Breaking A Lease Due To Financial Hardship

For millions of Americans, the dream of stable housing is increasingly threatened by a harsh reality: financial hardship. Rising inflation, stagnant wages, and unexpected job losses are forcing difficult decisions, and for many renters, that includes the agonizing prospect of breaking a lease. The legal and financial ramifications can be devastating, leaving individuals and families struggling to navigate a complex web of landlord-tenant laws and potential debt.

This article examines the growing trend of lease breaking due to financial hardship, exploring the legal landscape, the challenges renters face, and the potential consequences for both tenants and landlords. It also looks at available resources and strategies for mitigating the damage, aiming to provide a comprehensive understanding of this increasingly common crisis.

The Legal Tightrope: Understanding Lease Agreements

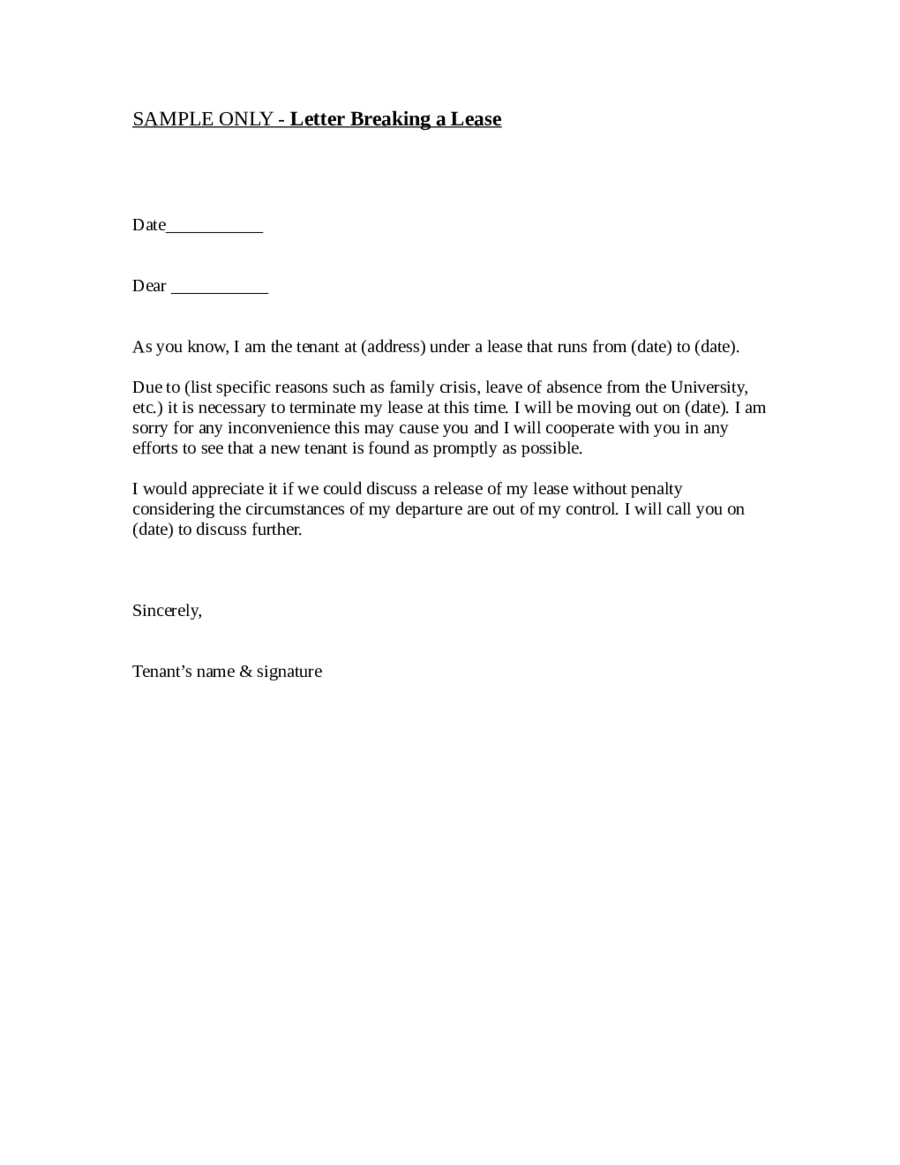

A lease agreement is a legally binding contract. It obligates both the landlord and the tenant to specific terms for a set period.

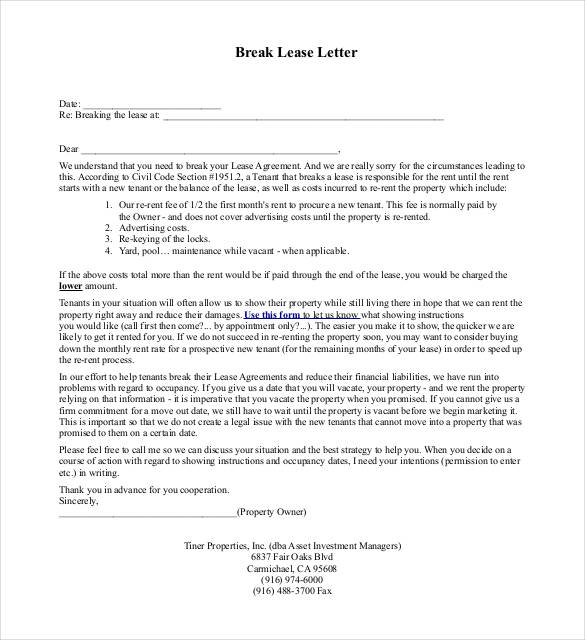

Breaking a lease, even due to financial distress, is generally considered a breach of contract, potentially exposing the tenant to significant financial penalties.

These penalties can include owing the remaining rent on the lease, covering the landlord's costs for finding a new tenant, and damage to the tenant's credit score.

State Laws and Landlord-Tenant Rights

Landlord-tenant laws vary considerably from state to state. Some states offer limited protections for tenants facing financial hardship, while others provide very little recourse.

For example, some states require landlords to mitigate damages by actively seeking a new tenant to fill the vacated property. This reduces the amount the original tenant owes.

However, the responsibility to prove financial hardship and the extent of the landlord's efforts to re-rent often falls on the tenant, adding to the burden.

The Servicemembers Civil Relief Act (SCRA)

The SCRA provides significant protections for active-duty military personnel. It allows them to terminate a lease without penalty under specific circumstances, such as a permanent change of station or deployment orders.

This federal law underscores the recognition that certain life events necessitate lease termination and provides a framework for mitigating financial repercussions in those cases.

However, the SCRA's protections are limited to military personnel, leaving many other renters vulnerable.

The Financial Fallout: Consequences of Breaking a Lease

The immediate financial consequences of breaking a lease can be severe. Landlords can pursue legal action to recover unpaid rent and other expenses.

This can result in a judgment against the tenant, which can negatively impact their credit score and ability to secure future housing.

Furthermore, the debt may be turned over to collection agencies, leading to persistent harassment and further financial strain.

Credit Score Impact

A negative credit history makes it harder to get approved for loans, credit cards, and even rental housing in the future. Landlords routinely check credit scores as part of the application process.

A history of broken leases can signal to potential landlords that the applicant is unreliable and poses a higher risk.

This can limit housing options and force individuals to accept less desirable or more expensive properties.

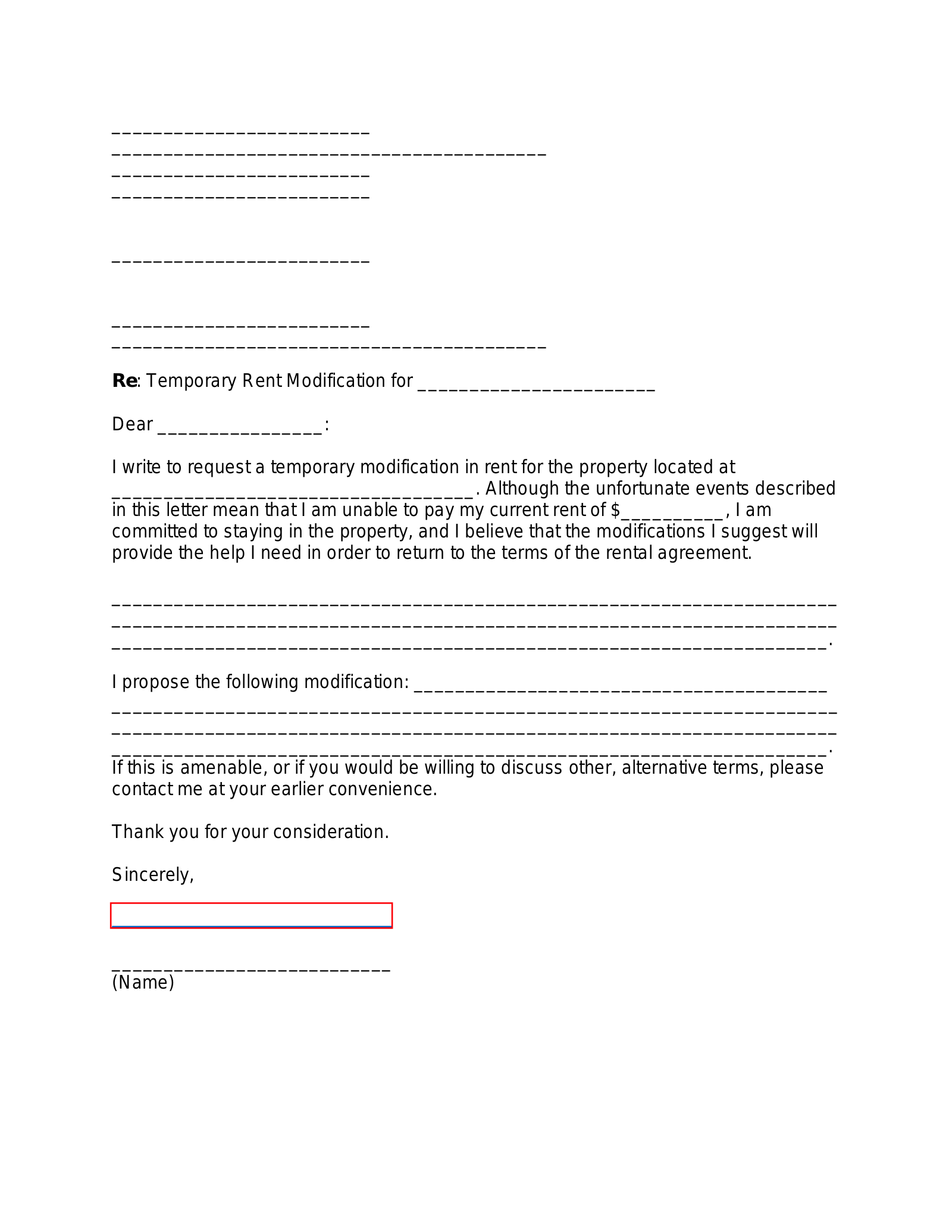

Negotiating with Landlords

Open and honest communication with the landlord is often the best first step. Some landlords may be willing to negotiate a payment plan, reduce the amount owed, or allow the tenant to find a suitable replacement tenant.

"Landlords are often more willing to work with tenants who are upfront and proactive," says Sarah Johnson, a housing counselor at the National Housing Law Project.

"They understand that evicting a tenant can be costly and time-consuming, and they may prefer to reach a mutually agreeable solution."

The Human Cost: Stories from the Front Lines

Beyond the legal and financial ramifications, breaking a lease due to financial hardship takes a significant emotional toll. The stress of facing eviction, dealing with debt collectors, and struggling to find affordable housing can be overwhelming.

Many individuals experience feelings of shame, anxiety, and depression. The instability can disrupt families and negatively impact children's education and well-being.

The experience highlights the precariousness of housing security for many Americans and the need for stronger safety nets.

Resources and Support

Several organizations offer assistance to renters facing financial hardship. These resources include legal aid societies, housing counseling agencies, and non-profit organizations that provide emergency rental assistance.

The U.S. Department of Housing and Urban Development (HUD) provides a directory of local housing counseling agencies that can offer guidance on landlord-tenant laws, budgeting, and finding affordable housing.

Seeking professional help can empower renters to navigate the complex legal and financial landscape and explore available options.

Looking Ahead: Addressing the Root Causes

Addressing the root causes of financial hardship is crucial to preventing lease breaking and ensuring housing stability. This includes policies that promote affordable housing, raise wages, and provide access to job training and education.

Strengthening tenant protections and providing greater access to legal aid can also help level the playing field and prevent landlords from exploiting vulnerable renters.

Furthermore, promoting financial literacy and encouraging responsible budgeting can empower individuals to manage their finances and avoid falling into debt.

The Role of Government and Community Organizations

Government agencies and community organizations play a vital role in addressing the housing crisis. "We need to invest in programs that help families stay in their homes," says David Thompson, a senior policy analyst at the Center on Budget and Policy Priorities.

This includes providing emergency rental assistance, expanding access to affordable housing, and strengthening tenant protections.

By working together, we can create a more just and equitable housing system that provides stability and opportunity for all.

The issue of breaking a lease due to financial hardship is a complex and multifaceted problem that requires a comprehensive solution. By understanding the legal landscape, the challenges renters face, and the available resources, we can begin to address the root causes of housing instability and create a more secure future for all.

Ultimately, ensuring access to safe and affordable housing is not just a matter of economic policy, but a fundamental question of human dignity and social justice.