources to help cardholders manage their credit responsibly.

This focus on member education and responsible lending practices sets Bethpage apart from some of the larger, profit-driven credit card issuers.

The online account management tools and mobile app further enhance the user experience, providing convenient access to account information and transaction history.

Competitive Landscape: Benchmarking Against Industry Standards

To fully understand the value proposition of Bethpage's credit cards, it's crucial to compare them to industry benchmarks and offerings from other credit card issuers.

According to data from websites like NerdWallet and Credit Karma, the average cash-back rate on credit cards ranges from 1% to 2% on most purchases, with some cards offering higher rates on specific categories like dining or gas.

Bethpage's cash-back cards generally align with or exceed these averages, making them a competitive option for those seeking to maximize their rewards earnings.

However, it's important to note that some premium credit cards from major banks may offer even more generous rewards programs, albeit often accompanied by annual fees.

In terms of interest rates, Bethpage's APRs are typically lower than the national average, especially for members with excellent credit scores.

This can result in significant savings on interest charges for those who carry a balance on their credit cards.

Bethpage's commitment to avoiding excessive fees also stands out in comparison to some of the more predatory lending practices employed by certain subprime credit card issuers.

Impact on Cardholders and the Community

The availability of affordable credit and responsible financial services can have a profound impact on individuals and communities.

Bethpage's credit cards can help members build credit, manage expenses, and achieve their financial goals.

The credit union's emphasis on financial education also empowers members to make informed decisions about their credit and avoid falling into debt traps.

"Our mission is to provide our members with the tools and resources they need to succeed financially," says Tricia Szymanski, Senior Vice President, Retail Banking at Bethpage Federal Credit Union.

The credit union also supports various community initiatives, further demonstrating its commitment to improving the financial well-being of its members and the surrounding areas.

By offering competitive credit card products and promoting responsible financial behavior, Bethpage contributes to a more stable and prosperous community.

However, it is important to acknowledge that credit cards, regardless of the issuer, can pose risks if not used responsibly.

Overspending, high balances, and missed payments can lead to debt accumulation and damage credit scores.

Challenges and Opportunities

Despite its successes, Bethpage Federal Credit Union faces several challenges in the competitive credit card market.

The rise of fintech companies and digital payment platforms is disrupting the traditional banking industry, forcing credit unions like Bethpage to adapt and innovate.

Maintaining a strong online presence and offering seamless digital experiences are crucial for attracting and retaining members.

Furthermore, the increasing prevalence of credit card fraud and data breaches requires ongoing investment in security measures and fraud prevention technologies.

However, these challenges also present opportunities for growth and innovation.

By leveraging technology, enhancing its rewards programs, and expanding its reach, Bethpage can solidify its position as a leading credit card issuer.

Collaborating with fintech companies and exploring new payment methods can also help the credit union stay ahead of the curve and cater to the evolving needs of its members.

The Future of Bethpage's Credit Card Offerings

Looking ahead, the future of Bethpage Federal Credit Union's credit card offerings appears bright, but it requires a continued commitment to innovation, member service, and responsible lending practices.

The credit union must continue to adapt to the changing landscape of the credit card industry while staying true to its core values of affordability, transparency, and member-centricity.

By prioritizing the financial well-being of its members and embracing new technologies, Bethpage can solidify its position as a trusted provider of credit card services for years to come. The credit union will likely focus on data security, given the recent widespread cyberattacks.

The key to sustained success lies in consistently delivering value, fostering financial literacy, and building strong relationships with its members.

![Bethpage Federal Credit Union Credit Card [Expired] Bethpage Federal Credit Union $250 Checking Bonus - Doctor Of](https://www.doctorofcredit.com/wp-content/uploads/2024/09/bethpage-federal-credit-union-250-1140x685.png)