Brookfield Global Infrastructure Securities Income Fund

Urgent market update: The Brookfield Global Infrastructure Securities Income Fund (INF) faces significant headwinds, prompting investors to reassess their positions. A sharp decline in net asset value and distribution adjustments are raising concerns.

This article provides a concise overview of the challenges facing INF, detailing recent performance issues, changes to distribution policies, and what investors need to know now.

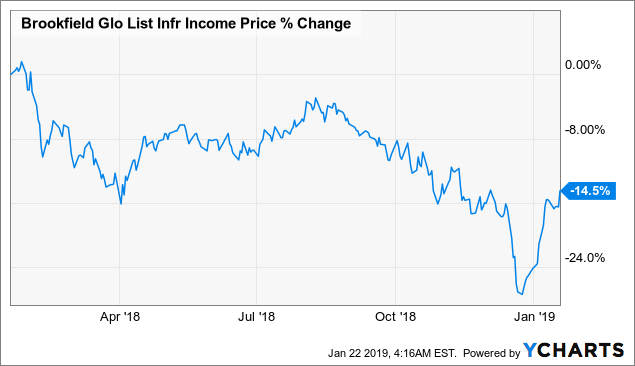

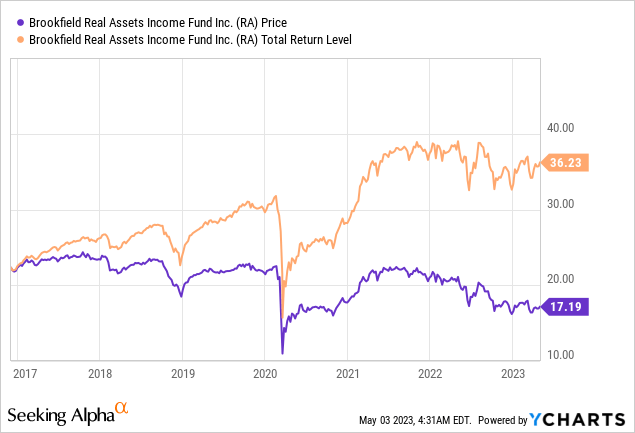

Recent Performance and NAV Decline

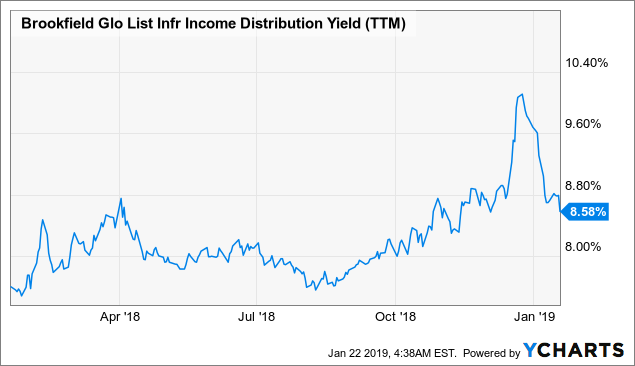

INF has experienced notable volatility recently. The fund's Net Asset Value (NAV) has decreased, impacting shareholder returns.

Specifically, recent market data indicates a decline in INF's NAV, reflecting broader market pressures and sector-specific challenges. These fluctuations have led to increased investor scrutiny.

Distribution Policy Adjustments

Brookfield has announced adjustments to INF's distribution policy. These changes are directly related to the fund's performance and market conditions.

The adjustments involve a reduction in the distribution rate, impacting the income received by investors. This decision was driven by a need to align distributions with the fund's current earnings capacity.

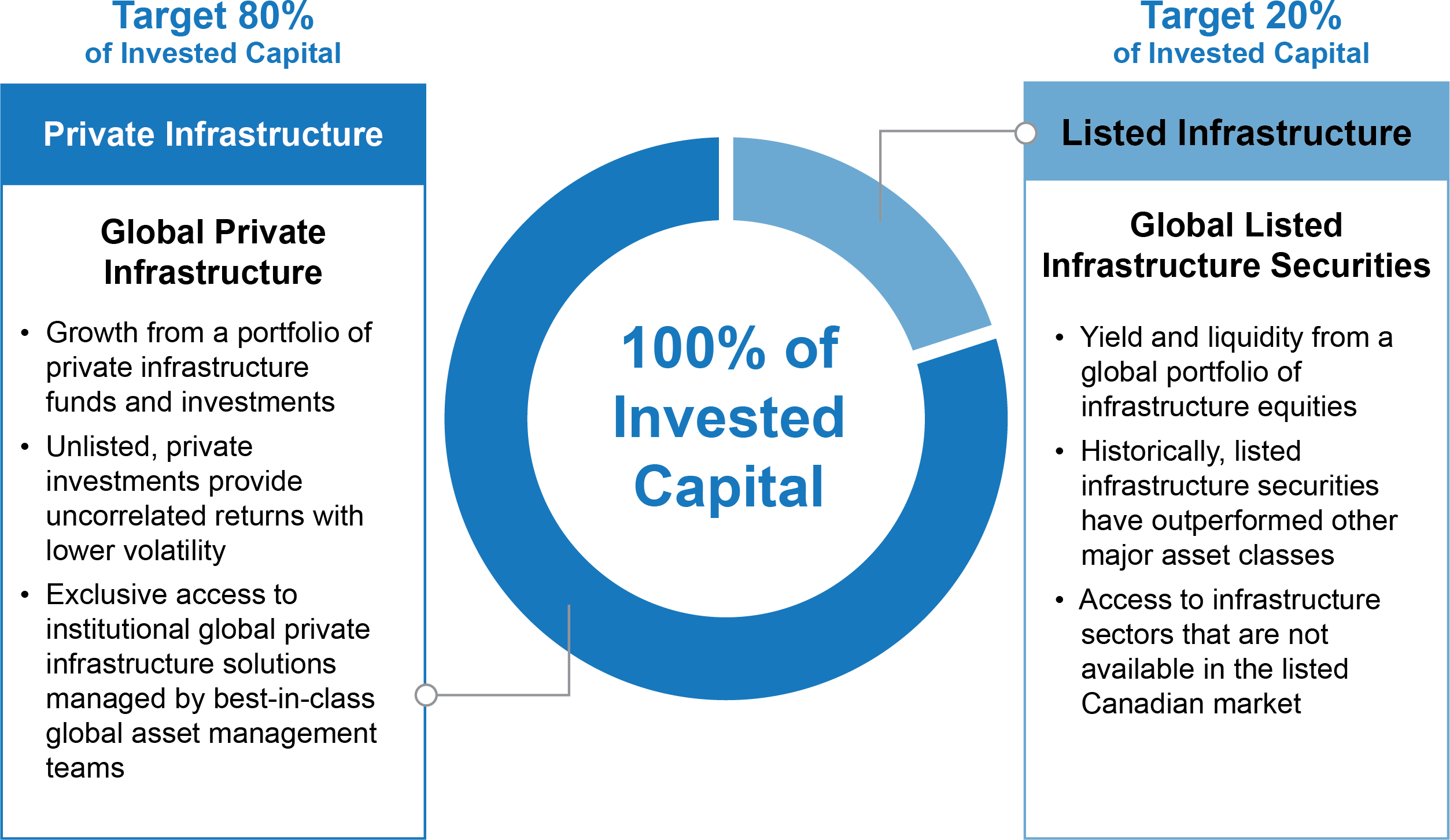

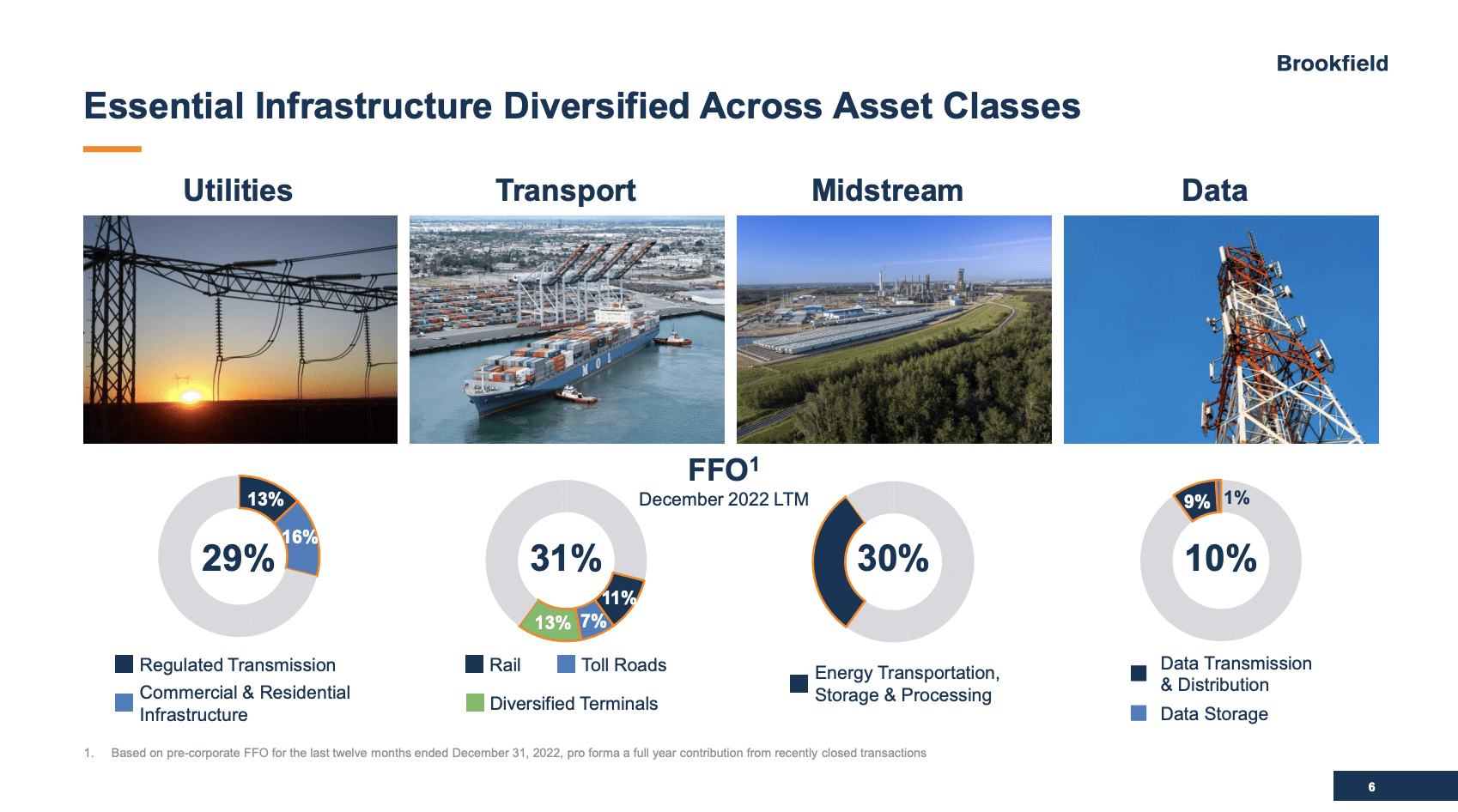

Fund Overview: What INF Invests In

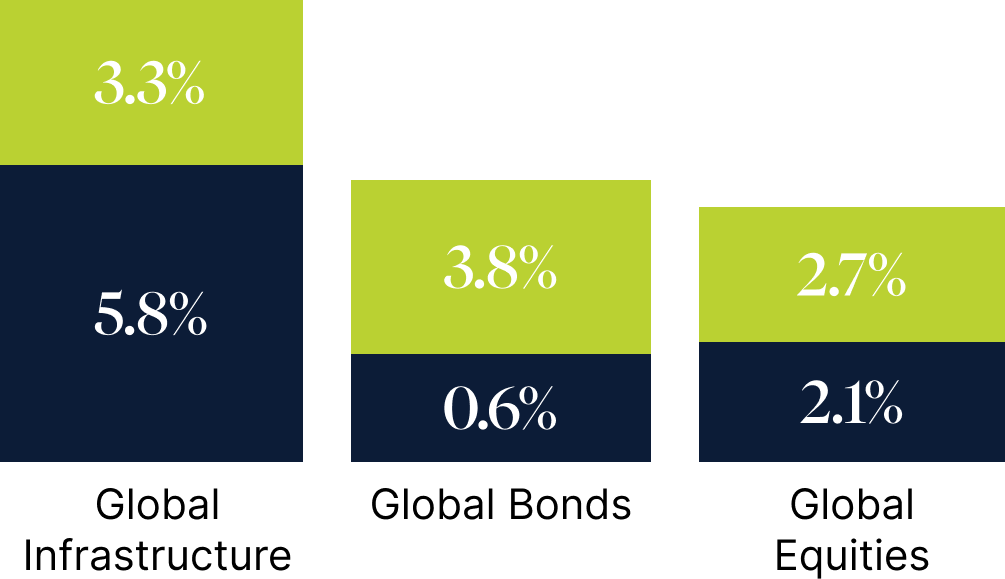

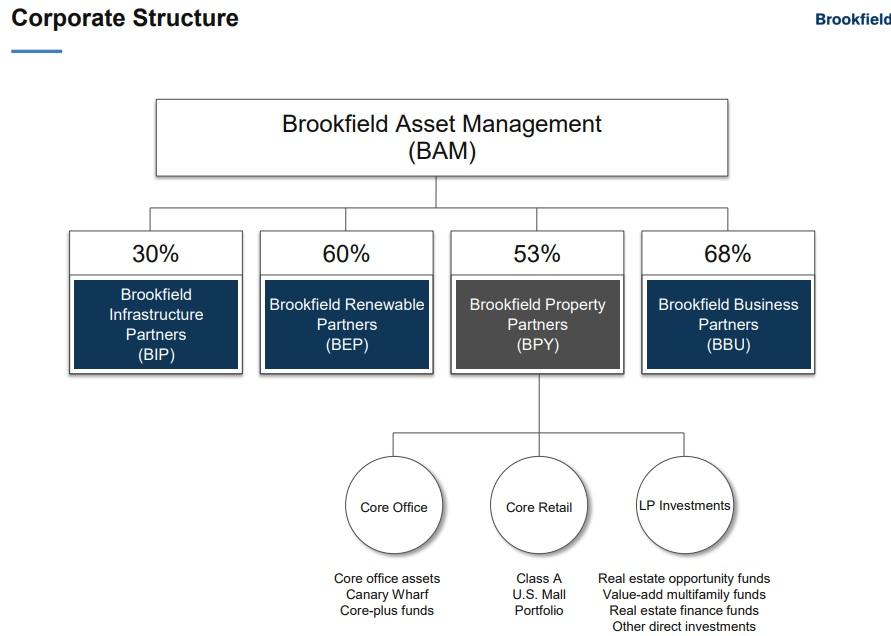

The Brookfield Global Infrastructure Securities Income Fund invests primarily in publicly traded infrastructure securities. These securities span various sectors including utilities, energy, transportation, and communications.

The fund aims to generate a high level of current income and long-term capital appreciation. This objective is achieved through a globally diversified portfolio.

INF's investment strategy focuses on companies that own and operate essential infrastructure assets. These assets typically exhibit stable cash flows and inflation protection.

Key Concerns for Investors

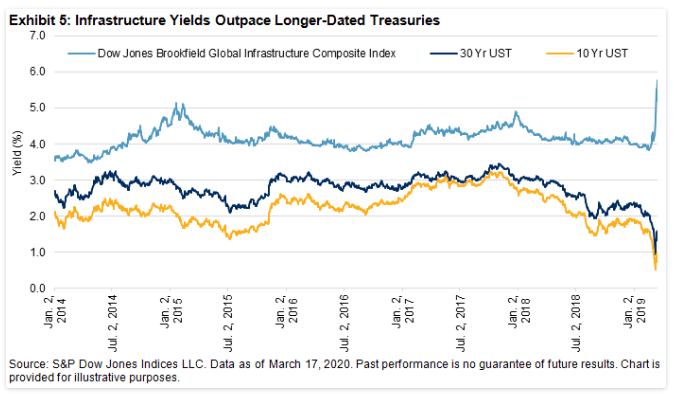

Several factors are contributing to investor concerns surrounding INF. These include market volatility, rising interest rates, and sector-specific headwinds.

Rising interest rates can negatively impact infrastructure investments, increasing borrowing costs and potentially reducing profitability. Market volatility also adds uncertainty to the fund's performance.

Investors are closely monitoring how Brookfield is managing these challenges. Transparency and communication are key during this period.

Expert Analysis and Outlook

Financial analysts are closely monitoring INF's performance and distribution adjustments. Their assessments provide insights into the fund's future prospects.

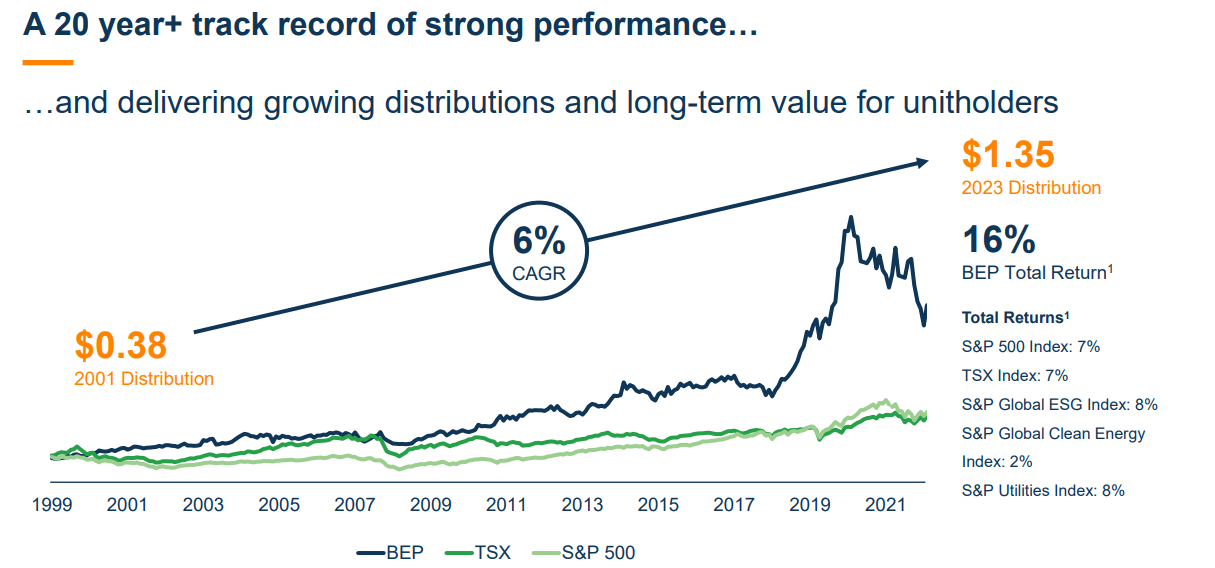

Some analysts suggest a cautious approach, advising investors to reassess their risk tolerance and investment objectives. Others believe that INF's long-term prospects remain positive, citing the essential nature of infrastructure assets.

Expert opinions vary, highlighting the need for individual investors to conduct their own due diligence.

Understanding the Impact on Shareholders

The distribution adjustments directly impact shareholders' income. Reduced payouts mean lower returns in the short term.

Shareholders should carefully review the fund's disclosures and consult with financial advisors. Understanding the implications for their individual portfolios is crucial.

Considerations should include the fund's expense ratio, tax implications, and overall portfolio diversification.

Brookfield's Response and Strategy

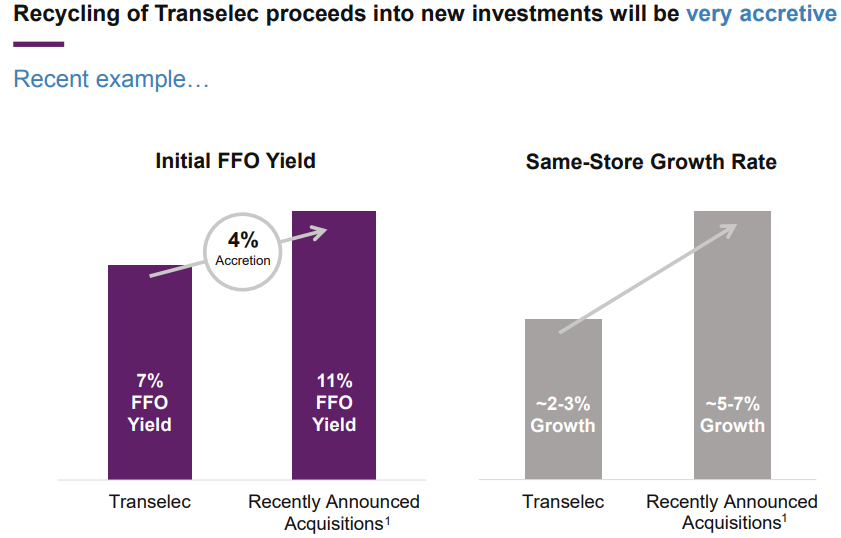

Brookfield is actively managing the fund in response to the challenging environment. They are focused on optimizing the portfolio and mitigating risks.

The company is also communicating with investors to provide updates and address concerns. Open communication is critical for maintaining investor confidence.

Brookfield's strategy involves actively managing the portfolio's asset allocation. This includes rebalancing investments to align with market conditions.

Alternative Investment Options

Investors concerned about INF's performance may consider alternative investment options. These alternatives offer varying degrees of risk and return.

Options include other infrastructure funds with different investment strategies. Fixed-income investments and diversified equity portfolios are also possibilities.

Consulting with a financial advisor is essential to determine the most suitable alternatives.

Conclusion: Next Steps and Monitoring

The Brookfield Global Infrastructure Securities Income Fund faces challenges that require careful monitoring. Investors should stay informed about the fund's performance and management's actions.

Ongoing developments include further distribution adjustments and portfolio rebalancing. Continued market analysis is crucial for making informed investment decisions.

The situation surrounding INF remains fluid, and staying informed is paramount.