Brookline Bank Home Equity Line Of Credit

Imagine sunlight streaming through your kitchen window, illuminating plans spread across the countertop: a new island, gleaming appliances, maybe even an expanded layout. The air buzzes with excitement, the scent of possibility mingling with the aroma of morning coffee. But between the dream and reality lies the question of funding, the bridge that needs to be built to bring those renovations to life.

The Brookline Bank Home Equity Line of Credit (HELOC) aims to be that bridge for homeowners in Massachusetts and beyond. It offers a flexible and accessible way to tap into the equity built up in their homes, providing a financial tool for renovations, debt consolidation, education expenses, or other significant life investments.

Understanding Home Equity and HELOCs

Home equity represents the difference between your home's current market value and the outstanding balance on your mortgage. As you pay down your mortgage and as your home's value appreciates, your equity grows, creating a valuable asset.

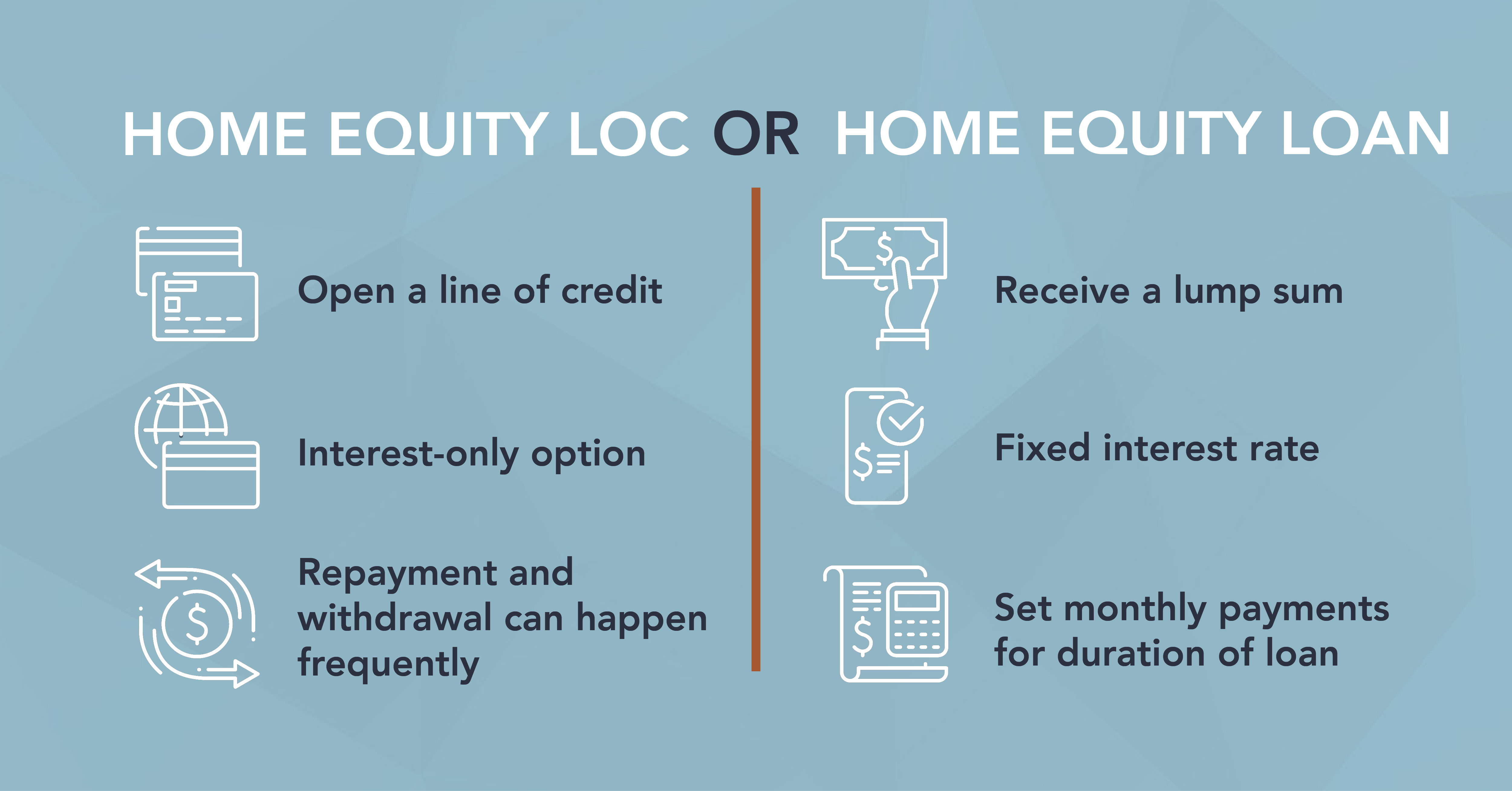

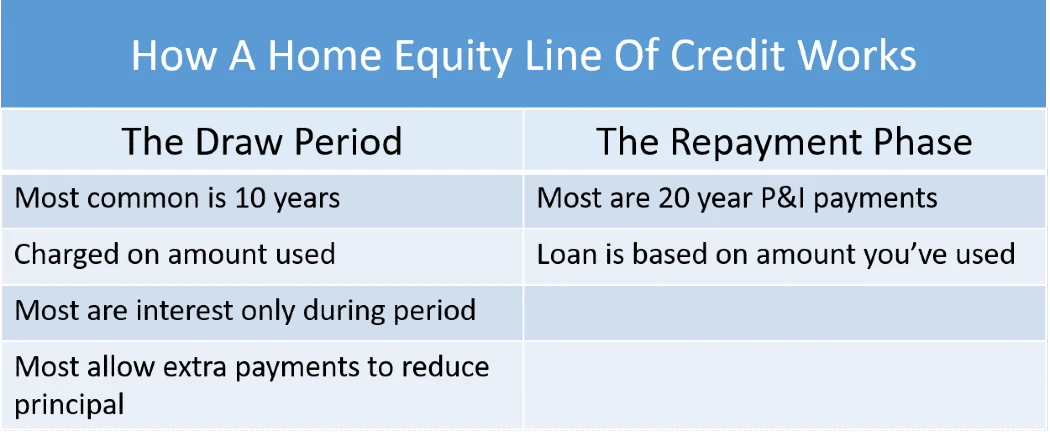

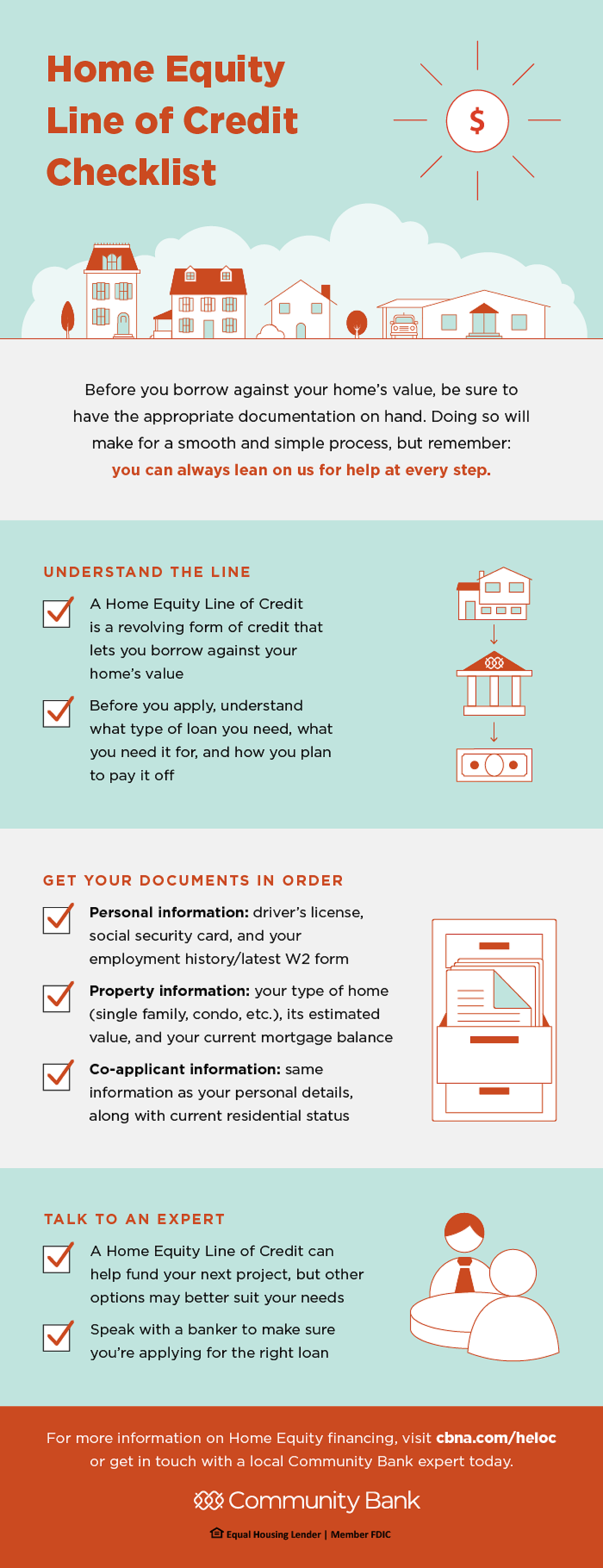

A HELOC is a revolving line of credit secured by your home equity. Unlike a traditional loan with a fixed amount and repayment schedule, a HELOC allows you to borrow funds as needed, up to a pre-approved credit limit.

Think of it as a credit card backed by your home. You can draw funds during the draw period, typically 5-10 years, and then enter a repayment period where you pay back the outstanding balance, plus interest.

Brookline Bank's Approach to HELOCs

Brookline Bank distinguishes itself by offering a personalized and community-focused approach to HELOCs. They emphasize building relationships with their customers, understanding their individual financial goals, and tailoring solutions to meet their specific needs. Their loan officers work closely with borrowers, guiding them through the application process and answering any questions along the way.

This personalized approach extends beyond the initial application. Brookline Bank strives to provide ongoing support and resources, helping homeowners manage their HELOCs responsibly and make informed financial decisions.

A key differentiator is their local expertise. Being a regional bank, they possess in-depth knowledge of the Massachusetts real estate market, enabling them to provide accurate valuations and insightful advice.

Key Features and Benefits

Several key features make the Brookline Bank HELOC an attractive option for homeowners. These features contribute to its flexibility, affordability, and ease of use.

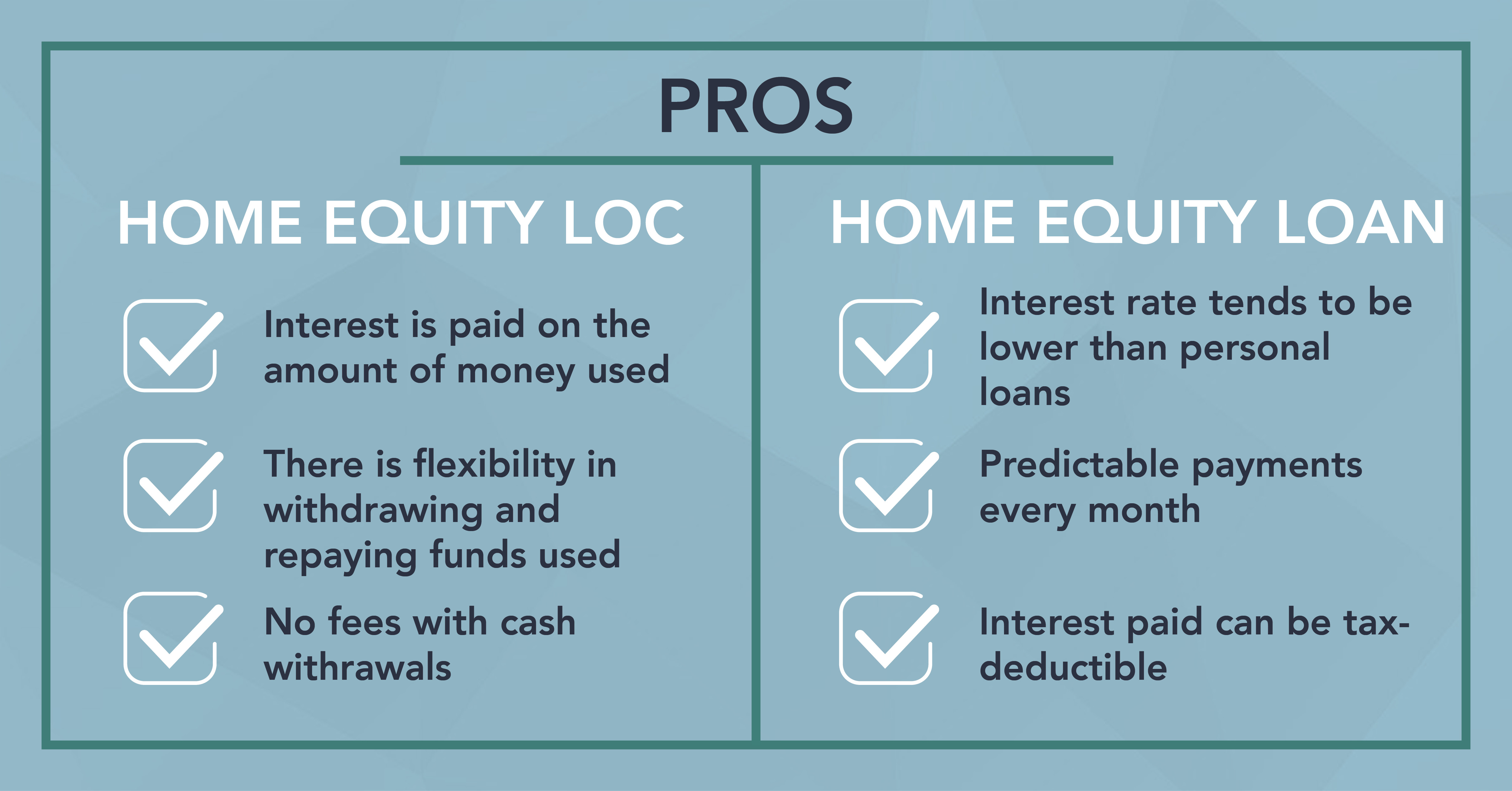

Competitive interest rates are a cornerstone of their offering. Brookline Bank regularly monitors market conditions to ensure its rates remain competitive, helping borrowers save money over the life of the loan.

Flexible repayment options allow borrowers to choose a repayment plan that fits their budget and financial goals. This flexibility can be particularly helpful during periods of financial uncertainty.

Online access provides convenient access to account information, allowing borrowers to track their balances, make payments, and monitor their credit line from anywhere with an internet connection. This 24/7 access enhances transparency and control.

No annual fees further enhance the affordability of the Brookline Bank HELOC. The absence of annual fees distinguishes them from some national competitors, leading to potential cost savings.

Using a HELOC Responsibly

While a HELOC can be a powerful financial tool, it's crucial to use it responsibly. Remember that a HELOC is secured by your home, so failing to make payments could result in foreclosure.

It's essential to borrow only what you need and to have a clear plan for repayment. Avoid using a HELOC for frivolous spending or unnecessary purchases. Instead, focus on using it for investments that will improve your home's value or enhance your financial well-being.

Consider consulting with a financial advisor to develop a budget and repayment strategy. A financial advisor can provide personalized guidance and help you make informed decisions about your HELOC.

Real-Life Applications: Stories from Homeowners

Many homeowners have successfully used Brookline Bank HELOCs to achieve their goals. Consider Sarah, who used a HELOC to renovate her outdated kitchen. She transformed it into a modern, functional space that increased her home's value and improved her quality of life.

Then there's David, who consolidated high-interest debt with a HELOC. This helped him lower his monthly payments and improve his credit score.

These are just a couple of examples of how a Brookline Bank HELOC can empower homeowners to achieve their dreams and improve their financial well-being.

Testimonial Snippets

"The team at Brookline Bank was so helpful throughout the entire process. They explained everything clearly and made sure I understood the terms and conditions." - Sarah M.

"I was able to consolidate my debt and save a significant amount of money each month. I'm so grateful for the support I received from Brookline Bank." - David L.

The Application Process: What to Expect

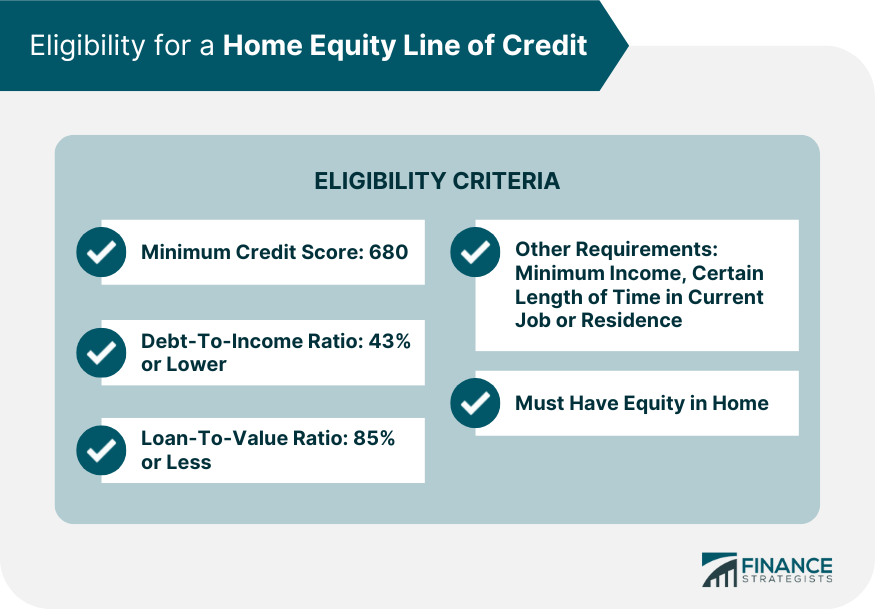

Applying for a Brookline Bank HELOC is a straightforward process. You'll need to provide information about your income, assets, and debts, as well as details about your home.

Brookline Bank will then assess your creditworthiness and the value of your home to determine your eligibility and credit limit. They will conduct an appraisal to confirm the current market value of the property.

The entire process typically takes a few weeks, from initial application to final approval. Their loan officers are readily available to answer questions and guide you through each step.

Looking Ahead: The Future of Home Equity

Home equity is likely to remain a valuable asset for homeowners in the years to come. As home values continue to appreciate in many markets, homeowners will have even greater opportunities to tap into their equity for various purposes.

Brookline Bank is committed to providing innovative and responsible lending solutions to meet the evolving needs of homeowners. They are constantly exploring new ways to enhance their HELOC offerings and provide even greater value to their customers.

As the economic landscape changes, understanding and leveraging home equity will become increasingly important. Brookline Bank aims to be a trusted partner in helping homeowners navigate these opportunities and achieve their financial goals.

A Final Thought

The Brookline Bank Home Equity Line of Credit represents more than just a financial product; it's a tool that empowers homeowners to invest in their future. Whether it's renovating a kitchen, consolidating debt, or funding a child's education, a HELOC can provide the financial flexibility needed to turn dreams into reality.

But remember, responsible borrowing is key. Using a HELOC wisely and strategically can unlock opportunities and enhance financial well-being, creating a brighter future for you and your family.

As the sun sets, casting long shadows across that envisioned kitchen, remember that the path to realizing those plans is paved with informed decisions and responsible financial management. Brookline Bank aims to be a partner on that journey, helping you build the bridge to your dreams.