Prime Financial Credit Union Milwaukee Wisconsin

In Milwaukee, Wisconsin, Prime Financial Credit Union stands as a cornerstone of community banking. Established decades ago, the institution has navigated economic fluctuations and evolving member needs. Recent developments, including strategic expansions and technological investments, are reshaping its role in the local financial landscape.

Prime Financial Credit Union, a member-owned financial cooperative serving the greater Milwaukee area, is undergoing a period of significant transformation. This includes expanding its digital footprint, enhancing member services, and reinforcing its commitment to financial literacy programs. The organization's strategic priorities aim to address the evolving needs of its diverse membership while maintaining its core values of community focus and financial stability.

History and Core Values

Founded in 1935, Prime Financial initially served a small group of employees from a local manufacturing company. Over time, its membership expanded to include residents and employees throughout Milwaukee County. This growth reflects a commitment to accessibility and community development.

The credit union operates on the cooperative principle of "people helping people." Prime Financial prioritizes its members' financial well-being, offering personalized services and competitive rates. This contrasts with the profit-driven motives often associated with larger, publicly traded banks.

Recent Developments and Expansion

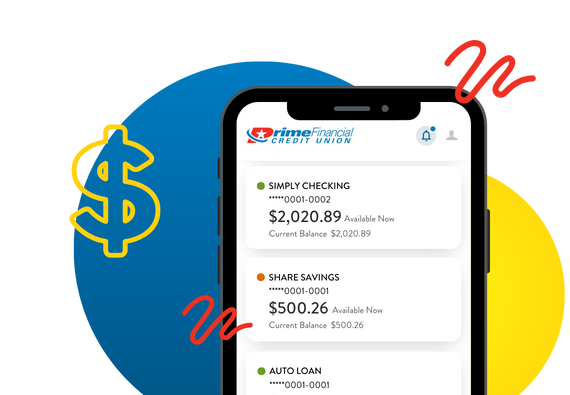

In recent years, Prime Financial has focused on expanding its digital banking capabilities. This includes launching a mobile app with enhanced features and streamlining online account access. These changes reflect the growing demand for convenient and accessible banking services.

The credit union also announced plans to open a new branch location in the city’s growing Bay View neighborhood. This expansion aims to better serve existing members and attract new ones in a thriving area. This physical presence signals a continued commitment to local communities.

Financial Performance and Stability

According to recent reports from the National Credit Union Administration (NCUA), Prime Financial maintains a strong capital position. This financial strength allows the credit union to weather economic downturns and invest in future growth. This fiscal stability benefits both its members and the community.

The credit union's loan portfolio has shown consistent growth, particularly in the areas of mortgage lending and auto loans. This indicates a healthy demand for credit within its membership base. It also reflects Prime Financial's role in supporting local economic activity.

Community Engagement and Financial Literacy

Prime Financial is deeply involved in community outreach programs. These initiatives include sponsoring local events and supporting non-profit organizations. This reinforces their commitment to social responsibility.

The credit union also offers a range of financial literacy workshops and seminars. These programs are designed to educate members on topics such as budgeting, saving, and credit management. Investing in financial education empowers individuals to make informed financial decisions.

"Financial literacy is crucial for building a strong and resilient community," says Jane Doe, CEO of Prime Financial Credit Union. "We are committed to providing our members with the tools and resources they need to achieve financial success."

Challenges and Opportunities

Like other financial institutions, Prime Financial faces challenges in a rapidly changing landscape. Increasing competition from online lenders and fintech companies requires continuous innovation. This also includes adapting to evolving regulatory requirements.

However, the credit union also has significant opportunities. The growing demand for personalized financial services and community-focused banking provides a competitive advantage. Investing in technology and cultivating strong member relationships are key to long-term success.

Member Perspectives

Many Prime Financial members express satisfaction with the credit union's personalized service and community involvement. They appreciate the accessibility of staff and the focus on building long-term relationships. The positive feedback highlights the value of a member-centric approach.

"I've been a member of Prime Financial for over 20 years, and I've always been impressed with their commitment to the community," says John Smith, a local business owner. "They're more than just a bank; they're a partner in my success."

Technological Investments

Prime Financial recognizes the importance of technology in meeting the evolving needs of its members. The credit union has invested heavily in upgrading its online and mobile banking platforms. These investments allow members to manage their accounts conveniently and securely.

Furthermore, the credit union is exploring the use of artificial intelligence (AI) to enhance customer service and detect fraud. Adopting innovative technologies will improve operational efficiency and enhance the member experience. Prime Financial's commitment to innovation ensures it remains competitive.

Looking Ahead

Prime Financial Credit Union is poised for continued growth and success in the years to come. The credit union's commitment to its members, community, and innovation will drive its future direction. This forward-looking approach ensures that Prime Financial remains a vital resource for the Milwaukee community.

By focusing on personalized service, community engagement, and technological advancements, Prime Financial is well-positioned to navigate the challenges and opportunities that lie ahead. Its dedication to its core values will ensure its continued relevance in an evolving financial landscape. This dedication will ensure that it continues to serve its members well for years to come.