Boi Reporting Software For Accounting Firms

Imagine an accounting firm, sunlight streaming through the windows, but instead of the usual furrowed brows and stacks of paperwork, a sense of calm pervades. Team members collaborate effortlessly, pulling up clear, concise reports on their screens, instantly understanding the financial health of their clients. This isn't a scene from a futuristic movie, but a growing reality thanks to the emergence of specialized Boi Reporting Software.

This innovative software is transforming how accounting firms handle Beneficial Ownership Information (BOI) reporting, streamlining compliance, reducing errors, and freeing up valuable time for more strategic client advisory work. Its impact is particularly relevant now, given the recent regulatory changes and the increasing scrutiny surrounding financial transparency.

The Rise of Boi Reporting Software

The journey toward streamlined BOI reporting began with the Corporate Transparency Act (CTA), enacted to combat money laundering and illicit financial activities. This legislation mandates that certain entities report information about their beneficial owners to the Financial Crimes Enforcement Network (FinCEN).

Compliance with the CTA presents a significant challenge for accounting firms, who are often tasked with guiding their clients through the complex reporting requirements. Gathering, verifying, and submitting accurate BOI can be time-consuming and prone to errors, especially for firms with a large client base.

Recognizing this challenge, software developers stepped in to create specialized tools designed to simplify the BOI reporting process. These tools, often referred to as Boi Reporting Software, automate many of the manual tasks involved, reducing the burden on accounting firms and their clients.

Key Features and Benefits

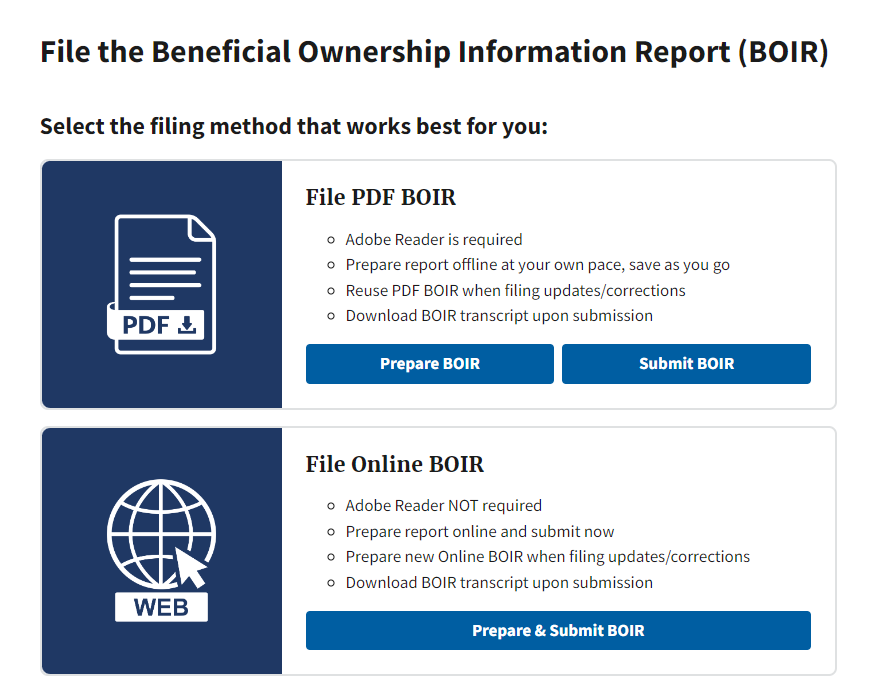

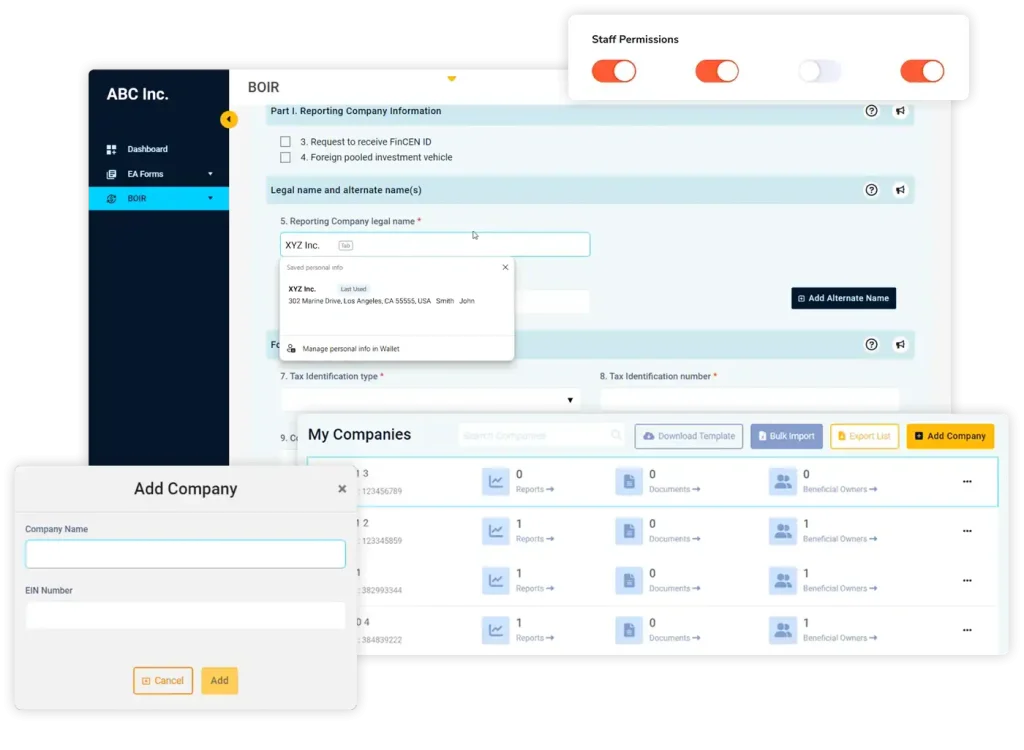

Boi Reporting Software typically offers a range of features designed to streamline compliance. Secure data collection portals allow clients to easily submit their BOI.

Automated reminders ensure timely submissions, and built-in validation checks help prevent errors and omissions. The software also generates compliant reports that can be directly submitted to FinCEN.

The benefits of using Boi Reporting Software are numerous. Accounting firms can save significant time and resources by automating the BOI reporting process.

Reduced errors minimize the risk of penalties and ensure compliance with the CTA. Improved data security protects sensitive client information.

Perhaps most importantly, Boi Reporting Software allows accounting firms to focus on providing valuable advisory services to their clients, rather than getting bogged down in tedious administrative tasks.

Impact on Accounting Firms

The adoption of Boi Reporting Software is having a profound impact on accounting firms of all sizes. Smaller firms can leverage the software to efficiently manage BOI reporting for their clients, without the need for extensive in-house expertise.

Larger firms can use the software to streamline their processes, improve data accuracy, and ensure consistent compliance across their entire client base. The software also enhances collaboration between team members, making it easier to manage complex reporting requirements.

“Boi Reporting Software has been a game-changer for our firm,” says Sarah Chen, a partner at a mid-sized accounting firm. “It has freed up our staff to focus on more strategic work, and it has given us peace of mind knowing that we are in full compliance with the CTA.”

Choosing the Right Software

With a growing number of Boi Reporting Software solutions available, it is important for accounting firms to carefully evaluate their options. Key considerations include the software's features, ease of use, security, and integration with existing accounting systems.

Firms should also consider the vendor's reputation and track record, as well as the level of customer support they provide. A demo or trial period can be invaluable in determining whether a particular software solution is a good fit for the firm's needs.

Data security is paramount, and firms should ensure that the software they choose meets industry standards for data encryption and protection. Compliance with regulations like GDPR and CCPA is also important, especially for firms with international clients.

The Future of Boi Reporting

The use of Boi Reporting Software is likely to continue to grow as the CTA matures and enforcement efforts increase. As FinCEN refines its guidance and interpretations, the software will need to adapt to ensure ongoing compliance.

Future developments may include enhanced automation, artificial intelligence (AI) powered data validation, and improved integration with other financial systems. The software may also expand to cover other regulatory reporting requirements, further streamlining compliance for accounting firms.

According to a recent report by Accenture, the adoption of AI and automation in accounting is expected to increase significantly in the coming years. Boi Reporting Software is a prime example of how these technologies can transform the accounting profession, making it more efficient, accurate, and strategic.

Beyond Compliance: A Strategic Advantage

While compliance is the primary driver for adopting Boi Reporting Software, the benefits extend far beyond simply meeting regulatory requirements. The software can also provide accounting firms with a strategic advantage.

By streamlining the BOI reporting process, firms can improve client satisfaction and build stronger relationships. They can also use the software to identify potential risks and opportunities for their clients, providing valuable advisory services that set them apart from the competition.

Furthermore, the data collected through Boi Reporting Software can be used to gain insights into client ownership structures and financial activities. This information can be valuable for identifying potential fraud, money laundering, or other illicit activities.

In a world where financial transparency is increasingly important, Boi Reporting Software is becoming an essential tool for accounting firms. It allows them to efficiently manage BOI reporting, reduce errors, and focus on providing value-added services to their clients.

The shift towards automated compliance solutions like Boi Reporting Software isn't just about adhering to regulations; it's about embracing a future where accountants can be strategic advisors, guiding their clients towards greater financial health and success, equipped with the right tools to navigate a complex regulatory landscape.